What Are Spread and Slippage in Crypto Trading? A Comprehensive Guide for Beginner Investors

Introduction: Why Does the Price Change During Trading?

When trading in the cryptocurrency market, you may not always catch the price you see on your screen. This is because many factors beyond the apparent price—such as supply-demand balance, liquidity, the order book, and market type—affect the outcome of a transaction.

For example, even if you see "Bitcoin is being bought at $70,000," when you place a buy order, the final price might be higher. But why?

In this article, we explain two key concepts that work behind the scenes of price:

- Bid-ask spread

- Slippage

What Is the Bid-Ask Spread?

Definition and Basic Logic

The bid-ask spread is the difference between the lowest asking price from sellers and the highest bidding price from buyers for an asset. This difference varies depending on market conditions and the liquidity of the asset.

Example:

BNB ask price: 351 USDT

Bid price: 350 USDT

Bid-ask spread: 1 USDT

Relation to Liquidity

High liquidity = Smaller spread: In heavily traded assets like BTC and ETH, there’s strong competition between buyers and sellers, leading to a tighter spread.

Low liquidity = Wider spread: In small altcoins, even opening a single position can impact the price.

Calculating as a Percentage

The spread percentage is calculated as follows:

(Lowest Ask Price - Highest Bid Price) / Lowest Ask Price × 100

Example:

Bid: 901 USDT

Ask: 907 USDT

Spread percentage = (907 - 901) / 907 × 100 ≈ 0.66%

On the same day, the spread for Bitcoin might be just 3 USDT. But for an asset priced at $70,000, this translates to only around 0.004%, a very low ratio.

How Do Market Makers Profit from This Spread?

Market makers profit by simultaneously buying and selling, collecting the spread as their earnings. On centralized exchanges, there are institutional market makers providing this service.

Example:

A market maker who buys at 350 USDT and sells at 351 USDT earns 1 USDT per trade. With thousands of trades in a day, this small margin can lead to significant profit.

Understanding the Spread with Depth Charts

On many crypto exchanges (e.g., Binance), you can visualize the order book through the “Depth” tab.

- Green areas: Buy orders

- Red areas: Sell orders

The gap between these areas shows the bid-ask spread.

This chart lets you visually analyze the liquidity of an asset and the potential risk of slippage.

What Is Slippage?

Definition

Slippage is when your trade is executed at an average price different from your expected price.

Causes:

- Insufficient liquidity

- Rapid price movements (volatility)

- Large order sizes

Example Scenario

You want to buy a coin for 100 USDT. But if there aren’t enough sellers at that price, your order is filled in chunks at higher levels like 101, 102, 103 USDT.

Result: Your average purchase price might become 102 instead of 100.

This difference is called slippage.

Can Slippage Be Positive?

Yes. If the market drops rapidly, your buy order might get filled at a lower price.

In this case, you experience positive slippage and make a more profitable trade.

What Is Slippage Tolerance?

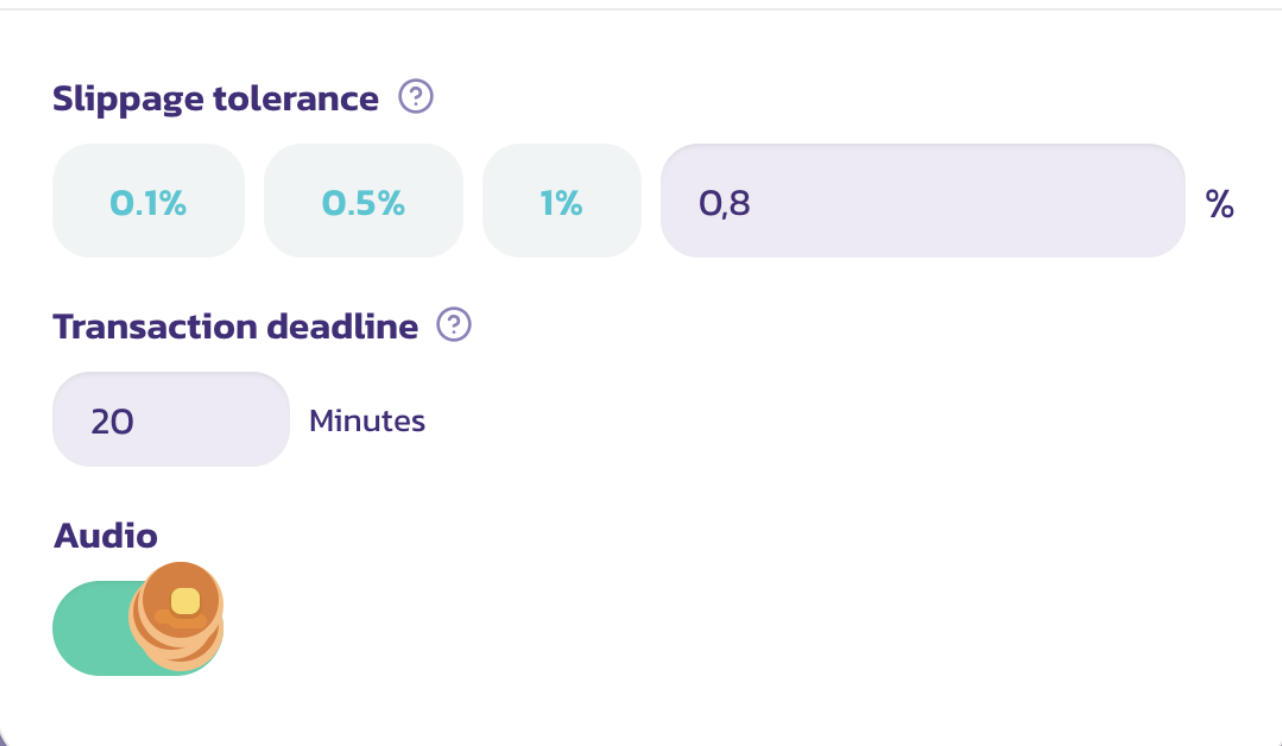

Especially on decentralized exchanges like Uniswap or PancakeSwap, slippage tolerance can be set manually.

- Low tolerance: Your order may fail.

- High tolerance: Increased risk of front-running bots manipulating the transaction.

Tip: A tolerance between 0.5%–2% is ideal for most users.

How to Avoid Slippage

- Use limit orders – Set a specific price instead of using market orders.

- Split your transaction – Break large trades into smaller portions.

- Choose liquid assets – Avoid low-volume altcoins.

- Trade during high activity – Place orders when global trading volume is high.

Conclusion: Look Beyond the Price for Smarter Trading

To make profitable trades in crypto markets, it’s not enough to just look at prices.

Bid-ask spread and slippage are critical factors that directly affect the outcome of your trades.

Once you understand these two concepts, you can:

- Place more strategic orders

- Protect yourself from unexpected losses

- Execute trades with lower costs

Frequently Asked Questions (FAQ)

Why does the spread vary so much between coins?

Because each coin has different trading volumes, liquidity, and levels of demand. Popular assets like BTC have very low spreads.

What should I do if the spread is high?

You might consider waiting, using a limit order, or switching to a more liquid market.

I lost money due to slippage, is this normal?

If you used a market order, this risk is always present. The best protection is using a limit order.

Final Words: Look Beyond the Price for Smarter Trading

The path to successful trades in the crypto market isn’t just about watching prices.

Understanding less visible but impactful factors like the bid-ask spread and slippage helps investors avoid many unpleasant surprises.

For beginners especially, grasping these concepts is critical for reducing long-term costs and improving trading strategies.

In every trade, factors like the spread, order book depth, liquidity conditions, and market volatility should be considered.

Slippage that occurs during market orders or expanding spreads caused by low liquidity can silently reduce trade profitability.

With this guide, you can:

- Interpret market conditions more accurately when placing orders

- Learn how to act more wisely on both centralized and decentralized exchanges

- Prevent sudden losses and make more professional investment decisions

Ultimately, trading is not just about pressing the “buy” and “sell” buttons.

Real success comes from understanding the mechanisms behind those buttons.

An investor who considers core dynamics like the bid-ask spread and slippage will take more confident steps in the market and achieve more sustainable profits over the long term.

Remember: Knowledge is your greatest investment tool

Comments ()