Unlocking DeFi Potential: The Strategic Partnership Between Mitosis and Theo

In February 2025, Theo announced the launch of its first product, the Straddle Matrix Vault, in partnership with Mitosis. This collaboration aims to expand decentralized finance (DeFi) opportunities by providing users access to institutional-grade strategies without requiring substantial capital investments.

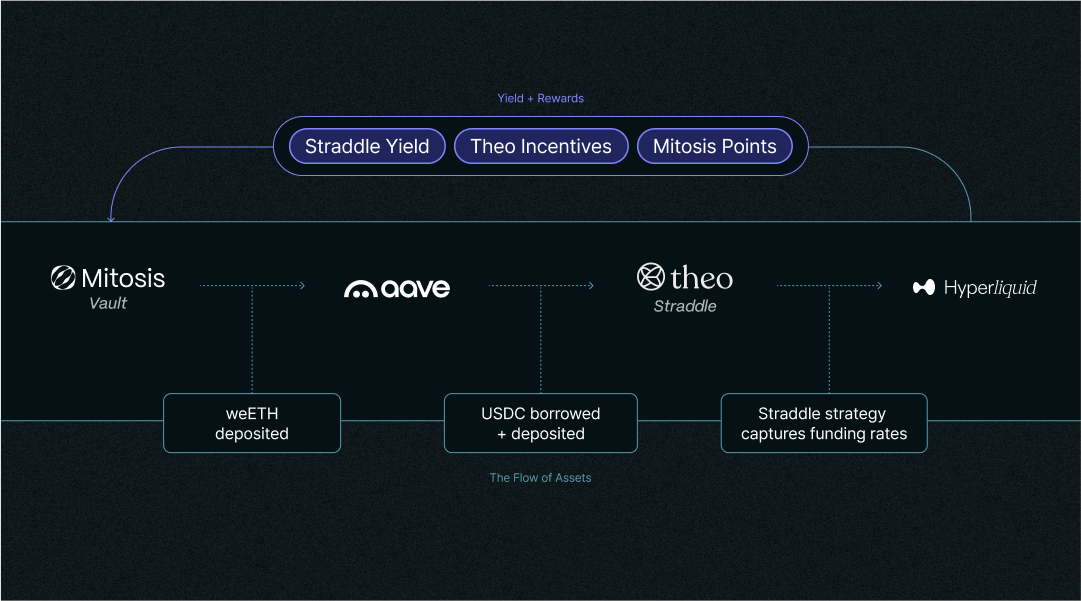

How It Works:

Users can deposit weETH into vault contracts on major networks like Ethereum, Arbitrum, or Linea. At the start of each new vault round, deposits are allocated to the Straddle strategy. This involves depositing weETH into a local Aave instance on the corresponding chain and borrowing USDC, which is then transferred to Hyperliquid to execute a short position—allowing users to earn yield from ETH funding rates.

The strategy remains delta-neutral, with conservative risk parameters. Users can initiate withdrawals anytime, with processing occurring approximately every two days during the vault’s round transition. Selected users will be able to deposit weETH and miweETH (for Mitosis Expedition participants) into the vault via the Mitosis Matrix interface. Depositors are entitled to Straddle profits, Theo tokens, and Mitosis points. The campaign is expected to run until April-May 2025, with further details to be announced later.

Democratizing Yield Opportunities:

Historically, the most profitable DeFi strategies were often restricted to private deals and closed allocations for large investors. The partnership between Theo and Mitosis ensures that incentives and strategies are accessible to a broader audience, rather than being limited to well-capitalized players. This aligns with Theo’s mission to scale DeFi beyond its traditional limitations.

Capital Efficiency and Compatibility:

One of the most attractive aspects of Mitosis Matrix infrastructure for Theo is its ability to transform locked liquidity into programmable positions. Users depositing weETH receive tokenized representations (maAssets) that remain usable as collateral or for participation in other DeFi strategies. This maximizes capital efficiency while still earning yield from funding rates.

Moving Away from Lockups

A common challenge in DeFi is how to incentivize long-term liquidity without enforcing strict locking periods. Traditional models either:

- Require rigid lockups, discouraging users who prefer flexibility.

- Have no lockups, but suffer from unstable liquidity.

- Utilize complex token emissions, often leading to short-term mercenary capital inflows.

The Matrix Vault approach offers a different solution. Users can initiate withdrawals at any time (processed within ~48 hours) but may forfeit a portion of accrued yields. This naturally aligns incentives without forcing users into rigid positions.

A Future-Forward Perspective

For Theo, this approach allows for predictable liquidity incentives without harsh lockups, reducing exposure to mercenary capital, simplifying vault management, and ensuring a more sustainable alignment between protocol and users. The launch of Straddle showcases how sophisticated financial strategies can be democratized through the right infrastructure.

For users, this means access to institutional-grade strategies and the flexibility to utilize their position tokens across the broader DeFi ecosystem. For integrations, it means building on an infrastructure that supports ambitious DeFi growth.

This model could set a new benchmark for liquidity management in DeFi. The combination of Matrix infrastructure and incentive mechanisms creates a sustainable and user-friendly approach to protocol liquidity.

By offering flexible withdrawal mechanics with profit-aligned incentives, Theo and Mitosis are spearheading a mature evolution in DeFi protocol design—one that respects both user autonomy and protocol resilience. As Theo continues to expand, this foundation will enable the development of even more advanced financial products and strategies, shaping the future of DeFi innovation.

Comments ()