What is DCA? Discover the Power of Dollar Cost Averaging in Crypto

Merve began exploring cryptocurrencies on December 1, 2017. After her research, she realized the potential of investing in this emerging market. That same day, she decided to buy 0.6 Bitcoin for $12,000 while Bitcoin was trading around $20,000. Looking back today, it may seem like a profitable move. But what if she had split that $12,000 investment into 12 smaller chunks, investing $1,000 each month instead? Would the outcome have been better? Let’s explore the answer through something called Dollar Cost Averaging (DCA).

What is Dollar Cost Averaging (DCA)?

DCA stands for Dollar Cost Averaging, an investment strategy where you divide your total investment into equal portions and invest them regularly over a certain period, regardless of market price.

This method helps reduce the impact of market volatility, as you buy more units when prices are low and fewer when prices are high—resulting in a more balanced average purchase price over time.

A Real-World Scenario: What If Merve Had Used DCA?

Let’s revisit Merve’s case. On December 1, 2017, she purchased 0.6 BTC for $12,000 when Bitcoin was at $20,000. Everything seemed promising—until Bitcoin dropped to $13,000 a month later. Two months after the initial investment, the price was down to $10,000, and eight months later, it fell to $6,000.

By the time a year had passed, Bitcoin had dropped to the $3,800–$4,800 range. At that point, Merve’s 0.6 BTC was worth just $2,400—resulting in a $9,600 loss.

Now imagine if she had used Dollar Cost Averaging instead.

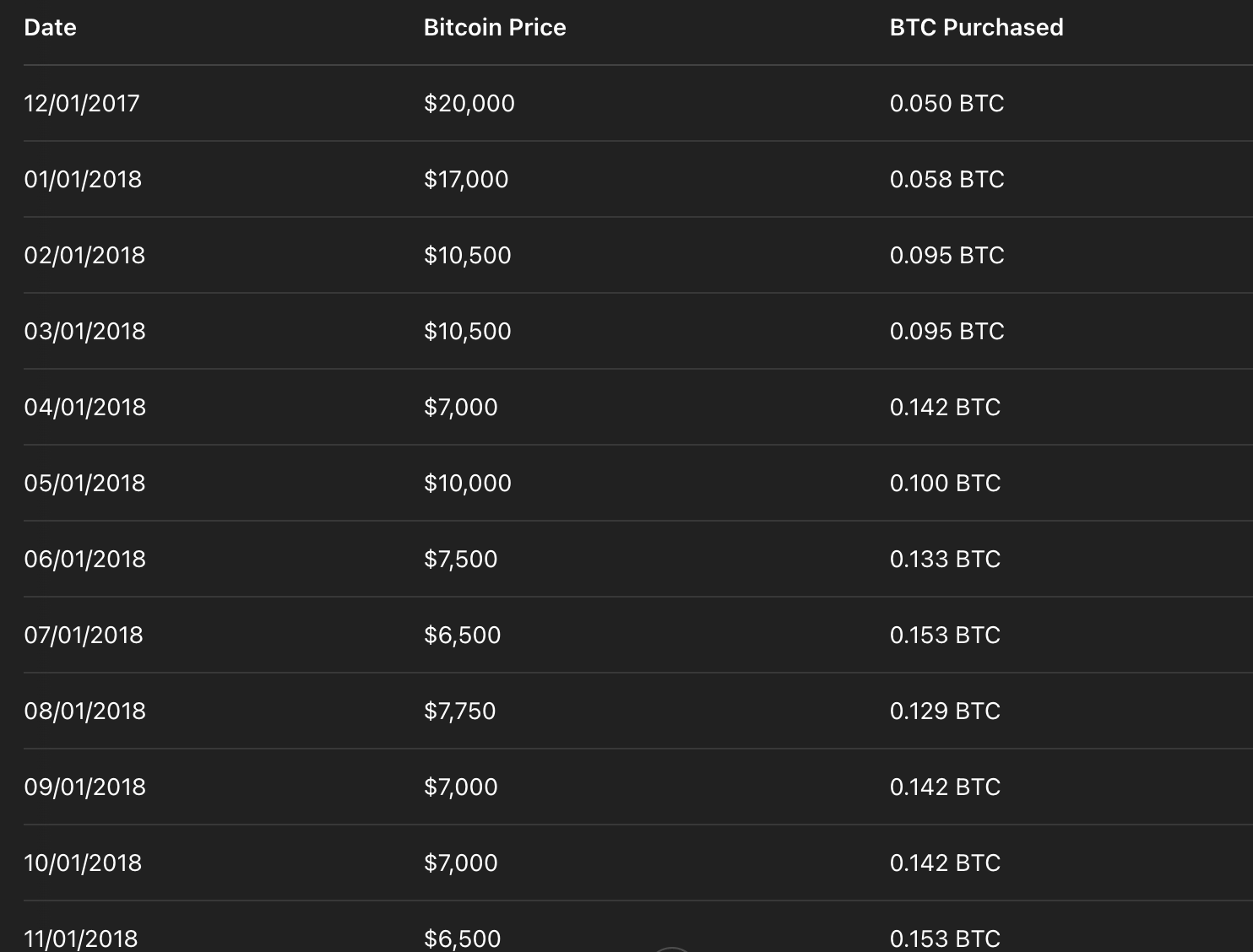

Hypothetical DCA Investment (December 2017 – November 2018)

If Merve had invested $1,000 each month instead of a lump sum, here's what her Bitcoin accumulation might have looked like:

- Dec 2017: 0.05 BTC @ $20,000

- Jan 2018: 0.058 BTC @ $17,000

- Feb 2018: 0.095 BTC @ $10,500

- Mar 2018: 0.095 BTC @ $10,500

- Apr 2018: 0.142 BTC @ $7,000

- May 2018: 0.10 BTC @ $10,000

- Jun 2018: 0.133 BTC @ $7,500

- Jul 2018: 0.153 BTC @ $6,500

- Aug 2018: 0.129 BTC @ $7,750

- Sep 2018: 0.142 BTC @ $7,000

- Oct 2018: 0.142 BTC @ $7,000

- Nov 2018: 0.153 BTC @ $6,500

Total BTC accumulated: 1.392 BTC

That’s more than double the amount of Bitcoin she would have received with a one-time purchase! DCA not only reduces risk but also helps maximize returns in volatile markets.

Why Do Investors Use Dollar Cost Averaging?

Timing the market is one of the most difficult aspects of investing. When to buy? When to sell? These questions often lead to emotional decisions, which can result in poor outcomes—even if the direction of the market is correctly predicted. DCA eliminates the need to time the market perfectly and brings discipline and consistency to your investing.

Here’s a simple truth: investing a lump sum in a single asset at the wrong time can result in significant losses. Diversifying your investments and spreading them out through strategies like DCA can help minimize risk and improve long-term outcomes.

By allocating fixed amounts regularly, DCA helps avoid the stress of market fluctuations and reduces the chance of making impulsive decisions. As seen in Merve’s example, trying to predict price movements is not easy—but by using DCA, you reduce the overall risk and increase the chances of building a stronger portfolio over time

Comments ()