🔍 What Is Ecosystem-Owned Liquidity (EOL)?

EOL is an innovative liquidity management model developed by the Mitosis protocol, designed to replace traditional liquidity pools with DAO-managed reserves. Instead of relying on short-term incentives to attract capital, EOL offers a sustainable, transparent, and decentralized framework where community members collectively decide how liquidity is allocated.

🔗 Detailed breakdown of EOL at Mitosis University

🔗 EOL vs. Matrix: Comparing Liquidity Models

🧠 How Does EOL Work?

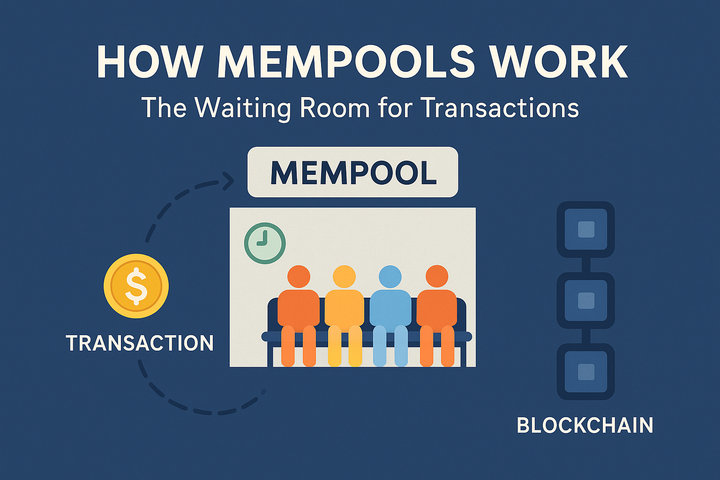

- Asset Deposit: Users deposit assets (e.g., ETH, USDC) into EOL vaults on supported networks.

- Receiving miAssets: In return, they receive miAssets that represent their proportional share in the liquidity pool.

- Voting on Allocation: miAsset holders participate in governance, voting on which strategies or protocols should receive funding.

- Automated Deployment: Smart contracts then autonomously allocate capital based on community voting outcomes.

🔗 In-depth mechanics of liquidity governance

🔗 How voting impacts allocation

🌉 Advantages of EOL

- Transparency: All decisions are made on-chain via DAO voting, eliminating behind-the-scenes deals.

- Sustainability: Liquidity is distributed based on long-term strategies instead of mercenary capital incentives.

- Accessibility: Anyone can deposit and take part in liquidity governance.

- Cross-chain compatibility: EOL liquidity can be allocated across multiple chains, offering both flexibility and scale.

📈 Use Cases for EOL

- Supporting New Protocols: Emerging DeFi protocols can propose strategies and request capital from the EOL pool via community voting.

- Yield Optimization: Liquidity can be dynamically reallocated to adapt to market trends and maximize return.

- Bear Market Resilience: EOL enables liquidity to remain active even during low-volume or bearish market cycles.

🔗 How EOL helps bootstrap new projects

🛠️ Integration with Matrix Vaults

While EOL focuses on long-term, community-owned liquidity management, Matrix enables short-term structured campaigns and automated strategies. Together, they form a modular and synergistic architecture for liquidity management within Mitosis.

🔗 EOL vs. Matrix: Full comparison

Comments ()