What Are Liquidity Pool Tokens (LP Tokens)? Earning Methods and Potential Risks

The Silent but Powerful Players of Crypto Assets

In the world of cryptocurrency, most eyes are on the big names Bitcoin, Ethereum, or popular altcoins. However, behind the scenes, there are certain assets that may appear ordinary at first glance but play an incredibly important role in the ecosystem. One such asset is the Liquidity Pool Token, commonly referred to as the LP token.

In today’s DeFi ecosystem, LP tokens are one of the most fundamental building blocks that enable decentralized exchanges (DEXs) to function properly. In this article, we will explore what LP tokens are, how they are earned, their use cases, potential risks, and what to be cautious about when dealing with them. You’ll find all the answers to these essential questions below.

What is an LP Token?

A Liquidity Provider Token (LP Token) is a type of representative asset granted to users who provide liquidity to decentralized exchanges (DEXs). To put it simply, when you deposit a pair of tokens (e.g. ETH/USDC) into a liquidity pool on a decentralized exchange, the platform generates an LP token for you. This token represents your contribution to that specific pool.

Think of the LP token as a receipt that proves your share in the pool. You can use this token later to redeem your original tokens along with the trading fees you’ve earned during the period your assets were in the pool.

Where Are LP Tokens Used?

Although LP tokens are commonly thought to be used only for redemption purposes, their actual utility extends far beyond that. Key use cases include:

1. Yield Farming

One of the most popular uses of LP tokens is staking them in yield farms. In this process, users lock their LP tokens into a special smart contract to earn additional rewards. These rewards are often distributed in the native token of the platform.

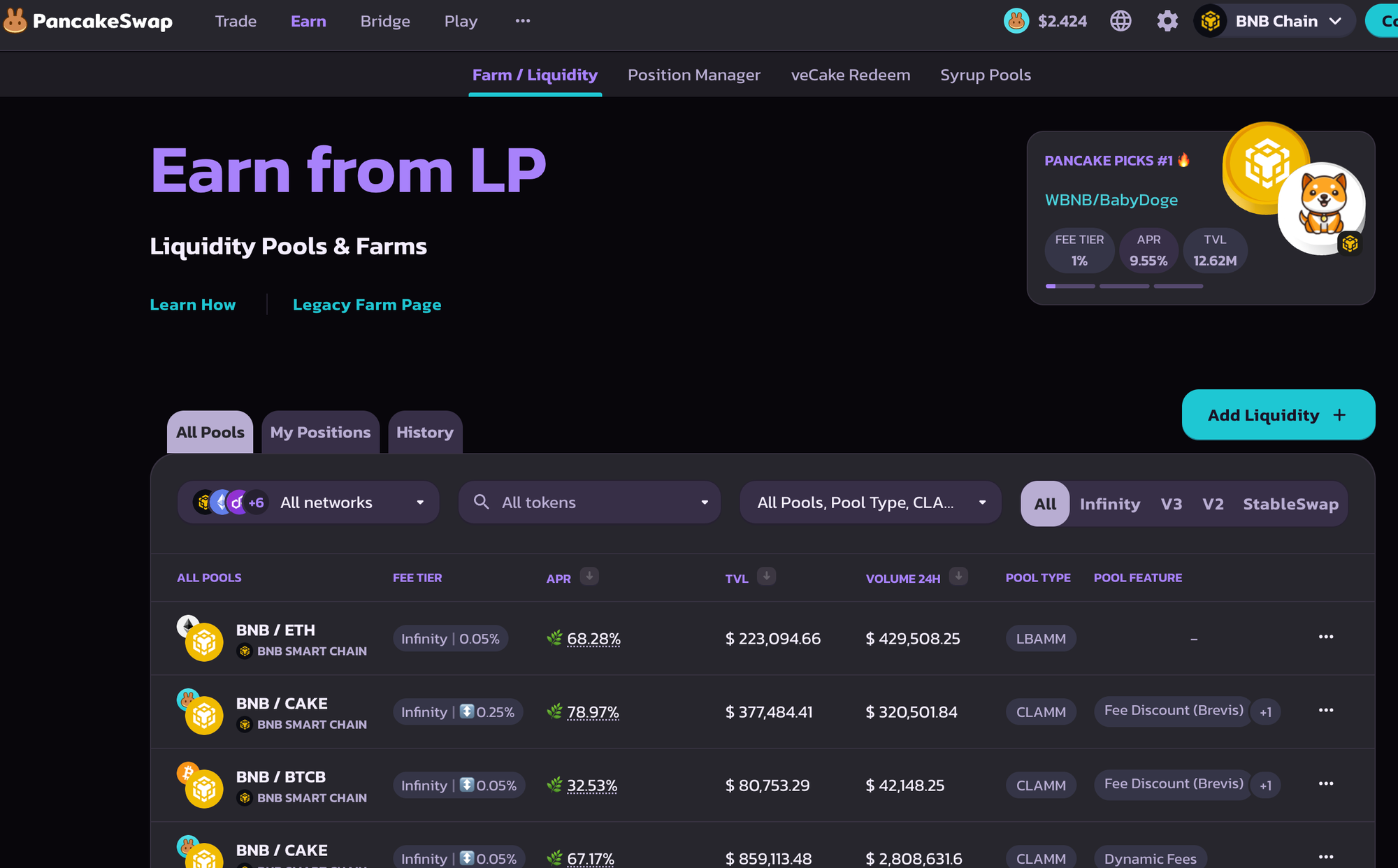

Example: On PancakeSwap, by staking your CAKE-BNB LP tokens in a yield farm, you can earn extra CAKE tokens as rewards.

2. Collateral for Loans

Certain decentralized lending protocols accept LP tokens as collateral. By locking your LP tokens in such platforms, you can borrow assets like stablecoins. This expands the financial utility of LP tokens within the DeFi ecosystem.

Example: Platforms like Alpaca Finance or Aave allow you to deposit your LP tokens as collateral to borrow USDC or other assets.

3. Transfer and Ownership Flexibility

Since LP tokens are typically built on ERC-20 or similar standards, they can be freely transferred between wallets, bought, or sold—just like any other crypto asset. This makes LP tokens highly flexible and easily tradable assets.

How to Earn LP Tokens?

Earning LP tokens involves a straightforward process that includes the following steps:

Step 1: Choose a Suitable Platform

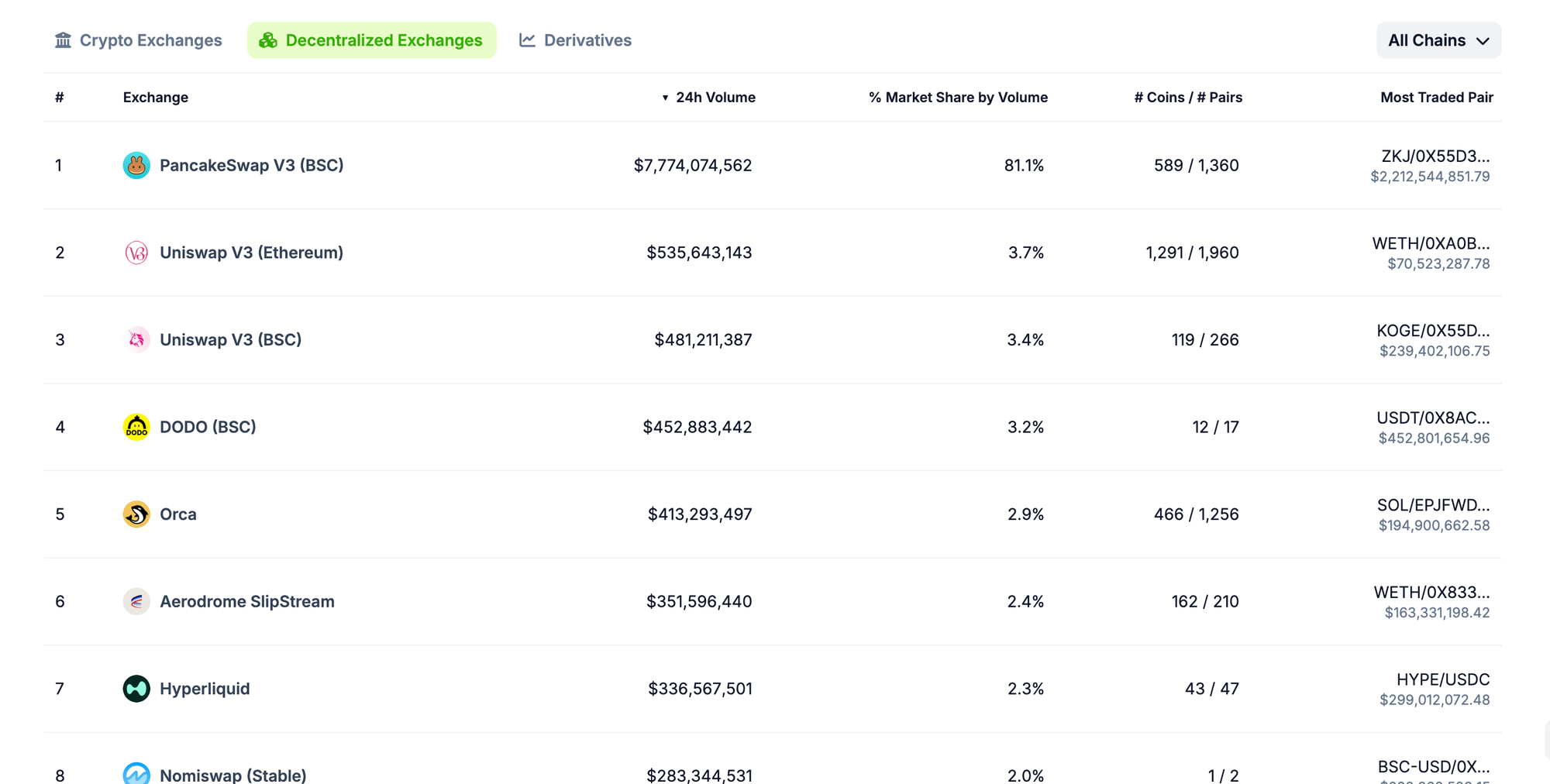

Popular DEXs such as Uniswap, SushiSwap, or PancakeSwap are among the most widely used platforms for earning LP tokens.

Step 2: Select a Token Pair for Liquidity

Choose a pair of tokens traded on your preferred platform. These pairs generally consist of two tokens of equal value. For instance, you might deposit $100 worth of ETH and $100 worth of USDC.

Step 3: Add Liquidity to the Pool

Once you've selected the token pair, contribute them to the liquidity pool. The platform will immediately issue an LP token representing your contribution to the pool.

Advantages of LP Tokens

- Passive Income Opportunity: You earn a share of the trading fees generated by the liquidity pool.

- Extra Earnings via Yield Farming: You can stake LP tokens to earn additional rewards.

- Collateral Use: LP tokens can be used to secure loans on compatible platforms.

- Ease of Transfer: Like any ERC-20 asset, LP tokens can be transferred between wallets or sold on supported platforms.

Risks Associated with Using LP Tokens

Just like any crypto asset, LP tokens come with certain risks. Here are some of the most common ones:

1. Impermanent Loss

When the price of one or both tokens in the pair changes significantly, the value of your LP token may decrease. This is known as impermanent loss and is one of the most common risks faced by liquidity providers.

2. Smart Contract Vulnerabilities

If the platform’s smart contract has a vulnerability, it may result in a complete loss of your deposited funds. In decentralized systems, such losses are often irreversible.

3. Loss of LP Tokens

If you lose or accidentally delete your LP token from your wallet, your contribution to the pool is also lost. Since your share is identified solely by this token, losing it means you can no longer reclaim your original deposit.

Where and How Can I View LP Tokens?

Some wallets (such as MetaMask) may not display LP tokens by default. In such cases, you’ll need to manually add the token using its contract address. This information is usually easily accessible from the platform where you provided liquidity.

Conclusion: Are LP Tokens the New Key to Investment?

Liquidity pool tokens are becoming increasingly important within the crypto space and are now a staple in many professional investors’ portfolios. Not only do they offer passive income, but they also provide access to multiple features of decentralized finance in one package.

However, before investing, it’s essential to fully understand how the system works, calculate potential risks such as impermanent loss, and ensure the platform you're using is secure. When used strategically and with proper risk assessment, LP tokens can become a highly profitable investment tool in the evolving DeFi landscape

Comments ()