Treehouse Finance

Treehouse is an infrastructure protocol that democratizes access to fixed income strategies in DeFi. Through its tokenized products and decentralized rate-setting mechanism, Treehouse enables users to earn yield by participating in arbitrage opportunities typically reserved for institutional players. The protocol plays a key role in aligning fragmented interest rates across blockchain ecosystems.

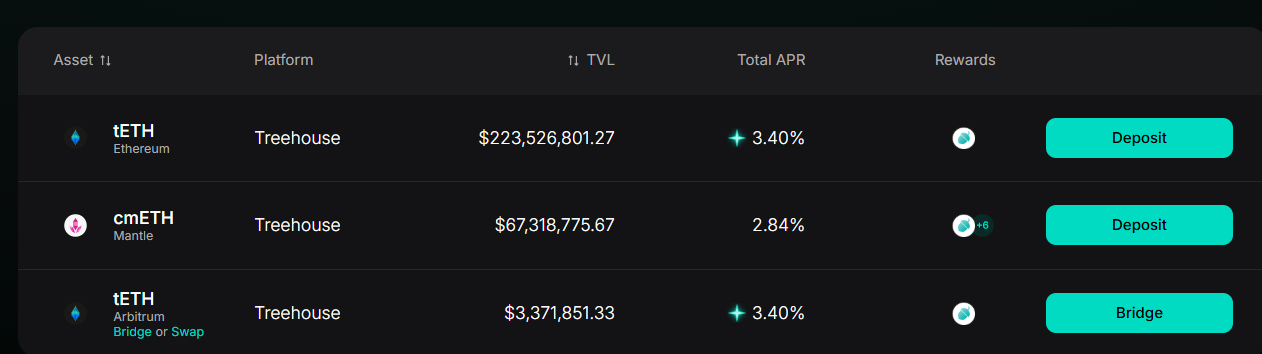

tAssets and tETH

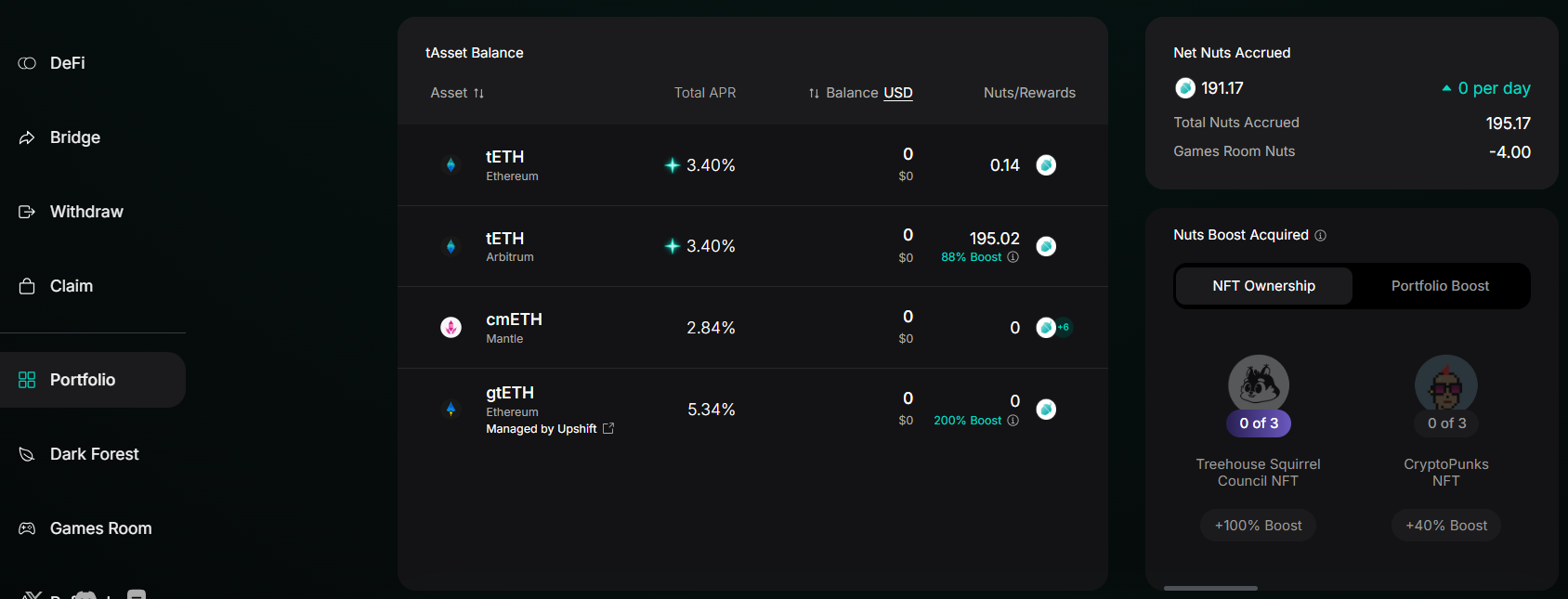

tAssets are tokenized staking products that generate real yield through rate arbitrage. The flagship asset, tETH, represents a liquid staking derivative that earns yield by converging various ETH staking rates toward the network’s “risk-free rate.”

Users can deposit ETH or Liquid Staking Tokens (LSTs) such as stETH and receive tETH in return. Holding tETH entitles users to:

- Yield from rate arbitrage

- Market Efficiency Yield (MEY)

- Incentive rewards in Nuts

- Potential Restaking Points from integrated platforms

tETH is composable with DeFi protocols and is actively used in liquidity pools and other on-chain strategies.

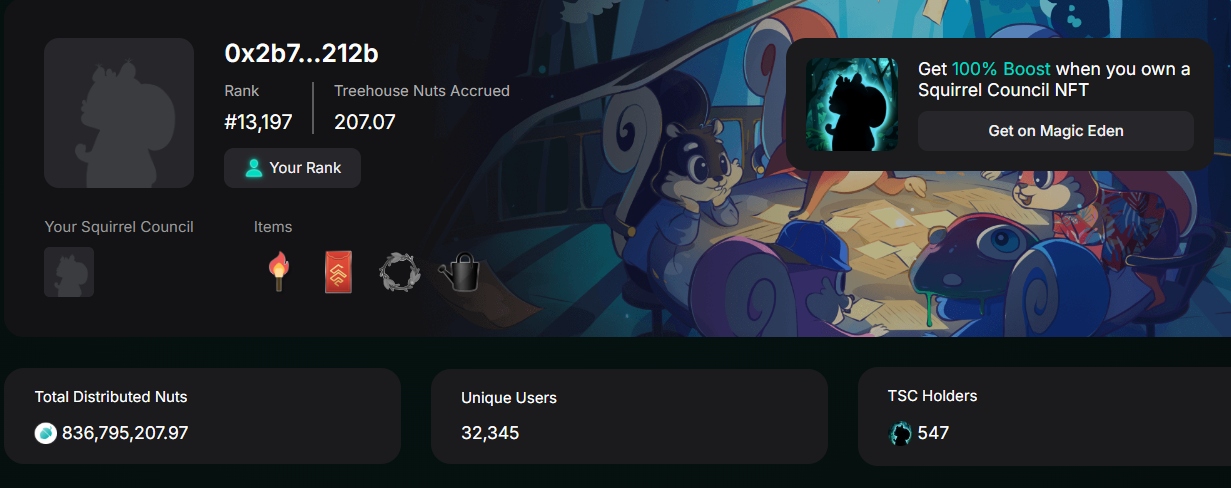

What Are Nuts?

Nuts are Treehouse’s native reward points distributed through the GoNuts incentive program. They are designed to encourage protocol engagement and reward users for contributing liquidity or staking activity.

How to earn Nuts:

- Hold tETH: 1 Nut per day for every 0.1 tETH held

- Stake LP tokens: Earn Nuts based on value locked in liquidity pools

- Minimum to qualify: 0.02 ETH equivalent

Nuts may later be used for governance participation, exclusive access to upcoming products or priority in airdrops or whitelist allocations.

1. Visit the dApp

Go to treehouse.finance and click “Stake Now” or navigate to the tAssets app.

2. Connect Your Wallet

Use MetaMask or another EVM-compatible wallet to connect to the platform.

3. Deposit ETH or LSTs

Choose the asset you want to deposit - ETH or a supported LST like stETH.

4. Start Earning

Once you receive tETH, you’ll begin earning:

- Arbitrage yield

- Nuts (reward points)

- MEY and potentially Restaking Points (for EigenLayer-compatible assets)

You can also:

- Provide liquidity in Curve or Balancer pools to earn extra yield and Nuts

- Stake tETH in future products

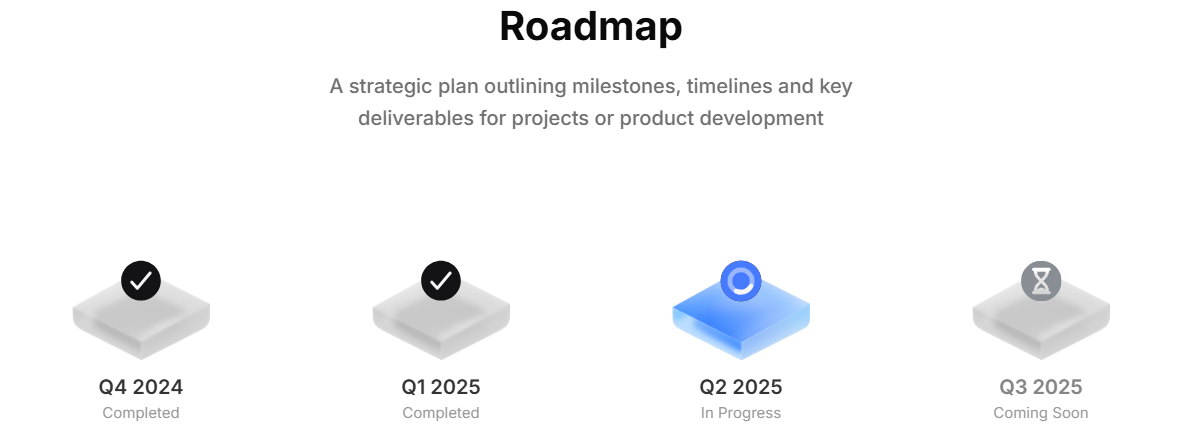

Milestones and Growth (as of Q2 2025)

- Over 30,000 unique wallets onboarded

- More than 120,000 ETH in total deposits

- Launch of tETH and TESR benchmark

- Strategic funding round valuing the protocol at $400M+

- Collaborations with Curve, Balancer, and EigenLayer

LINKS:

https://docs.treehouse.finance

Comments ()