Turtle Club: Phantom Liquidity for the Next Era of DeFi

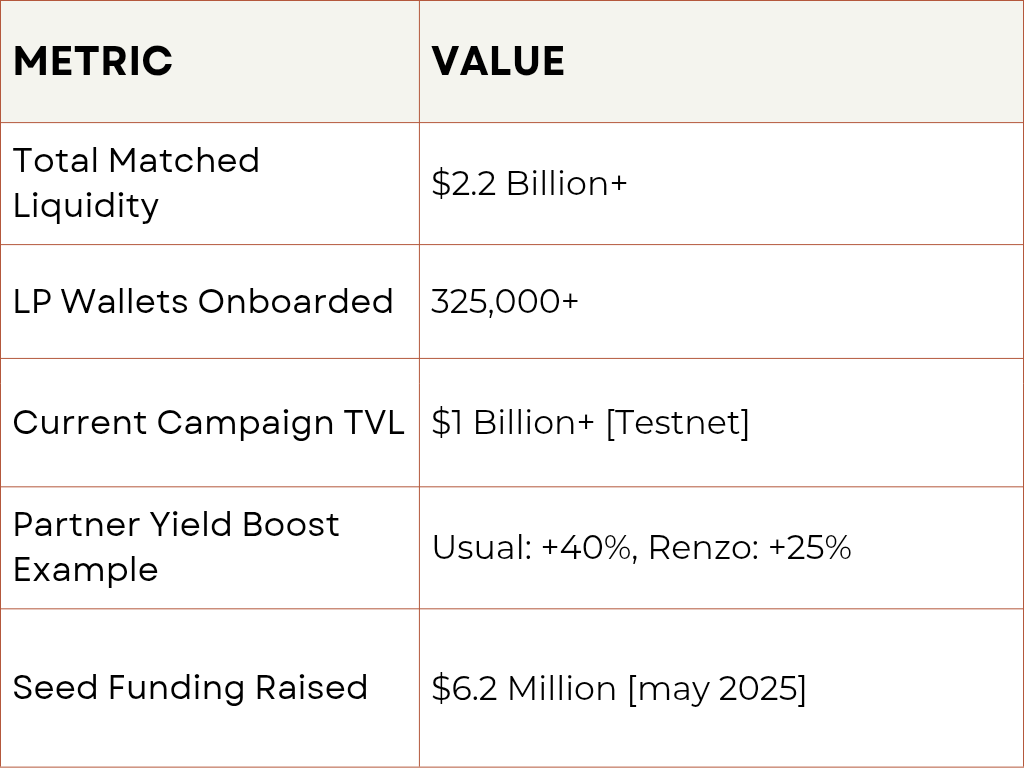

Turtle Club is pioneering a new DeFi infrastructure layer with its Phantom Liquidity Protocol, a non custodial, fee free system built for transparent, yield maximized capital distribution. Since launching in April 2024, it has attracted over 325,000 LPs, $2.2B+ in matched liquidity, and raised $6.2M from major crypto backers like THEIA, SIG, Consensys, and Joseph Lubin. Let’s break down how Turtle Club is reshaping liquidity provision in Web3.

The Vision: Liquidity Without Borders

Turtle Club is solving DeFi’s liquidity fragmentation problem by building a unified distribution layer that spans L1s, L2s, bridges, wallets, and dApps. Its mission is simple yet powerful:

Open up and enhance the distribution of backroom liquidity with transparency, fairness, and access for all.

The “Turtle” metaphor isn’t just branding, it represents resilience, endurance, and protection, aligning with Turtle Club’s long term, user first philosophy.

How It Works: Phantom Liquidity Infrastructure

Turtle Club’s design removes complexity for users:

● No custody, No contracts, No fees. ● LPs whitelist via signed message and retain full fund control. ● Capital is deployed directly into partner protocols (e.g., Usual, Renzo) with yield boosts. This infrastructure is tested across stablecoins, wBTC, RWAs, lending platforms, DEXes, and more.

Key Stats

How to Use Turtle Club

1. Join the Testnet: Start with the TAC Summoning Campaign, connect your wallet on turtle club, and earn points convertible to $TAC. 2. Create a Turtle Account: Link wallets, socials, or email for a unified user identity. 3. Deploy Liquidity: Use the dashboard to stake with partner protocols and earn boosted yields. 4. Track Rewards: Monitor where your liquidity is deployed and how your treasury share is growing. 5. Earn More via Community: Yapping on Kaito, referrals, and broadcasts contribute additional points.

Recent Milestones

● Seed Round: $6.2M raised from top tier VCs and ETH co-founder Joseph Lubin. ● Campaign Growth: 6,472+ users, $300M+ in Katana campaign TVL alone. ● Web App Revamp: Multi-wallet support, social login, new UX (July 2025). ● Top Partners: Usual, Renzo, Ether.Fi, Linea, Scroll, Merkl, Veda Labs. ● TAC Summoning: Live gamified testnet with real-time tracking and slashing for integrity.

Treasury Strategy: Yield with Purpose

Turtle Club doesn’t just collect partner rewards, it reinvests them: • Running validator nodes • Staking protocol tokens • Participating in lending/borrowing markets This compounds treasury value for LPs while supporting ecosystem health.

We run nodes, stake tokens, and lend assets to maximize yield for the DAO. ~ Benedikt Schulz

Governance & Community

Turtle Club is community first. Over 300,000 wallets have joined, and 11% of $TAC supply is reserved for early LPs. DAO governance will give $TAC holders direct control of the protocol’s future, with streamlined voting mandates and full transparency via the dashboard.

Security & Transparency

● Non custodial architecture = no smart contract risk for LPs ● Slashing mechanism = protects against low effort participation ● Transparent dashboard = real time insights into liquidity, boosts, treasury

Why It Matters

Turtle Club is opening access to what was once reserved for backrooms and spreadsheets, boosted yield for real users, with no custody, no hidden fees, and complete transparency. In the broader DeFi landscape, protocols like Turtle Club and Mitosis represent two sides of a larger shift: ● Turtle is building the distribution layer for latent liquidity. ● Mitosis is building the execution layer where that liquidity can become programmable, composable, and chain agnostic. Together, they reflect a new DeFi thesis: Liquidity shouldn’t just flow, it should think, move, and earn across ecosystems.

Explore Turtle Club at:

Docs: https://docs.turtle.club/

Join the Club: https://app.turtle.club/

Stay active on turtle X: https://x.com/turtleclubhouse

Explore Mitosis here and join Discord.

Thank you for reading.

Comments ()