Theo Raises $20M to Bring High-Frequency Trading Yields to the Masses — and What That Means for the Mitosis Community

In the fast-evolving world of decentralized finance (DeFi), where new protocols are launched almost weekly, one startup is taking a bold step toward bridging the gap between traditional high-frequency trading (HFT) and everyday crypto users. That startup is Theo, and it just raised $20 million to do exactly that.

But this isn’t just another headline about a funding round. For users in the Mitosis community, it’s a signal flare — an early indication that the tools and strategies once reserved for Wall Street elites are now being packaged, simplified, and made accessible through collaborative DeFi initiatives.

Let’s break down why this matters and how you can actually benefit.

From HFT to DeFi: Meet the Founders of Theo

Theo was founded by Abhi Pingle, along with his brother Arijit Pingle and cofounder TK Kwon — all three of whom share a background in computer science and a deep pedigree in quantitative trading. They’ve worked at some of the biggest names in HFT: Optiver and IMC Trading. In 2022, they made the jump into crypto, first working on the Canto blockchain before founding Theo in late 2023.

Their mission? Bring HFT-style strategies to a wider audience — particularly those locked out of traditional finance due to lack of capital, access, or infrastructure. And that mission just got a major boost with the announcement of a $20 million raise across two funding rounds.

The first round in March 2024 raised $4.5M and was led by Manifold Trading, a quantitative investment firm. The second, announced in April 2025, brought in $15.5M and was led by Hack VC and Anthos Capital. Other participants included Flowdesk, Selini Capital, and individuals from Citadel, JPMorgan, Jane Street, and Optiver.

Worth noting: the raise was conducted via token warrants, which means early investors are betting big on Theo’s upcoming native token and long-term vision.

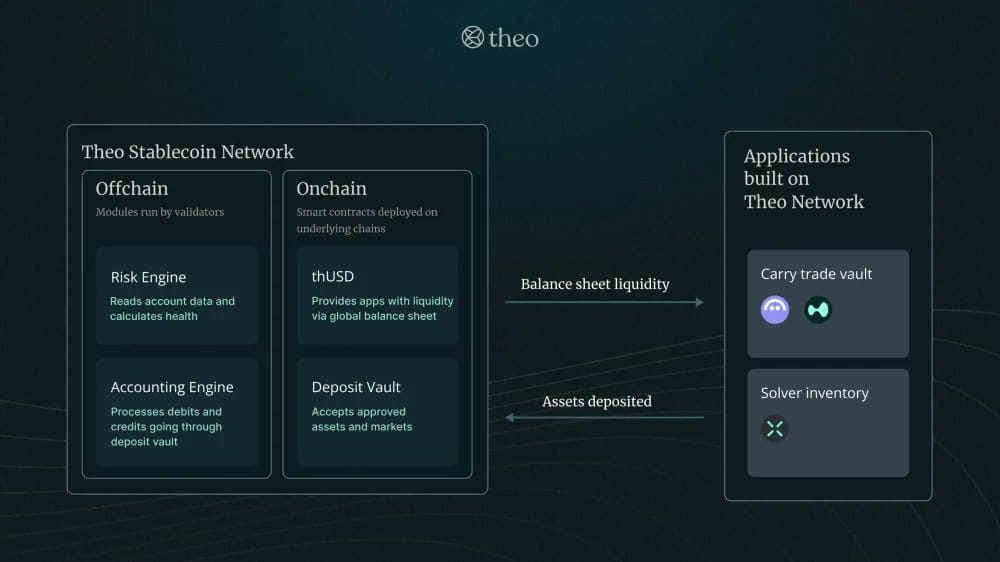

What Is Theo Network?

At its core, Theo Network is a sophisticated infrastructure protocol built to deliver capital efficiency to onchain traders. It combines onchain smart contracts with offchain risk engines and accounting systems — creating a hybrid system that feels like an HFT back office but for DeFi users.

Theo’s flagship product is Theo Earn, a product designed for cross-margining and carry trade execution across supported protocols. This allows users — from individual traders to family offices — to generate yield in a way that mimics the playbooks of hedge funds and quant desks.

Unlike most DeFi protocols, Theo puts heavy emphasis on real-time risk management. That’s how it’s been able to support integrations with high-risk, high-reward platforms like:

- Hyperliquid – a decentralized perpetuals exchange

- Aave – the most trusted name in crypto lending

These integrations allow users to take out leveraged positions, earn passive yield, and move between markets more freely — all while staying within Theo’s risk-controlled environment.

The Mitosis Connection: More Than Just a Collab

The Mitosis community has been watching Theo closely — and for good reason.

Right now, Mitosis and Theo are running a joint campaign called Theo Stradle that allows users to deposit weETH and unlock five streams of value, all from a single move:

- Base yield via Ether.fi (LRT)

- Additional Theo yield (~8.9% APY)

- $THEO airdrop eligibility (~10–15% est. APY)

- MITO Points for the future $MITO airdrop

- Vault-level multipliers that combine yield and rewards

This isn’t just yield farming. It’s yield stacking — a DeFi-native concept often referred to as "money legos", where various protocols are composably layered to maximize returns. With Theo’s new funding, the capacity and efficiency of these vaults are likely to improve even more.

As Mitosis puts it: One move. Five income streams. That’s DeFi alchemy.

🤓 If you haven’t grasped the potential of Mitosis’ First Matrix Vault Campaign in partnership with Theo Network, don’t worry — I’ll let physics explain it for you.

— febarce | DeFi 🍳🧬 (@primesoft_mkt) March 8, 2025

🔥 @MitosisOrg + @TheoNetwork_ + @ether_fi

When you combine these three protocols, BOOM!💥

🤑 Juicy yields start… pic.twitter.com/253Op8hagh

What Are Matrix Vaults?

All of this is made possible by the Mitosis infrastructure known as Matrix Vaults — a part of its Curated Liquidity Campaigns. These vaults allow protocols like Theo to:

- Bootstrap liquidity in a time-bound window

- Attract users with targeted incentives

- Avoid the pitfalls of mercenary capital

For users, it’s a chance to participate in campaigns that are built for efficiency, transparency, and long-term value — not just short-term hype.

The Future of Theo: Centralized Markets and Beyond

Until now, Theo has focused mainly on DeFi integrations — but that’s about to change. According to Abhi Pingle, the team is already planning to expand into centralized exchanges like Binance and Bybit, and eventually into traditional markets.

In other words, this isn’t a “DeFi-only” play. It’s a vision of a unified financial layer — one that blends the best of centralized and decentralized finance, and lets users benefit from both.

As of today, Theo has attracted over $50M in deposits, with users (including funds and family offices) seeing yields of 7%–8% over the past three months, and 18%–20% annually over the last year.

And they’re not stopping there. The team plans to uncap deposit limits by the end of April 2025.

Bonus Alpha: Exclusive Discord Role for miweETH Holders

If you’re already participating in the Mitosis x Theo campaign and holding miweETH, there’s an exclusive Discord role waiting for you inside Theo’s community.

That role could come with early access, special rewards, or future governance privileges — so don’t sleep on it.

👉 Join here: https://guild.xyz/theo

TL;DR

Theo isn’t just another DeFi protocol — it’s a bold attempt to bring Wall Street-level tools to the DeFi crowd. With $20M in fresh capital, a growing user base, and deep integrations with protocols like Mitosis, the future looks very bright.

For the Mitosis community, this is more than a partnership — it’s a chance to front-run the next wave of capital-efficient, high-yield opportunities in crypto. And the best part? All it takes is a deposit.

Welcome to the age of airdrop legos.

Did you enjoy this content?

If it helped you in any way, I’d really appreciate your support!

Feel free to connect with me on Twitter/X, and if you’d like to send a Praise, my Discord is open too. 🙏

Thanks in advance for your trust and support — it means a lot! 🙌

Follow me on Twitter/X: febarce |DeFi

My Dircord: febarce |DeFi

Check out my other articles

References:

• Fortune Crypto Interview

• Announcing the Inaugural Matrix Vault - Theo Straddle

• Matrix Vaults: Reimagining Liquidity Opportunities

• Theo Network Documentation

• Mitosis Documentation

Comments ()