The Smart Fusion of Decentralized Finance and Artificial Intelligence Reshaping the Future of Finance(DeFAI)

A significant transformation is underway in the world of blockchain and finance. DeFAI, or Decentralized Finance powered by Artificial Intelligence, is emerging as a bold convergence of two disruptive technologies. By blending DeFi protocols with AI’s predictive and adaptive capabilities, DeFAI aims to deliver financial systems that are not only decentralized but also intelligent, efficient, and accessible.

What Is DeFAI

DeFAI is the integration of AI technologies with blockchain-enabled financial systems. Its goal is to automate and optimize tasks like trading, yield generation, and risk management without relying on human intervention. AI agents analyze on-chain and off-chain data, make decisions, and trigger smart contracts to execute actions in real time. This allows DeFAI systems to respond swiftly to changing market dynamics, manage user portfolios, and guard against emergent risks, all in a transparent, trust-minimized environment.

Market Landscape and Growth

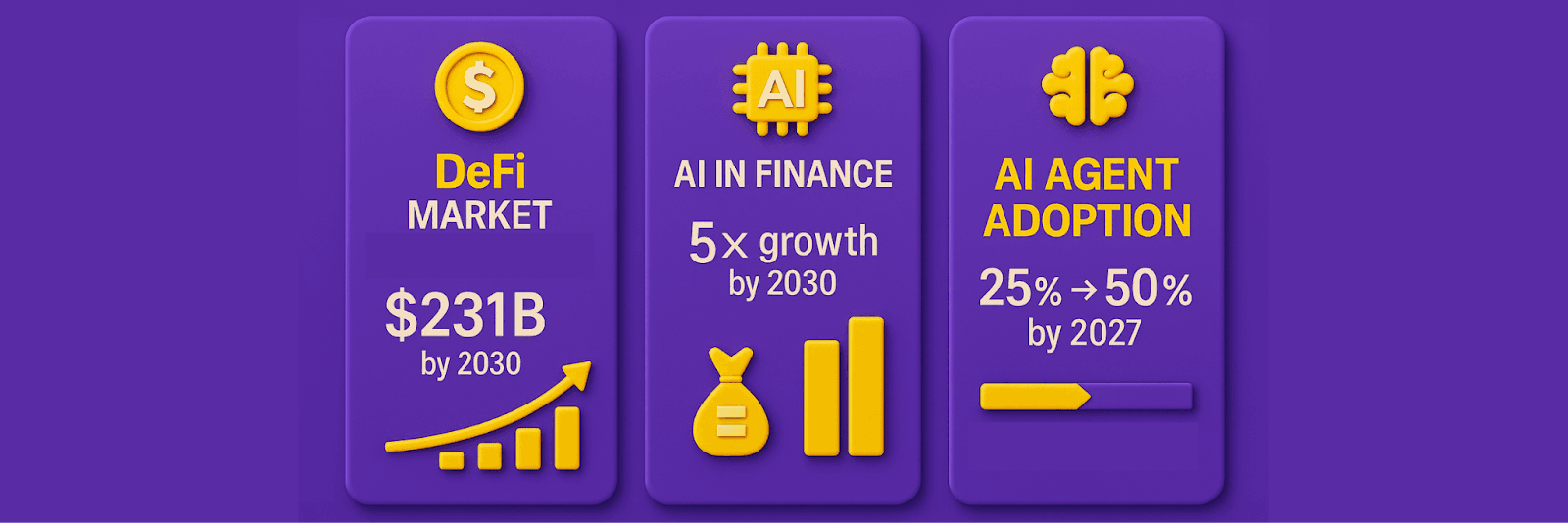

In early 2025, estimates valued the DeFAI market at roughly 1 billion dollars, though some measurements placed the ecosystem closer to 3 billion. Other data providers calculated much smaller figures, showing the variability in valuation methods. Industry projections have suggested that DeFAI could exceed 10 billion dollars in the next few years as projects mature and gain mainstream adoption.

This growth sits within a wider context. The overall DeFi market is expected to reach more than 200 billion dollars by 2030, while AI in finance may expand from about 38 billion dollars to 190 billion dollars in the same timeframe. Adoption of AI agents in various industries is also projected to grow from roughly 25 percent in 2025 to 50 percent by 2027, providing fertile ground for DeFAI.

How DeFAI Works

DeFAI operates through a combination of core components that work together to deliver results:

- Data Gathering

AI agents collect large amounts of on-chain and off-chain data, including liquidity metrics, transaction volumes, price feeds, social sentiment, and macroeconomic indicators. - AI Inference and Strategy Formation

Using machine learning, these agents process incoming data to identify patterns, market trends, risks, and opportunities. The insights form the foundation for strategies such as when to enter or exit trades, how to rebalance portfolios, and where to allocate capital. - Smart Contract Execution

Once a strategy is determined, AI agents interact directly with smart contracts to execute trades, shift liquidity, or adjust lending parameters. - Interoperability Across Chains

Many DeFAI platforms operate across multiple blockchains such as Ethereum, Solana, and BNB Chain. This allows agents to find the best opportunities regardless of where they exist. - Advanced Automation

Unlike traditional bots with fixed rules, DeFAI agents learn from outcomes and refine their approaches over time, adapting to new market conditions.

Why DeFAI Is Significant

DeFAI carries several potential advantages:

- Greater Accessibility: DeFi can be technically complex and intimidating for beginners. DeFAI’s AI-driven interfaces simplify participation, making the ecosystem more inclusive for novices and underserved populations.

- Operational Efficiency: AI agents run continuously, providing rapid execution and removing much of the manual oversight required in traditional DeFi.

- Product Innovation: The technology enables new types of products such as AI-managed lending pools, real-time arbitrage bots, dynamic risk-adjusted yield vaults, and self-adjusting insurance mechanisms.

- Transparency with Auditability: Even though AI algorithms are involved, all actions occur on-chain, allowing public verification and audits of decisions made by AI agents.

- Resilience in Volatile Markets: AI-driven systems can respond instantly to market changes, providing a layer of stability in conditions that could overwhelm manual traders.

Leading DeFAI Projects in 2025

A number of projects illustrate how DeFAI is being applied:

- Virtuals Protocol enables the creation and deployment of AI agents on Base, an Ethereum layer 2. Users can define agent behavior, test it in a simulated environment, and launch it on-chain without coding experience.

- Griffain operates on Solana and offers AI-powered yield optimization and portfolio automation.

- Hey Anon delivers personalized DeFAI tools with an emphasis on simplicity and user-friendliness.

- Orbit, Neur, Autonolas, Gekko AI, and Mode Network each add capabilities ranging from cross-chain optimization to governance automation.

- SingularityNET, Fetch.ai, and Numerai merge AI marketplaces, autonomous agents, and crowdsourced predictive models with DeFi services.

Challenges and Complexities

DeFAI’s promise comes with significant challenges:

- Transparency of AI Decisions: AI models are often seen as “black boxes.” Without clear explanations of how decisions are made, user trust may be limited.

- Security Risks: AI agents and the data they rely on can be targeted by malicious actors. Manipulated data feeds, flawed algorithms, or exploited code could cause large-scale losses.

- Regulatory Uncertainty: Few legal frameworks currently exist for AI-led financial decision-making. Questions about liability, data privacy, and compliance remain unresolved.

- Technical Complexity: Developing DeFAI systems requires expertise in both blockchain development and advanced machine learning, creating a high barrier to entry.

- Reliability Issues: AI systems can still make errors, act unpredictably, or be misled by flawed input data.

- Governance Concerns: Poorly designed governance systems could allow manipulation, leading to dangerous changes in AI behavior or platform rules.

- Operational Risk in Arbitrage: While AI-enhanced arbitrage tools improve efficiency, they also introduce dependencies that can become failure points.

How to Participate in DeFAI

For Developers

Learn the fundamentals of blockchain technologies and AI/ML frameworks. Explore DeFAI-specific development kits and platforms that provide agent templates and tools. Start with small, low-risk projects such as automated yield optimizers or portfolio balancers to gain hands-on experience.

For Users and Investors

Join active DeFAI communities to stay informed. Experiment with small amounts of capital to test platforms and understand how agents behave. Evaluate each project’s security history, transparency, and governance model before committing larger resources. Monitor AI token market trends but remain aware of the volatility and risk involved.

The Path Ahead

DeFAI is at an inflection point. The underlying DeFi and AI markets are both set for rapid expansion in the coming years. If successfully developed and adopted, DeFAI could become one of the most transformative financial innovations of the decade. In the future, autonomous agents could manage investments, administer governance systems, and deliver financial services to millions of people without centralized oversight.

However, the path forward will require overcoming challenges around trust, regulation, and technical reliability. While the technology is still experimental, its potential to deliver smarter, more inclusive, and automated finance is considerable. The next five years will determine whether DeFAI remains a niche innovation or becomes a foundational layer of the global financial system.

References

Comments ()