Why Ethereum Pectra Upgrade Will Change the World: What to Expect, How Investors React

The Ethereum upgrade codenamed Pectra has become one of the most talked about events in the crypto world in 2025. This upgrade promises to significantly improve user experience, strengthen network security, and expand scalability. In this article, we will look at what Pectra includes, what changes it will bring, and how investors and developers are reacting to it.

What is the Ethereum Pectra upgrade?

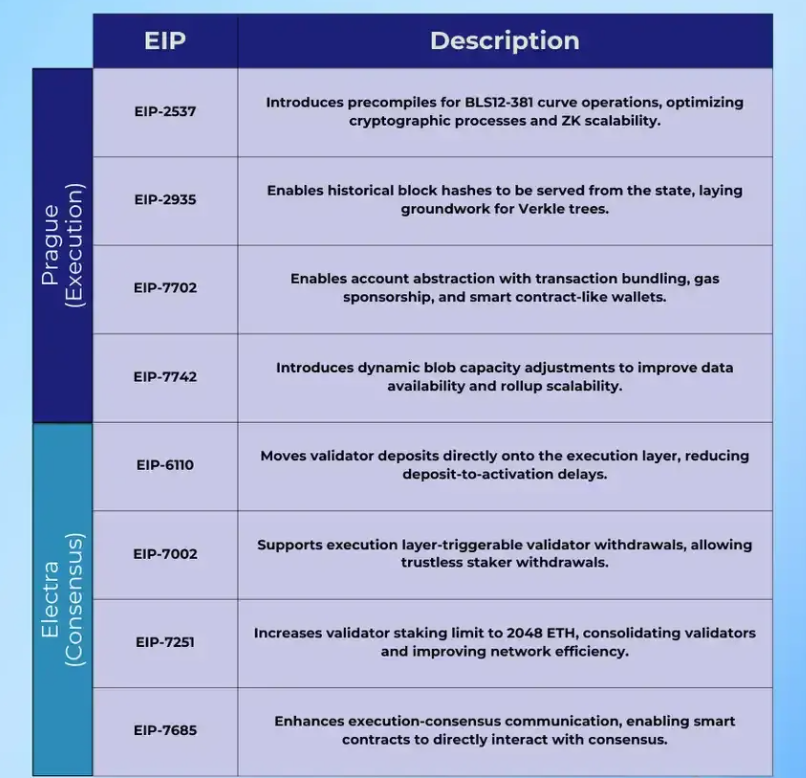

Pectra is a combination of two major upgrades: Prague (for the execution layer) and Electra (for the consensus layer). It is aimed at implementing several Ethereum Improvement Proposals (EIPs) that should make things easier for users, developers, and stakers.

The main goals of the upgrade are:

1. To improve the convenience of wallet management.

2. To improve the work of validators and delegated stakers.

3. To simplify interaction with decentralized applications (dApps).

4. To prepare the network for further scaling stages (including Danksharding).

Market Reactions to the Pectra Update

|

Stakeholder |

Reaction |

Strategic Moves |

Risks/Concerns |

|

Retail

Investors |

Mostly

bullish |

Accumulating

ETH; participating in staking pools. |

Uncertainty

around rollout timeline; need for better UX. |

|

Institutional

Investors |

Growing

interest |

Exploring

ETH staking funds; expanding exposure to Ethereum-based assets. |

Regulatory

clarity and ETH classification remain concerns. |

|

Developers |

Preparing

infrastructure |

Updating

smart contracts; adopting EOF standards. |

Migration

costs; testing and compatibility issues. |

|

DeFi

Platforms |

Strategically

optimistic |

Launching

tools to leverage EIP-3074 and EOF. |

Migration

and integration complexities. |

|

Centralized

Exchanges |

Cautious

adoption |

Evaluating

support for new staking and transaction features. |

Risk of

fragmentation if not updated in time. |

Key changes that Pectra will bring

Implementation of EIP-3074 — "superwallet"

EIP-3074 allows wallets to sign transactions on behalf of the user. This means that it will be possible to:

· Use multi-signatures without additional contracts.

· Make batch transactions (several actions in one).

· Trust signed messages from external services without losing control over funds.

Result: decentralized wallets are becoming almost as convenient as centralized exchanges.

New opportunities for stakers

The Electra update provides improvements for validators:

1. The ability to more flexibly exit staking.

2. Increased resistance to errors and attack actions.

3. Potential implementation of "partial exit", in which the validator can withdraw part of the funds without exiting completely.

Result: increased liquidity and attractiveness of participation in staking.

EVM Object Format (EOF) Support

EOF is an updated format for the Ethereum Virtual Machine that:

· Makes smart contracts more secure and readable.

· Improves code optimization at the runtime level.

· Provides a more stable environment for developers.

The result: fewer bugs, more reliable dApps and DeFi protocols.

Preparing for Danksharding

While Danksharding is a thing of the future, Pectra is already laying the technical foundation for its support. It will allow for a dramatic increase in Ethereum throughput without reducing decentralization.

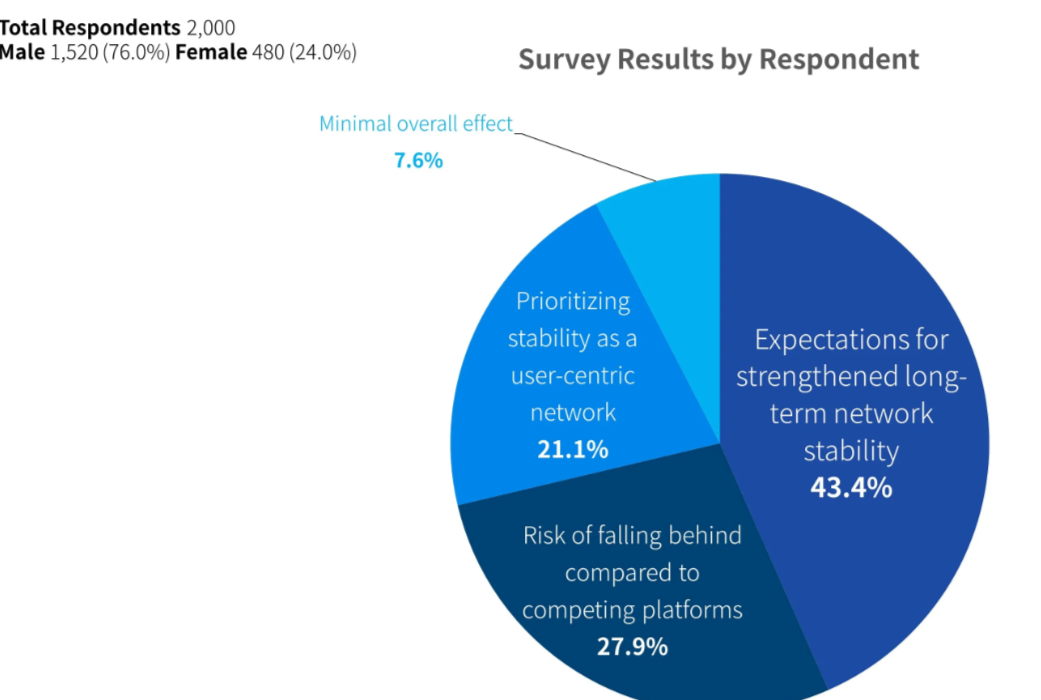

How are the market and investors reacting

Investors are watching Pectra with great interest, as this update is not just a “technical tweak”, but a step towards mass adoption of Ethereum.

Positive signals from the market:

1. Large addresses are increasing their ETH accumulation, preparing for potential growth in demand for staking and DeFi.

2. Funds and institutional players are starting to participate more actively in the Ethereum ecosystem, seeing long-term potential.

3. Analysts predict increased activity after the introduction of "superwallet" and new DeFi tools.

Some risks and concerns:

· Possible release delays: Large-scale Ethereum updates are often postponed.

· Compatibility of old dApps with the new EVM format may require time and effort from developers.

· Reaction of centralized exchanges and wallets - the transition to new standards may not be immediate.

Key Features Introduced by Ethereum Pectra Update

|

Feature |

Description |

Impact on Users |

Impact on Developers |

|

EIP-3074

(Superwallet) |

Enables

wallets to delegate control via signed messages, allowing batch transactions

and gas abstraction. |

Simplified

wallet experience; reduced transaction costs; fewer mistakes. |

Easier

integration of advanced UX flows; broader adoption of smart contract wallets. |

|

Validator

Enhancements |

More

flexible staking and exit options; support for partial withdrawals. |

Increased

staking liquidity; more incentives to stake ETH. |

Improved

staking architecture; new tools for validator services. |

|

EVM

Object Format (EOF) |

Modular

and safer structure for EVM smart contracts. |

More

reliable dApps; fewer security vulnerabilities. |

Easier

auditing; more efficient contract execution; standardized development. |

|

Danksharding

Preparation |

Technical

groundwork for future data sharding with proto-danksharding. |

Anticipated

lower gas fees and faster transactions in the long term. |

Builds

the base for scalable rollups and next-gen applications. |

What does this mean for users and developers?

Users will get:

1. Convenience of working with wallets without the risk of losing private keys.

2. More reliable and faster dApps.

3. Improved passive income opportunities through staking.

Developers will receive:

· Standardized and secure contract format (EOF).

· New tools for interacting with users.

· More transparent and convenient mechanisms for updating smart contracts.

Conclusion: Pectra as a transition to a new stage of Ethereum

The Pectra update is not just a technical evolution, but an important step in the strategic development of Ethereum. It opens the way to an improved user experience, a more flexible staking economy, and safe growth of the DeFi sector.

Judging by the reaction of investors and enthusiasts, Pectra may become the very "trigger" that will bring Ethereum closer to mass adoption and turn it from an experimental network into a full-fledged global financial infrastructure.

Comments ()