The Steady Force in the Crypto World: What is a Stablecoin and Why is it Important?

When people hear "cryptocurrency," the first thing that usually comes to mind is volatility. But there’s an exception to everything. That’s where stablecoins come into play. These digital assets, pegged to the value of a specific asset, serve as a safe haven for both investors and users. So, what exactly is a stablecoin, how does it work, and why is it so important? Let’s explore together.

🧠 What is a Stablecoin?

A stablecoin is a cryptocurrency designed to maintain a stable value, as the name suggests. It is typically pegged to fiat currencies such as the US Dollar (USD), Euro (EUR), or to precious metals like gold. The aim is to eliminate the extreme price fluctuations of traditional cryptocurrencies and offer a more predictable user experience.

Thanks to stablecoins, users can enjoy the benefits of blockchain technology while minimizing risks such as value loss or excessive price surges.

🧩 What Are the Types of Stablecoins?

Stablecoins are generally based on three main models. Each comes with different mechanisms for maintaining price stability and offers unique advantages:

1️⃣ Fiat-Backed Stablecoins (H3)

These stablecoins are backed by real-world fiat currencies. For every token issued, there is typically an equivalent fiat reserve held at a 1:1 ratio. Examples include:

- 🟢 USDT (Tether)

- 🟢 USDC (USD Coin)

- 🟢 TrueUSD (TUSD)

Users can easily redeem these coins for the corresponding fiat currency. However, transparency and regular auditing of reserves remain ongoing concerns.

2️⃣ Crypto-Backed Stablecoins (H3)

These are backed by other cryptocurrencies, usually over-collateralized to account for volatility. Digital assets like Ethereum (ETH) are commonly used.

- 🟠 Example: DAI (issued by MakerDAO)

The main advantage is decentralization. However, if the collateral value falls below a certain threshold, automatic liquidations can occur.

3️⃣ Algorithmic Stablecoins (H3)

This is the most innovative yet riskiest model. It does not use any collateral. Instead, smart contracts and algorithms manage the coin’s supply and demand to maintain price stability.

- 🔴 Example: Former UST (Terra)

While capital-efficient, these systems can collapse if the algorithm fails—just like the infamous Terra crash.

⚙️ How Do Stablecoins Work?

A stablecoin’s price typically follows its pegged asset. For example, a USD-pegged stablecoin is designed to always equal 1 USD. The mechanism differs by type:

- Fiat-backed stablecoins maintain reserves in traditional currencies.

- Crypto-backed stablecoins use smart contracts to lock collateral and mint/burn coins.

- Algorithmic stablecoins increase or decrease circulating supply to maintain the peg.

These systems rely on supply-demand balance, staking incentives, and user behavior, blending economic theory with modern technology.

✅ Advantages of Stablecoins

- 📌 Price Stability: Unlike assets like Bitcoin or Ethereum, stablecoins maintain a fixed value.

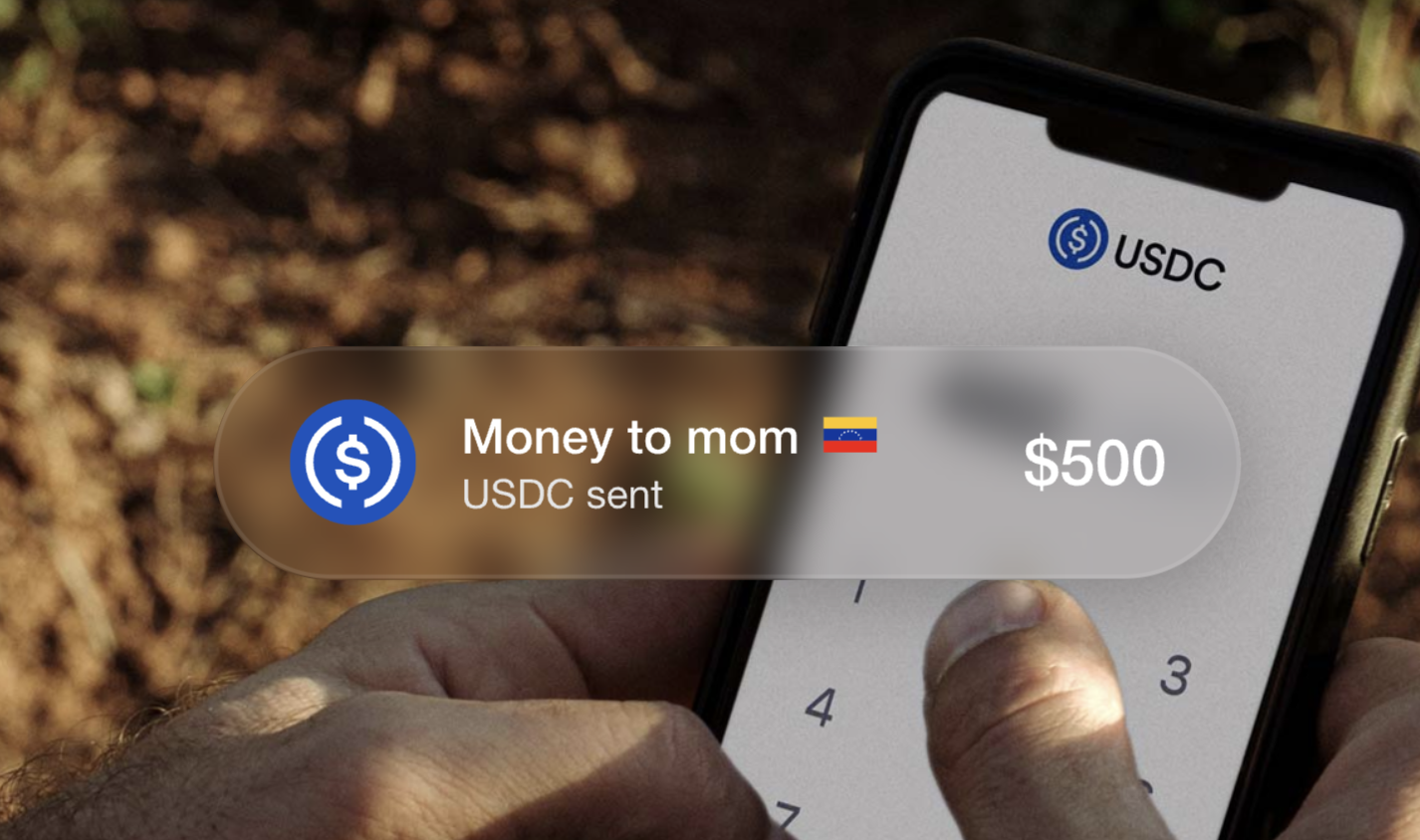

- 🌍 Cross-border Transfers: Enable fast, low-cost international payments.

- 🛍️ Daily Use: Can be used to pay for goods and services where accepted.

- 🔄 Trading Efficiency: Serve as intermediary assets in trading; ideal for waiting out market volatility.

- 📉 Portfolio Balancing: Provide a safe harbor in bear markets and can be used in short strategies.

⚠️ Risks and Disadvantages of Stablecoins

- ❌ Lack of Reserve Transparency: Not all projects clearly disclose or audit reserves.

- 🏦 Centralization Risk: Fiat-backed coins often rely on centralized entities.

- ⚖️ Regulatory Scrutiny: Governments are increasingly monitoring stablecoins; future regulations may include licensing and transparency obligations.

- 💥 System Failures: Algorithmic models are prone to collapse if supply-demand balance fails (e.g., Terra UST disaster).

🔍 Notable Stablecoin Examples

📌 MakerDAO – DAI

A decentralized, over-collateralized stablecoin operating on Ethereum. Community-governed and crypto-backed.

📌 TrueUSD (TUSD)

A fiat-backed stablecoin pegged 1:1 to USD. Regularly audited and offers reserve transparency through Chainlink.

⚖️ Are Stablecoins Regulated?

In recent years, stablecoins have caught the attention of global financial regulators. Authorities in the US, Europe, and Asia are implementing measures to prevent potential systemic risks. These include:

- Mandatory reserve disclosures

- Licensing requirements

- Transparency standards

🧾 Conclusion: Are Stablecoins the Digital Money of the Future?

Stablecoins act as a bridge between crypto and traditional finance, offering vital solutions for both cautious investors and everyday users. However, systemic risks, regulatory pressures, and lack of transparency remain significant challenges.

With growing applications in payments, decentralized finance (DeFi), and international trade, stablecoins are showing strong signs of becoming the digital money of the future

Comments ()