What Does Mitosis Bring to the Ecosystem?

The world of decentralized finance (DeFi) is evolving rapidly. Yet, the space still struggles with a few persistent problems:

📌 Small investors are often locked out of major opportunities

📌 Liquidity becomes static once committed

📌 Lack of transparency in private deals

This is where Mitosis steps in—offering not just a solution, but a revolution.

So, what exactly is Mitosis? Why is it attracting so much attention? And most importantly: What does it truly offer to the DeFi ecosystem? Let’s break it down in the simplest way possible.

🧩 1. What is Mitosis?

Mitosis is a DeFi protocol—a system where users can deposit assets into smart contracts to earn passive income. But what sets Mitosis apart?

Unlike traditional protocols where assets just sit idle, Mitosis transforms these positions into programmable, reusable, and portable components.

In other words, it turns passive capital into active tools.

🔄 2. What Was Wrong With the Old System?

Locked Liquidity: In standard DeFi, once you provide liquidity, your assets become locked and can’t be used elsewhere.

Whales Had All the Fun: High-yield opportunities were often reserved for large investors through private, off-chain deals. Small investors were left behind.

These issues go against the very essence of “decentralization.”

Mitosis is here to change that.

🧠 3. What Does Mitosis Offer?

When users deposit assets into Mitosis Vaults, they receive Vanilla Assets on the Mitosis Chain—tokenized representations of their deposits.

These assets can be used in two different ways:

🔷 Ecosystem-Owned Liquidity (EOL):

A community-driven model where users vote on where funds should be allocated.

Participants receive miAssets, representing their stake in this democratic pool.

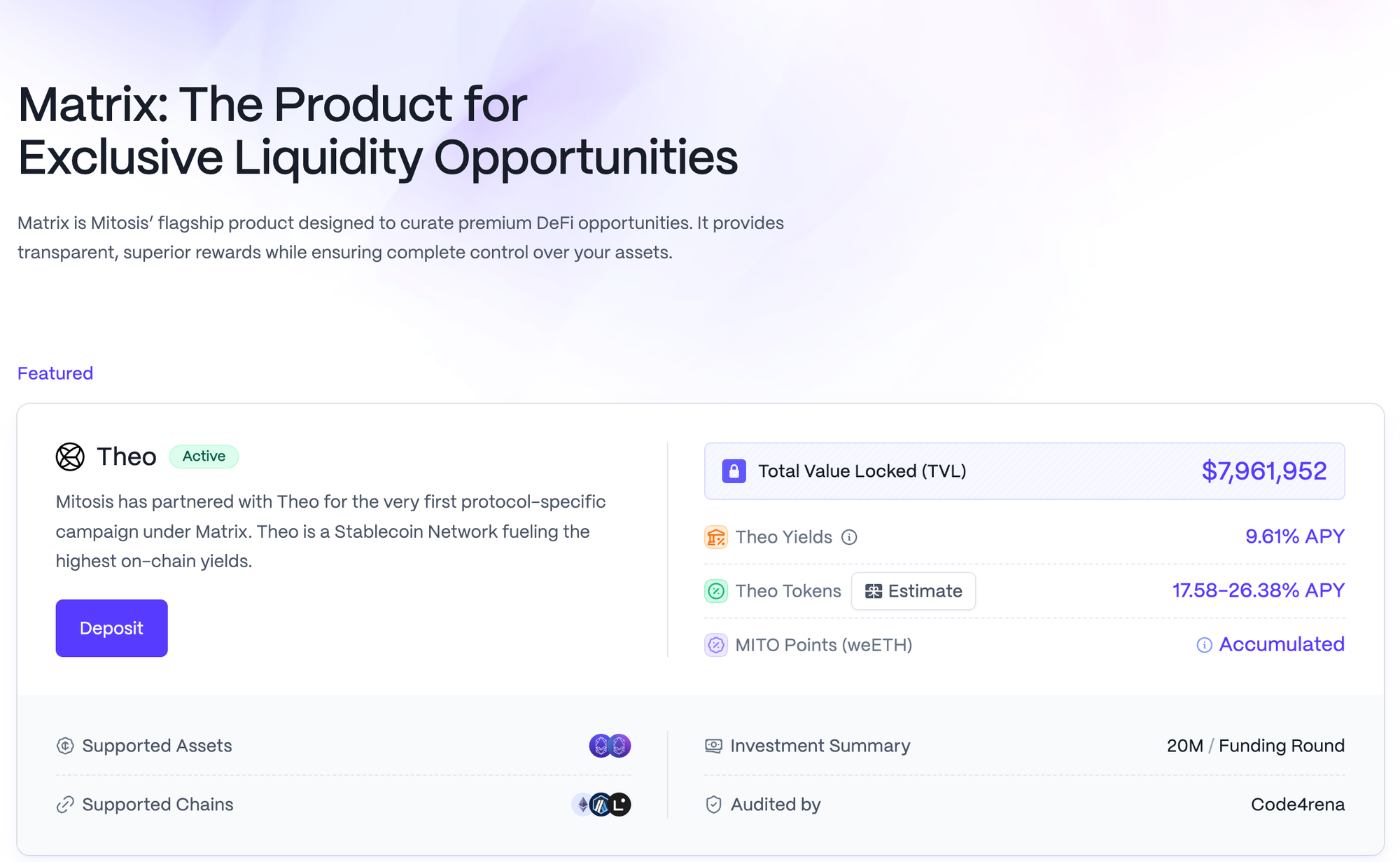

🔶 Matrix Campaigns:

Curated liquidity programs with defined terms and goals. Participants in these campaigns receive maAssets.

But these aren’t just placeholder tokens. They can be:

- Swapped or traded

- Used as collateral for loans

- Split into principal and yield components

- Combined into new financial products

This level of flexibility opens the door to an entirely new class of DeFi applications.

💎 4. Power to the People (Yes, Even Small Investors!)

Mitosis empowers individuals by letting them act collectively, achieving the kind of leverage only whales used to have.

By pooling assets together, the protocol increases bargaining power, giving everyone access to better yields and exclusive campaigns.

On top of that, everything is transparent—from pricing and governance decisions to allocation strategies. No more backroom deals. Just open, community-led finance.

🔗 5. Cross-Chain Synchronization: DeFi, But Smarter

Mitosis also introduces a cross-chain infrastructure that keeps everything in sync. Rewards, losses, and yield calculations are all accurately tracked—even across different blockchains.

This professional-grade system lays the groundwork for financial tools far more advanced than anything DeFi has seen so far.

🚀 Conclusion: Why Mitosis Is a Game-Changer

Mitosis introduces three groundbreaking innovations to the DeFi world:

💸 Unlocks liquidity: Your assets aren’t stuck—they’re mobile and programmable

👥 Equalizes opportunities: The gains that once belonged to whales are now accessible to the community

⚙️ Enables new products: Simple deposits can now become sophisticated financial instruments

In short, Mitosis doesn’t just protect capital—it multiplies its potential.

It empowers small investors and pushes the boundaries of what DeFi can do.

In this ecosystem, liquidity is no longer idle—it’s a building block for the future.

And with Mitosis, that future is already under construction

Comments ()