What happened to Movement and why it won't happen to Mitosis

Introduction

In April 2025, the DeFi market was rocked by a high-profile scandal: the Movement project token (MOVE) lost over $38 million in capitalization in a matter of days. The reason was internal machinations - hidden contracts, participation of shady intermediaries and deliberate token dump right after listing. This story reminded the crypto community why transparency and governance issues are critical.

Meanwhile, another cross-chain project, Mitosis, has built trust through open governance, fair token distribution, and technological reliability. In this article, let's look at how Mitosis avoids the mistakes that drowned Movement.

What happened to Movement?

What Happened to MOVE Shadow Contracts and Intermediaries

An investigation revealed that Movement Labs secretly transferred 66 million MOVE tokens to Rentech, a little-known intermediary affiliated with the Web3Port Foundation. This entity acted simultaneously on behalf of investors and the Foundation itself, creating a conflict of interest. These hidden schemes led to a massive sale of tokens on the market.

Fact: Rentech received almost 20% of the total turnover of MOVE tokens and started dumping them immediately after the launch of trading on centralized exchanges.

Collapse and aftermath

The manipulation caused the MOVE exchange rate to collapse by almost 70% and affected investors lost millions of dollars. The scandal triggered a mass exit of advisors, collapse of the project's reputation, Delisting of the token from the Coinbase exchange and firing of the project's cofounder!

Quote from Coindesk investigation: “It was the worst agreement we've ever seen” - from an anonymous comment from one of the project's employees.

Why this won't happen with Mitosis

1. Transparent Tokenomics and Distributions

In Mitosis, all stages of token distribution are open:

- MITO Initial Token Offering (ITO) was publicly announced in advance and held on its own cross-chain pools.

- All bonus programs, such as Morse Airdrop and Matrix Vault, come with clear terms of participation with no hidden beneficiaries.

- 20 million MITO tokens are dedicated to community programs, ensuring that value is distributed to real users, not insiders.

Fact: The official documentation states that no partner receives more than 5% of the total token issuance without DAO voting.

2. Decentralized Architecture and Governance

Mitosis is built on a modular architecture of Straddles and Vaults that are governed by DAOs and automated contracts:

- Users vote on network parameters, including commissions and new integrations.

- All contracts are verifiable on Github and reviewers like Etherscan.

Unlike the centralized management of Movement, Mitosis has no "center of power" that can single-handedly flip millions of tokens to unknown entities.

Fact: Mitosis' current TVL exceeds $40 million, spread across more than 7 ecosystems (Arbitrum, Polygon, Optimism, etc.).

3. educational and crisis management infrastructure

Mitosis actively educates users through Mitosis University:

- Guides on liquidity management without the risk of dumps and front-running have been released.

- Hosted regular AMAs where the team answers uncomfortable questions about bridge security.

- A MagicMito campaign is underway where members get points for educational content rather than speculation.

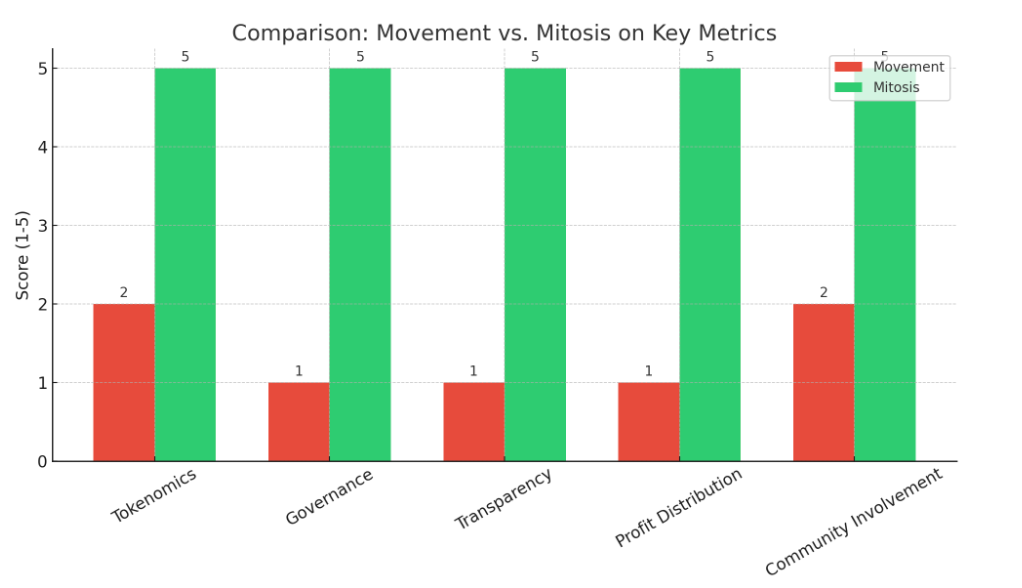

To illustrate, here are the scores of Movement and Mitosis on key parameters: tokenomics, governance, transparency, profit sharing and community participation. on a scale of 1 to 5.

Mitosis shows maximum scores on all items, while Movement has a big dip in transparency and governance.

Fact: Over 15k users have already been trained through Mitosis University and participated in the community drop-in program.

Conclusion

The Movement scandal revealed the worst-case scenario for the project: when centralized decisions, opaque contracts and shady schemes destroy investor confidence.

Mitosis contrasts this with an open model:

- Transparent tokenomics and incentive programs;

- Governance through DAOs and open source code;

- An emphasis on user education and fair liquidity allocation.

Practical conclusion:

Before investing in DeFi projects, check not only the technology, but also how they build management and work with the community.

This is what separates sustainable projects like Mitosis from those that will repeat the fate of Movement.

Resources: coindesk , university, movementlabs blog.

Comments ()