Why Is Mitosis Needed? Explained with Examples

The DeFi (Decentralized Finance) ecosystem has grown rapidly in recent years, reaching millions of users. However, there are still significant shortcomings and barriers in liquidity provision and management. Users often have to lock their investments, struggling to use these assets efficiently across different opportunities. Moreover, high-yield opportunities are mostly concentrated in the hands of large investors and institutional funds, leaving small and medium investors without access to these advantages.

Mitosis addresses these exact problems with an innovative approach, transforming DeFi liquidity positions into more flexible, accessible, and programmable components. In this article, we will explain why Mitosis emerged, what problems it solves, how it works, and how it can shape the future of financial markets with concrete examples.

What Is Mitosis?

Mitosis is a protocol that aggregates liquidity provided by users across different blockchains into a single hub, enabling this liquidity to be both manageable and tradable. This system not only locks liquidity in a single pool but also transforms these assets into complex financial instruments, creating new opportunities.

Example:

Nuri has provided liquidity to various DeFi protocols on the Ethereum and Arbitrum networks. However, this liquidity is generally locked in the respective protocols, and Ali cannot utilize these assets elsewhere. By joining Mitosis, Nuri receives “Vanilla Asset” tokens representing his deposited liquidity. These tokens can be directed toward different opportunities on the Mitosis chain, allowing Nuri to actively use his assets in various financial strategies instead of passively holding them.

Why Is Mitosis Needed?

1. Liquidity Is Static and Locked

In current DeFi protocols, when users provide liquidity, their assets are typically locked in specific pools and cannot be used elsewhere. This leads to inefficient capital utilization and increases the opportunity cost for investors.

Example:

Ali provided liquidity in the ETH-DAI pool on Uniswap and received LP tokens in return. However, these LP tokens only represent his share in the Uniswap pool; Ali cannot use these assets on another platform. Suppose another protocol offers higher yields Ali cannot take advantage of this opportunity.

Mitosis solves this issue through Vanilla Asset tokens. Ali receives tokens representing his deposited liquidity and can redirect them to different strategies. For instance, he can invest these tokens in a “Matrix” campaign to earn additional returns or use them as collateral in other investment tools.

2. Advantages of Large Investors and Market Inequality

In DeFi, large investors often access high-yield opportunities through private agreements with protocols. This creates market imbalances and reduces earning chances for smaller investors.

Example:

A hedge fund provides liquidity to a DeFi protocol under special terms and participates in high-yield campaigns, while small individual investors cannot access these opportunities. Mitosis pools liquidity collectively and offers all participants the same opportunities, enabling both small and large investors to compete on equal footing.

Technical Solutions and Structure of Mitosis

Vanilla Assets and Programmability

When assets are deposited into Mitosis, users receive Vanilla Asset tokens representing their investments. These tokens are not merely representations; they function as programmable financial components that investors can use in different ways.

Example:

Ayşe can sell her Vanilla Asset tokens to another investor, borrow funds by using them as collateral, or split the tokens into principal and yield components to pursue various financial strategies.

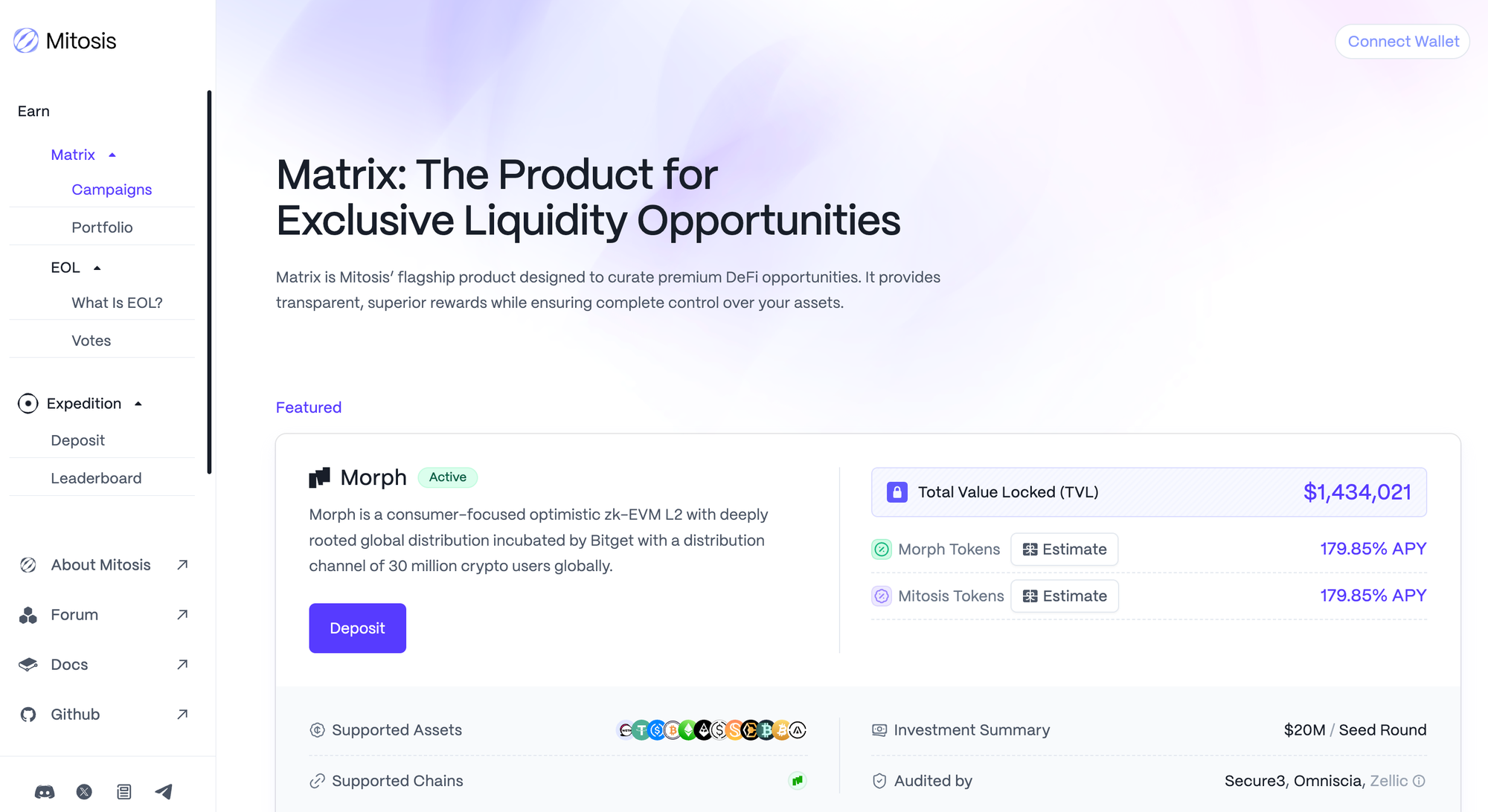

EOL (Ecosystem-Owned Liquidity) and Matrix Frameworks

- EOL: A democratic structure where users collectively manage liquidity. Participants vote on how and where funds should be allocated.

- Matrix: A framework allowing direct participation in liquidity campaigns with predefined conditions.

Example:

A group of investors gathers in an EOL pool to collectively analyze risk and return and decides to invest funds in a high-yield but risky protocol. They can also participate in Matrix campaigns by investing in controlled and predefined projects.

Contributions of Mitosis to the Financial Ecosystem

Higher Efficiency and Flexibility

Mitosis transforms liquidity positions from a “set and forget” model into actively managed and optimized financial tools.

Example:

Fatma invested her Vanilla Asset tokens into Matrix campaigns. Instead of relying on returns from a single protocol, she manages yields from multiple campaigns simultaneously, increasing overall efficiency. She can sell tokens anytime or convert them into different positions.

Transparency and Fair Access

Mitosis enables all participants to accurately and transparently view the value of their liquidity positions. This reduces information asymmetry and prevents market manipulation.

Example:

Burak can review the terms and expected returns of different liquidity campaigns within Matrix on a single platform. This allows him to evaluate fair opportunities accessible to everyone, rather than only those offered through private deals.

Future and Potential of Mitosis

By making liquidity management programmable, Mitosis fosters the development of next-generation financial products in DeFi. Vanilla Asset tokens can become foundational elements in complex derivatives or integrate with other blockchain assets like NFTs in the future.

Future Scenario:

A user can use Vanilla Asset tokens as collateral to obtain loans while continuing to benefit from the yield of the tokens. Additionally, by combining different position tokens, new investment strategies can be created.

Conclusion

Mitosis is a protocol that will revolutionize liquidity management in the DeFi ecosystem. It transforms liquidity positions from passive investments into programmable financial components. As a result:

- Investors can manage their liquidity far more efficiently,

- Markets gain fair and equal access,

- New financial products and strategies emerge,

- A strong bridge is formed between liquidity providers and protocols.

Mitosis stands out as a foundational infrastructure aiming to make financial markets more accessible, innovative, and inclusive in the future DeFi world

Comments ()