Why Trump Media’s Bitcoin ETF Filing Matters for Crypto’s Future

Introduction

If you thought politics and cryptocurrency were two completely different realms, think again. Back in late May 2025, Trump Media & Technology Group, the folks behind Truth Social, submitted paperwork for a Bitcoin ETF called the “Truth Social Bitcoin ETF B.T.” (Reuters, May 28, 2025).

Now, I know that sounds like a mouthful of legal jargon, but it’s actually pretty significant. This move could signal that crypto—once viewed as a niche, techy experiment—is now firmly in the spotlight, with major political figures and established financial institutions eager to jump on board. You might be asking yourself: why should the average person care about this? Sure, ETFs (exchange-traded funds) can seem a bit complex, and not everyone keeps up with political shenanigans. But here’s the deal: this filing represents a pivotal moment where politics, big money, and the future of digital currencies intersect. Whether you’re a passionate crypto enthusiast, a cautious investor, or someone who just scrolls past these headlines, it’s important to grasp what’s unfolding—and why it could reshape how cryptocurrencies integrate into our daily lives.

In this article, we’ll break down what Trump Media’s Bitcoin ETF filing really means, why Crypto.com’s role is significant, and how all of this ties into a larger trend of political and institutional interest in crypto products. No jargon, no fluff—just a straightforward look at why this story is relevant to anyone curious about the future of money, whether it’s digital or not.

What Exactly Is a “Spot Bitcoin ETF,” and What’s in This Filing?

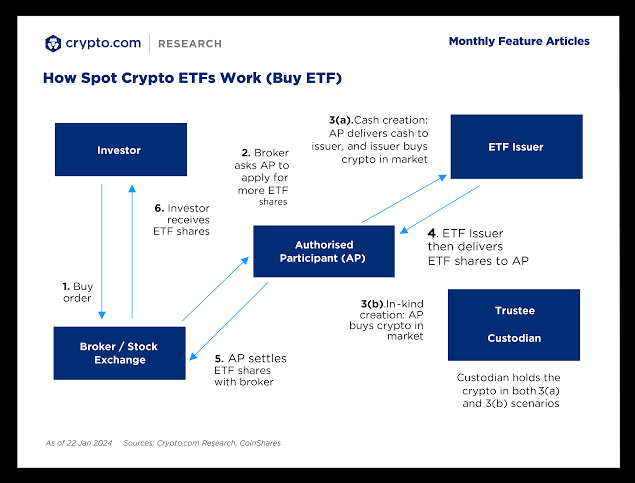

At its core, a spot Bitcoin ETF is a financial tool that allows individuals to invest in Bitcoin without the hassle of actually purchasing, storing, and securing the coins themselves. Rather than going through the process of setting up a crypto wallet, buying Bitcoin on an exchange, and stressing over the safety of your private key, you simply buy shares of the ETF—similar to how you would purchase shares in a company like Apple or Google. The ETF provider takes care of holding the actual Bitcoins in a secure location, and the price of the shares reflects the real-time value of Bitcoin (Bloomberg, May 29, 2025).

So, why is Trump Media looking to file for one? Let’s break down the key elements:

- Exposure to Bitcoin Without the Hassle

The Truth Social Bitcoin ETF is designed to hold Bitcoin directly, instead of relying on futures or other derivatives. This is a big deal because it means the ETF can track Bitcoin’s price changes more closely. For everyday investors, this offers a simple way to invest in Bitcoin without the complexities of crypto wallets or private keys, the fund handles all of that for you (CoinDesk, May 30, 2025). - Crypto.com as Custodian and Liquidity Provider

The filing names Crypto.com as the exclusive custodian for the fund’s Bitcoin assets, as well as the entity responsible for trading and liquidity. In layman's terms, Crypto.com is the guardian of the actual Bitcoin and also acts as the intermediary for buying and selling shares. Why is this important? Crypto.com is a well-established player in the crypto space, known for its solid track record in securing digital assets and adhering to regulations. Having a reputable name managing custody helps to ease the concerns of regulators and investors who might be hesitant about the safety of their funds and digital currencies (The Wall Street Journal, May 31, 2025). - NYSE Arca Listing

As the filing moves through the Securities and Exchange Commission (SEC), it also expresses a desire for the ETF to be traded on NYSE Arca, one of the leading U.S. exchanges. Being listed on NYSE Arca provides easier access for traditional investors who already have brokerage accounts, allowing them to buy and sell shares during regular trading hours. Plus, it means the ETF will adhere to the exchange’s listing standards and oversight, adding an extra layer of credibility to the product (Financial Times, June 1, 2025).

- Yorkville America Digital as Sponsor

Behind the scenes, Yorkville America Digital is the driving force behind this ETF. In simple terms, they’re the financial backbone that provides the necessary capital for the fund to kick off. But they’re not just any backer—they’ve already played a role in Trump Media’s ambitious Bitcoin strategy, which reportedly includes plans to hold billions in Bitcoin on their balance sheet. By sponsoring this ETF, Yorkville is essentially linking its future to both Trump Media and the long-term viability of Bitcoin as an investment (CNBC, June 2, 2025).

All of this shows that this isn’t just a casual endeavor. Trump Media isn’t merely slapping a crypto label on an existing financial product. They’re meticulously crafting something that adheres to regulatory standards, utilizes a trusted custodian, and integrates with the current financial system. Now, let’s explore why this blend of politics and crypto is such a significant development.

When Politics Enters the Crypto Arena

One of the most striking aspects of this whole situation is that Trump Media, yes, the very same company closely associated with former President Donald Trump, is stepping into the Bitcoin ETF arena. For years, mainstream politicians have eyed cryptocurrencies with skepticism, often labeling them as unstable or even dubious. But what happens when a prominent and divisive political figure dives headfirst into the crypto scene?

- A Shift in Political Messaging

If you rewind a few years, Donald If we take a trip down memory lane, Donald Trump’s past comments on crypto were pretty tepid. He dismissed Bitcoin as “not money” and made statements during his presidency that didn’t exactly encourage the adoption of digital assets. Fast forward to now, and Trump Media is launching a flagship Bitcoin investment product. Regardless of your stance on Trump’s politics, it’s tough to overlook the significance: a recognizable, mainstream political brand is now backing Bitcoin in the investment landscape. This changes the narrative around crypto from a niche digital curiosity to something that a wider audience might start to see as “legitimate” (Reuters, May 28, 2025; Bloomberg, May 29, 2025).

- Fundraising and Brand Strategy

By linking the ETF with Truth Social, the product gains a built-in marketing advantage aimed at the Trump supporter demographic—millions of individuals who are already engaged with the platform (CNBC, June 2, 2025). Think of it as a loudspeaker: whenever Trump brings up Bitcoin (and let’s be real, he likely will), supporters who may have never considered digital currencies before could find themselves intrigued. It’s a clever fundraising strategy, a way to build the brand, and a political statement all rolled into one. - Regulatory Implications

In a possible second term for Trump, the names being floated for key financial and regulatory roles seem to be leaning more towards the crypto side of things. Industry insiders are already buzzing that if the SEC, under a future Trump appointee, starts to fast-track the approval of various crypto products, it could trigger a surge of new investment opportunities. By filing this ETF now, while the current SEC leadership is still playing it safe, Trump Media might be looking to secure a position before the regulatory landscape changes. If that shift occurs, they could be among the first to launch in a potentially more favorable environment (The Wall Street Journal, May 31, 2025).

The politics of it all add more layers than you might expect. It’s not just about investing in Bitcoin; it’s about how political branding can move markets, shape narratives, and even push regulators to pay closer attention.

How This Fits into the Bigger Picture of Crypto Mainstreaming

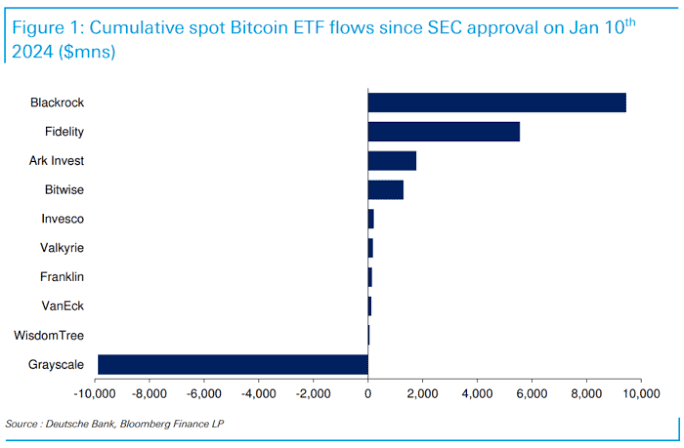

Let’s take a moment to step back and consider the bigger picture. Bitcoin has always been a known entity for investors. Since its inception in 2009, it has navigated through cycles of highs and lows, faced intense media attention, and sparked endless debates about whether it’s just a speculative trend or the future of currency. However, in recent years, we’ve witnessed a notable increase in major financial firms filing for or launching spot Bitcoin ETFs. Companies like BlackRock, Fidelity, and Grayscale have rolled out products that allow both institutional and retail investors to own Bitcoin in a more traditional manner. Now, with Trump Media’s recent filing, crypto has transcended mere financial news; it’s now intertwined with everyday political discussions.

Institutional Adoption Is Really Happening

When a powerhouse like BlackRock, which manages trillions in assets, files for a Bitcoin ETF, it sends a clear message: “This is legitimate. We believe in it.” That’s a significant development. Now, Trump Media is essentially riding that wave, indicating, “We want to be part of this established space.” Together, these actions are swiftly altering how traditional investors perceive crypto. It’s no longer just a playground for tech-savvy early adopters; it’s beginning to feel like a mainstream asset—almost comparable to gold or stocks in a well-rounded portfolio (Financial Times, June 1, 2025).

- Crypto.com’s Growing Role

It’s also worth noting that Crypto.com is mentioned as the custodian and liquidity provider. Back in 2022, Crypto.com was primarily recognized for its flashy marketing (who could forget that $100 million Super Bowl ad?) and its user-friendly trading app. However, over time, it has significantly enhanced its compliance efforts, secured licenses, and developed its infrastructure to compete with major Wall Street players. By placing billions of dollars in Bitcoin custody with Crypto.com, Trump Media is essentially saying, “We have faith in your systems and security.” This is a substantial endorsement of Crypto.com’s transformation from a consumer brand to an institutional-grade operation (CoinDesk, May 30, 2025). - A Crowded—but Growing—ETF Landscape

As we step into early 2025, we’re seeing several spot Bitcoin ETFs already making waves in the market, with some boasting billions in assets. However, new filings still hold significance, especially if they introduce fresh perspectives—like a recognizable political figure, a specific sponsor, or unique partnerships. For instance, Trump Media’s ETF might not make a huge splash in terms of asset size right off the bat, but its novelty is sure to pique interest. It’s a bit like a celebrity-backed startup; people will be curious to see how it performs, even if they don’t end up investing (Bloomberg, May 29, 2025). - What It Means for Everyday Crypto Users

If you’re someone who’s already got Bitcoin stashed away—whether you’ve been mining, trading, or just holding onto it for years—this ETF filing probably won’t shake things up for you. But for those who are still on the fence, diving into cryptocurrency can feel pretty overwhelming: private keys, hardware wallets, two-factor authentication—it’s a lot to wrap your head around. An ETF makes things easier. Instead of having to navigate a crypto exchange, you can simply buy shares through your regular brokerage account, and the fund takes care of the Bitcoin for you. This lowered barrier to entry means more folks—especially those who resonate with the Trump brand—might be tempted to explore digital assets.

All these changes point to one clear trend: crypto is moving away from its “quirky, niche hobby” reputation (no offense to the early adopters!) and is stepping into the realm of mainstream finance—complete with political endorsements, established custodians, and regulated exchanges. If you’re looking to brush up on some crypto basics, check out our Blockchain Foundations series. And if you’re interested in exploring other digital assets beyond Bitcoin—like Ethereum or DeFi—be sure to visit our Market Insights section.

Where Do We Go from Here?

So, what should you be keeping in mind as we look ahead in the coming days and months? Let’s break it down into a few practical points:

- Watch the SEC Timeline

Once an ETF filing is in, the SEC typically has around 240 days to either approve, deny, or ask for more information. This means we probably won’t see this ETF trading until late 2025 (CNBC, June 2, 2025). Potential investors should stay alert for any SEC comments or delays, as these often hint at deeper regulatory issues, ranging from how the ETF manages share redemptions to the specifics of Crypto.com’s security measures. - Follow Crypto.com’s Moves

If you’re curious about how prepared this ETF is in terms of security and compliance, pay attention to the latest news from Crypto.com. Have they encountered any security breaches lately? Are they receiving new licenses from regulators in Europe or Asia? The stronger Crypto.com’s reputation holds up, the smoother the road to approval for this ETF is likely to be - Consider the Broader ETF Competition

If you’re considering investing in a Trump-backed ETF, take a moment to compare it with other spot Bitcoin ETFs. Look into fee structures, how each fund manages custody, and the size of their initial backers. While the “celebrity factor” might attract some initial interest, in the long run, factors like fees and performance history usually take precedence. - Think About Political Risk

Politics can be quite unpredictable. A product closely linked to a political figure can thrive when that figure is in favor but may face challenges if the political climate changes. If you’re considering this ETF, keep in mind that its performance could be swayed not just by Bitcoin’s price but also by the overall business and political fortunes of Trump Media (Reuters, May 28, 2025).

- Stay Curious about Future Innovations

An ETF is just one piece of the ever-expanding crypto puzzle. We’re already witnessing attempts to roll out funds that focus on Ethereum, DeFi tokens, and even tokenized real estate. If a political figure can rally behind a Bitcoin ETF, who’s to say they won’t launch an “Ethereum for Small Business Development” fund next? This filing could mark the start of a trend where politicians and celebrities leverage their platforms to promote niche crypto funds aimed at very specific audiences

Conclusion

The filing for the “Truth Social Bitcoin ETF B.T.” isn’t just another clickbait headline; it’s a clear signal that cryptocurrency has officially made its way into the world of mainstream finance and politics. This ETF represents everything from an easy way to invest in Bitcoin through your current brokerage to a bold endorsement from a controversial political figure, showcasing just how rapidly the landscape for digital assets is evolving.

For the average reader, the key takeaway is this:

whether you’re intrigued, hesitant, or already all in on Bitcoin, it’s important to watch how political leaders are starting to engage with the crypto space.

Their actions can shape public opinion, influence regulatory oversight, and ultimately determine how accessible digital currencies will be for you.

As this ETF navigates the approval process, keep an eye on the key developments: feedback from the SEC, security updates from Crypto.com, and the reactions of other major players in the market. Looking back, we might see this filing as the moment crypto finally shed its “geeky outsider” label and stepped into the spotlight of American finance—making waves not just on Wall Street, but also across political discussions and social media.

The next few years will reveal whether this shift is a positive one, but one thing is certain: the evolution of Bitcoin from a niche token to a regulated, Trump-branded ETF is a story worth following closely.

Internal Mitosis Links & Glossary References

- Bitcoin

- Blockchain

- Cryptocurrency

- Mitosis Core: https://university.mitosis.org/mitosis-core

- Governance: https://university.mitosis.org/governance

- Glossary: https://university.mitosis.org/glossary/

- Ecosystem Connections: https://university.mitosis.org/ecosystem-connections

References

- Reuters. “Trump Media Files for Bitcoin ETF,” May 28, 2025.

- Bloomberg. “Crypto.com to Custody Trump Media ETF,” May 29, 2025.

- CoinDesk. “Crypto.com Named Custodian for Truth Social ETF,” May 30, 2025.

- The Wall Street Journal. “Political Branding in Bitcoin ETFs,” May 31, 2025.

- Financial Times. “Institutional Adoption of Crypto ETFs Picks Up Speed,” June 1, 2025.

- CNBC. “SEC Receives Truth Social Bitcoin ETF Filing,” June 2, 2025.

Comments ()