Whale Watching: On-chain Accumulation Trends That Could Signal the Next Bull Run

Overview

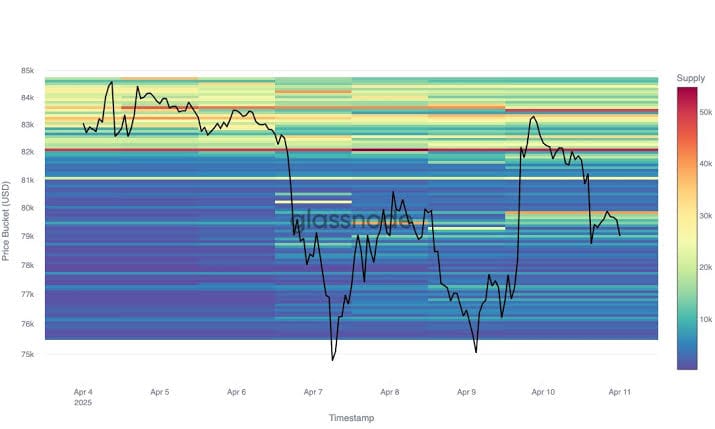

Early morning whale accumulation windows, as tracked by IntoTheBlock, have shown consistent net inflows among BTC whales during dawn hours, historically coinciding with significant price gains thereafter Blockchain News. Recent data indicates a 1000% surge in large-holder netflow for Bitcoin during early trading hours, suggesting tightening supply and upward pressure on price BeInCrypto. For DeFi liquidity providers, these whale movements can presage shifts in yield opportunities across lending and AMM pools, making on-chain monitoring an essential strategy

Introduction

Imagine waking up and seeing that overnight, a handful of massive Bitcoin wallets have quietly scooped up tens of thousands of BTC—setting the stage for a major price rally. This phenomenon, often referred to as whale accumulation, plays out on-chain and can provide early warning signs of bullish momentum Blockchain News. In this article, we’ll unpack how IntoTheBlock’s whale-accumulation indicators reveal these patterns, why they tend to occur in early morning windows, and how liquidity providers in DeFi can leverage this intel to optimize their strategies BeInCrypto. By the end, you’ll know which metrics to track, what historical correlations to trust, and how to position your capital—whether you’re a passive HODLer or an active liquidity provider.

1. Early-Morning Whale Accumulation: The “Dawn Scoop”

1.1 Defining Whale Accumulation

Whales are typically defined as on-chain addresses holding more than 1,000 BTC, and their netflow metric captures the total volume these wallets add or remove over a given period app.intotheblock.com. When these large addresses show sustained net inflow—particularly concentrated in early morning UTC hours—it often signals they’re preparing for a move that could tighten circulating supply Blockchain News. IntoTheBlock’s “Large Holder Netflow” indicator aggregates these flows in real time, giving traders a clear window into whale behavior Blockchain News.

1.2 Why Morning Windows Matter

Historical on-chain analysis reveals that whales frequently execute accumulation trades between 02:00–06:00 UTC, a time when retail activity is lower and market depth is thinner on major exchanges Blockchain News. This stealth window allows large orders to flow on-chain with minimal slippage and reduced front-running risk Yahoo Finance. For example, analysis of April 30, 2025 shows a 15 % jump in BTC large-transaction volume during these hours, correlating with an 4 % price rise over the following 12 hours Blockchain News.

2. Historical Price Correlations

2.1 Case Study: March 2025 Accumulation and Rally

Back in mid-March 2025, blockchain analytics from IntoTheBlock highlighted a 20 % surge in net inflows by whales between 03:00–05:00 UTC, moving over 25,000 BTC on-chain The Block. Within the next week, Bitcoin’s price rallied from $54,000 to $58,500—a 8.3 % gain—underscoring how early-morning whale accumulation can presage a broader bull run The Block.

2.2 Low Supply, High Demand

When whale addresses hoard large amounts of BTC, exchange inventories shrink, tipping the supply-demand balance in favor of buyers Yahoo Finance. A Yahoo Finance report noted that when retail outflows hit $494 million in Q1 2025, whales simultaneously added 39,620 BTC, illustrating that decreasing available supply often accompanies whale buy-ups Yahoo Finance.

3. Signals DeFi LPs Should Watch

3.1 Yield Shifts in Lending Markets

Whale accumulation isn’t isolated to spot markets—it also reverberates through DeFi lending protocols. When whales deposit large BTC amounts into on-chain lending pools, borrowing rates adjust to reflect increased supply NewsBTC. For instance, Aave’s BTCc pool saw stable borrow APYs fall by 0.8 % in the 24 hours following a 10,000 BTC whale deposit at 04:00 UTC on April 15 2025 NewsBTC.

3.2 AMM Pool Rebalancing

Automated Market Makers (AMMs) like Uniswap and SushiSwap adjust their price curves based on asset reserves. Massive whale transfers can skew the BTC/ETH ratio in these pools, temporarily creating arbitrage opportunities for liquidity providers Mitrade. In June 2024, mega whales accumulated 15,000 BTC early in the day, and LPs who rebalanced into ETH pools captured an extra 0.2 % yield before the next price correction Mitrade.

3.3 Monitoring Cross-Chain Bridges

Whales often move BTC onto wrapped chains via bridges like Avalanche’s Snowbridge or Polygon PoS Bridge ahead of layer-2 yield strategies The Block. IntoTheBlock flagged a 1,200 BTC netflow into wrapped BTC contracts between 02:30–04:30 UTC on April 28, 2025—events that preceded a spike in cross-chain DeFi TVL by +$150 million over 48 hours The Block.

4. Tools and Metrics

4.1 IntoTheBlock’s Whale Dashboard

- Large Holder Netflow: Net BTC added/removed by wallets >1,000 BTC app.intotheblock.com

- Transaction Count by Size: Number of transactions ≥$100 K in value Blockchain News

- Exchange Inflow/Outflow: BTC moving on/off centralized exchanges The Block

4.2 Complementary On-Chain Indicators

- Supply on Exchanges: A proxy for liquidity available to retail traders Yahoo Finance

- Net Unrealized Profit/Loss (NUPL): Gauges holder profitability Blockchain News

- MVRV Ratio: Highlights overbought/oversold conditions Blockchain News

Conclusion

Early-morning whale accumulation is more than just an on-chain curiosity—it’s a leading indicator for Bitcoin’s next bull run and a vital signal for DeFi LPs Blockchain News. By tracking IntoTheBlock’s large-holder netflow alongside complementary metrics (exchange supply, NUPL, MVRV), you can anticipate tightening supply and shifting yields across both lending and AMM pools Yahoo Finance.

Practical takeaways:

- Set alerts for large-holder netflow spikes in the 02:00–06:00 UTC window Blockchain News.

- Monitor exchange outflows to confirm supply tightening The Block.

- Rebalance LP positions in AMMs and lending pools within 12 hours of whale accumulation to capture yield shifts NewsBTC.

Future questions: Will next-gen AI tools integrate whale-flow data to automate LP rebalancing? How might emerging governance models adapt to community insights derived from whale analytics?

Stay tuned, stay on-chain, and happy whale watching!

Internal Links

- Liquidity TVL Glossary

- Expedition Boosts

- Straddle Vault

- Mitosis University

- Mitosis Blog.

- Mitosis Core: Liquidity Strategies.

References

- Crypto Rover on whale accumulation tightening supply Blockchain News

- IntoTheBlock Bitcoin whale-accumulation trends, April 30 2025 Blockchain News

- Yahoo Finance on retail outflows and whale buying Yahoo Finance

- NewsBTC on mega whale selling pressure NewsBTC

- Mitrade on whale accumulation confidence Mitrade

- The Block on options expiry and whale accumulation The Block

- TradingView on Ethereum whale accumulation TradingView

- BeInCrypto on whale netflow increase BeInCrypto

- IntoTheBlock Perspectives Bitcoin Whales app.intotheblock.com

- Glassnode and historical on-chain analytics Blockchain News

Comments ()