Today You Are Wrong, Tomorrow You Are Right: On Patience, Imbalances, and the Power of Unpopular Ideas

In the world of investing and financial markets, a well-known wisdom states: “In the short run, the market is a voting machine; in the long run, it’s a weighing machine.”

This metaphor, often attributed to Benjamin Graham, perfectly illustrates the dynamics of prices and their connection to fundamental value.

Today’s market is a reflection of opinions, emotions, and short-term trends. Tomorrow, after years have passed, facts and real indicators come to the forefront, revealing true value.

1. The Market as a Theater of Opinions

In the early stages of any idea or project, the market resembles a theatrical stage: here, reaction depends on public response, loud arguments, and speed of reaction.

At this stage, the winner is the thesis or asset that can attract attention faster and more loudly. This is “the democracy of hotheads,” where emotions and short-term liquidity flows dominate.

However, over time, the situation changes. In the long run, fundamental metrics—such as profitability indicators, user growth, and technological advantages—start to weigh more heavily. Then the scene is taken over by “the aristocracy of facts,” where true value is determined by real data rather than noise.

John Maynard Keynes’ famous quote underscores this imbalance: “Markets can remain irrational longer than you can remain solvent.” In other words, even if it seems that the market is wrong now, it can stay in that misconception for a very long time.

2. Why Sometimes “The Crowd” Is Not Wrong

Success stories show that mass opinion can sometimes be correct. Recall early ETH meetups: back then retail investors suggested XRP, LTC, and ADA — it seemed laughable. Today, these coins are in the top 15 by market cap.

Another example is Fantom. It was considered “dead,” until founder Andre Cronje returned to the project with a new release. Within a short period, its price tripled.

Even attempts by competitors to “sink” Hyperliquid DEX at around $14 triggered a Streisand effect: the price soared to nearly $50. These stories confirm that sometimes small players’ ideas turn out to be very powerful and can change the game.

Howard Marks emphasizes an important point: “Never make fun of the little guy with a big idea — he just might be right.” Sometimes unpopular ideas become breakthroughs.

Hyperliquid DEX - https://app.hyperliquid.xyz/

3. Price ≠ Value (Immediately)

The market often reacts quickly and emotionally to news; however, this does not always reflect an asset’s true value. For example, announcing Bitcoin ETF approval causes a +5% spike on the day of announcement — then prices plateau due to regulatory compliance requirements.

Similarly, major upgrades from top altcoins often generate minimal immediate reaction until real user growth or revenue figures appear.

Peter Lynch famously noted: “The market is filled with individuals who know the price of everything but the value of nothing.” That is: price reflects current sentiment or speculation; true value takes time to manifest.

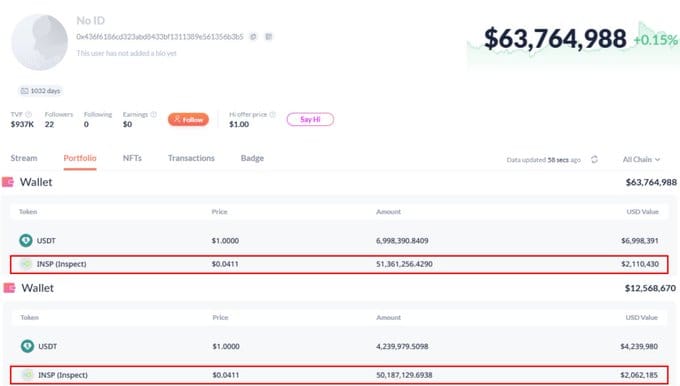

4. Billions Locked Up; Tokens Worth Cents

Sometimes large projects with enormous Total Value Locked (TVL) lose significant value due to market fluctuations or changes in fee distribution mechanics. For example, Aave had around $15 billion TVL but its token fell from $420 to $60.

However, when part of fees started being paid out to stakers—market participants remembered the project’s fundamentals—and its price quickly doubled. This demonstrates how understanding internal economics and long-term potential are crucial.

George Soros once said: “It’s not whether you’re right or wrong; it’s how much you make when you’re right and how much you lose when you’re wrong.” Success in investing depends not only on ideas or forecasts but also on risk management skills.

5. Belief as an Edge — Faith as a Market Advantage

Often faith in a project becomes an invisible asset. Even having an educated and persistent founder begins to be recognized by markets—albeit with a delay of one or two years.

Communities capable of holding long positions despite temporary fluctuations are an unseen strength. When fundamentals (product quality, revenue streams, legal clarity) catch up with prices—there’s often an explosive growth phase.

Steve Jobs famously said: “The people who are crazy enough to think they can change the world are the ones who do.” In crypto markets too often faith and patience are key ingredients for success.

Conclusion

Being “wrong” today is normal for those who look beyond news feeds and short-term trends. Price and value do not align immediately; long-term approaches require patience and belief in your ideas.

A “long position” isn’t just about holding assets—it’s a mindset. The main thing is to survive until facts drown out critics’ noise and mockery. When that moment arrives—when reality overtakes hype—the applause will go to those brave enough today to believe in what seems impossible now but could become inevitable tomorrow.

Useful Links

🌐 Website: https://mitosis.org

📖 Docs: https://docs.mitosis.org

🐦 Twitter / X: https://twitter.com/MitosisOrg

💬 Discord: https://discord.gg/mitosis

Comments ()