Understanding ICOs, IDOs, and IEOs: What’s the Difference?

All three are fundraising methods used by crypto projects, but each works differently.

Let’s explore how they work—with simple examples 👇

Initial Coin Offering (ICO): Direct Token Sales to the Public

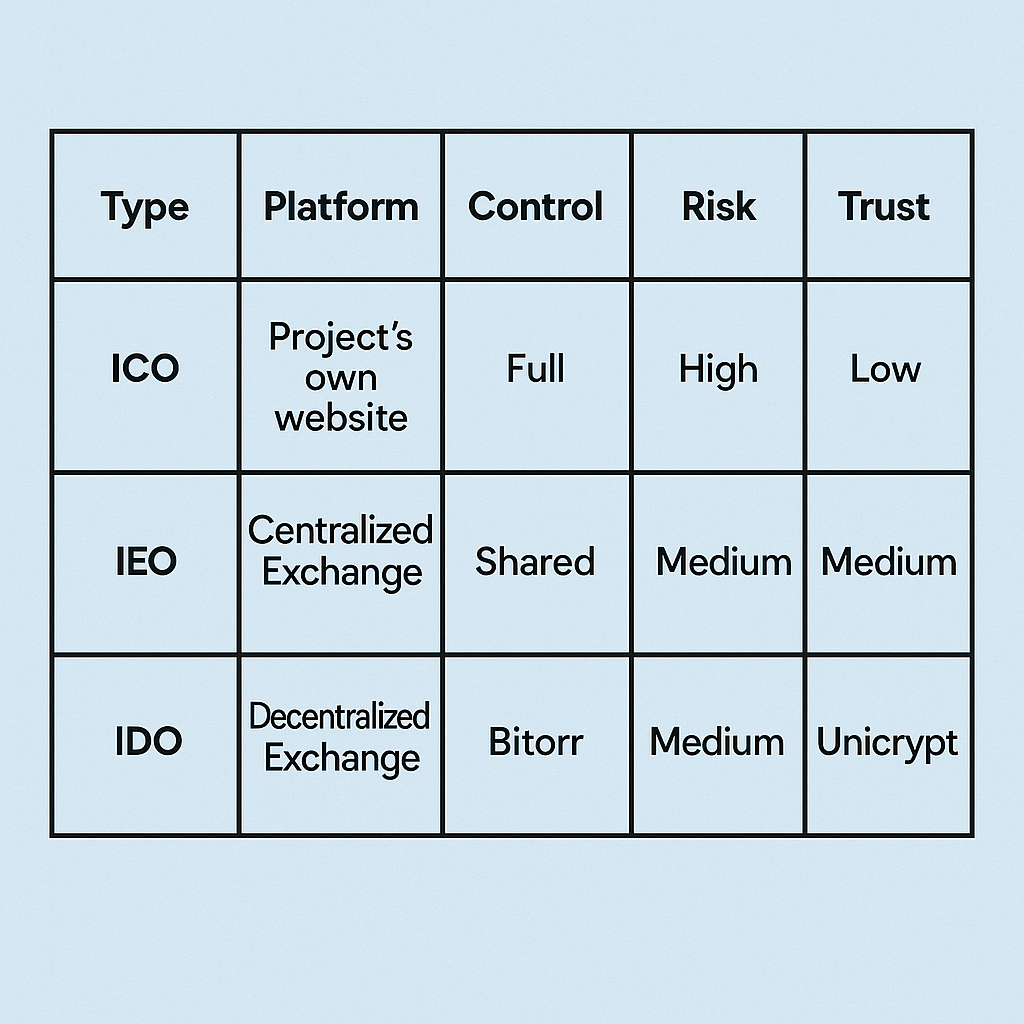

In an ICO, the project sells its tokens directly to investors.

There’s no exchange or third party involved.

Example:

Imagine a new game offering you early access to its coins before it goes public.

✅ Easy for projects to launch

❌ High risk for investors—less regulation, easier for scams

Real-Life ICO Example: Ethereum’s Token Sale

Ethereum launched an ICO in 2014.

Early buyers got ETH tokens at a very low price.

A $100 investment back then could be worth thousands today.

But many ICOs don’t succeed—some even turn out to be scams.

Initial Exchange Offering (IEO): Token Sales via Crypto Exchanges

In an IEO, the fundraising is managed by a centralized crypto exchange (like Binance or KuCoin).

Example:

It’s like launching a new product exclusively through Amazon, which promotes and sells it.

✅ More trust—exchange does background checks

❌ Exchange takes a fee and controls the process

IEO in Action: BitTorrent (BTT) on Binance

In 2019, BitTorrent raised funds through an IEO on Binance Launchpad.

It sold out within minutes.

Because Binance hosted it, investors had more trust in the project.

Initial DEX Offering (IDO): Fundraising on Decentralized Exchanges

An IDO is a public token sale hosted on a decentralized exchange (DEX) like Uniswap or PancakeSwap.

Example:

Think of it like selling lemonade at a community market. Anyone can join—no company in control.

✅ Open access, lower costs

❌ Fewer safety checks, higher risk of scams

IDO Platforms and Examples

Projects often launch IDOs using platforms like Unicrypt, TrustSwap, or DAO Maker.

These platforms help with token distribution and liquidity, but don’t always guarantee project quality.

Due diligence is still a must.

Quick Comparison: ICO vs. IEO vs. IDO

Final Thoughts: Invest Wisely and Stay Informed

Participating in token launches like ICOs, IEOs, and IDOs can be exciting, but it’s important to approach them with caution and clarity.

Each fundraising model offers unique benefits:

- ICOs give direct access but come with high risks.

- IEOs provide more safety and credibility thanks to exchange involvement.

- IDOs offer decentralization and open access but are often unregulated.

Always do your own research (DYOR) before investing. Even if a project seems popular or backed by influencers, that doesn’t guarantee success.

Look into the team’s background, the project’s use case, the tokenomics, community activity, and partnerships.

Read the whitepaper carefully.

Avoid projects that promise unrealistic returns or lack transparency.

In crypto, knowledge is your best defense against loss.

Don’t just chase hype—chase understanding

Comments ()