Unlocking Private Transactions: How Zero-Knowledge Proofs (ZKPs) Revolutionize Usability in DeFi

In the sleek, interconnected world of decentralized finance (DeFi), where trust is code and transparency is king, a quiet revolution is brewing.

Zero-Knowledge Proofs (ZKPs)—a cryptographic marvel born from the esoteric corners of computer science are reshaping how we think about privacy, security, and usability in DeFi. Imagine a world where you can prove you’re creditworthy without revealing your bank balance, trade assets without exposing your strategy, or verify your identity without sharing your name. ZKPs make this possible, blending the openness of blockchain with the discretion of a private vault. This isn’t just a technical upgrade; it’s a paradigm shift that could unlock DeFi’s full potential for millions. Let’s dive into how ZKPs are transforming DeFi, making it more intuitive, secure, and accessible while preserving the ethos of decentralization.

The DeFi Promise and Its Privacy Puzzle

DeFi has redefined finance. Built on blockchains like Ethereum, it offers a borderless, intermediary-free ecosystem where users can swap tokens, lend, borrow, stake, and earn interest all through smart contracts. By 2025, DeFi’s total value locked exceeds $3 trillion, a testament to its explosive growth. Yet, for all its brilliance, DeFi has a glaring Achilles’ heel: privacy, or the lack thereof.

Public blockchains are transparent by design. Every transaction whether it’s a $10 swap or a $10 million loan is recorded on an immutable ledger, visible to anyone with an internet connection. Your wallet address might be pseudonymous, but with enough data, analysts can trace it back to you. This openness is a double-edged sword. It fosters trust by ensuring no one can cheat the system, but it also exposes users to risks: competitors can front-run trades, hackers can target fat wallets, and regulators can scrutinize every move. For DeFi to go mainstream, it needs to balance transparency with privacy without sacrificing its decentralized soul.

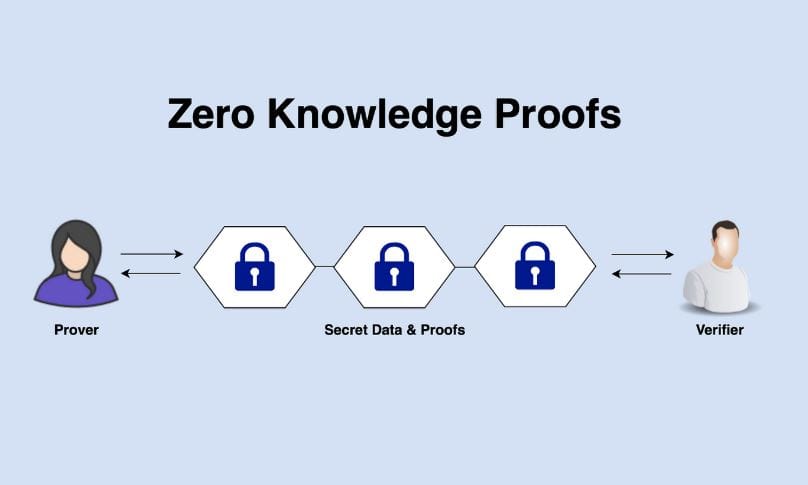

Enter Zero-Knowledge Proofs. ZKPs allow one party (the prover) to convince another (the verifier) that a statement is true without revealing any underlying details. Think of it as proving you’re over 21 without showing your ID, or confirming you’ve paid a bill without disclosing your account number. In DeFi, ZKPs promise to cloak sensitive data while preserving the trustless, verifiable nature of blockchain. They’re not just a patch; they’re a reimagining of what DeFi can be.

What Are Zero-Knowledge Proofs? A Layman’s Guide

To understand ZKPs, let’s strip away the jargon. At their core, ZKPs are a cryptographic technique that enables privacy-preserving computations. They allow you to prove something is true—like “I have enough funds to cover this trade”—without sharing the raw data, like your actual balance. The magic lies in three properties:

- Completeness: If the statement is true, an honest prover can convince an honest verifier.

- Soundness: If the statement is false, no dishonest prover can fool the verifier (except with negligible probability).

- Zero-Knowledge: The verifier learns nothing beyond the fact that the statement is true.

Picture a locked box with a tiny window. You can slide a note through the window to prove the box contains a specific item, but the verifier can’t see anything else inside. That’s ZKP in action.

The math behind ZKPs is dizzyingly complex, involving elliptic curves, polynomial commitments, and homomorphic encryption. But you don’t need a PhD to grasp their impact. ZKPs have been around since the 1980s, pioneered by cryptographers like Shafi Goldwasser and Silvio Micali. Early applications were theoretical, but advances in computing power and algorithms particularly zk-SNARKs (Zero-Knowledge Succinct Non-Interactive Argument of Knowledge) have made them practical for blockchains.

In DeFi, zk-SNARKs and their cousins (like zk-STARKs) are the engine driving privacy. They’re succinct, meaning proofs are small and fast to verify, and non-interactive, meaning no back-and-forth is needed between prover and verifier. This makes them ideal for blockchain, where every byte of data costs gas and every second counts.

Why DeFi Needs ZKPs: The Usability Gap

DeFi’s usability has come a long way. Wallets like MetaMask are smoother, interfaces are slicker, and gas fees on layer-2 solutions like Arbitrum are pennies. But privacy remains a sticking point. Without it, DeFi can’t compete with traditional finance’s discretion or appeal to users who value control over their data. Here’s why ZKPs are the missing piece:

1. Protecting User Data

In DeFi, every transaction is a public confession. A whale buying $1 million in ETH broadcasts their intent, inviting front-runners to manipulate prices. A borrower repaying a loan reveals their financial health. ZKPs can hide these details. For example, a ZKP-enabled protocol could let you prove you have sufficient collateral for a loan without showing your wallet’s contents. This shields users from predatory bots and nosy competitors.

2. Enabling Regulatory Compliance

DeFi’s pseudonymous nature clashes with anti-money laundering (AML) and know-your-customer (KYC) regulations. ZKPs offer a middle ground. Users can prove compliance say, that their funds aren’t tied to illicit activity without deanonymizing themselves. Imagine a DeFi platform where you verify your identity with a ZKP, satisfying regulators while keeping your personal data off-chain. This could bridge DeFi and TradFi, unlocking institutional capital.

3. Enhancing Scalability

DeFi’s growth strains blockchains. Ethereum processes thousands of transactions per second, but layer-2 solutions like zk-Rollups use ZKPs to batch hundreds of transactions into a single proof, slashing costs and boosting throughput. Zk-Rollups, like those powering StarkNet, compress data off-chain and submit only a tiny proof to the main chain. This isn’t just a privacy win; it’s a usability triumph, making DeFi faster and cheaper.

4. Empowering New Use Cases

ZKPs unlock DeFi applications that were previously unthinkable. Private voting in DAOs? ZKPs can prove your vote without revealing your choice. Confidential stablecoins? ZKPs can hide transaction amounts while ensuring the total supply is auditable. Even cross-chain bridges can use ZKPs to verify asset transfers without exposing sensitive data. These innovations expand DeFi’s reach, from retail users to enterprises.

ZKPs in Action: Real-World DeFi Projects

The promise of ZKPs isn’t hypothetical—it’s happening now. Several DeFi protocols are harnessing ZKPs to redefine usability. Let’s explore a few trailblazers:

Tornado Cash: Privacy for Transactions

Tornado Cash, a decentralized mixer, uses zk-SNARKs to break the link between sender and receiver addresses. Users deposit funds into a pool, then withdraw them to a new address, with ZKPs proving the withdrawal is legitimate without revealing the source. While controversial due to regulatory scrutiny, Tornado Cash showcases ZKPs’ power to anonymize transactions, a critical feature for privacy-conscious users.

Aztec Network: Private DeFi on Ethereum

Aztec, a layer-2 solution, brings confidential transactions to Ethereum. Its zk-Rollup, Noir, lets users send private payments and interact with DeFi protocols like Uniswap while hiding amounts and addresses. Aztec’s user-friendly SDK makes ZKP integration seamless for developers, lowering the barrier to private DeFi apps. By 2025, Aztec’s TVL rivals top layer-1 chains, proving privacy is a killer feature.

StarkNet: Scalability Meets Privacy

StarkNet, powered by zk-STARKs, is a layer-2 scaling solution with privacy baked in. Unlike zk-SNARKs, zk-STARKs are quantum-resistant and don’t require a trusted setup, making them future-proof. StarkNet’s DeFi ecosystem home to dApps like dYdX—uses ZKPs to process transactions off-chain, submitting proofs to Ethereum. This slashes fees and hides transaction details, offering a glimpse of DeFi’s scalable, private future.

Zcash: The OG of ZKP Cryptocurrencies

While not a DeFi protocol, Zcash pioneered ZKPs in blockchain. Its shielded transactions use zk-SNARKs to hide sender, receiver, and amount, inspiring DeFi projects. Zcash’s success shows ZKPs can scale to millions of users, a blueprint for DeFi’s privacy-first evolution.

The User Experience: ZKPs Behind the Scenes

For ZKPs to revolutionize DeFi, they must be invisible to users. No one wants to wrestle with cryptographic proofs to swap tokens. Thankfully, modern ZKP protocols are designed with UX in mind. Here’s how they enhance usability without adding complexity:

- Seamless Wallets: Wallets like Argent integrate ZKP-based layer-2s, letting users send private transactions with a tap. The ZKP magic happens off-screen, abstracted by clean interfaces.

- Lower Costs: Zk-Rollups reduce gas fees by orders of magnitude. A Uniswap trade that costs $50 on Ethereum’s mainnet might cost $0.50 on a ZKP-powered layer-2, making DeFi accessible to smaller players.

- Instant Confirmations: ZKPs’ succinct proofs enable near-instant transaction finality, rivaling centralized exchanges. Users get the speed of Coinbase with the security of Ethereum.

- Intuitive dApps: Developers are building ZKP-enabled dApps with familiar frontends. Whether it’s a lending platform or a DEX, users interact as usual, unaware of the privacy shield protecting their data.

This user-centric approach mirrors Apple’s design philosophy: powerful tech, simple experience. Just as Face ID authenticates you without exposing your face’s geometry, ZKPs secure DeFi without burdening users with crypto’s nuts and bolts.

Challenges and Trade-Offs

ZKPs aren’t a silver bullet. Their adoption in DeFi faces hurdles, both technical and cultural:

1. Computational Overhead

Generating ZKPs is resource-intensive. Proving a simple transaction can take seconds on a high-end CPU, a lifetime in blockchain terms. While zk-SNARKs are succinct, their setup requires trusted ceremonies, raising security concerns. zk-STARKs avoid this but produce larger proofs, eating bandwidth. Hardware acceleration and optimized algorithms are closing this gap, but ZKPs aren’t yet plug-and-play.

2. Developer Complexity

Building ZKP-based dApps is hard. Developers must master new tools like Circom or ZoKrates, a steep learning curve even for crypto veterans. Frameworks like Aztec’s Noir are simplifying this, but the talent pool is thin. DeFi needs more ZKP-savvy coders to scale.

3. Regulatory Uncertainty

Privacy tech is a regulatory lightning rod. Protocols like Tornado Cash have faced sanctions, and ZKP-enabled DeFi could draw similar heat. Balancing privacy with compliance say, through selective disclosure will be critical to avoid crackdowns.

4. User Education

Even with slick UX, users must understand why privacy matters. DeFi’s early adopters are crypto-natives who grok pseudonymity’s limits, but mainstream users may not. Educating them without overwhelming them is a marketing challenge.

The Road Ahead: ZKPs as DeFi’s Default

Despite these hurdles, ZKPs are poised to become DeFi’s backbone. By 2030, most layer-2 solutions will likely use ZKPs for privacy and scalability. Ethereum’s roadmap prioritizes zk-Rollups, with EIP-4844 paving the way for cheaper data availability. Other chains, like Polygon and Solana, are integrating ZKPs, signaling an industry-wide shift.

The real game-changer will be composability. Today’s DeFi protocols are like Lego bricks, snapping together to create complex financial systems. ZKP-enabled protocols will add a new dimension, letting developers build private, scalable dApps that interoperate seamlessly. Imagine a DEX that hides your trades, a lending platform that verifies your creditworthiness privately, and a stablecoin that conceals your balance all working in harmony.

For users, this means a DeFi ecosystem that feels as polished as Apple Pay but runs on trustless code. You’ll borrow, trade, and stake with confidence, knowing your data stays yours. For developers, it’s a canvas to innovate without compromising security. And for regulators, it’s a chance to embrace DeFi’s potential while addressing illicit use.

A Private, Usable Future

Zero-Knowledge Proofs are more than a cryptographic trick they’re a key to unlocking DeFi’s mass adoption. By marrying privacy with usability, ZKPs address DeFi’s core tension: how to stay open yet discreet, scalable yet secure. Projects like Aztec, StarkNet, and Tornado Cash are lighting the way, proving ZKPs can deliver real-world value today.

As DeFi matures, ZKPs will fade into the background, powering transactions as effortlessly as Wi-Fi powers your phone for Internet access. That’s the beauty of great technology: it works so well you forget it’s there. In a world where data is currency, ZKPs give users control, developers freedom, and DeFi a shot at redefining finance for billions. The future isn’t just decentralized,it’s private, intuitive, and ready for you.

Comments ()