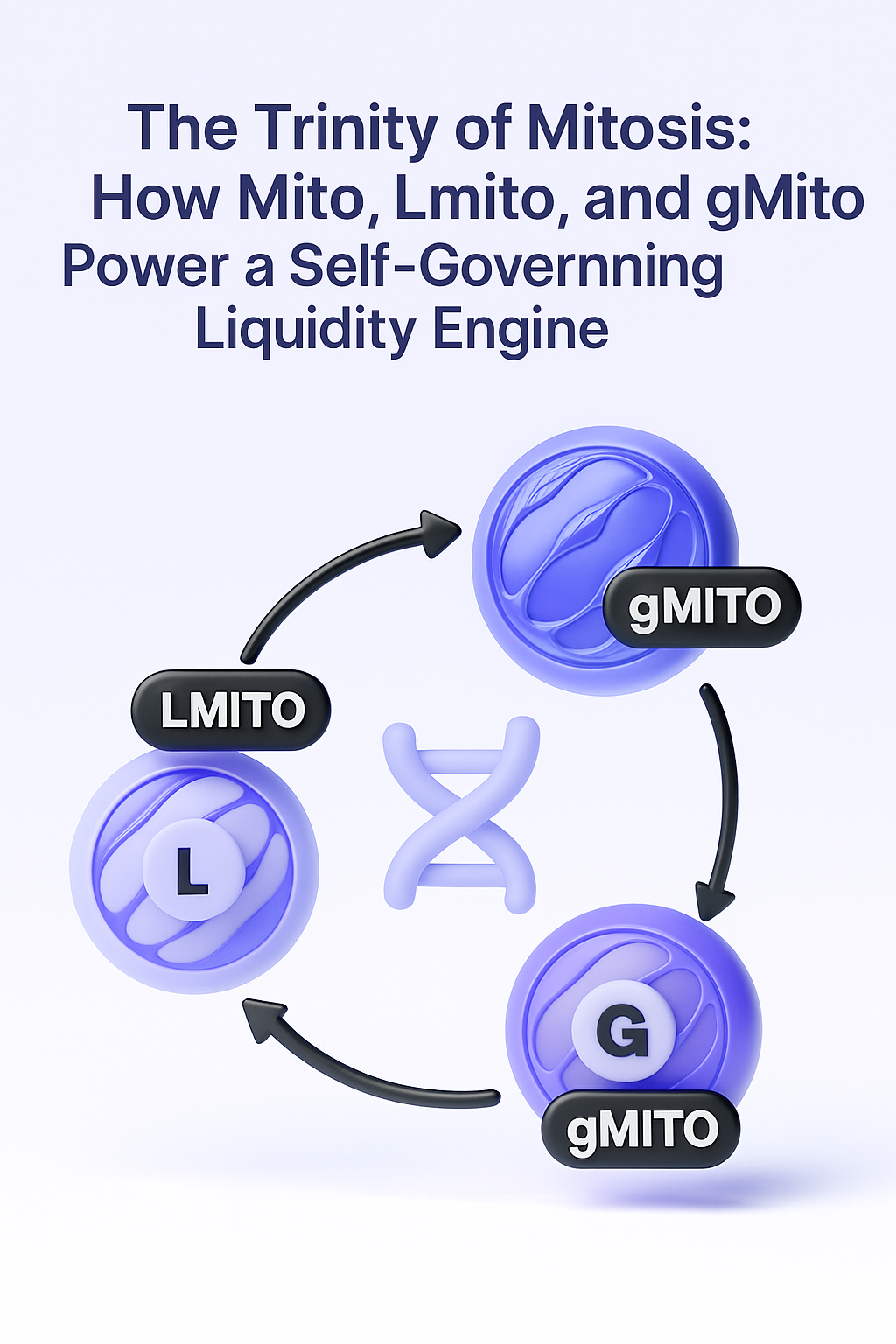

The Trinity of Mitosis: How Mito, Lmito, and gMito Power a Self-Governing Liquidity Engine

Introduction

At the core of Mitosis lies a bold experiment: can liquidity govern itself?

This question led to the creation of a three-token system, Mito, Lmito, and gMito, each designed to play a specific role in orchestrating capital, incentives, and governance across the protocol.

Where traditional DeFi projects rely heavily on external yield incentives or centralized treasury control, Mitosis aims to align ownership, utility, and decision-making through this trinity of tokens. It’s not just about earning yields or staking rewards, it’s about giving liquidity itself the tools to self-organize, self-incentivize, and ultimately self-govern.

This system transforms passive capital into active infrastructure, where every token has a purpose, and every action feeds back into the strength of the network.

Let’s break down what each token does and how, together, they enable a smarter, more sustainable liquidity engine.

The Trinity of Mitosis: Mito, Lmito, and gMito

1. Mito: The Base Token of Liquidity Participation

Mito is the foundational token in the Mitosis ecosystem. It represents both access and alignment, the entry point for users who want to participate in the network’s liquidity engine.

What Mito Does:

- Access to Yield Opportunities: Users deposit Mito into vaults to participate in Mitosis’ programmable liquidity strategies.

- Liquidity Entry Layer: It’s the token most users will interact with initially, whether through vault deposits, swapping into strategies, or accumulating for yield.

- Value Accrual: Mito benefits from protocol activity. As more users participate and more yield is generated, Mito’s demand can increase.

Mito is the primary fuel in the system, it’s what gets routed, rebalanced, and composed by VLF and Hyperlane. Its liquidity unlocks the network’s utility.

2. Lmito: Locked Mito for Committed Participants

Lmito (Locked Mito) represents a longer-term commitment to the protocol. When users lock their Mito for a defined period, they receive Lmito in return.

What Lmito Enables:

- Boosted Rewards: Vault participants with Lmito often receive higher yield boosts or additional protocol incentives.

- Governance Weight: Lmito can be used in some voting mechanisms to influence strategic decisions, especially those that align with long-term health.

- Signal of Alignment: Holding Lmito is a public commitment to the protocol, it indicates that the user is not just chasing short-term gains, but invested in the protocol’s sustainability.

Strategic Role:

Lmito introduces stickiness to the ecosystem. It’s an anti-mercenary measure, rewarding long-term users while strengthening protocol liquidity depth.

Lmito is the proof-of-loyalty layer. It ensures that those who contribute meaningfully get amplified benefits, helping stabilize the economic design.

3. gMito: Governance and Meta-Liquidity Coordination

gMito is the governance-layer token of Mitosis, the most advanced piece of the system’s token trinity.

What gMito Does:

- Voting Power: gMito holders can vote on core decisions such as vault strategy approvals, protocol parameters, yield routing, and ecosystem expansion.

- Incentive Allocation: Through governance, gMito can influence where protocol incentives are directed, for example, which chains or vaults should receive yield boosts.

- Meta-Liquidity Control: As Mitosis scales, gMito becomes the token through which the community steers the direction of its ecosystem-owned liquidity.

Flywheel Effect:

As the protocol grows and more yield strategies are deployed:

- More vaults = more utility for Mito

- More Mito demand = more Lmito locking

- More Lmito = more gMito voting

- More gMito votes = better capital coordination

Implication:

gMito represents protocol-level intelligence. it lets the community decide how the liquidity brain behaves over time. This is what makes Mitosis a self-governing liquidity engine. gMito shifts power from the core team to the community, enabling a self-governing liquidity infrastructure where capital is not only automated, but collectively guided.

Interconnected Dynamics: Why All 3 Matter

Each token serves a different purpose, but they interlock to create a powerful, decentralized feedback loop:

| Token | Role | Incentive | Impact |

|---|---|---|---|

| Mito | Capital & entry token | Base yield, flexibility | Fuels the ecosystem |

| Lmito | Locked capital | Boosted rewards | Reduces volatility, rewards loyalty |

| gMito | Governance layer | Strategic influence | Guides protocol evolution |

This structure ensures that:

- Short-term actors can earn via Mito.

- Long-term believers lock into Lmito.

- Vision-aligned contributors shape outcomes via gMito.

Together, they form a multi-layered incentive structure, resilient, adaptable, and community-aligned.

Conclusion: A Self-Governing Liquidity Engine in Motion

The Mito, Lmito, gMito structure is more than just a token trio, it’s the operating system for Mitosis’ liquidity brain.

- Mito keeps the engine running by powering vaults and enabling yield generation.

- Lmito strengthens the system’s core by locking in capital and rewarding loyalty.

- gMito gives the ecosystem its voice, ensuring that the community directs the flow of capital and strategic growth.

This interconnected design transforms Mitosis from a standard DeFi protocol into a self-governing, yield-optimizing organism. Capital is no longer idle or blindly chasing APR, it’s strategically deployed, cross-chain coordinated, and community-guided.

In a DeFi world often dominated by short-term incentives and fragmented liquidity, the Mito, Lmito, gMito model ensures alignment, resilience, and adaptability. It’s not just about earning yield; it’s about owning the system that creates it.

The result? An autonomous liquidity engine that learns, adapts, and grows, with the community at the helm.

References

• Glossary – Mitosis University

• Mito, gMito, Lmito: The Trinity of Alignment

• The Three‑Token Model of Mitosis: A Blueprint for Sustainable DeFi

Comments ()