Tokenomics: Token + Economics = The DNA of Crypto Projects

One of the most critical concepts that everyone who wants to succeed in the crypto world must know is Tokenomics, or "token economy." So, what exactly is tokenomics? Why does it appear as the most important aspect to pay attention to in every crypto project? In this article, you will discover step by step what tokenomics is, how it works, and why it is indispensable for crypto projects with real-life examples and detailed explanations.

What is Tokenomics and Why is it the Heart of the Crypto World?

The word “tokenomics” is formed by combining “token” and “economics.” Simply put, it is the sum of all rules that determine the creation, distribution, circulation, usage areas, and value of tokens in a crypto project.

As crypto investors, it is not enough to just look at the project’s technical features, roadmap, or the founding team’s experience. Understanding a project’s tokenomics means knowing how the token will appreciate in the future, what the supply-demand dynamics will be, and what incentives are offered to participants. Therefore, tokenomics is the compass to understand whether a crypto asset is healthy or risky.

Overview of Tokenomics: How Does It Work?

Tokenomics is essentially like the “central bank” in decentralized projects. However, unlike central banks, it does not make secret decisions; all mechanisms are coded on the blockchain and are visible to everyone. The total supply of tokens, distribution method, burning processes, and incentives all are managed transparently and immutably.

Example: Bitcoin (BTC)

Bitcoin is the best-known example of tokenomics.

- Total supply: Limited to 21 million BTC (this limit is never exceeded).

- New BTC creation: Through mining and given as block rewards every 10 minutes.

- Halving: Mining rewards are halved every 210,000 blocks (approximately every 4 years).

- Final Bitcoin issuance: Expected to complete around the year 2140.

This way, Bitcoin’s supply is predetermined, and the annual issuance of new bitcoins is predictable. Additionally, transaction fees provide extra incentives for miners to keep the network secure. This mechanism guarantees the preservation of Bitcoin’s value and network security.

Fundamental Elements of Tokenomics

To understand a tokenomics structure, some critical topics must be considered:

1. Token Supply: Maximum, Circulating, and Burning

- Maximum Supply: The maximum total number of tokens that can ever be created. For example, Bitcoin is capped at 21 million, Litecoin at 84 million.

- Circulating Supply: The number of tokens currently in the market and being traded.

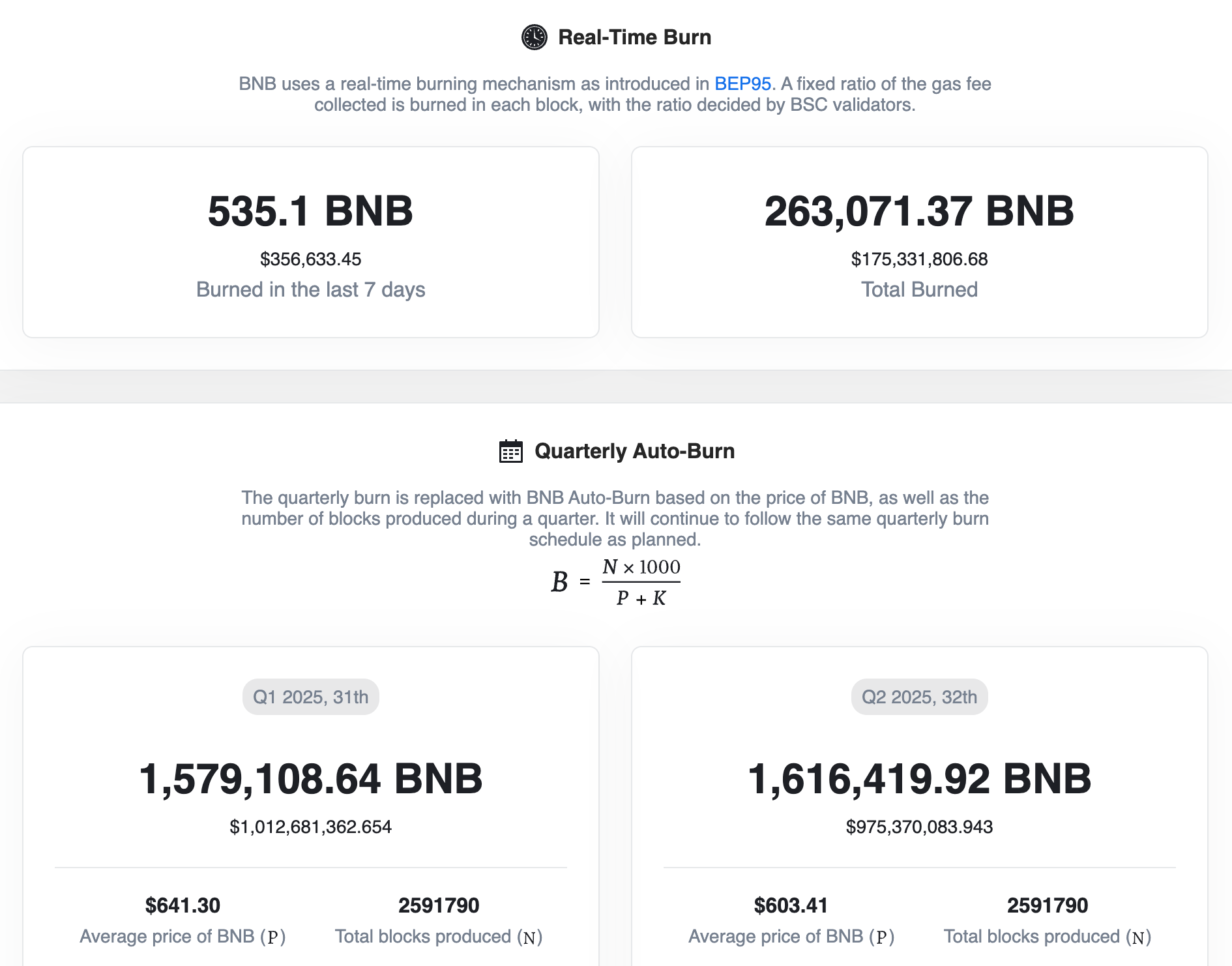

- Token Burning: Some projects permanently “burn” a certain amount of tokens to reduce supply. For example, Binance Coin (BNB) regularly burns tokens to reduce total supply, creating a deflationary effect.

2. Token Use Cases (Utility)

It is important not only that a token exists but also how it is used in the real world and ecosystem.

For example, BNB offers discounts on trading fees within the Binance ecosystem, can be staked, and provides access to certain products.

Ethereum (ETH) is not just a currency but also the fuel for smart contracts.

Governance tokens give holders voting rights in project decisions (e.g., Compound’s COMP token).

Stablecoins (USDT, USDC) maintain a stable value and are used for everyday payments.

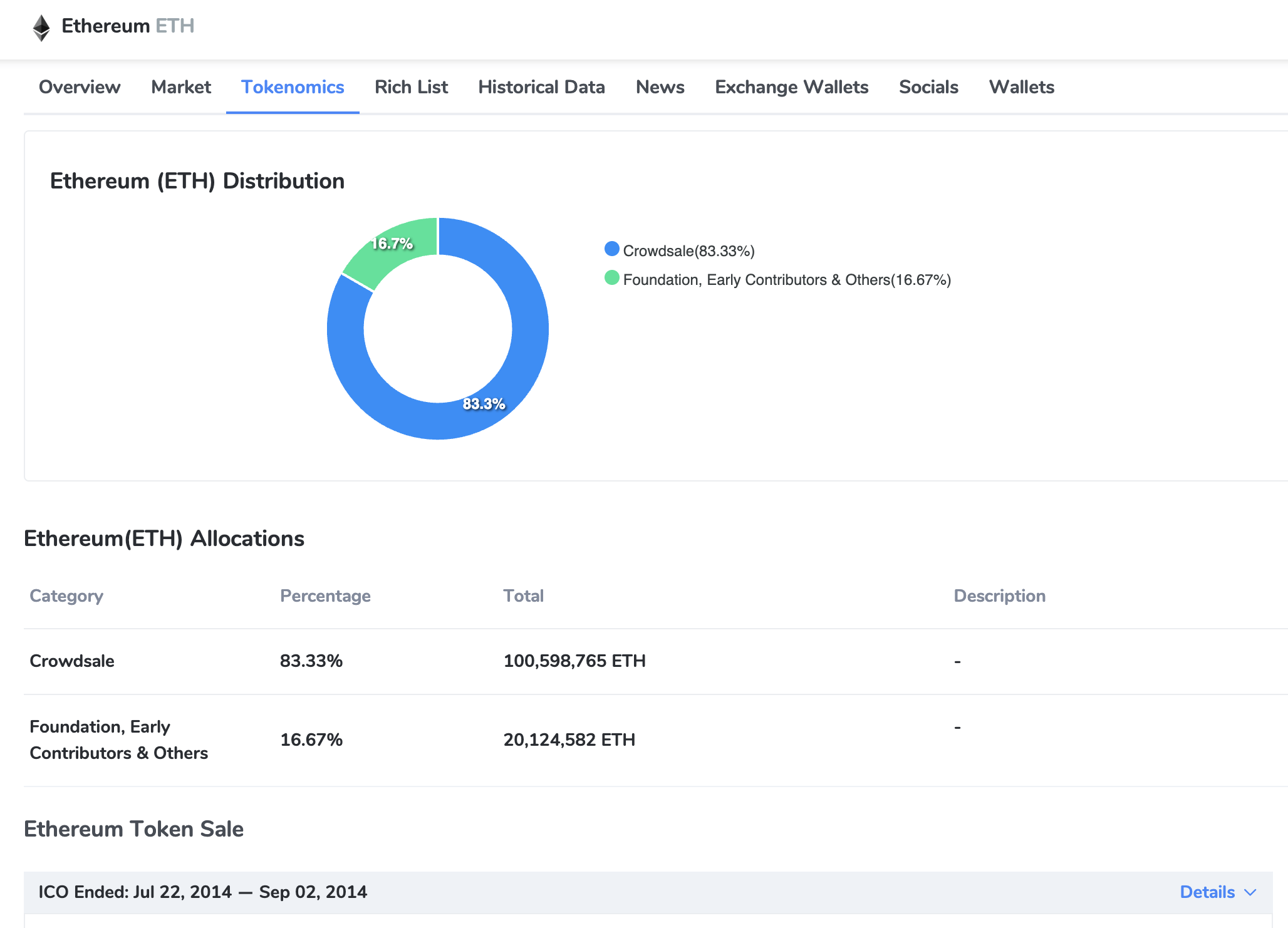

3. Token Distribution and Ownership

How tokens are distributed matters greatly. Excessive token holdings by large investors or founding teams increase the risk of price manipulation.

- Fair Launch: Tokens are offered equally to everyone without prior allocation (e.g., Bitcoin).

- Pre-Mining: Tokens are allocated early to specific parties in certain amounts (e.g., Ethereum, BNB).

4. Incentive Mechanisms

Incentives are the core of tokenomics. Users and validators are rewarded for contributing to the network.

- Proof of Work (PoW): Mining for block validation and rewards (Bitcoin).

- Proof of Stake (PoS): Locking tokens to become validators and earn rewards (Ethereum 2.0, Cardano).

- DeFi Incentives: For example, Compound rewards liquidity providers with interest and governance tokens.

Interesting Real-Life Tokenomics Examples

1. Dogecoin (DOGE) — Fun but Unlimited

Dogecoin is a token without a supply cap. Therefore, its potential for value increase is limited, but it remains popular due to an active user base and low transaction fees. Unlimited supply means the price inevitably avoids deflationary effects.

2. Binance Coin (BNB) — Deflationary Model

BNB regularly burns tokens to reduce total supply. This process raises BNB’s price as supply decreases while demand remains constant. Such deflationary models can be attractive to investors.

3. Ethereum (ETH) — Both Supply Increase and Burning

Ethereum produces new supply annually, but with the EIP-1559 update, a portion of transaction fees is burned to balance the supply. This hybrid model keeps Ethereum’s economy dynamic and is an important factor for its price.

The Importance of Tokenomics for Crypto Projects

Tokenomics plays a major role in a crypto project’s success. Poorly designed or weak tokenomics:

- Undermines investor confidence,

- Causes excessive price volatility,

- Threatens long-term project sustainability.

On the other hand, well-designed tokenomics:

- Incentivizes participants,

- Increases project loyalty,

- Accelerates ecosystem growth,

- Ensures the token’s healthy value appreciation.

The Future of Tokenomics: NFTs and More

Tokenomics is not limited to cryptocurrencies. NFTs (Non-Fungible Tokens) offer a new tokenomics model based on the rarity and uniqueness of digital assets. Furthermore, tokenization of real estate, art, and other physical assets will deepen the economy even further.

Conclusion: Understanding Tokenomics is the Path to Success

For crypto investors, tokenomics is not just a technical term but the backbone of investment decisions. The stronger and more transparent the economy behind a token is, the more reliable and long-lasting it will be. When evaluating tokenomics, carefully examine:

- Maximum and circulating supply,

- Token distribution,

- Use cases,

- Incentive mechanisms,

- Burning and deflation policies.

Remember, a strong tokenomics model builds both the value and the ecosystem of a project on solid foundations.

Trying to succeed in the crypto world without understanding tokenomics is like navigating a sea without a compass. Therefore, make token economics your first research topic in every new project

Comments ()