The Role of AMMs and Yield Tokenization in Mitosis

Introduction

Imagine a DeFi world where every drop of liquidity moves smarter, earns harder, and opens endless new possibilities.

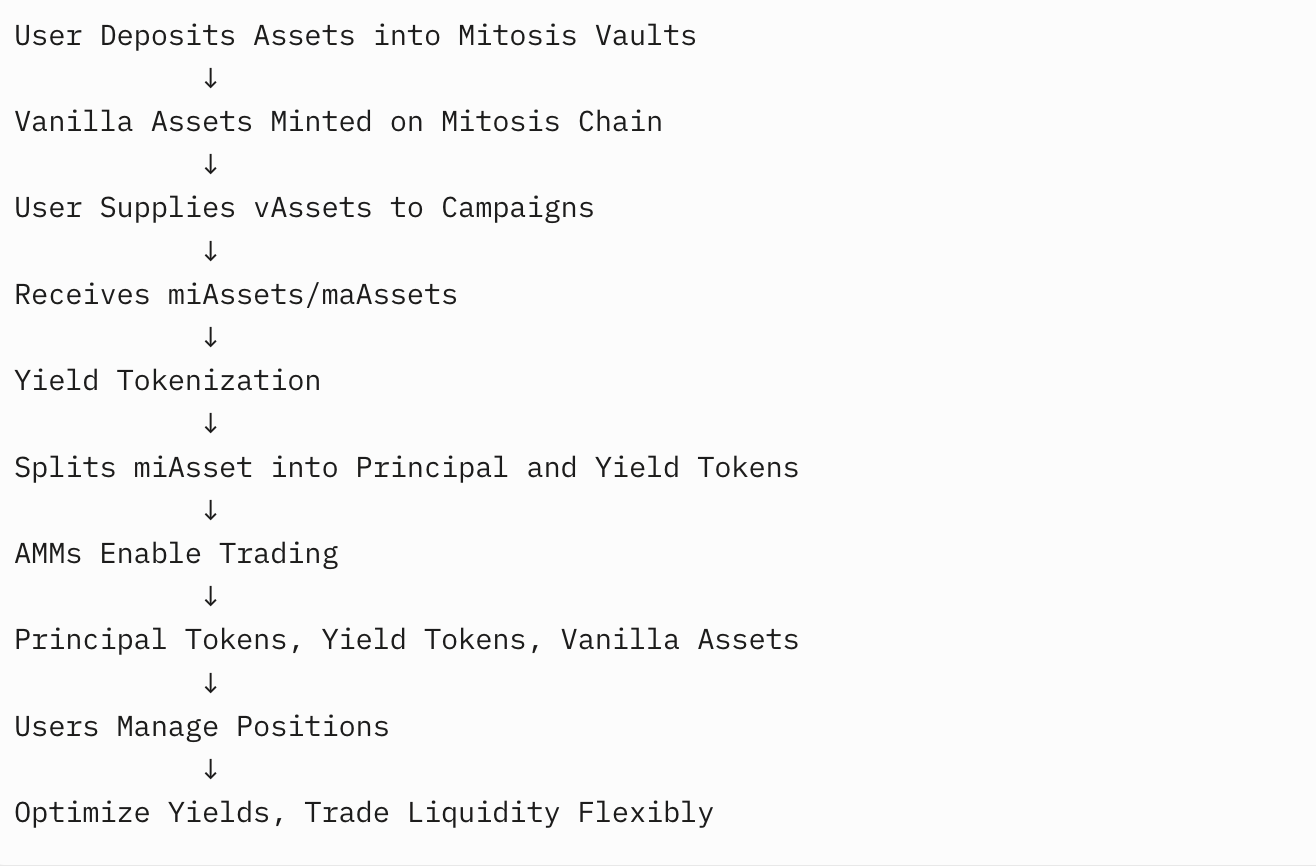

That’s exactly what Mitosis is building — and two of its most powerful engines are Automated Market Makers (AMMs) and Yield Tokenization. Together, they completely change how liquidity flows, grows, and gets deployed across DeFi.

In this article, we'll unpack how AMMs and yield tokenization work inside Mitosis, why they’re revolutionary, and how you, the user, get massive advantages from them.

What Are AMMs and Yield Tokenization Anyway?

First, a quick refresher:

- AMMs (Automated Market Makers) are protocols like Uniswap that allow you to swap tokens instantly without needing an order book. Liquidity providers add funds into pools, and smart contracts automatically determine the trading prices based on supply and demand.

- Yield Tokenization splits yield-bearing assets into two parts:

- Principal (your original deposit)

- Yield (the interest it earns)

This separation lets users trade, lend, and speculate on future yields — like trading tomorrow’s earnings today.

How AMMs Power Mitosis' Programmable Liquidity

In Mitosis, AMMs don’t just swap one token for another. They swap programmable assets — Vanilla Assets, miAssets, and maAssets.

Here’s the real magic:

- Liquidity providers don’t have to sit on static, locked tokens.

- They can supply Vanilla Assets, miAssets, and maAssets into specialized AMMs on the Mitosis Chain.

- These AMMs feature dynamic pricing models that optimize deep liquidity, low slippage, and efficient trading between all types of Mitosis assets.

🌟 Result:

Your tokenized liquidity positions (your LP tokens) can be instantly traded, adjusted, or leveraged without losing your yield opportunities.

Matrix Theo Campaign Overview explains how miweETH holders interact with programmable LP assets and earn campaign-specific rewards.

How Yield Tokenization Unlocks New DeFi Superpowers

Traditionally, you stake your asset and… that's it. It sits there.

With Mitosis' Yield Tokenization:

- Your yield-bearing positions split into Principal Tokens (representing the original deposit) and Yield Tokens (representing future rewards).

- You can:

- Trade yield separately from principal.

- Sell your future yield to lock profits today.

- Leverage your principal while still earning yield.

- Hedge your exposure by dynamically managing principal and yield risk.

This flexibility transforms your boring staked asset into a living, breathing financial instrument.

How AMMs and Yield Tokenization Work Together in Mitosis

✅ Cross-chain support and composability further amplify this power, as detailed in Mitosis x Hyperlane.

Real-World Example: Let’s Make It Real

Imagine you deposit ETH into Mitosis and earn a yield.

- You tokenize your stake, getting a Principal Token and a Yield Token.

- You need cash now? You sell your Yield Token on a Mitosis AMM to someone else betting on future returns.

- You still keep your Principal Token — and your underlying ETH.

- Later, you can rebuy Yield Tokens when the rates are favorable, or move your principal into another campaign.

This is exactly the kind of strategic flow Mitosis is unlocking, as explored in their broader ecosystem vision.

You’re not stuck anymore.

You’re in full control.

Conclusion

AMMs and Yield Tokenization inside Mitosis completely rewire how we think about DeFi liquidity.

No more idle capital. No more dead-end staking. No more stuck yields.

Instead, Mitosis gives you a fully programmable, flexible liquidity environment — where assets move freely, yields are dynamic, and users can build, trade, and grow wealth with maximum efficiency.

In short?

You’re not just a liquidity provider anymore.

You’re a liquidity architect.

Welcome to the future of DeFi — powered by Mitosis.

Comments ()