What Is REV and Why It’s Reshaping How We Value Blockchains

In the fast-paced world of crypto, data is everything but not all metrics are created equal. Some reflect real user activity. Others can be gamed, misinterpreted, or completely taken out of context.

Among the newer metrics drawing attention is REV, short for Real Economic Value. At first glance, it may seem like just another number in the sea of blockchain analytics, but behind it lies a deeper attempt to quantify true economic demand on-chain.

So what exactly is REV, how is it calculated, and can it be trusted as a benchmark for blockchain utility?

Understanding REV: Real Economic Value Explained

REV measures how much users are actually paying to use a blockchain.

That includes:

- Base transaction fees

- Tips or bribes to validators (especially in MEV scenarios)

The core idea is simple: REV captures the willingness of users to pay for blockspace especially when demand surges. It was introduced by analysts at Blockworks Research in 2024 to help clarify on-chain economic activity beyond just base gas fees.

Formula:REV = Network fees + MEV-related tips

This makes REV an indicator of payment-based demand—what people are actually spending to push transactions through. That’s very different from simply measuring volume or number of active addresses.

REV vs. TEV: What’s the Difference?

To fully understand REV, it helps to compare it to another concept: TEV, or Total Economic Value.

- TEV accounts for all value flows in the network:

TEV = Network fees + Tips + Token issuance - REV, in contrast, filters out inflationary emissions to focus on user-driven payments:

REV = TEV – Token issuance

In essence, TEV tells you the total size of the economic machine. REV tells you how much of that value comes from real users reaching into their pockets.

Used together, these metrics separate organic demand from subsidized usage.

The MEV Factor: Why It Matters

REV is tightly linked to the growing world of MEV (Maximal Extractable Value)—the profit earned by rearranging transactions in a block.

There are two main types:

- Toxic MEV: Often involves front-running. Bots monitor pending transactions, jump ahead with higher fees, and profit off unsuspecting users.

- Benign MEV: Includes arbitrage and liquidations that support DeFi infrastructure and protocol efficiency.

Historically, MEV-related rewards didn’t show up in most revenue stats because they were distributed off-chain between validators, builders, and bots.

REV changes that by including MEV tips as a legitimate part of user payments. This gives a fuller picture of who’s paying for what—and why.

Why REV Isn’t Perfect

REV brings a lot to the table, but it’s not a silver bullet.

Strengths:

- Captures real, non-subsidized user spending

- Shows demand for blockspace under pressure

- Reflects validator and miner earnings from both fees and MEV

Limitations:

- Speculative spikes: REV often rises during meme coin frenzies or airdrop farming, distorting long-term value.

- Missed costs: Failed MEV attempts still cost gas, but only successful ones are included in REV.

- Not universal: Some chains (like Bitcoin) don’t support MEV or priority fees, so REV offers limited insight.

- Can signal inefficiency: High REV isn’t always good—it could mean users are overpaying due to poor scalability or congestion.

The Debate Around REV

Since its debut, REV has become one of the most hotly debated metrics in crypto.

Some analysts, like Jon Charbonneau of DBA Crypto, argue that REV is the closest thing blockchains have to “revenue” in traditional finance. It’s not perfect—but it’s a great starting point.

Others, like Kaito Yanai from Spire Labs, warn against treating REV as gospel. He believes REV should be one of many indicators, not the final word. Blockchains aren’t businesses, and REV isn’t a quarterly earnings report.

Brendan Farmer (Polygon co-founder) adds a critical perspective. He notes that while Ethereum’s annual REV once hit $21.6B and Solana’s reached $6.6B, both figures later collapsed. If REV truly measured enduring value, such swings wouldn’t happen so often. He suggests short-term REV often mirrors hype more than fundamentals.

Even debates on podcasts like Unchained have featured sharp disagreements. Thomas Dunleavy, co-author of REV’s original thesis, sees it as a useful tool for comparing Layer-1 chains—especially when combined with other data. Austin Federa, meanwhile, cautions that REV can be inflated by MEV bot wars and isn’t always aligned with healthy network use.

Case Studies: Ethereum vs. Solana

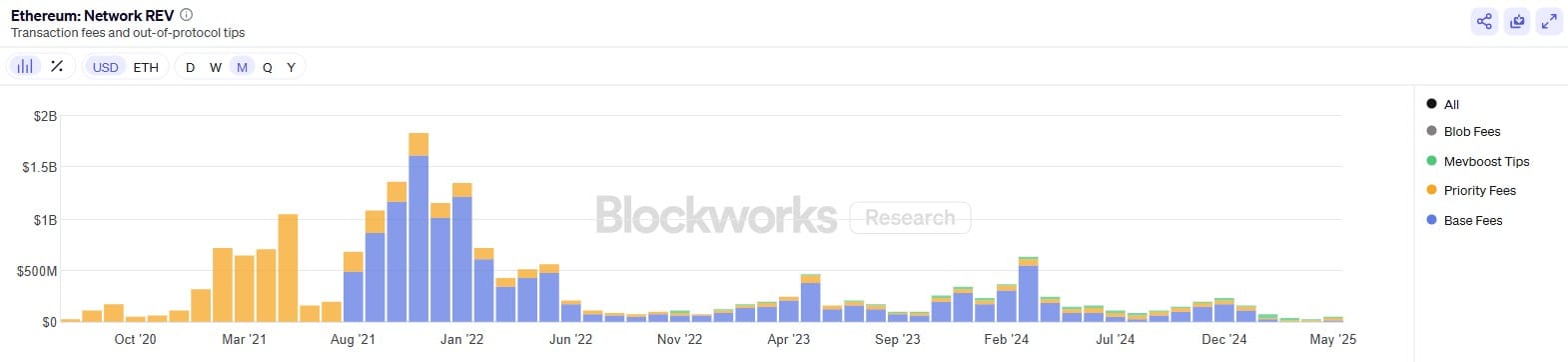

Ethereum’s Decline in REV

During the 2021 DeFi/NFT boom, Ethereum dominated REV charts—peaking at over $1.8 billion in a single month. But since the Dencun upgrade in March 2024 (which drastically lowered fees), REV has dropped.

This isn’t a sign of decline just a shift. Ethereum’s activity moved to L2s, reducing base layer fees and, by extension, REV.

Solana’s Surge

Solana, in contrast, has kept much of its activity on the base chain. Low base fees combined with surging tip-based competition (especially from tools like Jito Tips) boosted REV dramatically.

In January 2025, Solana hit a record $551.6 million in monthly REV—nearly 3x Ethereum’s $166 million at the time. Memecoin mania and massive usage of platforms like pump.fun were key drivers.

Why Ethereum’s MEV Doesn’t Fully Show in REV

Despite high MEV activity, Ethereum’s REV underrepresents this revenue. That’s due to its Proposer-Builder Separation (PBS) model:

- Searchers find MEV opportunities

- Builders bundle them into blocks

- Relays pass the blocks to validators

At each stage, value leaks off-chain—via private payments or direct deals between operators. These don't show up in REV because they’re not recorded on-chain.

So, Ethereum’s true MEV may be higher than REV suggests—it just isn’t fully visible.

Can We Compare REV Across Chains?

Yes, but context is everything.

Each network has different:

- Fee structures

- MEV markets

- Validator reward systems

- Architecture and user behaviors

REV makes sense as a network-level metric. But applying it to individual protocols or apps doesn’t work. DEXs, bridges, and games need different KPIs.

Final Thoughts: REV Is a Tool, Not a Verdict

REV isn’t a magic number—but it’s a powerful lens. It helps analysts move beyond hype and measure real, user-paid demand for blockspace.

But like any financial metric, it must be used in context. REV is shaped by architecture, economics, and user behavior. It shines brightest when paired with other indicators like TVL, active addresses, and protocol usage.

The broader lesson? In Web3, no single number tells the whole story. But REV pushes the space one step closer to meaningful valuation—anchored not in speculation, but in what people are truly willing to pay.

Comments ()