The Ultimate Toolkit to Navigate DeFi Like a Pro

In the ever-evolving world of decentralized finance (DeFi), finding the right tools can be the difference between blindly guessing and making informed, profitable decisions. Whether you're creating crypto content or diving deep into liquidity pools, having the proper setup can save you time, reduce risks, and open doors to real opportunities.

Over time, many in the community have asked me: “What tools do you use daily to research, create, and explore the best of what DeFi has to offer?” This article is my answer — a practical breakdown of my personal toolkit, refined over countless hours of experimentation, research, and trial-and-error.

If you're part of the Mantle ecosystem, love on-chain analytics, or want to improve your ranking on Kaito’s leaderboard, this curated list might just give you an edge.

Let’s dive in.

My Toolkit Categories

I’ve divided the tools into 5 main categories, depending on your goals and where you are in your DeFi journey:

- General Info about Crypto Protocols

- On-Chain Analytics

- Technical Analysis Tools

- Liquidity Pools & DeFi

- Security

General Info About Crypto Protocols

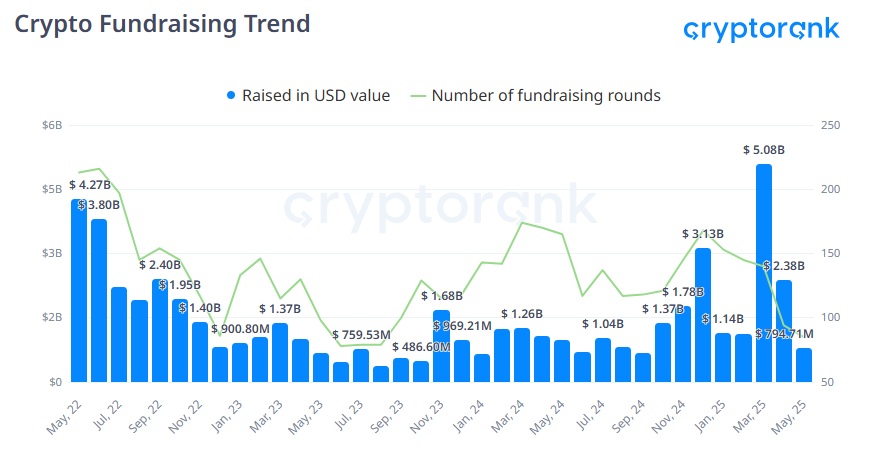

Crypto Rank

CryptoRank is a comprehensive platform offering crowdsourced and professionally curated research, price analysis, and crypto market-moving news. It provides insights into fundraising deals, token sales, unlocks, fund portfolios, and launchpad ROI. Users can access a variety of tools, including market data APIs, cryptocurrency converters, and widgets for their sites.

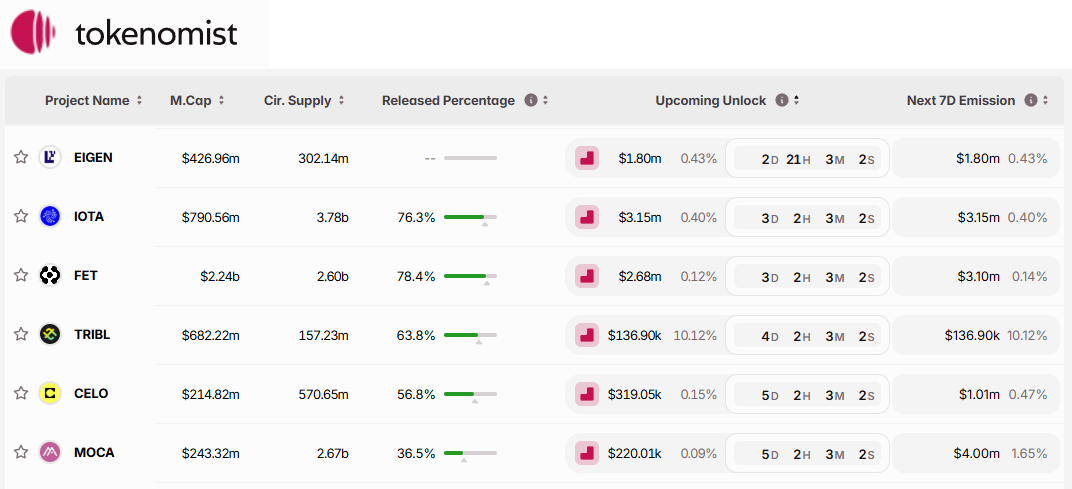

Tokenomist

Tokenomist.ai is an AI-powered tokenomics platform that offers a complete solution for supply-side tokenomics data. It allows users to analyze future token emissions, track vesting schedules, and compare standardized tokenomics and allocations across projects to gain actionable insights.

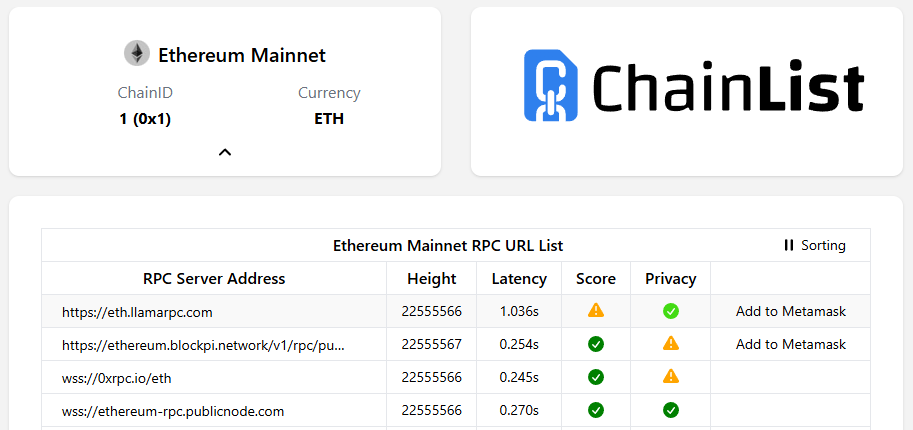

Chain List

Likely developed by DefiLlama. Originally helpful for importing chains into Metamask, now useful for selecting high-score privacy RPCs and switching from unstable nodes (especially after switching to Rabby).

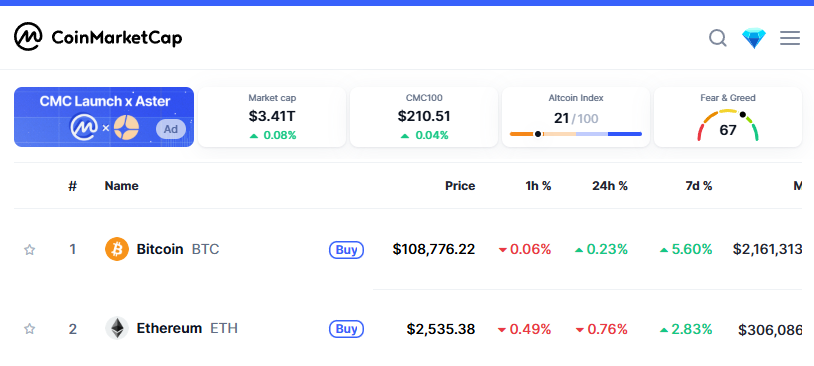

Coin Market Cap

My go-to for daily market price checks. I organize watchlists by token category (L1s, L2s, DEXs, etc.), and also check token contracts across multiple chains to ensure there's liquidity.

Coingecko

CoinGecko is the world's largest independent cryptocurrency data aggregator, tracking over 17,000 different crypto assets across more than 1,000 exchanges. It provides users with a comprehensive 360-degree view of the market, delivering accurate, reliable, and in-depth information from thousands of data points.

MCxyz

A fun and powerful market cap simulator. Want to see what happens if $MNT hits the ATH of $POL or matches ETH’s current MC? You can project it easily here.

On-Chain Analytics

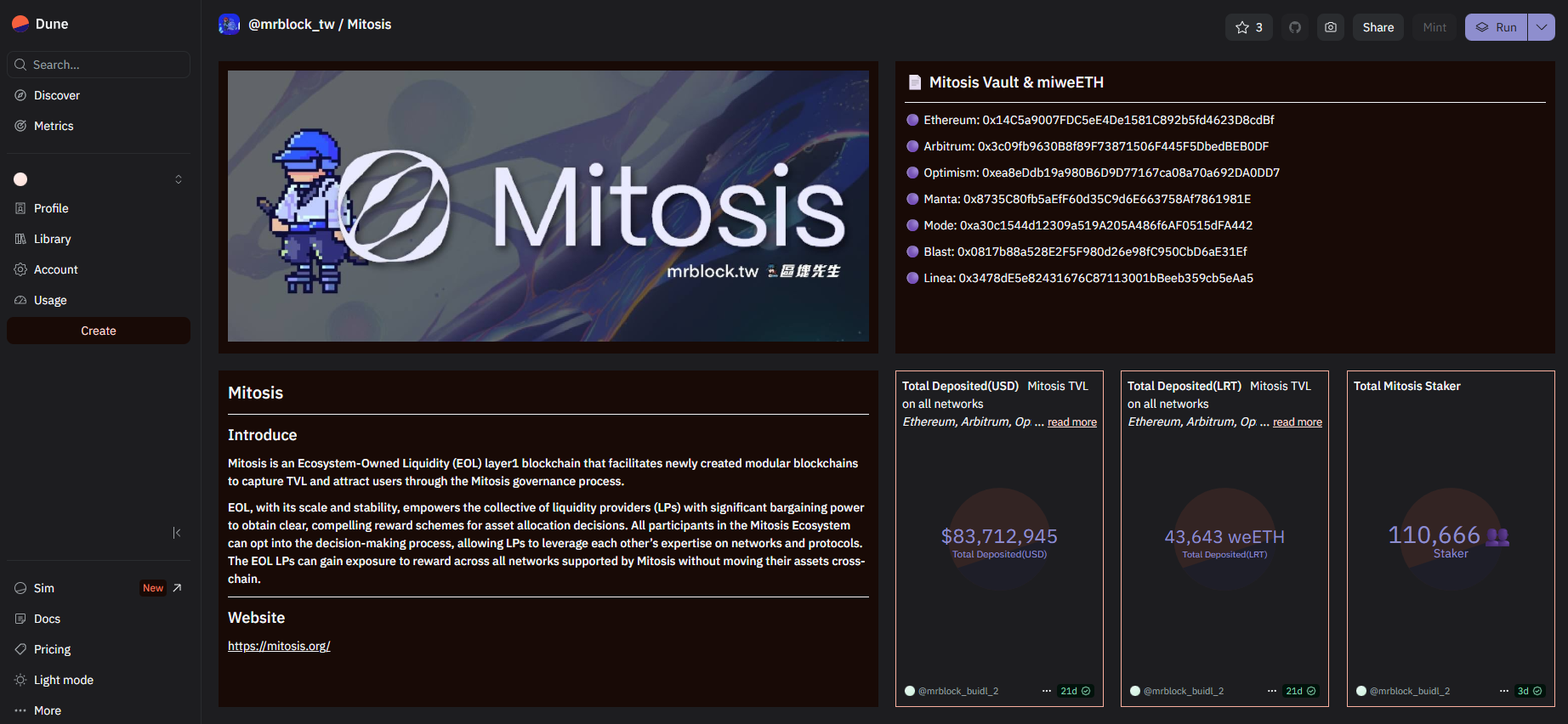

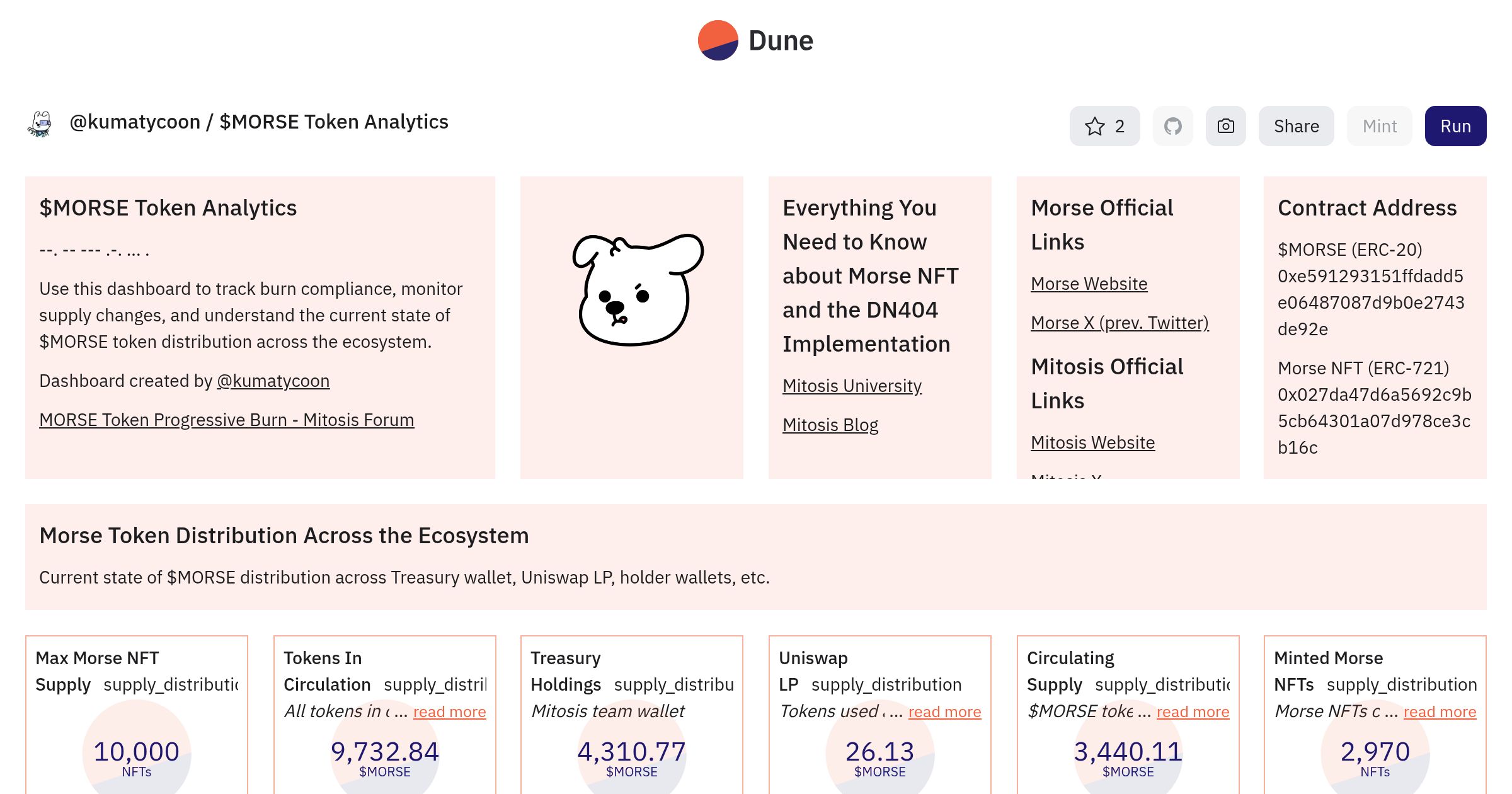

Dune

Dune is a specialized tool designed to simplify the creation of interactive dashboards using on-chain data. The great thing is that anyone with basic knowledge of programming logic and database querying can build their own dashboards with charts, tables, and other useful information about crypto protocols and their campaigns.

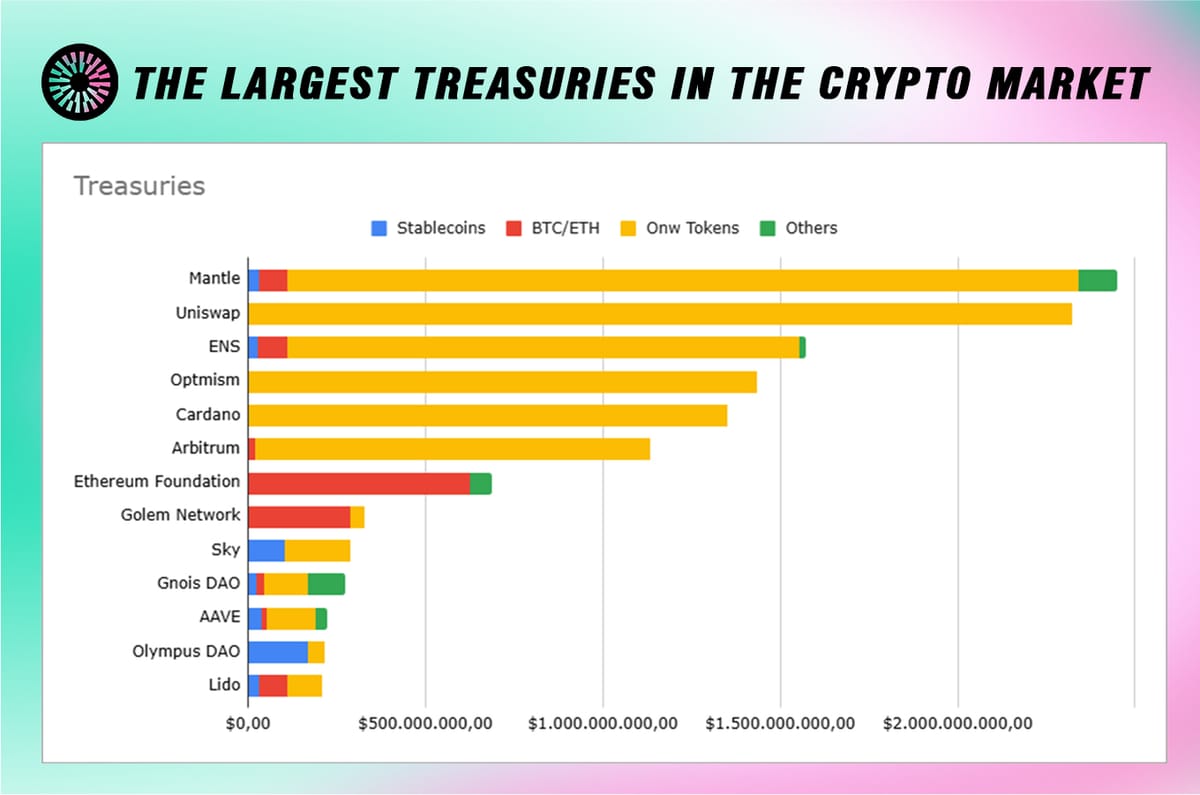

DefiLlama

Probably the most comprehensive tool on this list. DefiLlama is a DeFi TVL aggregator committed to providing accurate data without ads or sponsored content. It offers transparency in tracking the total value locked (TVL) across various DeFi protocols and chains, serving as a reliable source for DeFi analytics.

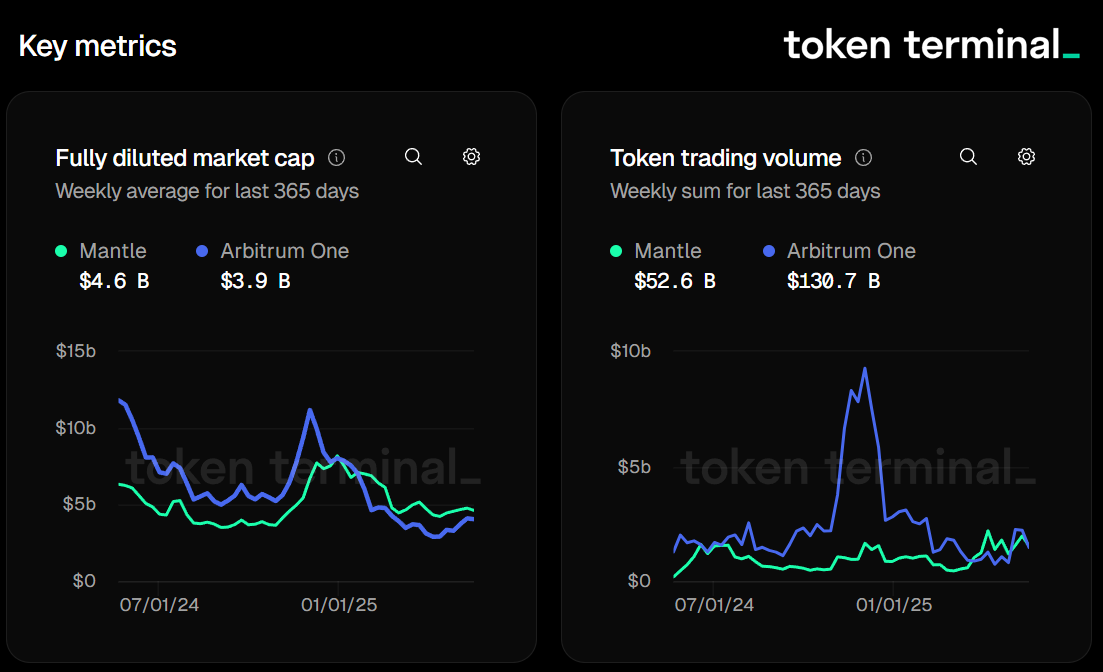

Token Terminal

Token Terminal is a full-stack on-chain data platform focused on standardizing financial and alternative data for widely used blockchains and decentralized applications. It provides fundamental metrics and analytics to help users understand the financial performance of crypto projects.

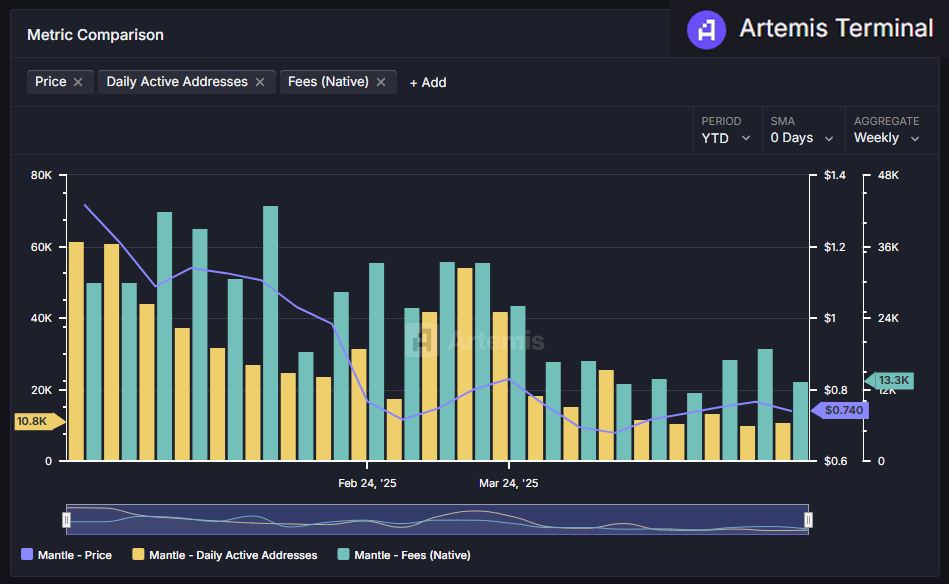

Artemis

Artemis offers a no-code terminal for digital assets, allowing users to track metrics that move crypto markets. It provides deep dives into key fundamentals for protocols and chains, enabling users to analyze asset performance and market dynamics effectively.

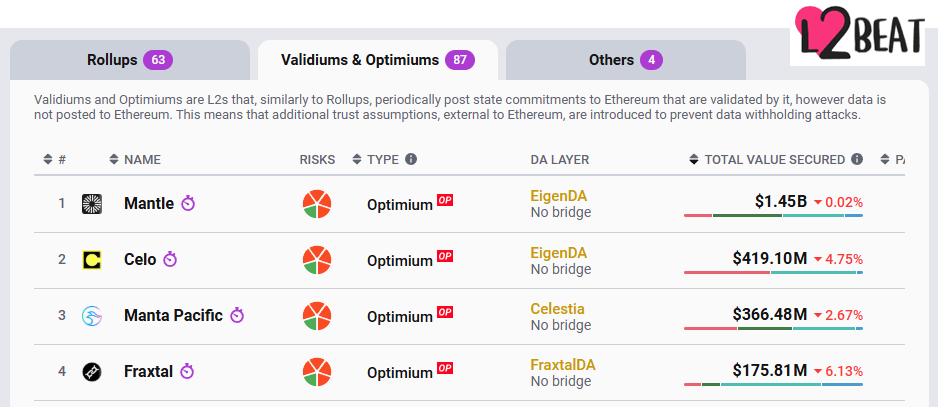

L2 Beat

L2BEAT is an analytics and research website focusing on Ethereum layer 2 scaling solutions. It provides in-depth comparisons of major protocols live on Ethereum, offering insights into their security, decentralization, and other critical metrics.

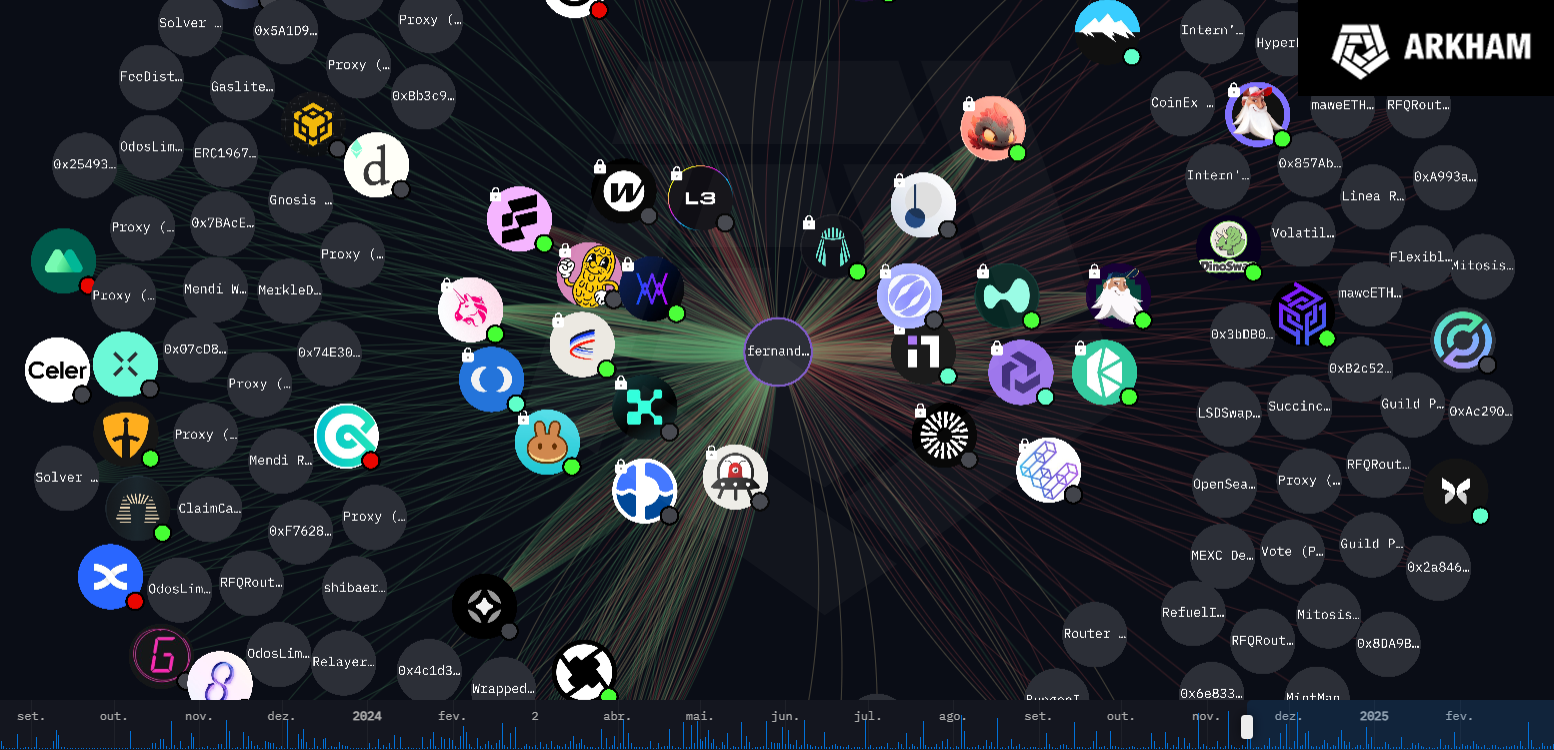

Arkham

Arkham Intelligence is a blockchain analytics platform that deanonymizes the entities behind blockchain wallets and transactions. It reveals the activities of top traders, hedge funds, whales, and governments, providing transparency into their buying, selling, and holding behaviors.

Technical Analysis Tools

Tradingview

TradingView is a supercharged charting platform and social network for traders and investors. It offers advanced charting tools, real-time data, and a community-driven environment for sharing trading ideas and strategies across various markets, including cryptocurrencies.

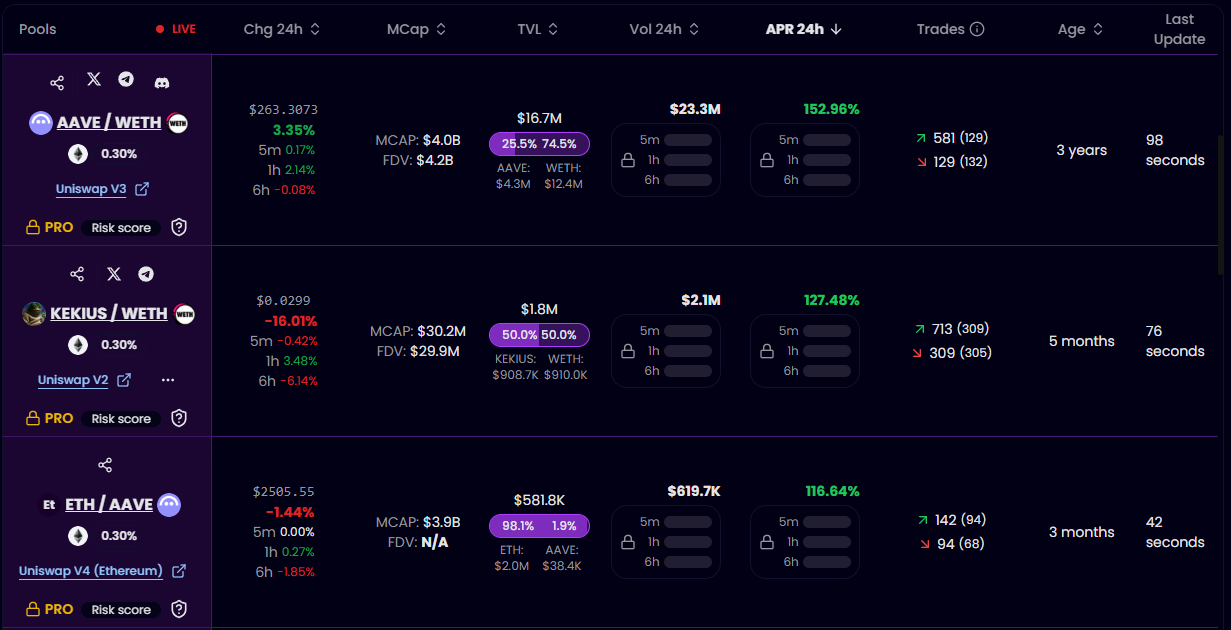

Dexscreener & GeckoTerminal

For on-chain degen action — especially tokens not listed on CEXs — use Dexscreener or GeckoTerminal. They provide TradingView-based charts using on-chain liquidity data.

Liquidity Pools & DeFi

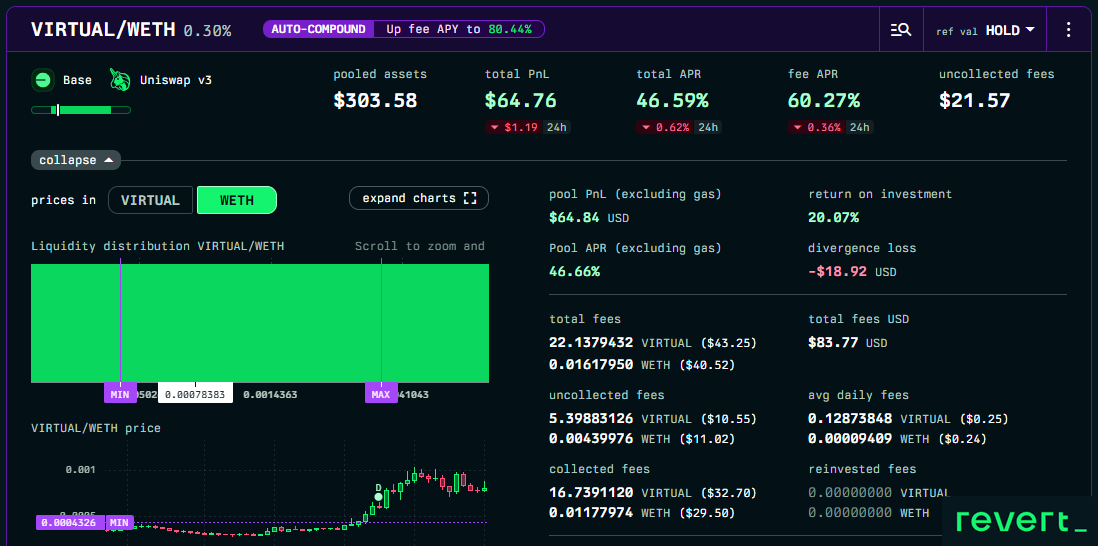

Revert Finance

Revert Finance is a tool designed to help liquidity providers assess their performance. It calculates whether users are earning more from fees than they're losing to impermanent loss, providing insights into the profitability of their liquidity positions.

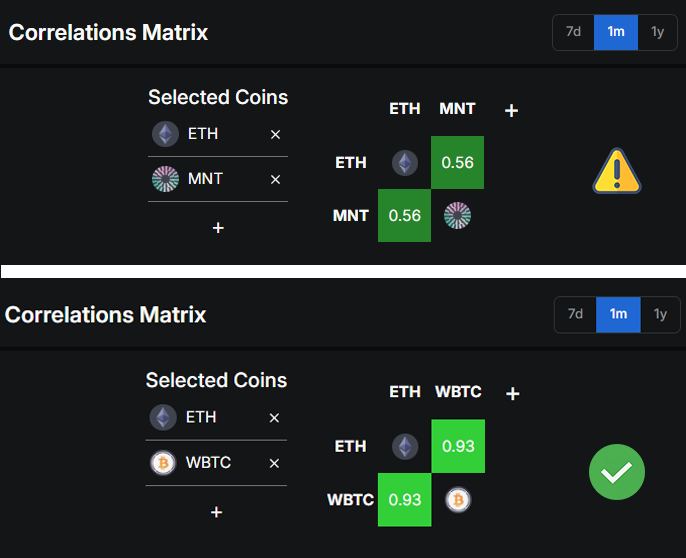

Token Correlation

Before providing liquidity with two volatile tokens, it’s crucial to check their correlation to see if the pool actually makes sense. A high APY means nothing if the pool easily goes out of range, since the risk of impermanent loss outweighing the collected fees becomes very high.

That’s why I recommend a new feature from Defi Llama: Token Correlation. It allows you to quickly check how correlated two assets are. The closer the value is to 1, the better for your LP strategy.

In the image, you can see the correlation between $ETH / $BTC and $ETH / $MNT over the past 30 days.

(where 1 = 100% correlation, 0 = no correlation, -1 = inverse correlation)

It's worth noting that these correlation values are not fixed — the correlation between two tokens can vary throughout the cycle, with periods of higher or lower correlation. So it's important to keep monitoring them regularly.

Defi Station XYZ

Excellent for discovering high-quality LPs across EVM chains and Solana. Filter by TVL, volume, chain, and DEX. Built by the Brazilian community!

Portfolio Management Tools

DeBank DeFi

DeBank is a real-time dashboard for EVM wallets, allowing users to view balances across chains, track dApps usage, and ensure no tokens are forgotten. It also functions as a social network for crypto users, featuring badges and other interactive elements.

CoinMarketCap & Coingecko

Both platforms offer portfolio tracking to log your entry/exit prices and monitor performance.

Security Tools You Shouldn’t Skip

Wallet Guard, Revoke Cash & Kerberus

These tools scan the transactions you're signing and alert you to potential scams or malicious contracts. They also warn about suspicious websites.

Still using Metamask? Use revoke.cash monthly to remove outdated contract approvals. Rabby users — you're already covered by native revocation features.

Bonus Tip: Wallet Guard also alerts you when your wallet extensions are outdated — super important to stay safe.

Final Thoughts

Did you enjoy this curated list of DeFi tools?

There’s a lot more I could share, but I’ll stop here to keep things digestible. If this helped you discover even one new tool that improves your journey, give it a share or drop me a message.

If enough people find this valuable, I’ll put together Part 2 soon.

Until then — stay curious, stay safe, and keep exploring the frontier of DeFi.

Did you enjoy this content?

If it helped you in any way, I’d really appreciate your support!

Feel free to connect with me on Twitter/X, and if you’d like to send a Praise, my Discord is open too. 🙏

Thanks in advance for your trust and support — it means a lot! 🙌

Follow me on Twitter/X: febarce |DeFi

My Dircord: febarce |DeFi

Check out my other articles

Comments ()