UNDERSTANDING MITOSIS TECHNICAL DESIGN: A NEW APPROACH TO BLOCKCHAIN LIQUIDITY.

Mitosis is a Layer 1 blockchain built to improve how liquidity works in decentralized finance (DeFi), especially in the evolving modular blockchain space. This blockchain helps to solve the problem of fragmented and inefficient liquidity by making liquidity more flexible and programmable.

A brief about what Mitosis does?

Think of Mitosis like a smart system that transforms traditional, rigid liquidity pools into dynamic assets that can move and adapt easily. This means that instead of liquidity being locked in one place, it can flow more freely and be used more efficiently across different blockchain networks.

How Does Mitosis Work?

Mitosis distributes liquidity more efficiently across different parts of the blockchain ecosystem. This ensures that capital isn’t stuck in one place but can be used where it’s needed most.

In this article, I’ll break down Mitosis’ technical design and key use cases in a way that’s easy to grasp, even if you’re new to blockchain technology.

Technical Design Behind Mitosis

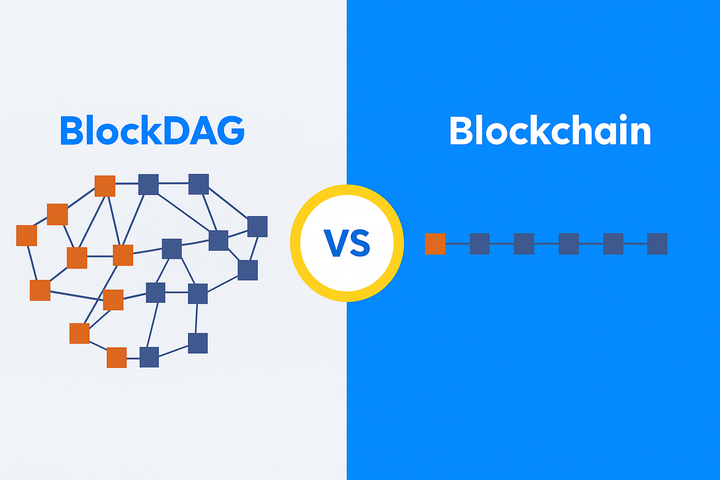

- Core Architecture: Modular Layer 1 Blockchain

- Modular Design: Mitosis is a Layer 1 blockchain designed to connect seamlessly with other specialized blockchains, such as rollups, data availability layers like Celestia, or settlement layers. This approach allows Mitosis to focus on providing liquidity while relying on other networks for tasks like transaction execution, consensus, and data storage.

- Consensus Mechanism: While the exact consensus model isn’t publicly detailed, Mitosis likely uses a scalable and efficient system tailored for high-speed DeFi transactions. It likely involves a network of validators who secure the blockchain and facilitate liquidity-related processes.

- Scalability: Mitosis scales by creating new blockchain instances as user activity grows, similar to how cells divide in biological mitosis. This method enables parallel processing, reducing delays and preventing congestion as demand increases.

- Ecosystem-Owned Liquidity (EOL) – Simplified

EOL is the foundation of Mitosis’s liquidity system. Instead of liquidity being owned by individual users looking for quick profits, it’s pooled together and managed by a DAO (Decentralized Autonomous Organization). This ensures long-term stability and efficiency.

How It Works

- Vaults for Liquidity: Users deposit assets like ETH or stablecoins into Mitosis Vaults (smart contracts) and in return, they receive special tokens (miAssets), which represent their share of the vault.

- DAO-Controlled Allocation: A DAO, made up of token holders (likely holding $MITO or a governance token), decides how this liquidity is distributed. In this case, decisions are made through on-chain voting, and approved proposals are executed automatically through smart contracts.

- Maximizing Returns: The vaults invest liquidity across various earning opportunities like staking, lending, and liquidity pools on different blockchains. This ensures optimized rewards for participants while maintaining security and efficiency.

EOL creates a sustainable, community owned liquidity model, reducing reliance on short-term profit seekers and strengthening Mitosis’s ecosystem.

- miAssets: Smart Liquidity Tokens

- What Are miAssets?

When users deposit assets into a Vault, they receive miAssets—special tokens that represent their deposit. For example, if you deposit eETH, you get meETH in return. These tokens act like digital receipts for your liquidity and are built on Mitosis’s blockchain.

- Why Are miAssets Special?

Unlike regular liquidity tokens in DeFi, miAssets are programmable, meaning they can do more than just sit in your wallet. They can be used in different ways, such as:

i. Smart Contract Integration – miAssets can interact with other DeFi platforms, allowing users to lend, trade, or use them as collateral for borrowing.

ii. Cross-Chain Compatibility – miAssets can move between different blockchains using bridges, keeping their value and function intact.

- How Do They Gain Value?

As Mitosis grows and its Vaults generate more rewards, the value of miAssets increases. This means holding miAssets reflects the performance and earnings of the liquidity pools they represent.

- Cross-Chain Infrastructure Made Simple

Mitosis helps different blockchain networks work together by making it easy to move assets between them. It does this by partnering with bridge protocols like Hyperlane and modular ecosystems like Ether.fi and Symbiotic.

- How Does It Work?

i. You deposit your assets into a Vault on one blockchain (let’s call it Chain A).

ii. Mitosis creates a new version of your asset, called miAsset, on its main network (L1).

iii. Using special messaging systems or token-wrapping techniques, your miAsset can then be used on another blockchain (Chain B). This ensures your assets remain liquid and accessible across multiple chains.

- Is It Secure?

Yes! Mitosis uses secure messaging protocols and carefully tested smart contracts to prevent issues like double-spending or hacks on bridges.

- Matrix: Curated Liquidity Campaigns

Matrix is a feature in Mitosis that organizes special liquidity campaigns with set rules, like how long they last and how much yield (profit) they aim to generate. These campaigns use smart contracts to automatically invest assets from Mitosis Vaults into high-yield opportunities.

- How Does It Work?

Automation: Smart contracts handle everything from deploying funds, managing investments, and withdrawing profits, so there’s minimal manual work.

Incentives: Users who join Matrix campaigns can earn extra rewards, making participation even more attractive and rewarding.

- The Economic Flywheel: How Mitosis Grows

Mitosis operates on a self reinforcing cycle called the Mitosis Flywheel:

- More users deposit assets into Mitosis Vaults.

- This increases the Total Value Locked (TVL), the total amount of assets in the system.

- With more TVL, Mitosis can access better yield opportunities, generating higher profits.

- The value of miAssets (the tokens representing deposited assets) increases.

- Higher miAsset value attracts even more users, repeating the cycle.

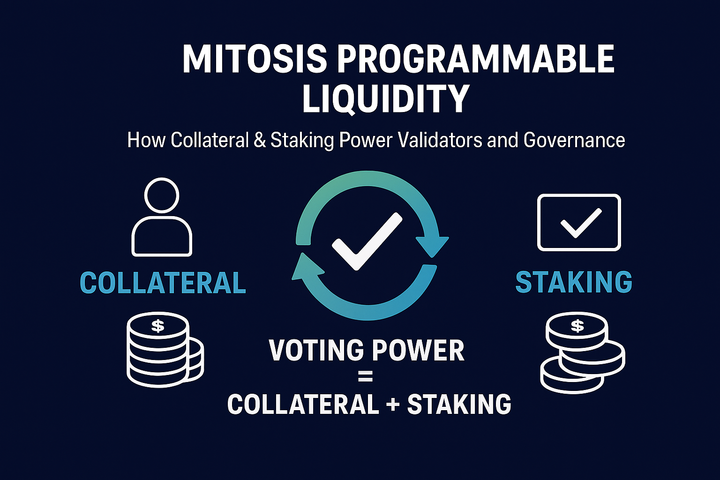

- The Role of Tokens

Mitosis will likely have its own token ($MITO) or other tokens that play a role in:

Governance: Allowing token holders to vote on decisions.

Staking: Users may be able to lock their tokens for rewards.

Incentives: Encouraging liquidity provision and participation in the ecosystem.

Essentially, the more people use Mitosis, the stronger the system becomes, creating a sustainable and growing economy.

CONCLUSION

Mitosis is building a powerful system that improves how money moves between different blockchains. Its technical design explains how it combines key blockchain features smart contracts, cross-chain connections, and a solid foundation to solve big problems in DeFi, like scattered liquidity, inefficiency, and limited access.

Instead of keeping funds separate on different blockchains, Mitosis turns liquidity into programmable assets (miAssets) and manages them under community control. This helps users earn better yields, move funds across chains easily, and build more scalable financial applications.

As Mitosis moves toward its full launch, it has the potential to change how liquidity flows between blockchains, just like how mitosis in biology allows life to grow and continue through cell division.

Comments ()