Vault Liquidity Framework (VLF): The Infrastructure Behind Yarm's Liquidity Engine

In the emerging world of programmable liquidity, few systems offer the modular power and real world execution of VLF, the Vault Liquidity Framework. Built by Mitosis, VLF powers Yarm, an onchain launch and growth platform that blends capital deployment with social signal intelligence. Where most platforms treat liquidity and community as separate problems, VLF unifies them into a single programmable structure. The result? Capital that’s not just fast, flexible, and liquid, but targeted.

What Is VLF?

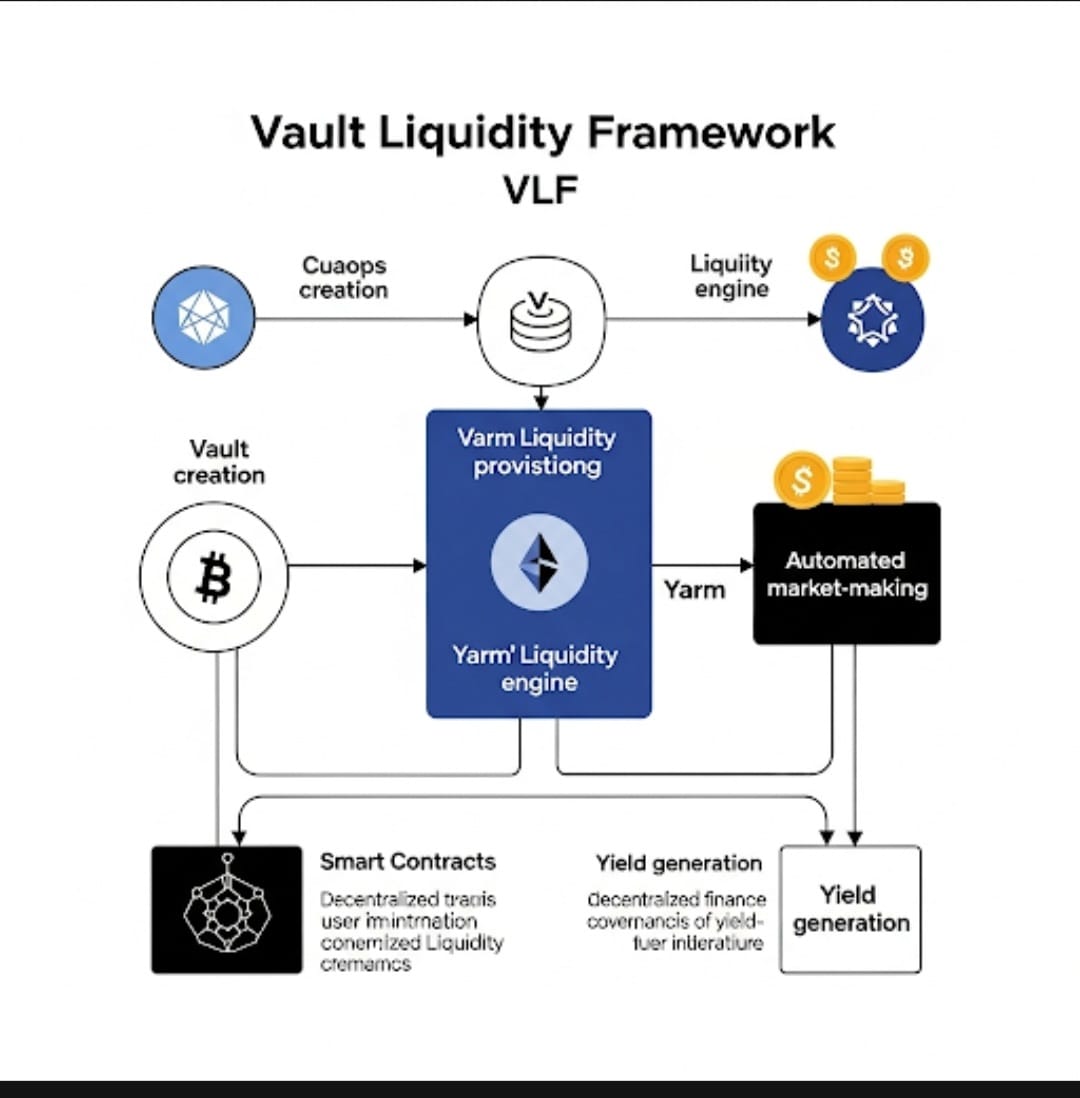

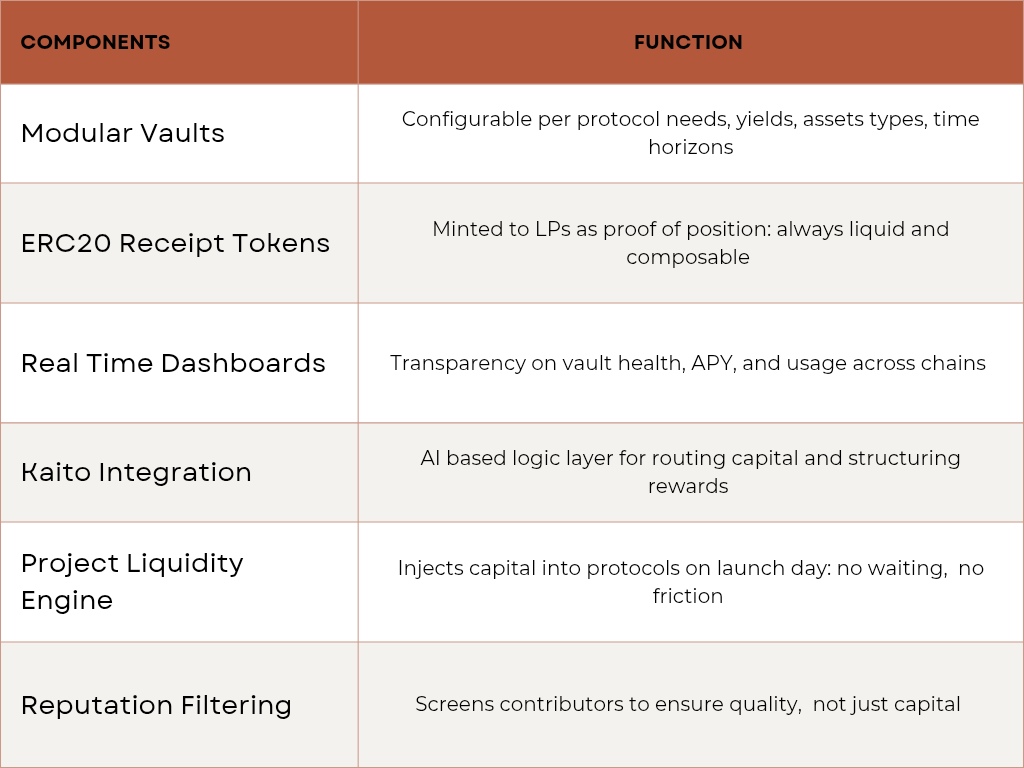

VLF (Vault Liquidity Framework) is Mitosis' modular vault system that acts as the technical foundation for Yarm’s social capital coordination. It enables liquidity providers (LPs) to deploy capital into curated vaults that plug directly into launch stage protocols. Each vault is programmable, composable, and built to handle both capital logistics and incentive logic via integrations with Kaito AI.

Key Functions of VLF

How VLF Works

The Vault Liquidity Framework is made of flexible, modular vaults that live within the Mitosis ecosystem. Here's the lifecycle: 1. Liquidity Providers deposit capital into VLF vaults via the Mitosis Chain. 2. ERC20 receipt tokens are minted: these act as liquid, transferable claims on vault assets. 3. Kaito AI processes community activity and signal data, pairing capital with high intent projects. 4. Vaults deploy capital directly into selected protocols during launch or growth phases. 5. LPs earn yield, while protocols receive aligned, long term liquidity and curated user bases. Unlike traditional farming models, there are no lockups, no one size fits all contracts, and no wasted TVL.

Why Projects Choose VLF

Projects launching via Yarm get more than just capital, they get community aligned capital. VLF vaults inject ready to deploy liquidity directly into protocol contracts on launch day. This removes the need for complex coordination, fundraising, or fragmented airdrop games. All liquidity is backed by actual user participation.

Why LPs Choose VLF

Liquidity Providers aren’t just farming numbers. With VLF, they: ● Stay liquid at all times via ERC20 receipt tokens ● Get early access to high quality opportunities ● Earn layered yield: base vault returns + Yarm partner incentives ● Deploy across chains using Mitosis’ programmable infrastructure This is DeFi yield with context not just passive staking.

VLF in the Mitosis Stack

VLF is not a stand alone tool. It’s deeply embedded in the modular architecture of Mitosis, where components like: ■ Zygo (settlement & accounting) ■ Matrix Flow (yield routing logic) ■ Chromo (chain neutral UX) ■ Telo (chain level incentives) They all come together to ensure capital moves where it's needed, earns efficiently, and remains composable across chains.

Use Case: Launching a New Protocol with VLF

Scenario: A DeFi protocol is preparing to launch liquidity pools and needs $2M in stablecoins. Without VLF: • The team hurries to secure TVL • Requires separate independent campaign • Uncertain if LPs will stay long term • No community filtering With VLF: • Mitosis deploys vaults via VLF for that protocol • LPs allocate capital and mint receipt tokens • Vault auto deploys liquidity on launch day • Kaito ensures the LPs are high intent contributors • Protocol gets capital + aligned users in one shot.

The Strategic Importance of VLF

Liquidity is fragmented for the wrong reasons. VLF changes this logic. It builds liquidity as a programmable layer, tied directly to signal, reputation, and protocol intent. It's not just TVL, it’s targeted liquidity with purpose. As the Yarm ecosystem grows, VLF will be the silent engine that turns social capital into real capital, and speculative attention into growth.

Final Thoughts

DeFi is evolving beyond passive liquidity. The next generation of protocols will require modular, intelligent, and intent driven vault systems, exactly what VLF offers. By blending technical composability with incentive intelligence, VLF stands as one of the critical innovations powering the Mitosis Yarm stack.

When capital can listen, route, and respond, it’s no longer static. It’s programmable liquidity.

Explore More: Mitosis Website: https://mitosis.org Yarm by Mitosis: https://yarm.mitosis.org Mitosis Documentation (for VLF, Matrix Flow, etc.): https://docs.mitosis.org

https://discord.gg/mitosis?ref=university.mitosis.org

Comments ()