Understanding Mitosis Architecture: The Future of Programmable Liquidity in DeFi

Decentralized Finance (DeFi) has revolutionized the financial landscape by removing intermediaries and democratizing access to financial services. However, despite its rapid expansion, liquidity inefficiencies remain a major challenge. DeFi protocols often struggle with fragmented liquidity, poor price discovery, and suboptimal capital utilization. Mitosis Protocol emerges as a transformative solution, redefining liquidity provisioning through programmable, tokenized assets.

Introducing Mitosis Vaults, Vanilla Assets, and structured liquidity deployment mechanisms, enables a seamless, efficient, and democratized financial ecosystem. This deep dive into Mitosis architecture explores how it optimizes liquidity management, fosters interoperability, and unlocks new financial possibilities.

Optimizing Liquidity Through Deposit, Supply, and Utilization

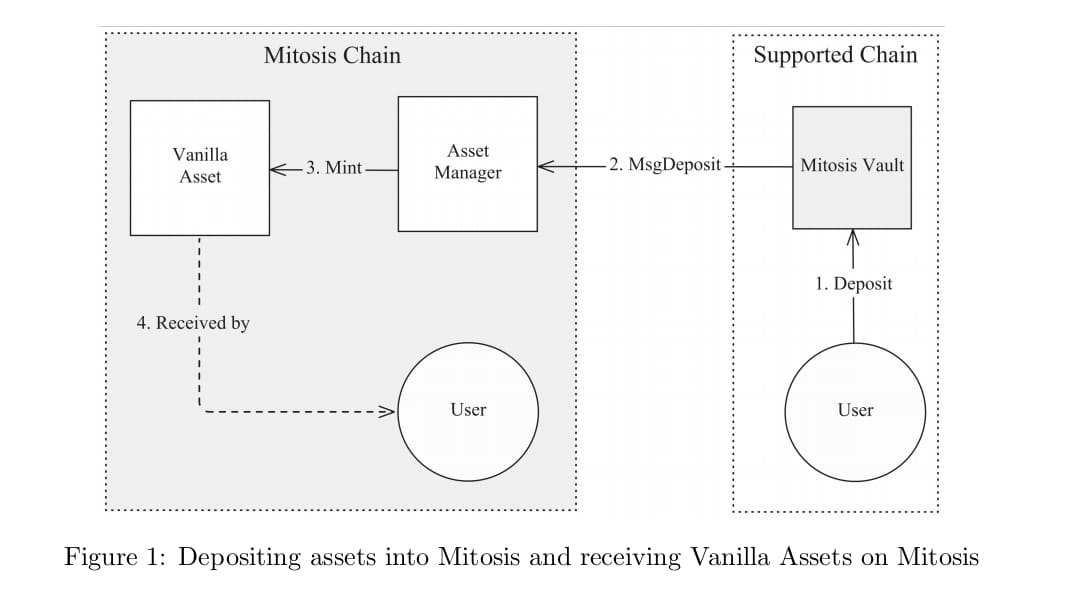

At its core, Mitosis is designed to make liquidity positions more flexible, tradeable, and composable. Traditional liquidity provision mechanisms lock up assets, preventing them from being utilized in alternative yield strategies or leveraged for collateral. This leads to inefficiencies where capital remains underutilized, and yield opportunities are limited to those with privileged access. Mitosis disrupts this status quo by tokenizing liquidity positions, making them programmable and easily transferable across DeFi applications. Through an intricate process of deposit, supply, and utilization, the protocol ensures that liquidity providers (LPs) can seamlessly manage, optimize, and deploy their assets for maximum capital efficiency. The journey begins with the deposit phase, where users contribute assets to the Mitosis ecosystem via smart contract-based Mitosis Vaults. These Vaults act as secure custody mechanisms that support multi-chain liquidity aggregation. Upon depositing, users receive Vanilla Assets, which are 1:1 representations of their original assets. This innovative approach maintains asset flexibility, as Vanilla Assets can be freely moved, traded, or deployed into liquidity campaigns without permanently locking the original capital. Unlike traditional LP tokens, Vanilla Assets ensure composability across multiple DeFi ecosystems, making them a cornerstone of Mitosis' programmable liquidity framework.

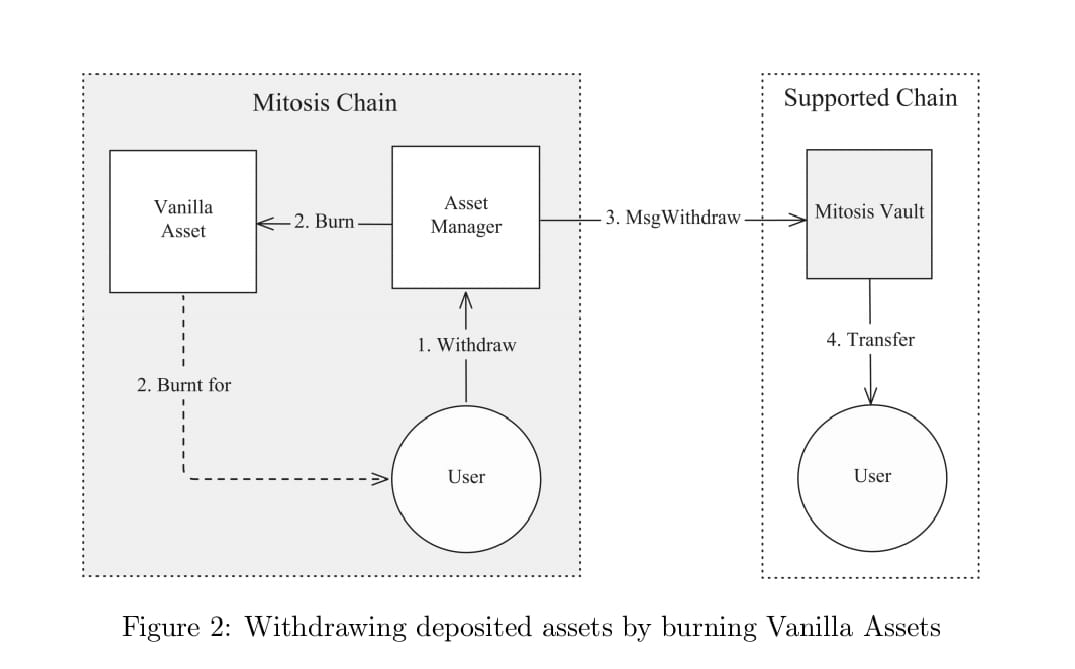

When users want to withdraw their assets, they simply burn their Vanilla Assets, triggering the Vault to release the original deposit. This withdrawal process ensures liquidity remains fluid and easily reclaimable across different blockchain networks.

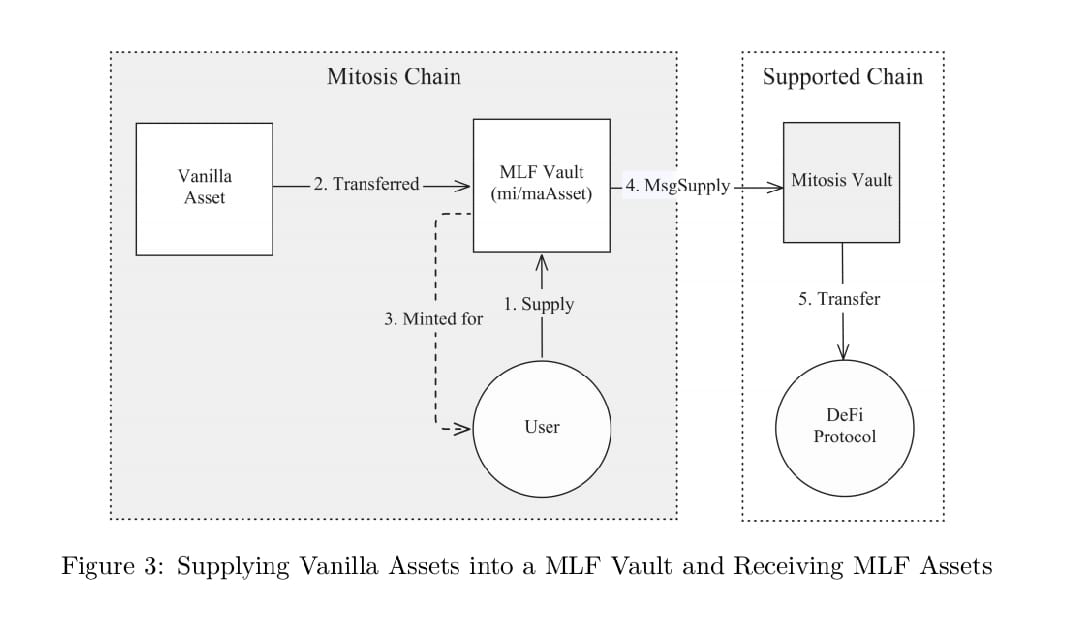

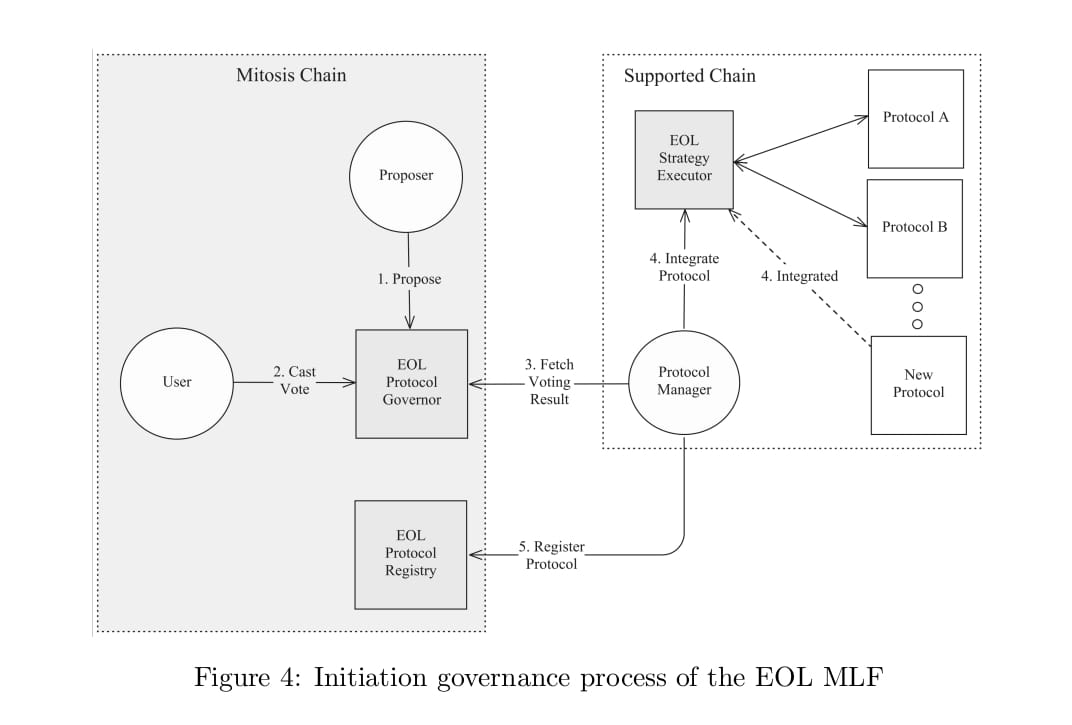

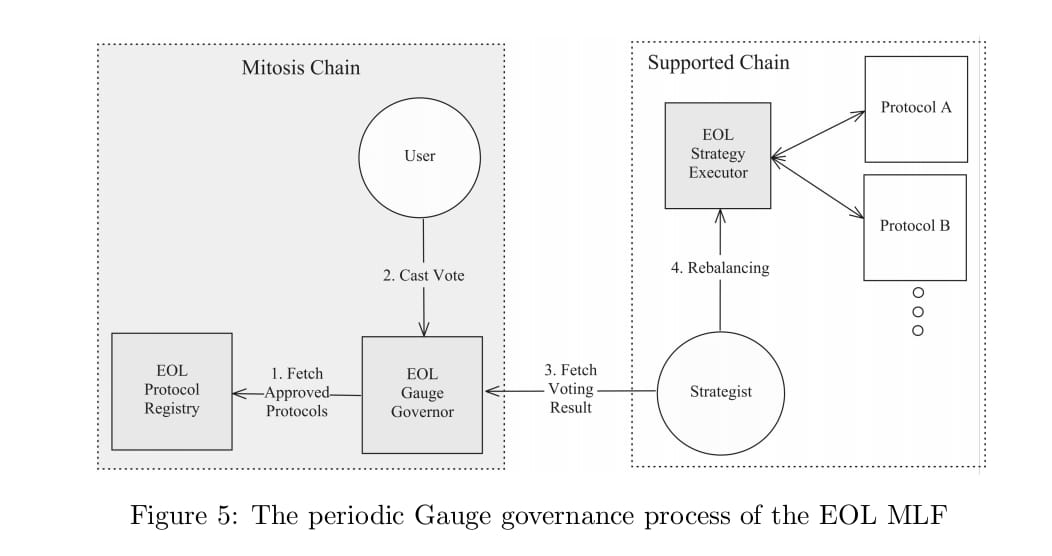

Once users acquire Vanilla Assets, they enter the supply phase, where liquidity can be deployed into various yield-generating opportunities. The protocol structures these opportunities into Mitosis Liquidity Frameworks (MLFs), each designed to optimize capital deployment differently. Ecosystem-owned liquidity (EOL) follows a governance-driven model, allowing participants to collectively manage and allocate liquidity based on community-driven decisions. Those who supply liquidity to EOL receive miAssets, which not only represent their stake in the liquidity pool but also grant governance rights. These miAssets fluctuate in value depending on yield performance, ensuring dynamic capital appreciation.

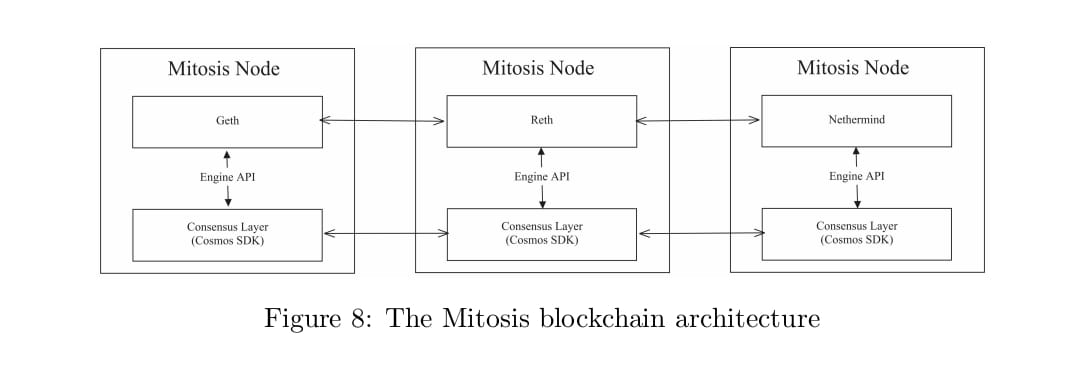

The second supply mechanism, Matrix, takes a more structured approach by allowing LPs to commit their Vanilla Assets to curated liquidity campaigns. Unlike EOL, where funds are managed collectively, Matrix enables individual liquidity providers to choose specific campaigns with predefined lock-up periods and yield rates. Upon commitment, users receive maAssets, which act as on-chain receipts and entitle them to rewards based on the terms of the selected liquidity campaign. By integrating both governance-based and campaign-specific liquidity models, Mitosis ensures that liquidity providers have diverse and flexible avenues to optimize their assets. As liquidity flows through the protocol, the utilization phase comes into play, transforming passive capital into an active component of DeFi’s financial infrastructure. The Mitosis Chain, built on the Cosmos SDK with EVM compatibility, serves as the foundation for programmable liquidity applications. Tokenized liquidity positions, including miAssets and maAssets, become key financial primitives that can be pooled, collateralized, or traded across various DeFi protocols.

The Role of Mitosis Vaults in Liquidity Deployment

Mitosis Vaults are crucial in ensuring seamless liquidity deployment and multi-chain interoperability. These Vaults operate across different blockchain networks, allowing users to deposit assets on one chain while receiving corresponding Vanilla Assets on the Mitosis Chain. This cross-chain capability enables users to deploy liquidity in the most capital-efficient manner, without being restricted by the limitations of a single blockchain. Each Mitosis Vault is governed by smart contracts that manage asset security, liquidity rebalancing, and withdrawal processes. When users wish to reclaim their original assets, they simply burn their Vanilla Assets, triggering the Vault to release the corresponding deposit. This system ensures that liquidity remains fluid, composable, and accessible across different blockchain ecosystems.

Vanilla Assets: The Backbone of Seamless Asset Management

One of the most groundbreaking aspects of Mitosis is the introduction of Vanilla Assets, which serve as the backbone of the protocol’s liquidity architecture. Unlike traditional liquidity tokens, which are often restricted to a single protocol or chain, Vanilla Assets are fully interoperable, allowing users to navigate multiple DeFi ecosystems without fragmentation. These assets maintain a 1:1 ratio with the underlying collateral, ensuring that users can freely transfer or deploy them while preserving their intrinsic value. Additionally, Vanilla Assets eliminates liquidity lock-up constraints, enabling users to participate in multiple yield opportunities simultaneously. For instance, a user can supply Vanilla Assets to an AMM, use them as collateral in a lending protocol, or stake them in an MLF—all without compromising liquidity availability. The transformative potential of Mitosis lies in its ability to convert liquidity from a static resource into a programmable asset class. By leveraging the Mitosis Chain’s EVM compatibility, developers can build advanced financial instruments that optimize capital efficiency and risk management.

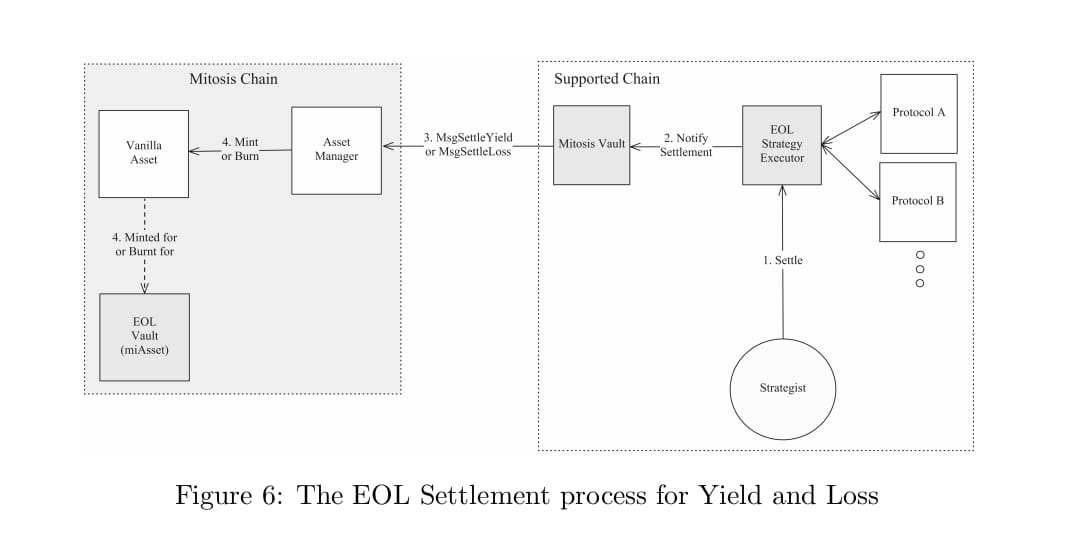

For liquidity providers participating in EOL, the settlement process ensures fair distribution of rewards, adjustments for losses, and allocation of additional governance token incentives.

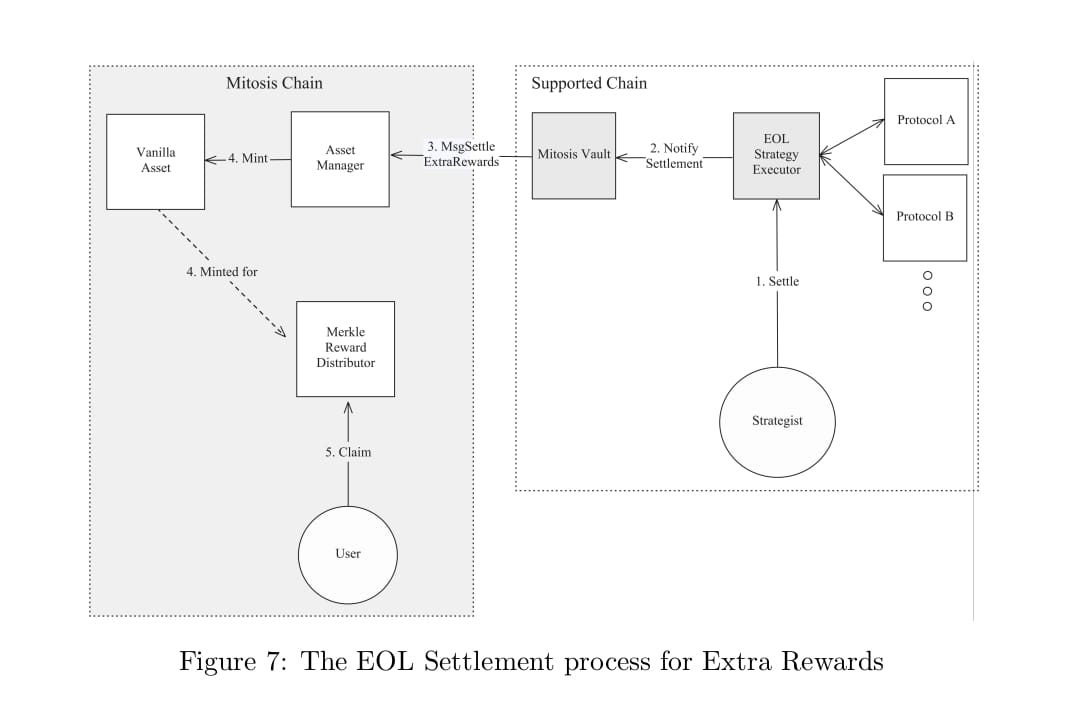

When extra incentives, such as governance tokens from external DeFi protocols, are distributed to EOL participants, they are fairly allocated based on participation levels and governance weight.

Conclusion

Mitosis does more than solve liquidity inefficiencies—it redefines how liquidity is perceived and utilized in DeFi. Through its structured approach to deposit, supply, and utilization, the protocol removes barriers to liquidity participation, allowing both retail and institutional investors to benefit from preferential yields. Mitosis Vaults facilitate seamless cross-chain liquidity movement, while Vanilla Assets ensure that capital remains composable and mobile. The integration of programmable liquidity primitives not only improves price discovery and capital efficiency but also unlocks new financial instruments that were previously unattainable in DeFi. As DeFi continues to evolve, the demand for efficient, composable, and programmable liquidity will only increase. Mitosis positions itself as a pioneering force, offering an infrastructure that bridges liquidity gaps while enabling next-generation financial engineering. The protocol’s innovations set a new standard for how DeFi protocols manage and optimize capital, paving the way for a more stable, transparent, and accessible decentralized financial ecosystem. But the question remains—as DeFi matures, will other protocols adopt similar approaches to liquidity programmability, or will Mitosis remain the leader in this space? The answer will shape the future of decentralized liquidity markets and determine how capital moves in an increasingly interconnected financial world.

Comments ()