Unlocking Cross-Chain Power: How Mitosis and Ether.fi's weETH are Building the Future of Liquidity

Hey everyone! If you've been navigating the world of Web3 and DeFi (Decentralized Finance), you've probably noticed something: it's a bit like a sprawling city with many districts (blockchains), but sometimes getting value (liquidity) to move smoothly between them is a real headache. This is often called "liquidity fragmentation." I've been exploring projects trying to solve this, and one fascinating collaboration is between Mitosis and Ether.fi, specifically involving a token called weETH.

Mitosis is building something ambitious: a system designed to pool liquidity from different blockchains and manage it collectively. Think of it as building superhighways between those city districts. Ether.fi, on the other hand, is a major player in the Liquid Restaking scene. Their token, weETH, represents staked Ether that's also earning extra rewards through restaking – pretty neat, right?

So, why does this partnership matter, especially as we look through 2025? And what does it mean for regular users like you and me? Let's break down how Mitosis leverages Ether.fi's weETH and why it's such a cornerstone of their strategy. In this article, I'll walk you through:

- What Ether.fi and weETH actually are.

- How you can use weETH within the Mitosis system.

- The role weETH played (and plays) in Mitosis's growth campaigns.

- The benefits for people holding weETH who decide to jump into the Mitosis ecosystem.

- How this all ties into Mitosis's bigger vision of creating deep, shared liquidity across chains.

Let's get started!

The Strategic Handshake: Mitosis Meets Ether.fi

First Up: What's Ether.fi and weETH Anyway?

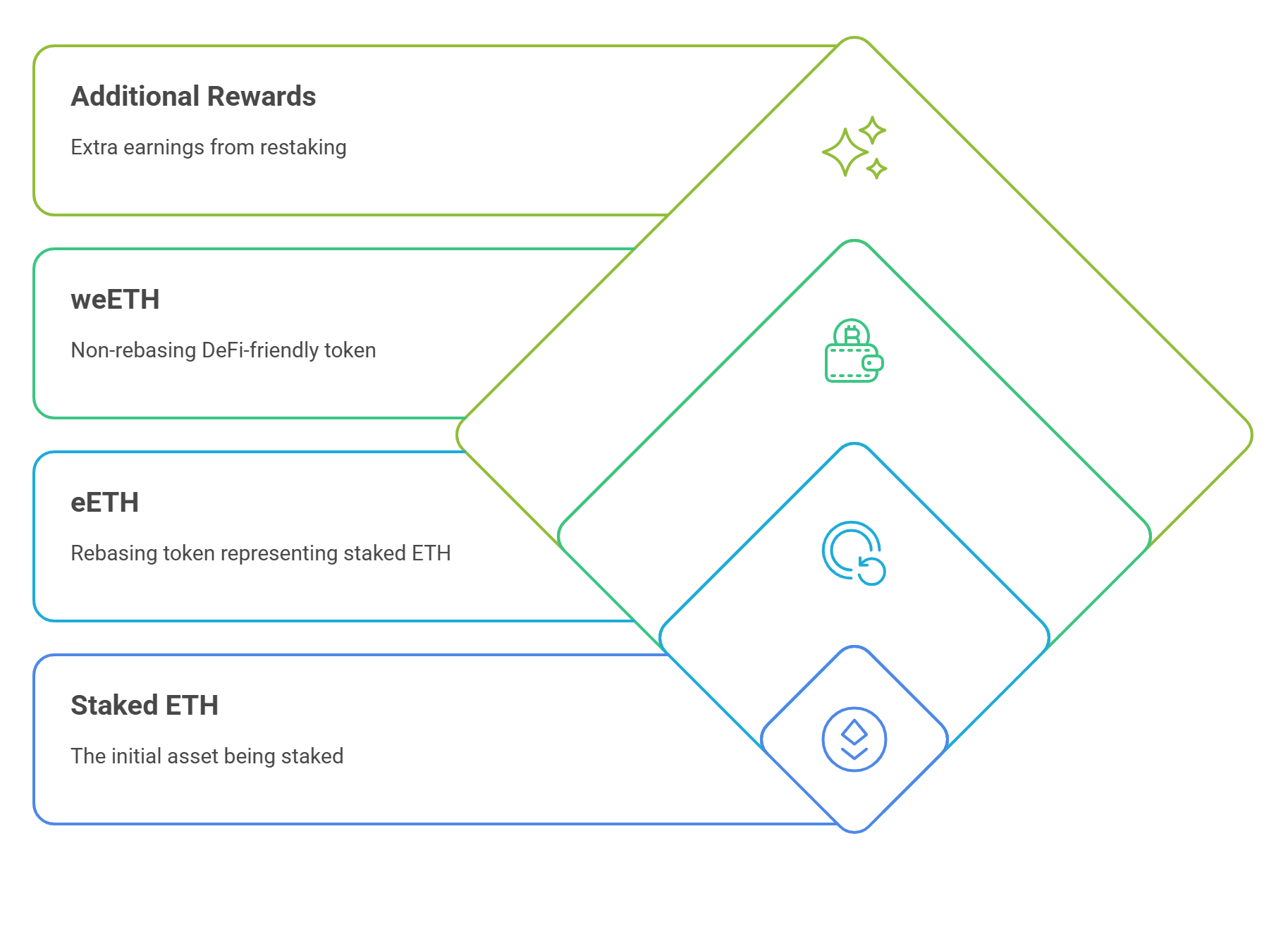

Before we dive into the partnership, let's quickly demystify Ether.fi and weETH. Ether.fi is what's known as a liquid restaking protocol. In simple terms:

- You stake your Ethereum (ETH) with Ether.fi.

- You receive a token, usually eETH, which represents your staked ETH and automatically increases in balance as it earns staking rewards.

- Ether.fi takes that staked ETH and restakes it in other systems (like EigenLayer) to earn additional rewards. So, you're earning yield from multiple sources. Pretty cool for maximizing returns!

Now, what about weETH? It stands for Wrapped Ether.fi Ether. It's essentially a different version of eETH. While eETH's balance changes daily (rebases) to reflect rewards, weETH's balance stays constant. Instead, the value of each weETH token increases over time to account for the earned rewards. Why does this matter? Many DeFi protocols find it easier to work with tokens that have a fixed balance. So, weETH is the non-rebasing, DeFi-friendly version of Ether.fi's liquid staked ETH. You get the same underlying staking and restaking rewards, just represented differently.

Why This Partnership is a Big Deal for Mitosis

Mitosis has a grand vision called Ecosystem-Owned Liquidity (EOL). The core idea is to pool assets from users across many different blockchains (cross-chain) into communal vaults. This collective pool can then be deployed strategically where it's needed most, acting like a large, community-controlled liquidity fund rather than relying on temporary "mercenary capital".

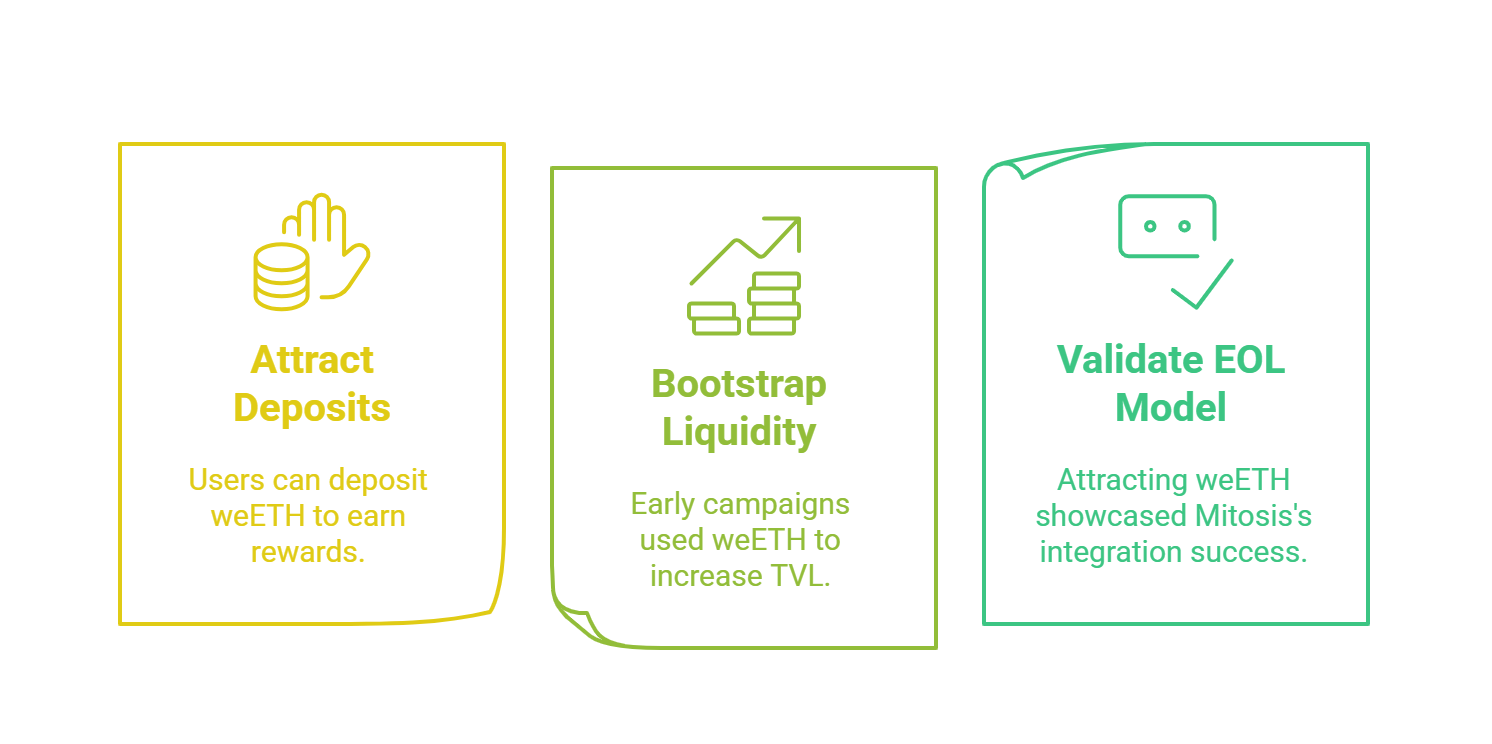

To make EOL work, Mitosis needs to attract significant amounts of liquidity. And what better asset to attract than one that's already popular, widely held, and inherently yield-bearing? Enter weETH.

By partnering with Ether.fi, a leader in the liquid restaking space, Mitosis tapped into a massive pool of potential liquidity. weETH was (and continues to be) one of the most popular Liquid Restaking Tokens (LRTs). Integrating weETH allowed Mitosis to:

- Attract Substantial Deposits: Users already holding weETH could deposit it into Mitosis to potentially earn even more rewards (we'll get to that).

- Bootstrap Liquidity: Early campaigns heavily relied on weETH deposits to build up Mitosis's initial Total Value Locked (TVL) – a key metric showing how much value is entrusted to a protocol.

- Validate the EOL Model: Successfully attracting a major asset like weETH demonstrated the appeal of the EOL concept and Mitosis's ability to integrate valuable tokens.

This partnership wasn't just convenient; it was strategically vital for Mitosis to kickstart its liquidity aggregation goals, especially during its crucial growth phases in 2024 and leading into 2025.

weETH in Action within the Mitosis Ecosystem

Okay, theory is great, but how does this actually work for someone holding weETH? Let's look at the practical side.

Depositing weETH: Your Gateway to Mitosis

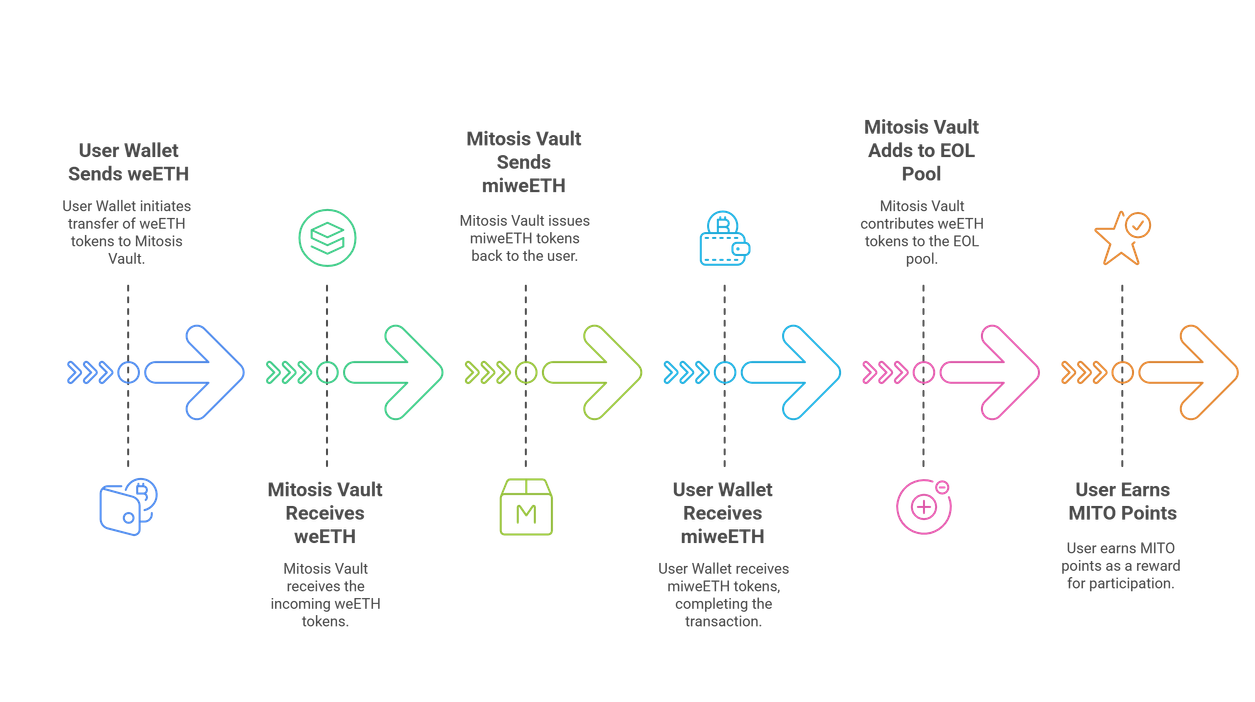

The process of bringing your weETH into the Mitosis ecosystem is designed to be straightforward. Here’s a simplified, hypothetical example of how I might do it:

- Get Some weETH: Let's say I've already staked some ETH on Ether.fi and have received eETH. I could then go to Ether.fi's platform and wrap my eETH into weETH. Alternatively, I might acquire weETH on a decentralized exchange. Let's imagine I now have 1 weETH sitting in my wallet on the Arbitrum network (an Ethereum Layer 2).

- Head to Mitosis: I'd navigate to the Mitosis application (like app.mitosis.org).

- Connect Wallet: Connect the crypto wallet where my weETH is stored (like MetaMask/Rabby Wallet).

- Select Network & Vault: I'd choose the network I'm depositing from (in my case, Arbitrum) and find the specific vault designated for weETH deposits on that network. Mitosis supports deposits from various chains, including Ethereum mainnet and popular L2s like Arbitrum, Optimism, Linea, Mode, Blast, Scroll, and others.

- Deposit: I'd enter the amount (my 1 weETH) and approve the transaction in my wallet.

Voila! My 1 weETH is now deposited into the Mitosis vault on Arbitrum.

Fueling the Engines: weETH in Mitosis Campaigns

Mitosis used special campaigns, notably the "Mitosis Expeditions," to incentivize users to deposit assets like weETH. These campaigns were crucial for bootstrapping the protocol's liquidity.

- Expedition (weETH): This was one of the flagship campaigns. Users who deposited weETH during specific "Epochs" (time periods) earned MITO Points. The earlier you deposited and the longer you held, the more points you typically earned. There were often bonus multipliers for depositing on certain L2s to encourage activity across different networks. Reports indicated that weETH constituted a massive portion, potentially over 80%, of the total LRTs deposited during these initial campaigns, highlighting its central role. The TVL saw significant growth thanks to these weETH deposits.

- Later Initiatives (like Matrix Theo): Even after the initial Expeditions, weETH continued to be a key asset. For example, in partner campaigns like the "Matrix Theo" vault launched around March 2025, users could deposit weETH (and even miweETH, the receipt token we'll discuss soon) to gain exposure to specific yield strategies plus earn additional rewards, including more MITO Points.

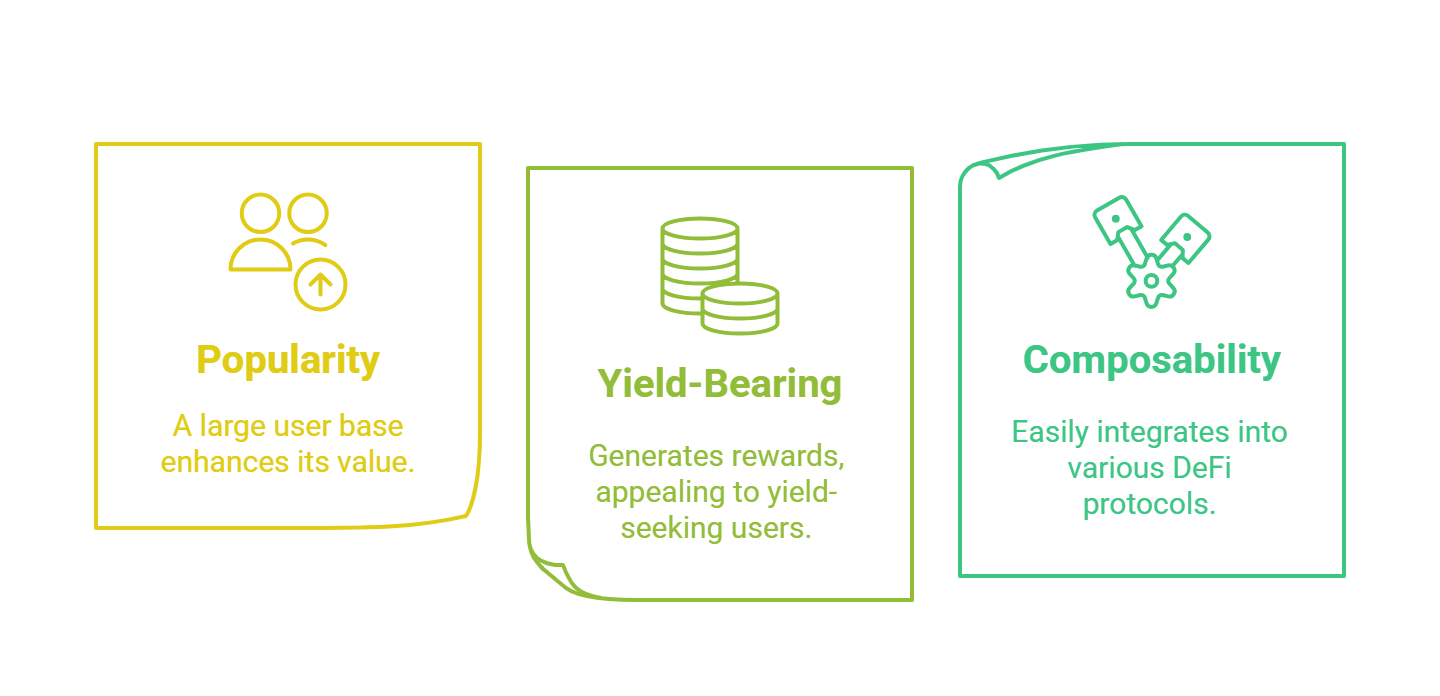

Why was weETH so central?

- Popularity: A huge number of users already held it.

- Yield-Bearing: It naturally generates rewards, making it attractive for users looking to stack yields.

- Composability: The wrapped, non-rebasing nature makes it easy to integrate into DeFi protocols like Mitosis.

These campaigns successfully leveraged the appeal of weETH to draw in the critical mass of liquidity needed for Mitosis's EOL vision.

The Wins: Benefits for Everyone

So, why would someone holding weETH bother depositing it into Mitosis? What's in it for them, and how does it help Mitosis overall?

More Than Just Yield: What weETH Holders Gain

Participating in Mitosis by depositing weETH offered (and potentially still offers, depending on ongoing campaigns) several compelling advantages:

- Earning MITO Points for the Future $MITO Airdrop: This was arguably the biggest draw. Mitosis explicitly stated that accumulating MITO Points would grant eligibility for the future airdrop of their native governance token, $MITO. So, by depositing weETH, users were essentially farming potential future tokens.

- Layered Yield: This is where things get really interesting. When you deposited weETH into Mitosis, you didn't stop earning the underlying rewards! You continued to accrue:

- Base ETH staking rewards (via Ether.fi).

- EigenLayer restaking points (also via Ether.fi).

- Ether.fi Loyalty Points (often with a bonus multiplier, like 2x, for participating via Mitosis).

- And on top of all that, you earned MITO Points.

This "yield stacking" or "layered yield" approach is incredibly attractive, allowing users to potentially maximize returns on a single underlying asset.

- Exposure to Multi-Chain Opportunities: Through Mitosis's EOL model, the pooled liquidity (including your weETH) could be deployed across various DeFi protocols on different chains. As a depositor, you could potentially benefit from yields generated across this diverse range of opportunities, managed collectively.

Powering Up Mitosis: weETH's Impact on TVL and EOL

For Mitosis, the influx of weETH was transformative:

- Massive TVL Growth: As mentioned, weETH deposits were the primary driver behind Mitosis's rapid TVL accumulation, reaching tens of millions of dollars within months of launching its campaigns. High TVL builds credibility and demonstrates user trust.

- Achieving EOL: This substantial liquidity base, largely built on weETH, is the foundation for the Ecosystem-Owned Liquidity model. Without significant assets under management, the EOL concept remains theoretical. weETH helped make it a practical reality.

- Cross-Chain Liquidity: By attracting weETH deposits from multiple networks (Ethereum, Arbitrum, Linea, etc.), Mitosis started building the deep, cross-chain liquidity pools it needs to function as an effective interoperability layer.

Behind the Scenes: weETH and Mitosis Technology (miAssets)

So what happens to your weETH once it's in a Mitosis vault? This is where miAssets come in.

When you deposit an asset like weETH into a Mitosis vault, you typically receive a receipt token called an miAsset. In this case, depositing weETH would give you miweETH on a 1:1 basis.

Think of miweETH as your claim check for the weETH you deposited. But it's more than just a receipt:

- Represents Your Deposit: Holding miweETH proves your share in the vault.

- Earns Rewards: Holding miweETH is what actually earned you the MITO Points during campaigns.

- Potential DeFi Utility: The vision for miAssets (including miweETH) is that they become usable within the Mitosis ecosystem (once its own L1 chain is fully live) or potentially other integrated DeFi protocols. This means your capital isn't just sitting locked; the miweETH representing it could potentially be used as collateral, in liquidity pools, or other DeFi activities, further enhancing capital efficiency.

- Voting Power: In the full EOL model, holding miAssets like miweETH grants you voting rights to help decide how the pooled liquidity in the vault is allocated.

So, the deposited weETH isn't just locked away; it's transformed into a potentially productive miAsset that represents your stake and allows you to interact with the Mitosis ecosystem.

Conclusion: A Symbiotic Relationship Powering Cross-Chain Liquidity

Wrapping things up, the partnership between Mitosis and Ether.fi, centered around the weETH token, has been absolutely fundamental to Mitosis's journey so far.

From my perspective, it's a clear example of strategic collaboration in DeFi. Mitosis needed a significant, reliable source of liquidity to bring its innovative EOL concept to life, and Ether.fi's popular, yield-bearing weETH was the perfect fit. For weETH holders, Mitosis offered an attractive opportunity to stack yields and gain exposure to a potential future airdrop ($MITO) without sacrificing their existing staking and restaking rewards.

The integration of weETH via deposits into Mitosis vaults, tracked by miweETH receipt tokens, fueled the early growth campaigns like "Mitosis Expeditions" and significantly boosted the protocol's TVL. This laid the groundwork for Mitosis's broader ambition: creating a robust, cross-chain liquidity layer governed by its community.

While the crypto space moves incredibly fast, the role weETH played highlights a key theme: the importance of composability (assets working together across protocols) and strategic partnerships in building the next generation of DeFi infrastructure. It will be fascinating to see how Mitosis continues to leverage EOL and assets like weETH as it moves towards its mainnet launch and beyond. What other powerful collaborations will shape the future of cross-chain finance? It's definitely a space I'll be keeping a close eye on!

Official Mitosis Resources:

- Official Website: https://mitosis.org/

- X (formerly Twitter): https://x.com/MitosisOrg

- Discord: https://discord.gg/mitosis

- Telegram (Announcements): https://t.me/+s-8hkIaw_WMzM2M1

Comments ()