When Dollars Go Digital: How Stablecoins Hit $27.6 Trillion and Overtook Visa & Mastercard in 2024

In 2024, stablecoin transfers rocketed to $27.6 trillion, exceeding the combined transaction volume of Visa and Mastercard by 7.68%—a landmark shift that underscores the growing dominance of on-chain dollar substitutes in global finance CryptoSlateCointelegraph. This surge came even as legacy payment networks processed trillions of dollars but couldn’t match the speed, programmability, and composability that stablecoins afford World Economic ForumBitcoin & Crypto Trading Blog - CEX.I. Behind the scenes, network effects on chains like Solana and Base, plus algorithmic and yield-bearing variants, fueled both trading activity and remittance flows CryptoSlateBitcoin & Crypto Trading Blog - CEX.I. As we unpack the data, we’ll explore (1) the drivers of stablecoin growth, (2) the head-to-head comparison with Visa/Mastercard, and (3) the wider implications for DeFi, payments, and the Mitosis ecosystem.

Introduction

Imagine frictionless value transfers—24/7, near-instant, and programmable—without the tag-along fees or settlement delays of traditional rails. That vision is now reality for many users who opt for stablecoins over credit-card networks. Stablecoins are tokenized dollars on blockchains—a concept covered in our Blockchain Foundations series—designed to combine fiat stability with crypto efficiency World Economic ForumCoinsPaid Media. Yet until recently, questions lingered: could these digital dollars ever rival Visa’s $25.6 trillion and Mastercard’s $20.9 trillion in annual flows? The answer arrived in early 2025, when multiple reports confirmed stablecoins had not only caught up but overtaken them, signaling a tectonic shift in global payments CointelegraphCryptoNinjas.

1. The Meteoric Rise of Stablecoins

1.1 Explosive Supply Growth

In 2024, the stablecoin supply swelled by 59%, crossing $200 billion in circulation and representing 1 % of all U.S. dollars CryptoSlateCoinsPaid Media. This expansion reflects both institutional adoption—where treasury departments hedge via tokenized dollar deposits—and DeFi users seeking yield on platforms like Aave or Curve.

1.2 Bot-Driven Volume

Automated traders (“bots”) accounted for roughly 70 % of stablecoin transfers, especially on Solana and Base, where high throughput and low fees favor algorithmic strategies CryptoSlateBitcoin & Crypto Trading Blog - CEX.I. These bots propelled unadjusted transfer volumes to $27.6 trillion, marking a fourfold year-over-year increase CryptoSlateBitcoin & Crypto Trading Blog - CEX.I.

1.3 Network Effects

Chains optimized for stablecoin activity—Solana overtaking Tron and Ethereum for volume—demonstrate how performance and cost shape user behavior CryptoSlateCryptoRank. As more stablecoins and dApps flocked to these networks, liquidity concentrated, reinforcing a virtuous cycle of adoption.

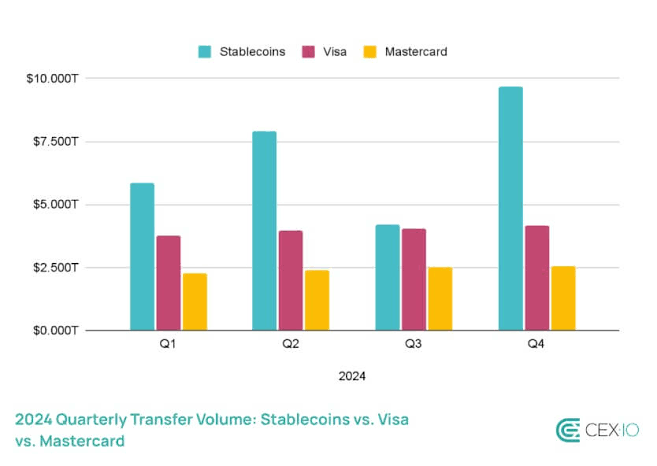

2. Head-to-Head: Stablecoins vs. Visa and Mastercard

2.1 Raw Transaction Volumes

Visa processed $25.6 trillion and Mastercard $20.9 trillion in 2024, based on company disclosures CointelegraphAInvest. By contrast, stablecoin transfers hit $27.6 trillion, surpassing the combined legacy-rail total by 7.68 % CryptoSlateCointelegraph.

2.2 Transaction Speeds and Costs

While Visa/Mastercard settle batches in seconds with fees of 1–3 %, stablecoin transfers on L1 chains can finalize in 1–2 minutes (or sub-second on high-performance chains) at fees under 0.1 % World Economic ForumForbes. This transforms remittances, B2B settlements, and micropayments—where every basis point matters.

2.3 Geographic Reach and Accessibility

Stablecoins operate globally without bank accounts or correspondent banking networks. In regions with underbanked populations, tokenized dollars on public blockchains provide an on-ramp that traditional rails often lack World Economic Forum.

3. Implications for DeFi, Payments, and Mitosis

3.1 DeFi’s Liquidity Frontier

Greater stablecoin volumes mean deeper on-chain liquidity—key for Total Value Locked (TVL) in lending, swaps, and margin protocols. Mitosis’s Cross-Chain Liquidity Strategies can harness this capital, routing assets to optimize yields and minimize slippage.

3.2 Programmable Money = New Use Cases

Smart-contract money unlocks subscriptions, dynamic collateralization, and on-chain payroll—innovation areas we explore in our Mitosis Core deep dives Forbes. As stablecoins dominate flow, DeFi primitives become the building blocks for next-gen financial tooling.

3.3 Regulatory and Risk Considerations

Surpassing traditional rails brings scrutiny. Regulatory clarity on reserve audits, KYC/AML, and smart-contract risk will shape stablecoin design and adoption. Mitosis’s modular architecture allows for compliance-friendly integrations, safeguarding both users and protocols.

Conclusion

2024 marked a watershed moment: stablecoins leapfrogged Visa and Mastercard, proving that public blockchains can serve as the backbone for high-volume, low-cost, programmable payments. For DeFi and the Mitosis ecosystem, this means:

- Unprecedented Liquidity: Billions unlocked for lending, trading, and yield optimization.

- Broadened Access: Financial inclusion via on-chain rails beyond banks.

- Innovation Catalyst: Programmable dollars powering new primitives.

As stablecoins mature, the boundary between “traditional” and “decentralized” finance will blur. How will Mitosis leverage this liquidity surge to build the rails of tomorrow’s financial system? Share your thoughts and join the conversation in our Telegram contributors’ group!

Internal Links

- Liquidity TVL Glossary

- Expedition Boosts

- Straddle Vault

- Mitosis University

- Mitosis Blog.

- Mitosis Core: Liquidity Strategies.

References

- CryptoSlate: Stablecoins surpass Visa and Mastercard with $27.6 trillion transfer volume in 2024 CryptoSlate

- Cointelegraph: Stablecoin volumes surpassed Visa and Mastercard combined in 2024 Cointelegraph

- World Economic Forum: Reserve-backed cryptocurrencies are on the rise World Economic Forum

- CEX.io Ecosystem Blog: Stablecoin Landscape: What 2024 Reveals About 2025? Bitcoin & Crypto Trading Blog - CEX.I

- CryptoNinjas: Stablecoin Volume Surges Past Traditional Payment Giants CryptoNinjas

- CoinsPaid Media: Detailed Stablecoin Usage Stats for 2024 CoinsPaid Media

- AInvest: Stablecoin Transaction Volume Surpasses Visa’s AInvest

- Forbes: Stablecoins Seek To Rewire The Financial System Forbes

Comments ()