The Role of Modular Infrastructure in Token Design: From Celestia to Dymension

Introduction

Modular blockchains are redefining how tokens are designed—from launch mechanics to long-term utility and upgradeability. Unlike traditional monolithic chains, modular architectures divide consensus, data availability, and execution into specialized layers. This separation enables greater flexibility in token use and governance.

This article unpacks how these principles play out in three modular platforms—Celestia, Dymension, and their impact on token design. We’ll explore token issuance models, utility cases tied to modularity, and how architecture informs token longevity and adaptability—helping developers and holders make sense of the evolving modular landscape.

1. Celestia: Data Availability Tokenization

Architectural Context

Celestia pioneered modular architectures by separating data availability and consensus from execution. It introduces Data Availability Sampling (DAS), enabling lightweight clients to verify data efficiently without downloading full blocks.

Token Attributes

- $TIA token secures the network via Proof-of-Stake, pays for data availability, and governs protocol parametersreddit.com+2research.tokenmetrics.com+2reddit.com+2.

- Launch supply: 1B tokens total; emission begins at 8% inflation, tapering yearly to a 1.5% floorresearch.tokenmetrics.com+1reddit.com+1.

Utility & Lifecycling

- Developers must pay in $TIA to publish blobs and launch chains atop Celestia.

- Staking supports consensus and Data Availability; delegators earn rewards while influencing governance.

- Fee-burn mechanisms (akin to EIP-1559) balance long-term inflationhk.okx.com

Implications

By assigning token utility to specific ecosystem functions—data publication, staking, and governance—Celestia ties token demand directly to modular use. As alternative DA layers mature, the $TIA model offers both explicit scarcity control and fee-based value accrual.

2. Dymension: Token Design for App-Chains

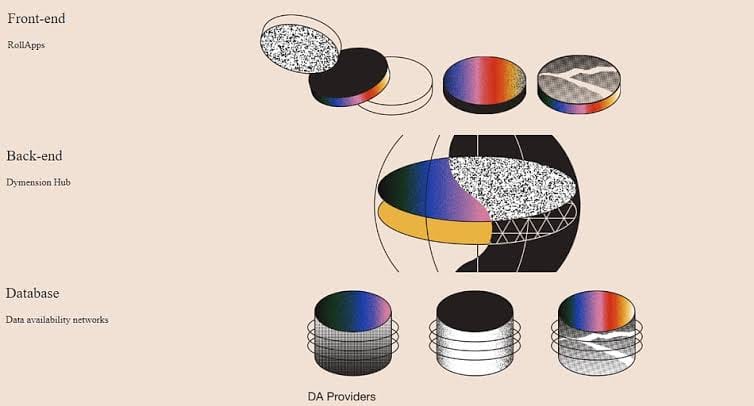

Modular Architecture

- RollApps: sector-specific execution chains built atop the Dymension Hub, enabled by RDK (RollApp Dev Kit)coingecko.com

- The Dymension Hub handles consensus, settlement via Proof-of-Stake, and uses DA layers like Celestia for data availability dymenslon.net.

Tokenomics & Utility

- Token supply: 1B $DYM; initial circulation was ~146M early 2024. Large airdrops (70M to over 1M users) broaden distribution reddit.com

- Dynamic inflation: issuance adjusts based on staking rates, with annual inflation ranging 1%–10%, stabilizing around 67% staking arc.ai+1blog.bitfinex.com+1.

- Allocation: 33% to incentives DAO, 20% core team, 20% ecosystem/R&D, 14% backers, 8% public, 5% community pool arc.ai.

Utility Breakdown

- Stakers secure Hub consensus and earn from RollApp sequencing and bridging fees.

- Although individual RollApps may issue tokens, $DYM secures the underlying infrastructure—similar to an AWS model for blockchains

- Governance control over inflation, sequencing rules, and DAO incentives resides on-chain.

Implications

Dymension’s modular design separates core infrastructure from app-specific tokens. $DYM represents both a security anchor and coordination token. Its dynamic inflation incentivizes participation, while broad allocation supports ecosystem growth.

3. Modular Architecture Influencing Token Design

Layer-Defined Token Roles

- DA Layer tokens (Celestia): focus on resource usage, storage payments, and security

- Settlement Layer tokens (Dymension): enable shared security, capital coordination, and inter-chain liquidity

- Execution Layer tokens (RollApps): tailored for app-specific use, staking, and governance

This arrangement mirrors traditional cloud infrastructures: DA as storage, settlement as server, execution as application.

Flexibility and Upgradeability

Modular tokens are naturally upgradeable: new DA or settlement layers can integrate smoothly without substituting existing token sets. Early modular projects have created dynamic token flows with minimal protocol reworksreddit.com+9reddit.com+9reddit.com+9.

Governance & Incentives Synergy

Tokens are tied to specific network layers, reducing conflicts and aligning stakeholder goals: validators drive consensus, app developers focus on execution, and operators manage data availability. Integrated staking across layers ensures accountability.

Comparative Snapshot

| Platform | Token Role | Supply & Inflation | Utility | Governance & Incentives |

|---|---|---|---|---|

| Celestia | DA & Consensus ($TIA) | 1B supply, 8→1.5% inflation | Pays for blob publishing, staking & governance | DAO parameters, fee burn control |

| Dymension | Settlement & Security ($DYM) | 1B supply, dynamic inflation 1–10% | Hub staking, bridge & seq fees, DAO incentives | Voting on inflation & module grants |

| RollApps | App-Specific Tokens | Independent supply rules | App execution, staking, governance per RollApp | Managed per RollApp DAO |

Community Perspective

Reddit users highlight this architectural division:

“Celestia separates consensus, data availability, and execution… freeing up developers … modular SDKs are set to revolutionize…”

“Dymension is the only blockchain that functions solely as a settlement layer… devs deploy chains, users deposit capital… like AWS” These voices emphasize that modular token roles reduce operator burden and enable more scalable token models.

Conclusion

Modular architecture is carving a paradigm where tokens are purpose-aligned with protocol roles—storage, settlement, execution—rather than generic network assets.

- Celestia ties token value to data availability and security, with deflationary pressure baked into fee burns.

- Dymension incentivizes ecosystem coordination, dynamic staking, and shared infrastructure usage, akin to cloud services.

- RollApp tokens move toward usage-driven economics, decoupled from core infrastructure concerns.

The result: token design becomes more resilient, adaptable, and granular. As developers and token designers, understanding these distinctions allows for more intentional token launches, upgrades, and ecosystem growth strategies in the modular era.

Internal Mitosis Links & Glossary References

- Bitcoin

- Blockchain

- Cryptocurrency

- Mitosis Core: https://university.mitosis.org/mitosis-core

- Governance: https://university.mitosis.org/governance

- Glossary: https://university.mitosis.org/glossary/

- Ecosystem Connections: https://university.mitosis.org/ecosystem-connections

Comments ()