Why "Navigating Zootosis" is the Most Ambitious Cross-Chain Campaign Yet

DeFi is no stranger to campaigns — but few have aimed as high as Navigating Zootosis. Launched by Mitosis, this program isn’t just another liquidity mining event; it’s a massive, multi-phase initiative designed to unify liquidity across chains and protocols at a scale rarely seen before.

As fragmented liquidity continues to be one of DeFi’s biggest bottlenecks, Zootosis emerges as an ambitious attempt to turn Mitosis’ Matrix Vaults from an experiment into the new normal.

In this article, we’ll break down why Zootosis is so large in scope, why it delivers real value to users (not just protocols), and how it sets itself apart from structured campaigns like Theo’s vaults.

Zootosis: A Multi-Chain Liquidity Movement, Not Just a Campaign

What makes Navigating Zootosis so expansive is its structure. Rather than being a single-chain or single-phase rewards event, Zootosis spans multiple vaults across several ecosystems — including Arbitrum, Kava, Mode, and more.

Each vault offers users time-bound opportunities to supply liquidity and earn yield, but the big innovation lies in how these vaults interact:

- They mobilize liquidity across chains through Mitosis’ decentralized cross-chain layer, avoiding wrapped assets or bridges.

- Protocols like Kava Rise and Mode are using Zootosis as a liquidity engine to attract and retain capital.

- TVL (Total Value Locked) is not siloed in one ecosystem but spread dynamically across participating chains.

By onboarding multiple chains and protocols, Zootosis has scaled Matrix Vaults from an isolated tool into a network-wide infrastructure — turning fragmented liquidity into an interconnected flow. That scale is what makes this campaign one of the largest cross-chain liquidity programs in DeFi today.

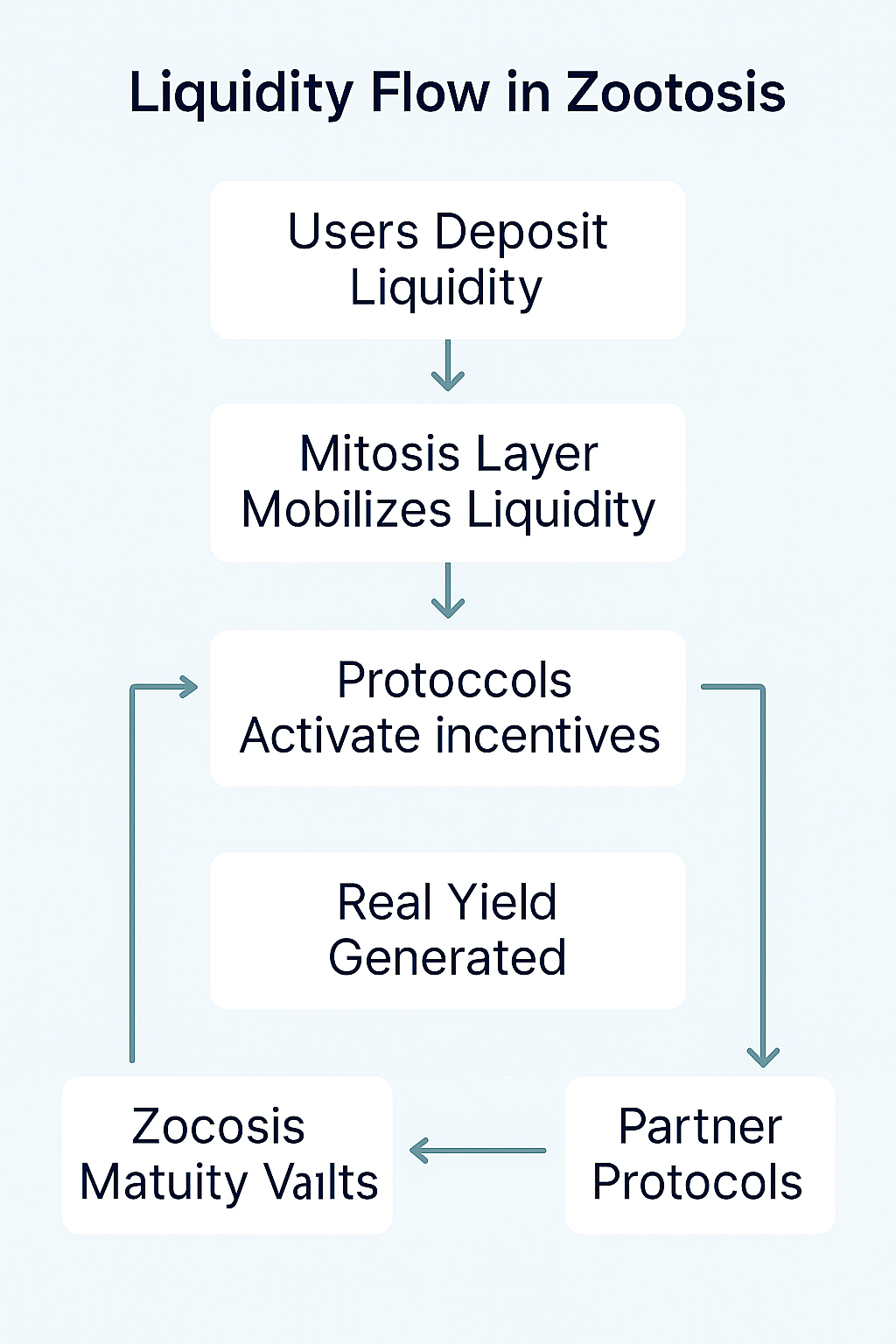

Liquidity Flow in Zootosis

- Users deposit liquidity directly into Zootosis Matrix Vaults on their native chains.

- Mitosis’ cross-chain layer dynamically allocates this liquidity across connected chains like Kava, Mode, and Arbitrum.

- Partner protocols activate incentives that tap into this shared liquidity pool.

- Rewards are generated in real assets and flow back to users — without bridging costs or exposure to wrapped tokens.

- Users can withdraw liquidity back to the native chain or recycle it into new campaigns with minimal friction.

This liquidity engine allows for fast, efficient capital movement at scale, benefiting both users and protocols.

Why It’s Built for the Community: Accessibility and Real Yield

For users, Zootosis isn’t just another farm — it’s one of the most user-centric programs currently live. Here’s why:

- No deposit caps or whitelists in Phase 4: Anyone, big or small, can participate in the latest vaults without hurdles.

- Real yield, not point farming: Users earn rewards in real assets, rather than speculative points or promises.

- Cross-chain ease: Thanks to Mitosis’ no-wrap, no-bridge design, users avoid the high gas fees and security risks that plague other multi-chain campaigns.

Unlike many programs that favor early insiders or require users to juggle multiple wallets and chains, Zootosis vaults make it simple: deposit once, earn yield across chains, and enjoy instant usability.

This accessibility is key — it brings in everyday DeFi users, not just whales or advanced players, and helps democratize cross-chain liquidity mining.

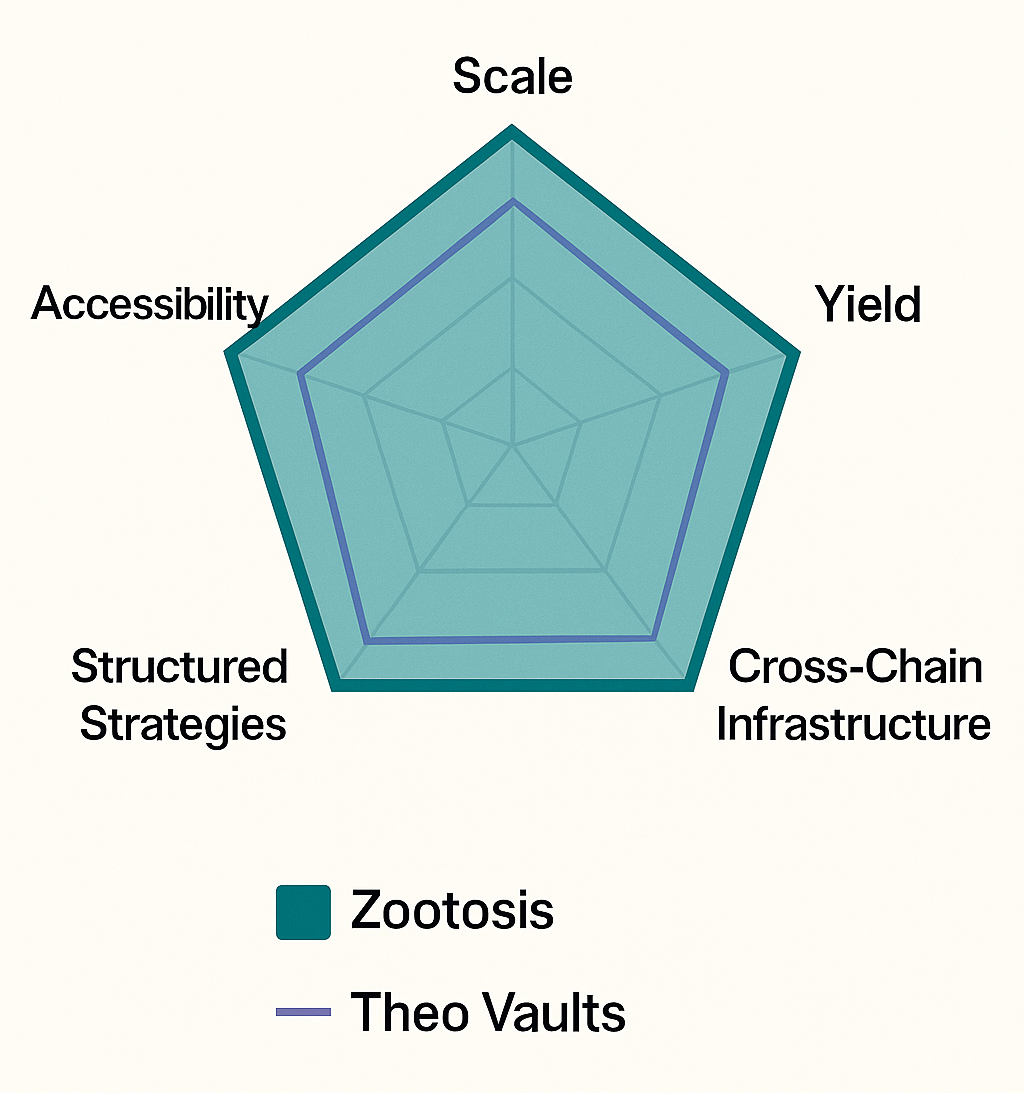

Matrix Zootosis vs Theo Vaults: The Key Difference

Theo Network’s vaults have been praised for their stablecoin-based, delta-neutral strategies that focus on structured DeFi products like leverage and hedging. But Mitosis’ Matrix Zootosis campaign operates on a broader, more open liquidity layer:

- Theo targets risk-managed strategies around stablecoins and structured assets.

- Matrix Zootosis targets raw liquidity mobilization across L1 and L2 ecosystems, powering multiple protocols and chains at once.

Where Theo aims to stabilize DeFi through structured vaults, Zootosis aims to supercharge liquidity movement — offering flexible, scalable infrastructure that protocols and users alike can tap into.

Think of Theo as the DeFi stabilizer and Matrix Zootosis as the liquidity amplifier.

Comparative Table: Zootosis vs. Theo vs. Traditional DeFi Farms

| Criteria | Zootosis | Theo Vaults | Traditional DeFi Farms |

|---|---|---|---|

| Access | Open to everyone, no cap in Phase 4 | Selective, eligibility criteria apply | Often requires large LP deposits |

| Yield Source | Real yield from protocol incentives | Delta-neutral, stablecoin strategies | Mostly inflationary token emissions |

| Cross-Chain Capability | Native cross-chain liquidity movement | Limited to Theo's chain operations | Chain-specific, manual bridging |

| User Friction | Low: no bridges, no wrapped assets | Medium: structured deposits | High: bridging costs, slippage |

| TVL Scalability | Dynamic, scales across ecosystems | Stable, focused on risk management | Fragmented, siloed per protocol |

Conclusion: Is Zootosis the Future of Cross-Chain DeFi?

Navigating Zootosis shows us what’s possible when cross-chain liquidity mining is done at scale, with users at the center.

By combining multi-chain scope, real yield, and broad accessibility, it delivers benefits not only to DeFi protocols but also to everyday users looking for frictionless, profitable cross-chain strategies.

For those watching the future of liquidity mining and cross-chain infrastructure, the question isn’t if more campaigns will follow this model — it’s when.

Will your favorite DeFi protocol be the next to join the Zootosis movement? The liquidity flow is only getting stronger.

Resources: Mitosis Blog Zootis, Mitosos x Morph, Theo Matrix Campaign, Mitosis Blog, docs.mitosis.org

Comments ()