What Makes MLGA Different? A Self-Sustaining Rewards Alliance

The Mitosis Long-term Growth Alliance (MLGA) is a new framework designed to solve one of DeFi’s oldest and most stubborn problems: the sustainability of rewards. For years, decentralized finance protocols have relied on short-term incentives to attract liquidity and grow usage, but the pattern has always been the same.

Subsidies create temporary excitement, mercenary capital floods in to chase yield, and when the incentives dry up, the liquidity disappears just as quickly. Protocols are left weakened, their treasuries drained, and the community that once celebrated their rise begins to scatter.

MLGA sets out to change that by introducing a different kind of incentive system. It is not just about handing out tokens in exchange for deposits; it is about creating a cycle where rewards are generated by real activity and sustained over the long term.

In this article, we will explore three key aspects that make MLGA stand apart:

- First, why traditional DeFi incentives have failed to deliver lasting ecosystems.

- Second, how MLGA replaces subsidies with buybacks that tie rewards to genuine economic activity.

- Finally, how its alliance-based structure builds a foundation for perpetual sustainability. By the end, you will see why MLGA represents more than just another DeFi rewards program and why it could serve as a blueprint for the future of incentives.

The Problem with Traditional Incentives

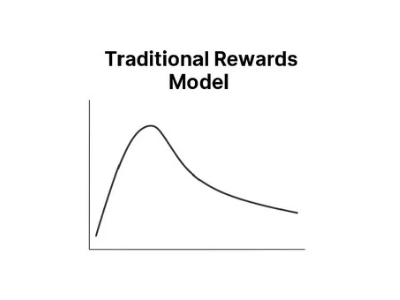

From the earliest days of DeFi, liquidity mining and token subsidies have been the go-to strategy for attracting users. At launch, protocols often announce generous rewards for those willing to provide liquidity or stake assets. The effect is immediate and visible: total value locked rises sharply, token communities celebrate rapid growth, and the project gains temporary visibility in the broader market. However, beneath the surface, this model contains a structural flaw that almost always catches up.

When incentives are built on subsidies, the clock starts ticking from day one. Protocols are essentially paying users to show up, but those payments come directly from their own treasuries or token supply. As long as the rewards are generous, liquidity providers remain. Yet once the treasury begins to run low or the project reduces emissions to preserve its future, the same users who once rushed in quickly rush out. Capital is mercenary, chasing the next best yield, and without a sustainable reason to stay, the liquidity that once appeared so promising evaporates.

This cycle has been repeated countless times in DeFi. The launch phase feels like a success story, but within months, sometimes even weeks, total value locked begins to collapse. The project enters a slow decline as incentives fade, community interest wanes, and usage dwindles. It is what many call the “mercenary capital death spiral.” At the core of this spiral lies the reliance on subsidies that are finite by nature. They offer no feedback loop between the activity happening in the ecosystem and the rewards being paid out. Once the handouts stop, so does the growth.

How Buybacks Replace Subsidies

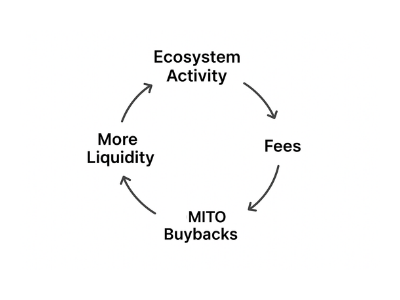

The Long-term Growth Alliance offers a different approach by removing subsidies from the center of its incentive structure. Instead of handing out rewards that drain the treasury, MLGA ties rewards to real protocol activity through a system of fee-driven buybacks. This shift is what makes it fundamentally different from the models we have seen before.

Here is how it works

Users bring liquidity into Mitosis and the protocols that operate under its frameworks. That liquidity powers activity, whether it is trading, lending, or participating in vault strategies. As the activity grows, it naturally generates fees. Rather than leaving those fees idle or treating them as simple revenue, the Mitosis Foundation uses them to buy MITO tokens back from the open market. Once those tokens are bought, they are redistributed as rewards to users.

What this achieves is a direct link between ecosystem usage and incentives. The more activity the system supports, the more fees are generated. The more fees there are, the larger the buybacks. The larger the buybacks, the greater the rewards that can be distributed to participants. Unlike subsidies, which are one-way outflows, buybacks recycle value back into the system and create a feedback loop. Rewards no longer depend on how long a treasury can afford to subsidize users; they depend on how much real value is being created inside the network.

This also means that MLGA incentives can scale with actual adoption rather than arbitrary emissions schedules. Traditional models often issue tokens upfront in hopes that future growth will justify the expense. In contrast, MLGA ensures that growth itself is the engine of rewards. When usage increases, fees increase, and rewards increase alongside them. It is a model where sustainability comes not from endless generosity but from aligning user rewards with protocol success.

This break from the subsidy model is critical. It changes incentives from something that expires into something that can last indefinitely. In traditional DeFi, subsidies come first, and value creation is uncertain. In MLGA, value creation comes first, and rewards follow naturally. Instead of bribing users to show up, the system rewards them for helping generate the very activity that sustains it.

MLGA as a Blueprint for the Future

What makes MLGA particularly powerful is that it isn’t just a short-term campaign but a framework that grows with the ecosystem. As more liquidity, assets, and dApps flow into Mitosis, the buyback engine strengthens, generating more rewards and fueling further adoption.

This creates a compounding effect. Developers are incentivized to build because they know MLGA can provide long-term rewards to their users. Liquidity providers and participants are drawn in because the incentives are not at risk of vanishing overnight. And the entire ecosystem benefits because the model doesn’t weaken the token’s value; it supports it through continuous buybacks.

In a way, MLGA serves as a proof of concept for how DeFi incentives can evolve. Instead of burning through resources for temporary growth, protocols can adopt models that reward based on real activity. This approach aligns everyone’s incentives: users benefit, developers benefit, and the protocol’s token economy remains healthy.

Conclusion

The Mitosis Long-term Growth Alliance represents a genuine shift in how DeFi approaches incentives. Instead of temporary subsidies that drain treasuries and attract short-term capital, MLGA builds rewards on top of real activity through fee-driven buybacks. This simple change ensures that incentives are not only sustainable but also directly tied to the success of the ecosystem itself. Coupled with its alliance-based structure, featuring both core and peripheral protocols under the guidance of the Mitosis Foundation, MLGA creates a collaborative model where users, developers, and the network all share in the same growth.

The key takeaway is clear. Traditional DeFi incentives fail because they rely on finite handouts that vanish when treasuries run dry. MLGA replaces subsidies with buybacks, creating a cycle where rewards are sustained by actual usage. Its alliance structure adds transparency and long-term coordination, ensuring that incentives are not fragmented but aligned across the ecosystem.

The important question is whether MLGA can prove in practice what it promises in theory: can it truly break the mercenary capital death spiral and deliver perpetual incentives?

If it succeeds, the impact will stretch beyond Mitosis itself. MLGA could become a model for how the entire DeFi industry approaches growth, showing that rewards don’t have to be temporary bribes but can evolve into self-sustaining engines that power ecosystems indefinitely.

Comments ()