What is Liquidity Provision in DeFi?

Liquidity provision is fundamental to both traditional finance (TradFi) and decentralized finance (DeFi). It ensures markets run smoothly, enabling assets to be traded efficiently. In the world of DeFi, liquidity provision has been revolutionized by decentralized exchanges (DEXs) and lending protocols, which function without intermediaries.

This article examines liquidity provision, its functioning in DeFi, important platforms like Uniswap, Compound, and Curve, as well as the associated risks and future innovations.

1. What is Liquidity Provision?

In finance, liquidity refers to how easily an asset can be converted into cash without affecting its price.

- In TradFi, liquidity is provided by market makers, who facilitate transactions between buyers and sellers.

- In DeFi, liquidity provision relies on individuals, called liquidity providers (LPs), who deposit tokens into liquidity pools on decentralized exchanges.

Why is Liquidity Important in DeFi?

Liquidity enables smooth trading, reduces slippage (price changes during a trade), and ensures markets remain efficient. Without adequate liquidity, DeFi protocols would struggle to function.

2. How Does Liquidity Provision Work in DeFi?

DeFi protocols use Automated Market Makers (AMMs) to replace traditional order books. AMMs use mathematical formulas to price assets in a pool.

The most common formula is:

x * y = k

xandyrepresent the token amounts in a liquidity pool.kis a constant that remains fixed during trades.

For example, in a ETH/USDC pool, when a user buys ETH, its quantity (x) decreases while the USDC amount (y) increases, adjusting the price dynamically.

LPs earn a share of trading fees generated from the pool in exchange for providing liquidity.

3. Early DeFi Liquidity Provision Platforms

To understand the evolution of DeFi liquidity provision, let’s look at how four major protocols introduced foundational concepts that shaped the space:

Uniswap: The Pioneer of AMMs

Uniswap popularized the AMM model and made liquidity provision accessible to everyone.

- LPs deposit equal values of two tokens (e.g., ETH and USDC) into a Uniswap pool.

- Users trade tokens directly from the pool, and LPs earn trading fees proportional to their share of the pool.

Example:

An LP deposits 1 ETH and 2,000 USDC into the ETH/USDC pool. If a trade generates $10 in fees, the LP earns a percentage of those fees based on their contribution.

Fact Check: Uniswap remains one of the largest DEXs, with a Total Value Locked (TVL) ranging between $3 billion and $5 billion as of early 2024, depending on market conditions

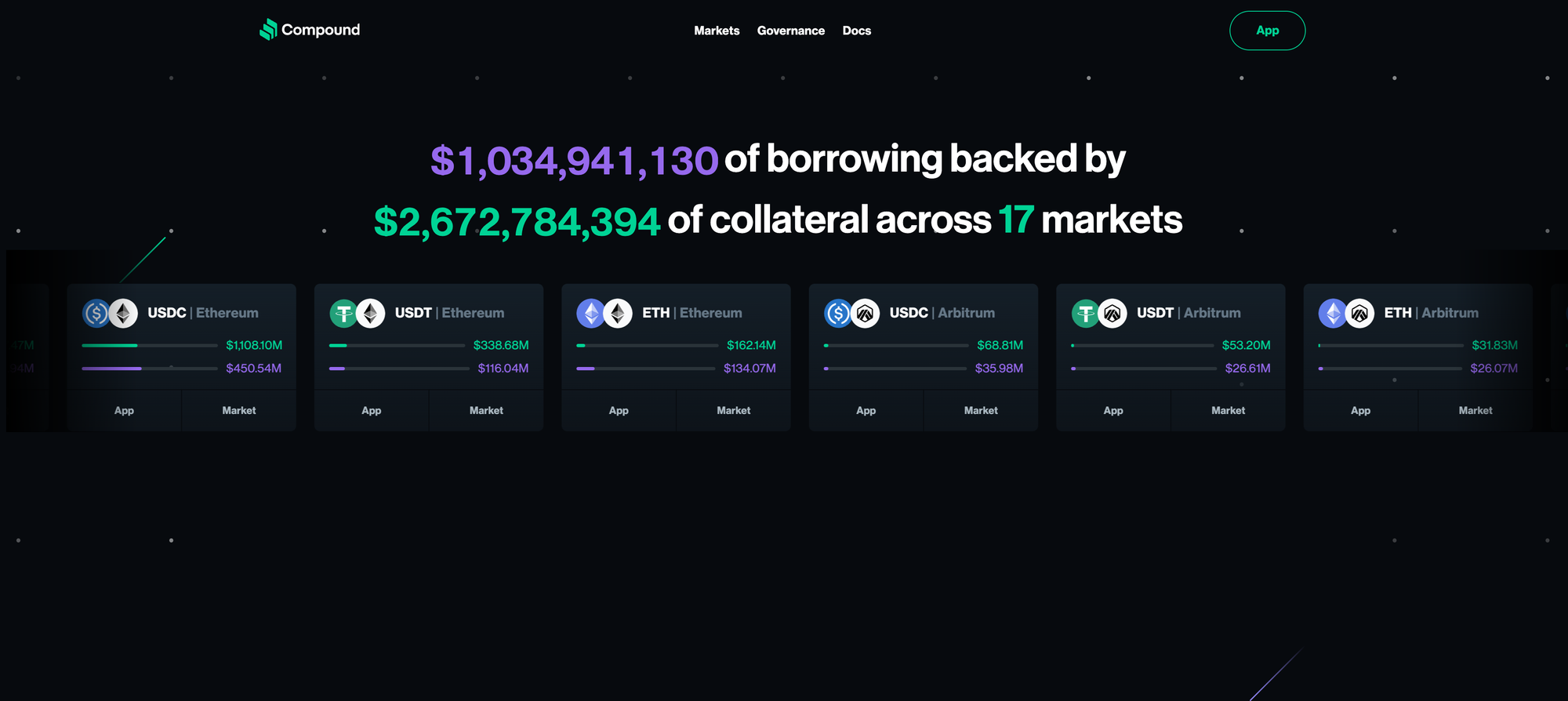

Compound: Lending and Borrowing Liquidity

Compound provides liquidity for lending and borrowing instead of trading. LPs supply assets (e.g., DAI, USDC) into Compound’s liquidity pool, earning interest from borrowers.

How It Works:

- LPs supply assets (e.g., USDC).

- Borrowers pay interest to use these assets.

- Interest rates adjust based on supply and demand.

Example:

An LP supplies 1,000 DAI into Compound and earns a 4% annual interest rate, equivalent to 40 DAI over the year.

Curve Finance: Optimized Stablecoin Liquidity

Curve specializes in low-slippage trading for stablecoins (e.g., USDC, DAI, USDT). Its algorithm minimizes price loss, making it ideal for stablecoin liquidity providers.

How It Works:

- Curve pools focus on tokens with similar values, reducing impermanent loss.

- Curve achieves this by using custom bonding curves optimized for correlated assets, ensuring efficient pricing compared to traditional AMMs like Uniswap.

- LPs earn trading fees and often receive additional rewards (e.g., CRV tokens).

Example:

An LP deposits equal amounts of USDC and DAI into a Curve pool. They earn fees from traders swapping between these two stablecoins.

4. Risks of Liquidity Provision

While liquidity provision can be profitable, it’s not without risks:

1. Impermanent Loss

- A form of opportunity cost that occurs when the price of tokens in a pool changes compared to holding them in a wallet.

- The larger the price change, the greater the impermanent loss.

Example:

If ETH’s price doubles while deposited in an ETH/USDC pool, the LP might lose some ETH compared to simply holding it.

Mitigation: Protocols like Uniswap v3 offer tools to minimize impermanent loss.

2. Smart Contract Risks

- DeFi protocols rely on smart contracts, which can contain bugs or vulnerabilities.

- It’s essential to check if protocols have undergone third-party audits and what parties have conducted third party audits.

3. Market Volatility

- Sudden market movements can impact the value of LP tokens.

- LPs should choose stable pairs (e.g., USDC/DAI) to reduce volatility exposure.

5. The Future of Liquidity Provision

As DeFi evolves, liquidity provision is becoming more efficient and scalable. Here’s what’s next:

1. Concentrated Liquidity (Uniswap v3)

- LPs can focus their liquidity within specific price ranges, maximizing capital efficiency.

- This allows LPs to earn higher fees with less capital.

2. Cross-Chain Liquidity

- Innovations like Mitosis are addressing liquidity fragmentation across multiple blockchains.

- Mitosis introduces modular liquidity by enabling synthetic tokens that can be used for additional yields while maintaining cross-chain scalability and composability.

- These solutions make liquidity more efficient and accessible in a multi-chain DeFi world.

3. Addressing Inequities for Retail LPs

While liquidity has traditionally favored institutions and whales, Mitosis is addressing the struggles faced by retail LPs:

- Lack of Bargaining Power: Retail LPs miss out on private negotiations that offer better reward terms.

- Opaque Terms: Reward structures for public yield options often lack clarity compared to private deals.

- High Costs: Gas and bridging fees disproportionately impact retail LPs, hindering diversification.

By addressing historical inequities, Mitosis is creating a more transparent and inclusive marketplace for all participants. From empowering retail LPs to optimizing multi-chain liquidity, Mitosis is at the forefront of reshaping DeFi liquidity provision.

Stay tuned as Mitosis continues its mission to build a fairer and more efficient ecosystem for all LPs and protocols.

6. Conclusion

Liquidity provision is a foundational pillar of DeFi, enabling efficient trading, lending, and borrowing without intermediaries. Early platforms like Uniswap, Compound, and Curve have paved the way for decentralized liquidity, while innovations continue to improve capital efficiency and accessibility.

Whether you’re a beginner looking to earn passive income or an advanced user optimizing yield strategies, understanding liquidity provision is key to navigating DeFi successfully.

Key Takeaway: Start small, understand the risks, and explore well-audited protocols to participate safely in DeFi liquidity provision.

Frequently Asked Questions

What is liquidity provision in DeFi?

Liquidity provision in DeFi involves depositing tokens into liquidity pools on decentralized exchanges (DEXs) or lending protocols to facilitate trades and earn rewards.

How does liquidity provision differ between TradFi and DeFi?

In TradFi, market makers provide liquidity, while in DeFi, individuals (liquidity providers) contribute tokens to liquidity pools, eliminating intermediaries.

Why is liquidity important in DeFi?

Liquidity ensures smooth trading, reduces slippage, and keeps markets efficient. Without sufficient liquidity, DeFi platforms would struggle to operate effectively.

How do liquidity pools work?

Liquidity pools use Automated Market Makers (AMMs) that rely on algorithms to price assets. LPs deposit token pairs, and traders swap assets from the pool while LPs earn fees.

How can I mitigate risks in liquidity provision?

Mitigate risks by:

- Using stable pairs like USDC/DAI to reduce volatility.

- Choosing well-audited protocols.

- Opting for advanced features like Uniswap v3’s concentrated liquidity.

Comments ()