🌐🔁 Unlocking New Horizons: How Mantle's mETH Protocol & Mitosis Are Redefining Modular Liquidity 🚀

In the ever-evolving DeFi landscape, 🧠 smart liquidity solutions are at the heart of innovation. Enter 🧪 Mantle’s mETH Protocol and 🧬 Mitosis, two powerhouse protocols merging to form a next-gen DeFi synergy.

💧 What is Mantle’s mETH Protocol?

🎯 Mantle’s mETH is a permissionless, non-custodial Ethereum liquid staking protocol:

💠 Stake ETH → receive mETH (a value-accruing token)

💠 mETH earns sustainable staking rewards

💠 Integrated across the Mantle Ecosystem for additional DeFi opportunities

🧱 On top of that, there's cmETH – a composable liquid restaking token, unlocking additional yields and restaking layers 🌊

👉 Learn more in the cmETH deep-dive

🧬 Enter Mitosis: The Modular Liquidity Engine

🚀 Mitosis is a modular liquidity protocol designed for the future of programmable finance. It turns liquidity into a primitive – easy to compose, integrate, and extend across chains.

🌐 Key features:

- 🪙 Users deposit LSTs like mETH/cmETH to receive micTokens (e.g. micmETH)

- 🔗 These tokens can flow cross-chain and into other protocols

- 📈 Optimizes price discovery, capital efficiency, and liquidity routing

📘 Read the Litepaper

📂 Explore micTokens: micmETH Docs

🧩 Mantle + Mitosis = Composable Liquid Power

Let’s break down how this fusion unlocks new DeFi potential 🔓

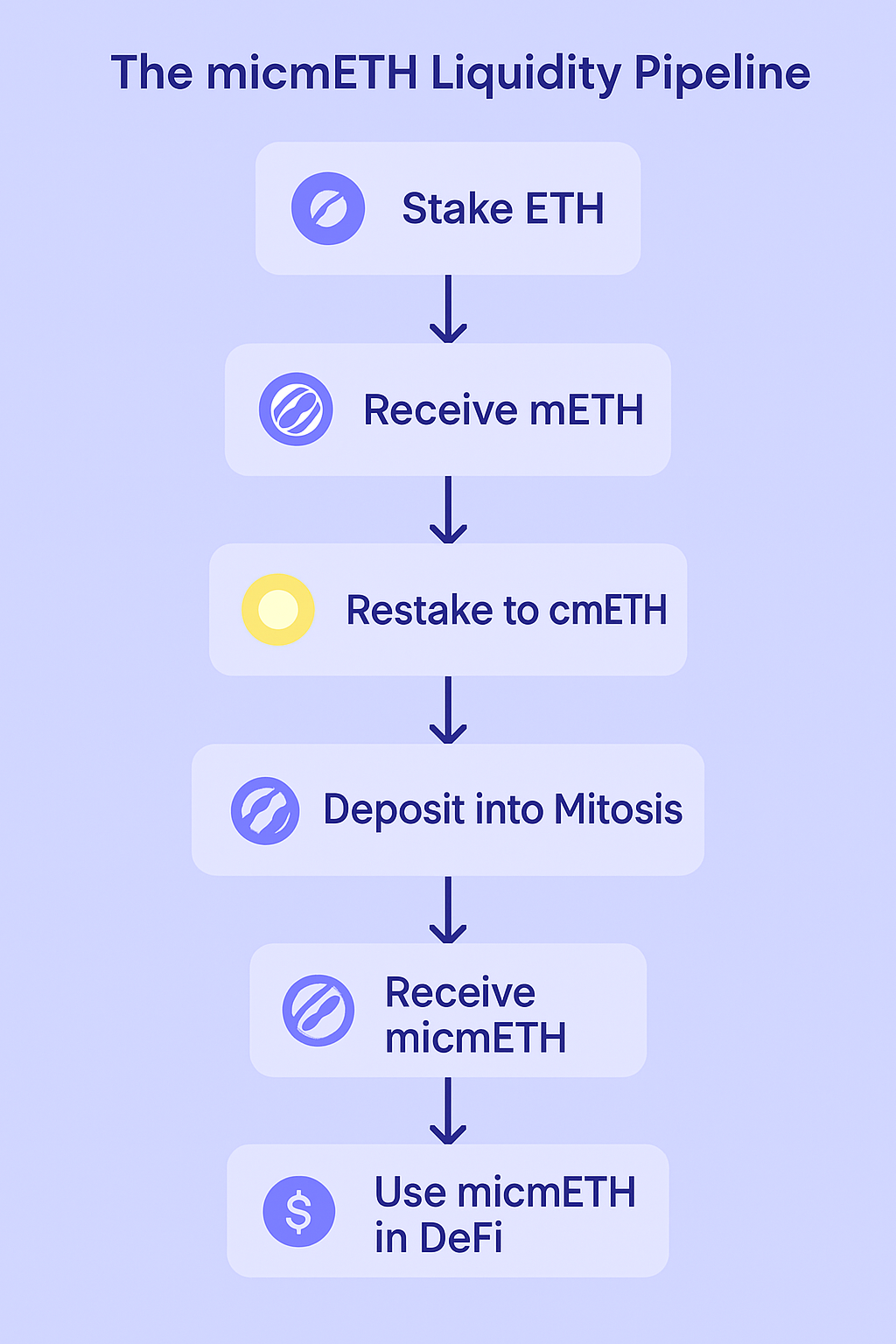

1️⃣ 🪙 mETH to cmETH to micmETH

Users:

- Stake ETH → 🔁 mETH

- Restake → 🔁 cmETH

- Deposit to Mitosis → 🔁 micmETH

2️⃣ 💹 Yield Boosting

With micmETH:

- Tap into cross-chain DeFi strategies

- Automate rewards through Mitosis's vaults 🧿

- Access modular restaking flows and maximize reward-to-risk ratios 📊

🔗 Try the Matrix Vault Campaign

🛠️ Dive into Modular Design

3️⃣ 🌉 Cross-Chain & Composability

Thanks to Mitosis’s Hyperlane-based infrastructure, micTokens are easily bridged to other chains for use in external protocols or interchain markets 🛰️

📡 Read about Cross-Chain Liquidity Flow

🧱 Powered by Hyperlane Modular Interoperability

🖼️ Flow Diagram: The micmETH Liquidity Pipeline

🧠 Real-World Use Case: Programmable Yield Strategies

Imagine this 👇

💼 A DAO earns ETH → stakes to mETH → converts to cmETH → deposits in Mitosis → receives micmETH

📈 It uses micmETH in a Mitosis Vault, and configures a smart rebalance strategy to:

- Send 40% to Arbitrum farms 🌾

- Lock 20% in EigenLayer restaking 🧱

- Use 40% in lending markets 🔄

💥 Result: Maximized rewards, automated flows, cross-chain flexibility

🧬 Final Thoughts: Why It Matters

🌍 The fusion of Mantle's mETH protocol and Mitosis’s micLiquidity framework represents a shift toward programmable, portable, and composable liquidity in DeFi.

🚧 DeFi is no longer just about locking and earning — it’s about moving, composing, and optimizing liquidity dynamically, across chains and use cases. With protocols like Mitosis, we’re entering a world where liquidity thinks for itself. 🧠💧

🔗 Useful Links & Docs

- 🟣 Mitosis: docs.mitosis.org

- 🧪 Litepaper: Read PDF

- 💡 micmETH Overview: micToken Docs

- 🧰 Matrix Vault: Use Case Guide

- 🌉 Cross-Chain Architecture: Learn More

- 💠 Mantle Ecosystem: mantle.xyz/ecosystem

📲 Stay Connected with Mitosis & Mantle

🔷 Mitosis Official

- X (Twitter): https://x.com/mitosisorg

- Discord: https://discord.com/invite/mitosis

- Website: mitosis.org

🟣 Mantle Official

- X (Twitter): https://x.com/mantle_official

- Discord: https://discord.com/invite/0xMantle

- Website: mantle.xyz

Comments ()