What Is Inflation? Causes, Effects, and Solutions

Many people have heard their elders say, “Everything used to be so much cheaper.” This statement actually points to a frequently encountered phenomenon in economics: inflation. So, what exactly is inflation, why does it occur, and how can it be controlled?

Definition of Inflation

Inflation is the sustained increase in the general price level of goods and services in an economy. In other words, the same amount of money buys fewer products or services over time. This means the purchasing power of money decreases.

Inflation is not about the rise in prices of a few items; it’s characterized by a consistent rise across most sectors. Temporary price increases do not constitute inflation continuity is the key factor.

Main Causes of Inflation

Economists typically link inflation to three main sources: demand-pull inflation, cost-push inflation, and built-in inflation. Each is the result of different economic dynamics.

1. Demand-Pull Inflation

This type of inflation arises when total spending by the public exceeds the economy’s production capacity. For example:

Let’s say a baker produces 1,000 loaves of bread per day. If economic prosperity increases, people may begin to purchase more bread. But the baker’s capacity is limited. When demand exceeds production, prices start to rise. This can happen with other goods as well.

In short, when people spend more than the economy can supply, prices increase.

2. Cost-Push Inflation

Rising production costs lead businesses to pass these increases on to consumers. For instance:

The same baker now faces higher wheat prices. As the cost of making bread rises, so does the final selling price.

Raw material costs, labor expenses, or increased taxes can all contribute to cost-push inflation. Ultimately, producers raise prices to maintain profitability.

3. Built-In Inflation

Built-in inflation occurs when people expect inflation to continue into the future. If the public believes that prices will keep rising, employees may demand higher wages. Employers, in turn, raise prices to afford those wages. This leads to a wage-price spiral.

In essence, the expectation of inflation can actually cause inflation itself.

How Is Inflation Measured?

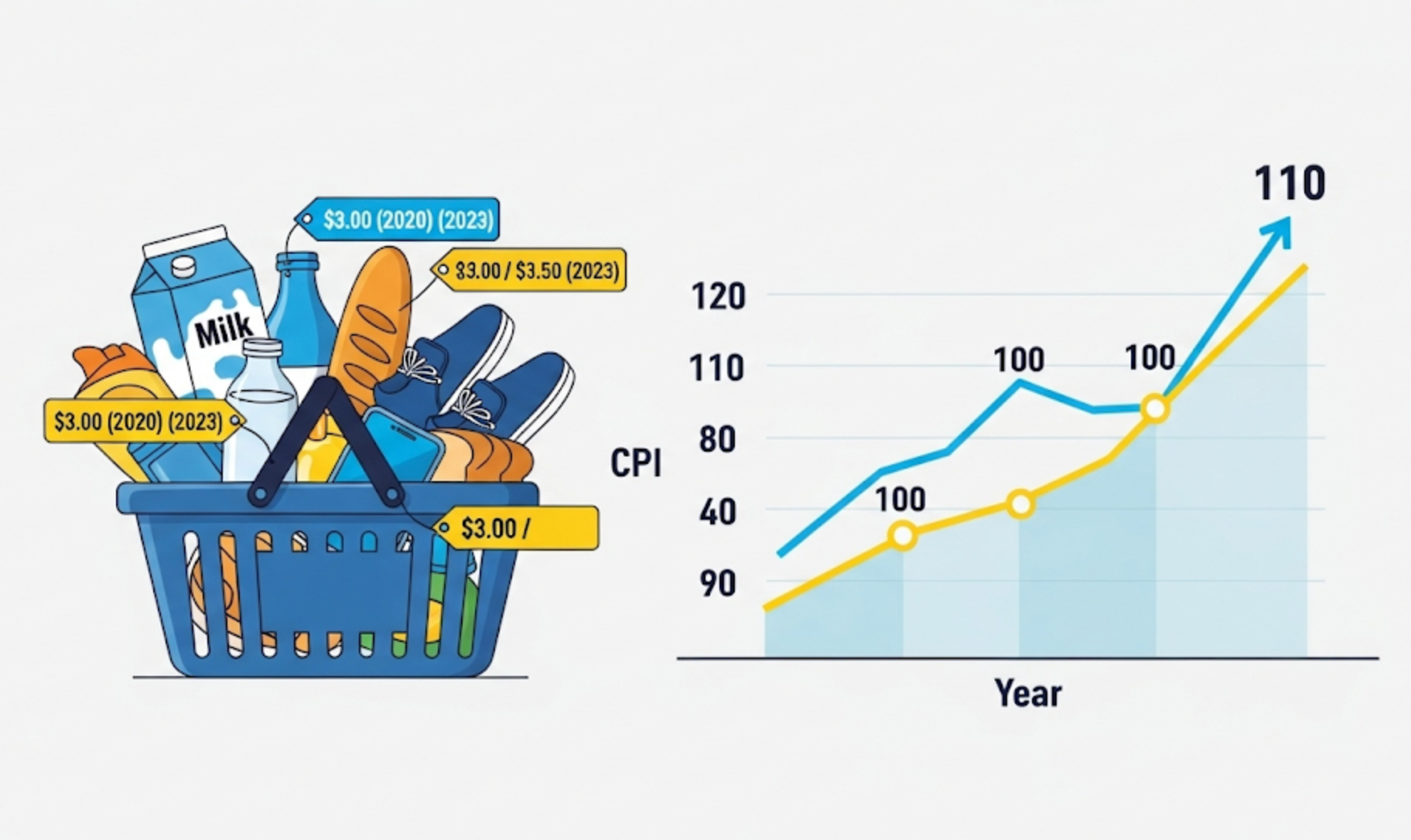

The most widely used tool to measure inflation is the Consumer Price Index (CPI). The CPI tracks average price changes of a basket of goods and services purchased by households over time.

For example, if the CPI is 100 in the base year and increases to 110 the next year, prices have risen by 10%. This allows governments to monitor inflation and implement necessary measures accordingly.

Ways to Control Inflation

If left unchecked, inflation can lead to economic instability. However, with the right tools, it can be managed. Here are the main approaches:

1. Raising Interest Rates

Central banks raise interest rates to make borrowing more expensive and reduce the amount of money circulating in the economy. This results in:

- More expensive loans

- Reduced consumer spending

- Decreased demand, which helps slow price increases

However, this method may also slow economic growth and reduce investment.

2. Fiscal Policy Intervention

Governments can increase taxes to reduce disposable income among citizens. For example, higher income tax reduces consumption, thereby lowering inflationary pressure.

But this approach may lead to public discontent and must be applied cautiously.

Advantages of Inflation

Although inflation is often viewed negatively, controlled and low levels of inflation can offer several benefits:

- Encourages spending and investment: Knowing money will lose value in the future makes immediate spending more logical.

- Favors borrowers: Debts can be repaid with money that is worth less over time.

- Protects against deflation: Falling prices can lead consumers to delay purchases, which may harm economic activity. Mild inflation avoids this.

Disadvantages of Inflation

If inflation becomes uncontrollable, it can seriously damage the economy:

- Currency devaluation: The same amount of money buys fewer goods.

- Erosion of savings: Money in the bank loses value over time.

- Risk of hyperinflation: Price increases of over 50% per month may occur, rendering the currency nearly useless.

- Investment uncertainty: Unclear future costs deter entrepreneurs from investing.

Conclusion: Inflation Is Inevitable but Manageable

Inflation is an inevitable part of modern economies. While it cannot be completely eliminated, it can be effectively managed with prudent monetary and fiscal policies. Low and predictable inflation supports economic growth and stability.

Government decisions on interest rates and taxes, as well as individual consumption and saving behaviors, all play key roles in shaping the course of inflation

Comments ()