Wall Street’s Crypto Endorsement: How Circle’s NYSE Listing Legitimizes Stablecoins for Big Money

In a defining moment for crypto’s integration with traditional finance, Circle, the issuer of USD Coin (USDC), made headlines with its landmark listing on the New York Stock Exchange (NYSE). More than just a corporate milestone, this move signals a new era: the legitimization of stablecoins as a serious asset class for institutional investors, regulators, and Wall Street at large.

From Crypto Startups to Wall Street Titans

For years, stablecoins like USDC and USDT have been essential tools in crypto markets, providing dollar-pegged liquidity for traders and DeFi users. However, concerns about transparency, regulatory compliance, and systemic risk kept many institutional players on the sidelines.

Circle’s listing changes this dynamic:

✅ Regulatory oversight: Circle must now meet rigorous SEC reporting requirements.

✅ Transparency : Regular disclosures about reserves and operations build trust.

✅ Wall Street credibility: LA NYSE listing signals Circle as a mainstream financial entity, not a crypto-only startup.

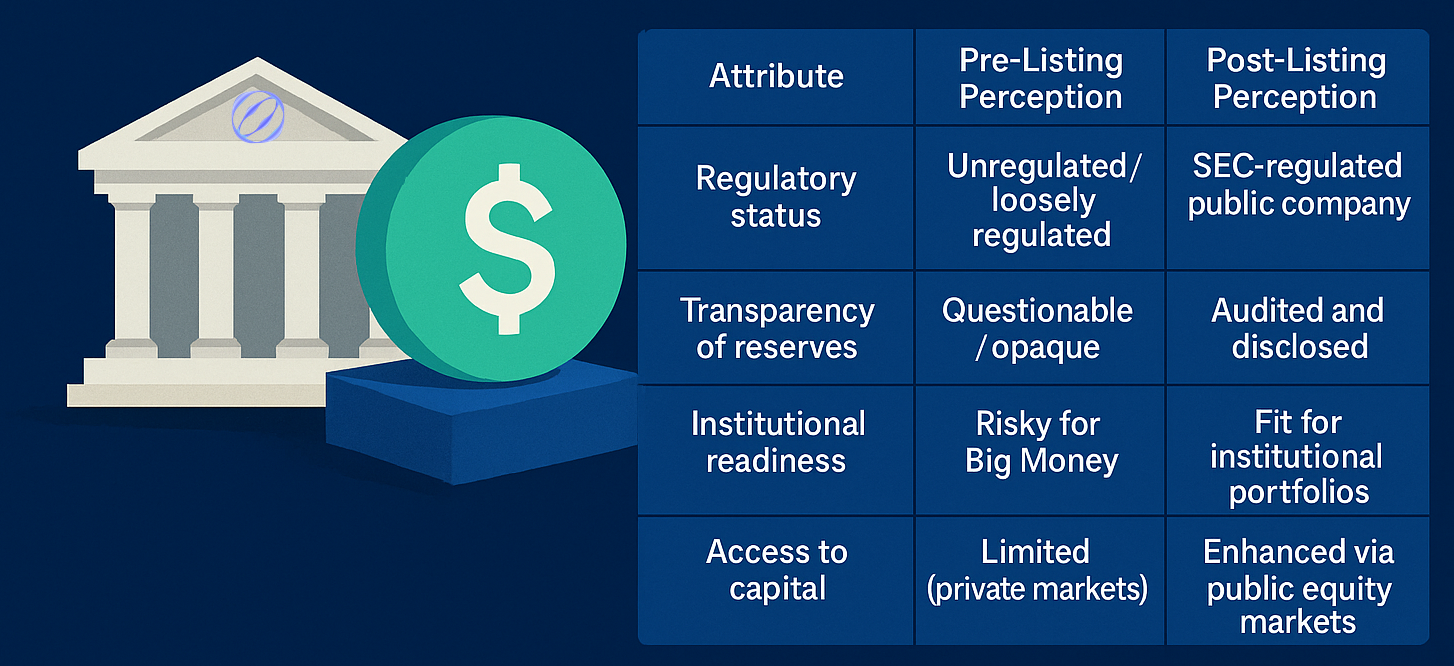

Table: How Circle’s NYSE Listing Changes Perception

| Attribute | Pre-Listing Perception | Post-Listing Perception |

|---|---|---|

| Regulatory status | Unregulated / loosely regulated | SEC-regulated public company |

| Transparency of reserves | Questionable / opaque | Audited and disclosed |

| Institutional readiness | Risky for Big Money | Fit for institutional portfolios |

| Access to capital | Limited (private markets) | Enhanced via public equity markets |

Why This Matters for Big Money

- Legitimization of Stablecoins: Circle’s public listing gives stablecoins a formal seat at the table alongside established financial instruments. Pension funds, insurers, and asset managers are now more likely to view USDC as a trustworthy settlement asset or liquidity tool.

- Clearer Regulatory Path: Circle’s decision to go public aligns it closely with U.S. regulators, helping bridge the gap between crypto innovation and compliance. This could accelerate:

- Regulatory clarity for stablecoins

- Broader adoption in traditional financial systems

- Stablecoin integration into payment, lending, and settlement infrastructure

- New On-ramps for Institutional Capital: Circle’s NYSE-listed stock offers Wall Street firms a crypto-adjacent equity play without needing direct exposure to volatile tokens like BTC or ETH. This lowers the psychological and operational barrier for investment.

Table: Institutional Use Cases Enabled by Circle’s NYSE Status

| Use Case | Pre-Listing Barriers | Post-Listing Opportunities |

|---|---|---|

| Settlement in stablecoins | Regulatory uncertainty | Greater legal comfort |

| Treasury diversification | Volatility, counterparty risk | USDC as a stable option |

| Tokenized asset markets | Limited participation | Expanded adoption |

| Blockchain payments | Hesitation over compliance | Enhanced trust in stablecoin rails |

Broader Implications for Crypto Markets

Circle’s NYSE success sets a blueprint for other crypto companies:

- Path to legitimacy: Public listings could become a gold standard for stablecoin issuers.

- Competitive pressure: Tether and others may face greater calls for transparency.

Market maturity: Bridges the gap between decentralized finance and regulated capital markets.

Conclusion

Circle’s NYSE listing isn’t just a win for one company, it represents Wall Street’s formal endorsement of stablecoins. As Big Money seeks reliable, compliant ways to engage with crypto, stablecoins like USDC are poised to play a central role.

In many ways, Circle’s success may mark the start of a new phase of crypto adoption, where stablecoins serve as the glue binding traditional finance and blockchain ecosystems.

Comments ()