What is Rugpull in Crypto? – What Investors Need to Know

In recent years, the cryptocurrency world has seen significant interest and growth, but this growth also brings certain risks. One of these risks is a form of fraud known as "rugpull." In this article, we will take a detailed look at what rugpull is, how it occurs, and why it poses a significant threat to investors.

What is Rugpull?

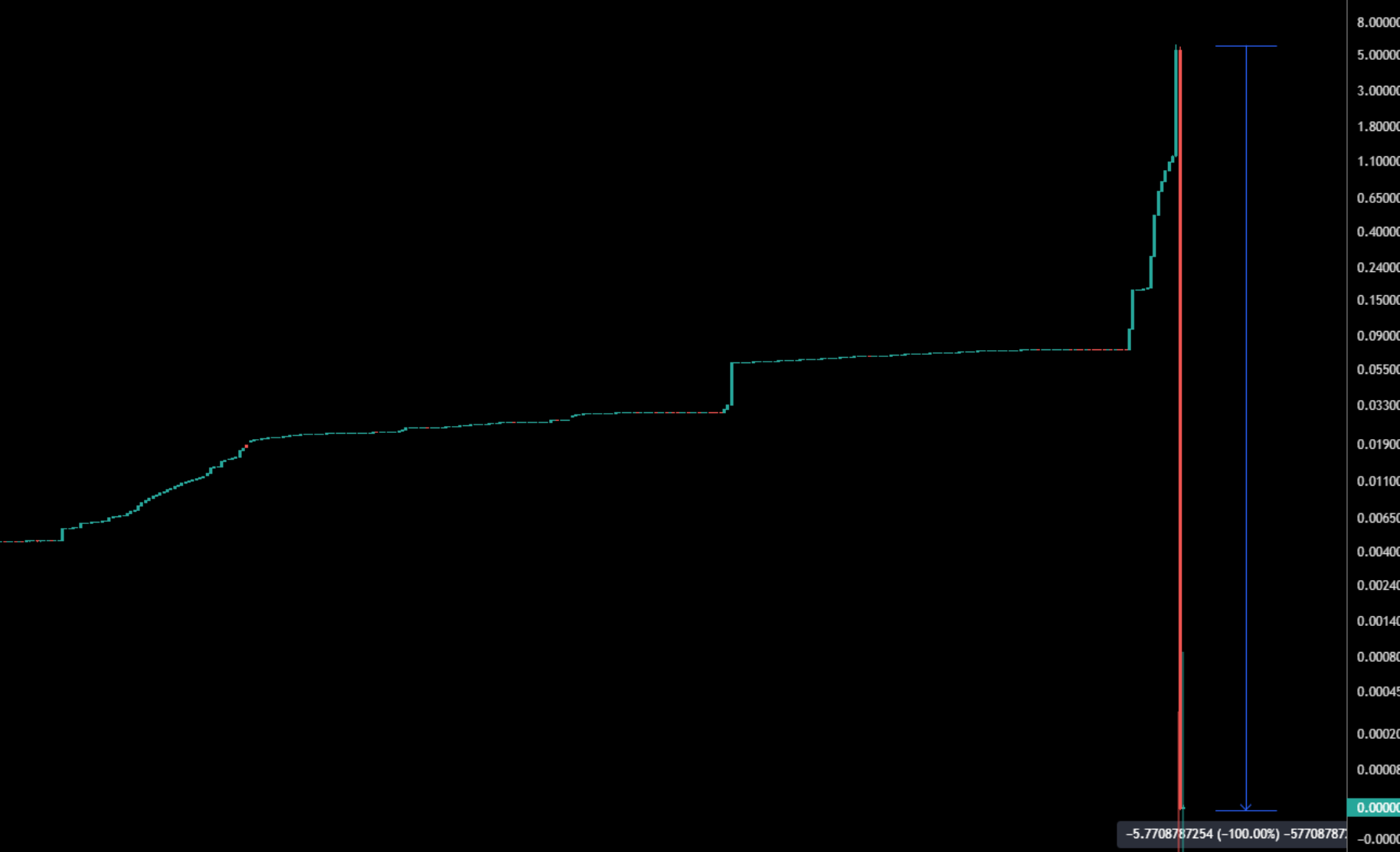

Rugpull refers to the sudden withdrawal of liquidity from a cryptocurrency project or token with fraudulent intent. This situation causes significant losses for investors who trusted the project and its liquidity. Rugpulls are typically seen in fake projects created by malicious teams that have low liquidity.

How Does Rugpull Happen?

Rugpull typically unfolds in the following way:

- Project Promotion and Attracting Investors: The project is promoted to attract investors with big promises and enticing offers.

- Providing Liquidity and Inflating Token Prices: The project is given enough liquidity, token prices are inflated, and investors start trusting the project.

- Withdrawing Liquidity: At some point, the project’s owners or developers decide to withdraw the liquidity from the project.

- Token Price Drops: As liquidity is pulled, the token’s price suddenly drops, and investors face significant losses.

Consequences of Rugpull

Rugpulls can have serious consequences for investors:

- Financial Loss: Investors may face huge losses as their tokens become worthless when the liquidity is withdrawn.

- Loss of Trust: Rugpull incidents contribute to a general loss of trust in the cryptocurrency market and shake investors' confidence in the sector.

- Regulatory Risk: Rugpull cases attract the attention of regulatory authorities, which could lead to stricter oversight in the industry.

How to Reduce the Risk of Rugpull?

To minimize the risk of rugpulls, investors should adopt the following strategies:

- Do Your Research: Thoroughly examine projects and their teams. Evaluate the white papers and understand the project's mission and vision.

- Monitor Liquidity: Keep an eye on the liquidity of projects. Watch out for sudden or suspicious liquidity movements.

- Invest in Legitimate Projects: Opt for projects with a strong foundation and a reputable team.

- Practice Risk Management: Diversify your investment portfolio and spread out your risk.

Examples of Rugpulls

- Squid Game Coin (2021):

Date: October 2021

Project: Squid Game Coin was a token inspired by the popular Netflix series.

Rugpull Process: The project gained significant attention, and the token price rapidly increased. However, after manipulating the price to attract investors, the developers pulled all liquidity and abandoned the project.

Outcome: Investors struggled to sell their tokens, which became worthless. The developers were not held accountable for the losses, and fraud charges were filed. - Flogecoin (2022):

Date: February 2022

Project: Flogecoin was a meme token launched by a social media influencer that quickly became popular.

Rugpull Process: The project attracted investors with grand promises and raised significant liquidity. However, after a short time, the developers pulled the tokens from the liquidity pools and abandoned the project.

Outcome: Investors suffered significant losses, and social media reactions increased. After abandoning the project, the developers did not provide any further responses. - MemeCoin XYZ (2023):

Date: April 2023

Project: MemeCoin XYZ was launched as a meme coin and quickly attracted investors.

Rugpull Process: The token was launched with a lot of hype, and its price surged rapidly. However, within weeks, the project team pulled the liquidity and removed the token from the market entirely.

Outcome: Investors lost their investments, and the tokens became worthless. This incident highlighted the risks associated with meme coin projects.

Conclusion

Rugpull is one of the most significant threats in the cryptocurrency market for investors. By conducting thorough research, monitoring liquidity, and applying risk management strategies, investors can reduce the risk of falling victim to rugpulls. However, it’s important to remember that the cryptocurrency market is volatile and risky, so investors need to be vigilant.

This article aims to help you understand what a rugpull is, how it occurs, and why it is a significant risk for investors. By taking careful and informed steps when investing in crypto projects, you can position yourself for long-term success

Comments ()