Whales Are Moving BTC After 14 Years What Does It Mean?

Bitcoin wallets that have been dormant since the early 2010s are suddenly showing signs of life. In July 2025, one such wallet moved over $8.6 billion in BTC, capturing widespread attention. The big question: are these old whales simply upgrading wallet infrastructure or preparing to sell at near all time highs?

Dormant Wallets Waking Up: Why Now?

Multiple early Bitcoin wallets, inactive for 10–14 years, are reactivating. Why? Several factors might be driving the timing: ● BTC has surged 44% in July 2025, trading between $100,000–$115,000. ● Institutional interest spiked after the U.S. declared "Crypto Week”, boosting crypto legitimacy. ● Holders may be migrating funds to more secure or modern wallets. ● Others could be preparing to liquidate holdings while prices remain high. ● Regulatory tightening in various jurisdictions might be prompting early whales to reposition. While the motivations remain speculative, these movements are historically rare and often precede shifts in market momentum.

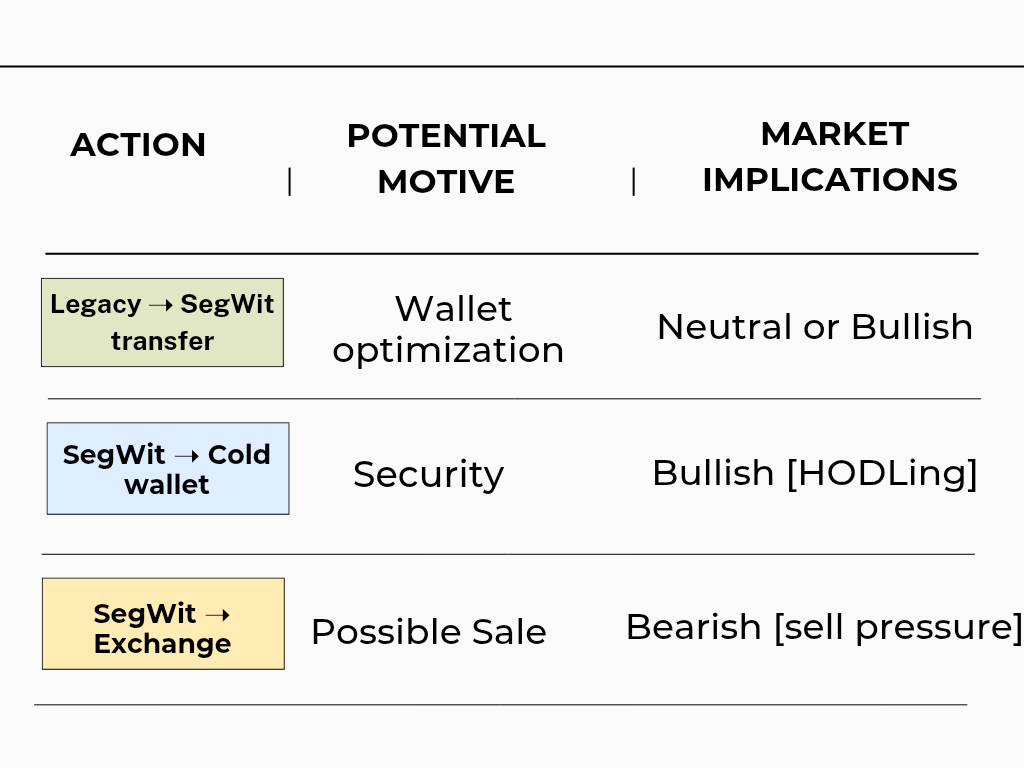

Legacy vs SegWit: Technical Move or Market Play?

Most of these long dormant wallets are tied to legacy Bitcoin addresses, created before the SegWit (Segregated Witness) upgrade of 2017. SegWit enables: • Lower transaction fees • Faster confirmations • More efficient use of block space Transferring funds from legacy to SegWit addresses is often a technical upgrade, not necessarily a signal to sell. However, if funds move from SegWit wallets to exchanges, it could indicate liquidation intent.

Possible Motives Behind Whale Movements

Without specific onchain context (destination tags, exchange labels), it’s hard to confirm the exact motive. But historical trends suggest caution during large movements.

Market Reaction: Sentiment and Speculation

Bitcoin’s price has held steady in the $100K+ zone despite these whale movements but trader sentiment is mixed:

● On X (Twitter), analysts debate whether a dump is incoming or if whales are simply reorganizing.

● Exchanges report rising inflow volumes, suggesting some movement toward liquidity.

● Onchain tools like Whale Alert and Glassnode show spikes in aged coin transfers.

The last time a significant number of dormant coins moved was early 2021, Bitcoin followed with a brief correction before climbing again. It’s a signal worth watching.

CONCLUSION

While no single wallet movement defines the market, long dormant whales becoming active always matters. These reactivations could reflect a mix of technical upgrades, regulatory repositioning, or strategic selling.

Learn More To track Bitcoin whale activity in real time: Whale Alert Real time notifications of large crypto transfers Glassnode Onchain metrics and age band wallet analysis

Comments ()