When Bitcoin's Dominance Over Altcoins Will Decrease: What Will It Bring, Prospects

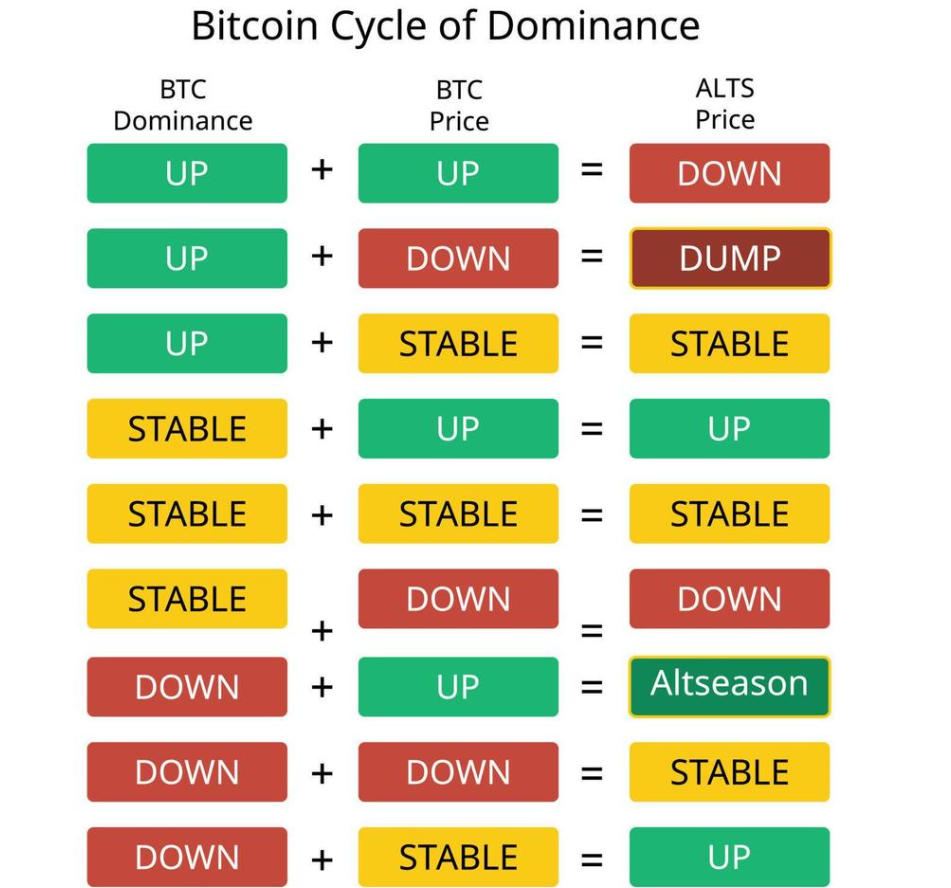

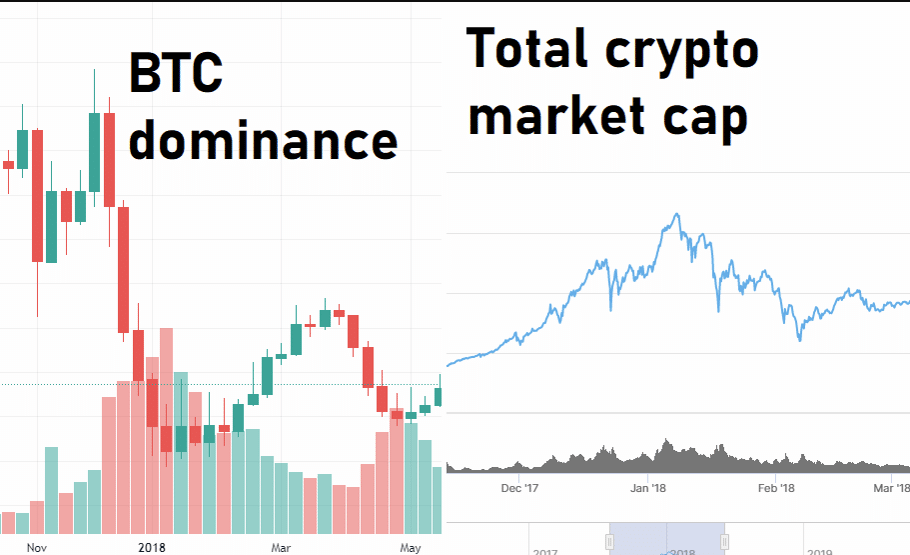

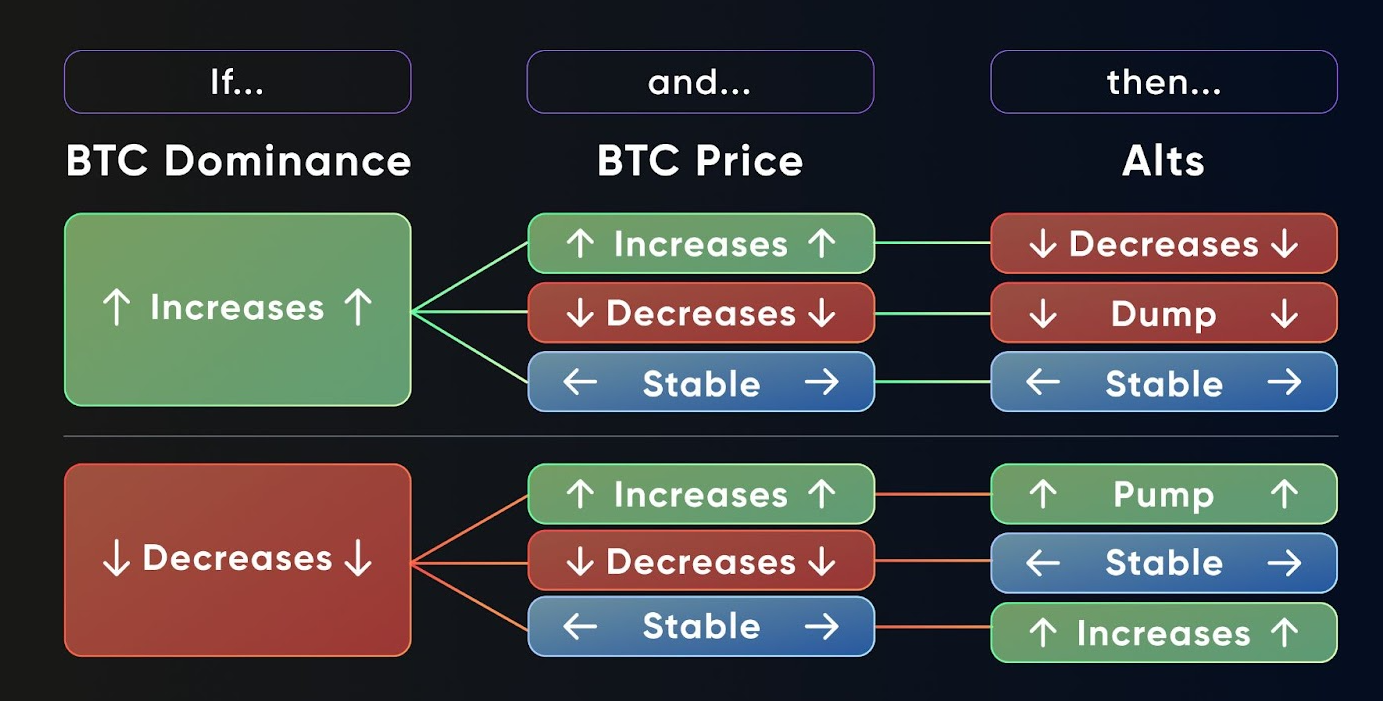

Bitcoin Dominance is one of the key indicators by which traders and analysts evaluate the market phase. It shows what share of the capitalization of the entire crypto market is occupied by BTC. And although Bitcoin is the undisputed leader, history shows that when its share decreases, a phase of rapid growth of altcoins begins, the so-called altseason.

What is Bitcoin Dominance

Simply put, Bitcoin Dominance (BTC.D) is the share of Bitcoin in the total market capitalization of cryptocurrencies. For example, if the entire market is valued at $2 trillion, and Bitcoin's capitalization is $1 trillion, dominance is 50%.

This indicator:

• grows during periods of uncertainty or decline (capital goes to "digital gold");

• falls when market participants are ready for riskier investments in altcoins.

Why Bitcoin's dominance may decline

Growing interest in new technologies

DePIN, AI chains, RWA and ZK platforms are becoming a new field for innovation. Investors are increasingly betting not on "digital metal", but on blockchains with functionality and infrastructure breakthroughs.

Development of Layer 1 and Layer 2 solutions

Solana, Avalanche, Sui, Aptos and other platforms offer high speed, scalability and low fees. These parameters attract both developers and capital.

Cycle Change

During a bull run, BTC dominance typically rises first, but then falls as participants start switching to altcoins in search of a higher ROI.

Institutional Interest

After the launch of the Bitcoin ETF, interest in it stabilized. But institutions are increasingly looking at Ethereum, Solana, and other networks where they can build application ecosystems, rather than just store the asset.

What happens when BTC dominance falls

📉 1. Start of the altseason

Investors switch to projects with higher volatility and potential profitability. This can lead to exponential growth of some tokens.

🌱 2. Growth of new ecosystems

Second-layer protocols, independent Layer 1, and decentralized services are receiving a new wave of users and liquidity. Blockchains with a developed DeFi infrastructure especially benefit.

🚀 3. New leaders emerge

This was the case with Ethereum in 2017, with DeFi networks in 2020, and with Solana in 2021. Each cycle brings new heroes, and the current one will be no exception.

Which altcoins and sectors are winning

1. Ethereum and L2 (Arbitrum, Optimism, Base) — due to the growth of active users and institutional interest.

2. Solana, Sui, Aptos — due to high throughput and DePIN/AI/game ecosystems.

3. ZK networks (Starknet, zkSync, Polygon zkEVM) — as the next generation infrastructure.

4. RWA and asset tokenization — in the focus of regulators and banks.

5. Meme and culture tokens — due to the retail wave and virality.

What are the risks

• Overheating: altcoins can quickly grow and also quickly correct.

• Manipulation: In conditions of low liquidity, the prices of individual tokens are easily manipulated.

• Trend change: A sudden return of interest in BTC (for example, due to geopolitics) can bring down alts.

When can this happen?

A decrease in dominance usually occurs in the second phase of a bull market, when:

1. Bitcoin has updated historical maximums;

2. Retail investors return;

3. Altcoins begin to lag sharply in profitability, creating pressure on capital rotation.

Judging by the current trends and BTC capitalization in the region of $60-70 thousand, the alt season may begin when BTC dominance decreases below 48-50%.

BTC Dominance: Key Factors, Effects, and Altcoin Prospects

|

Aspect |

Details |

|

What is

Bitcoin Dominance (BTC.D)? |

The

percentage of Bitcoin's market cap relative to the entire crypto market. |

|

Why BTC

Dominance Decreases? |

-

Increased interest in new technologies like DePIN, AI, and ZK networks. |

|

-

Growth of Layer 1 and Layer 2 solutions such as Solana, Avalanche, and Aptos. |

|

|

- Shift

in market cycles (from BTC to altcoins during bull markets). |

|

|

-

Institutional interest in decentralized ecosystems and smart contract

platforms (e.g., Ethereum, Solana). |

|

|

What

Happens When BTC Dominance Decreases? |

- Start

of Altseason: Investors move capital to altcoins for potentially higher

returns. |

|

- Growth

of New Ecosystems: Layer 1, L2 solutions, and decentralized platforms

gain momentum. |

|

|

- Emergence

of New Leaders: Ethereum, Solana, and newer networks benefit from capital

inflows. |

|

|

Top

Altcoins That Benefit |

- Ethereum

and L2 solutions (Arbitrum, Optimism, zkSync, Polygon zkEVM) |

|

- Solana,

Sui, Aptos: Focus on high scalability and innovative applications (AI,

gaming, DePIN). |

|

|

- ZK-networks:

Starknet, zkSync, Polygon zkEVM provide next-gen infrastructure. |

|

|

- Meme

tokens: Retail-driven trends in tokens like Dogecoin, Shiba Inu. |

|

|

- RWA

and Asset Tokenization: Platforms focusing on real-world asset-backed

tokens (e.g., RealT). |

|

|

Risks |

- Overheated

markets: Altcoins can rapidly increase in price but also correct sharply. |

|

- Manipulation:

Low liquidity in some altcoins makes them susceptible to price manipulation. |

|

|

- Trend

Reversal: Sudden return of interest to BTC could deflate altcoin prices. |

|

|

When

Can This Happen? |

Typically

occurs during the second phase of a bull market after BTC reaches a new high

and altcoins lag behind. |

|

Bitcoin

Dominance Threshold for Altseason |

BTC

Dominance < 48–50% is a typical threshold for altcoins to

begin outperforming BTC. |

|

Long-Term

Perspectives |

- For

developers: More opportunities for building decentralized apps (dApps). |

|

- For

traders: Increased volatility and new altcoins with large potential

returns. |

|

|

- For

institutional investors: Diversification into various blockchain

ecosystems. |

|

|

- For

users: Access to innovative Web3 products with real utility beyond just

holding Bitcoin. |

Prospects

A decrease in Bitcoin dominance is not a sign of its weakness, but an indicator of the development and complexity of the crypto market. Investors no longer look at just one asset - they are looking for opportunities in niches, ecosystems and infrastructure.

This opens up new horizons:

for developers — more users and interest in dApps;

for traders — new waves of alts and tokens;

for institutions — portfolio diversification;

for users — access to Web3 products with real utility.

Comments ()