Yarm and Mitosis VLF

Let's start with - What exactly is Yarm?

Yarm is a blend of DeFi and InfoFi platform powered by Mitosis Vault Liquidity Framework (VLF) and Kaito’s data analytics.

With the introduction of Yarm users can now participate in multiple fronts you're not just a content creator anymore - if you're obsessed with one of the protocols partnered with Yarm then you're going to become an ultimate user of such protocol that's one of the best ways to put Yarm

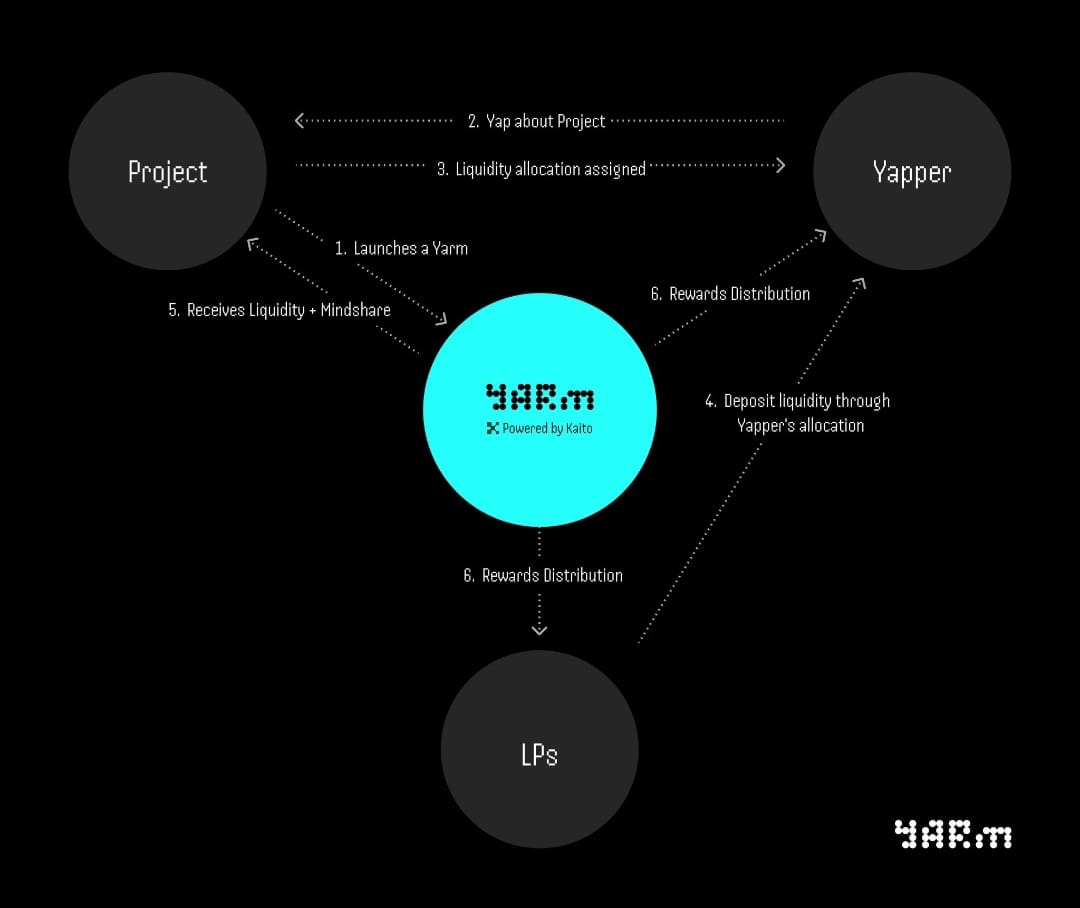

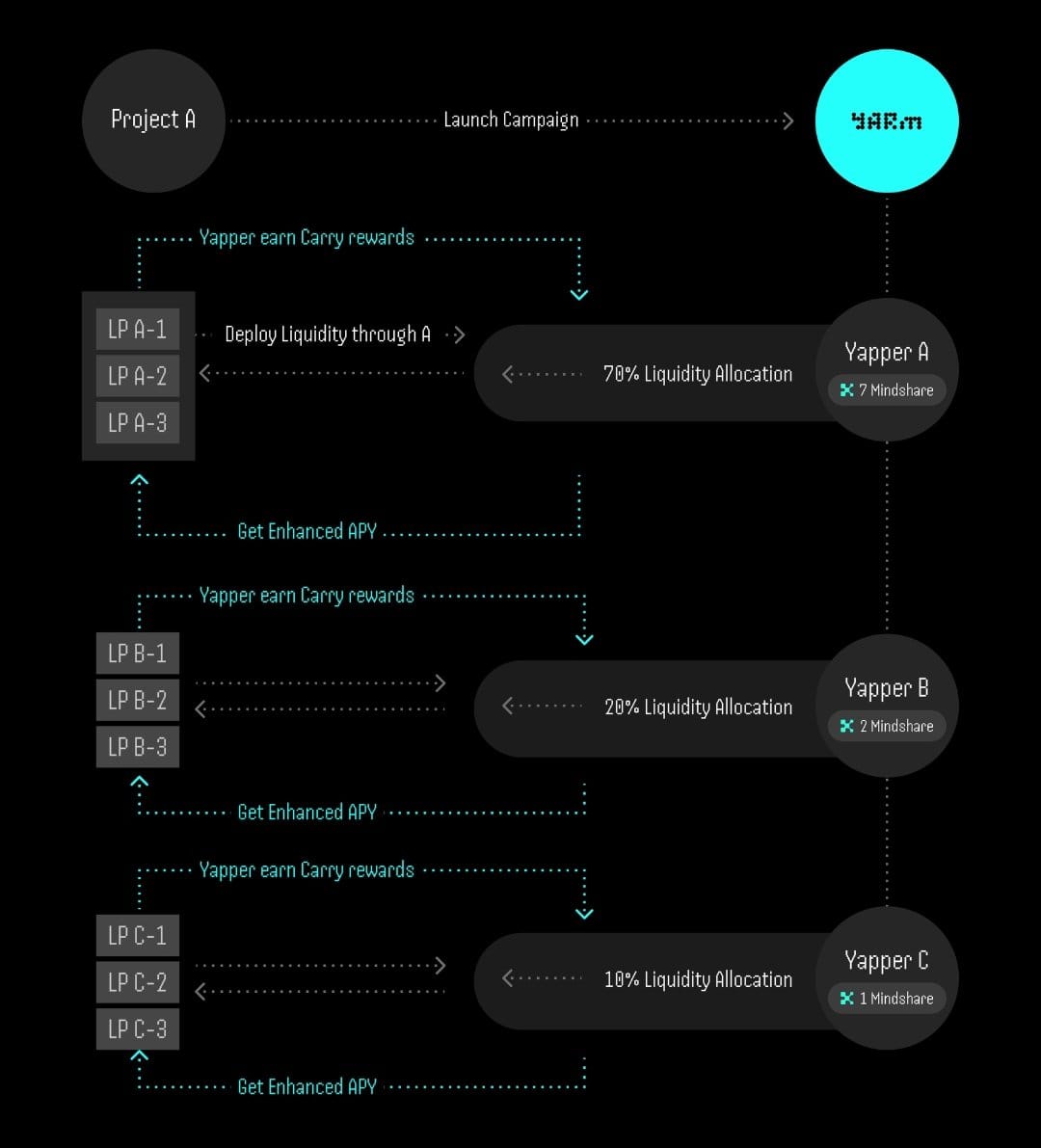

TL;Dr "Yarm blends social influence with DeFi power, rewarding creators and stakers to amplify protocols and fuel explosive user growth where the priority are yappers for the liquidity allocation." How does the Mitosis VLF vault come into play and what exactly is the Mitosis VLF vault? If you're already a user of Mitosis and if you've almost all the awareness about MLF (Mitosis Liquidity Framework) and EOL/Matrix then you don't have to scratch your head for VLF it's a revamped term of MLF itself. Let's go through the process to understand it better :

➡ Say we Deposit our underlying asset into Mitosis Vault ➡ Mitosis vault mints Hub assets on Mitosis chain ➡ VLF vault executes programmable strategies to optimize yield based on market conditions. ➡ And now our Hub asset can be traded not only between vaults but into the whole mitosis ecosystem. All while maintaining cross-chain functionality enabling seamless yield farming across multiple chains. The process is quite similar to Matrix vaults if we see it in some way.

Participants of Yarm and How Individual LPs can provide liquidity in yarm?

Participants in Yarm are divided into two broad categories - yappers and liquidity providers.

Yappers (content creators) -

Yappers are influential content creators who leverage their social "mindshare" to guide liquidity allocation within Yarm’s ecosystem. They identify and promote promising DeFi opportunities, directing liquidity to specific pools. Yappers attract followers who deposit liquidity into their designated pools, increasing the pool’s size and earning carry rewards based on their influence. Their insights and reputation drive the allocation of funds to curated DeFi projects.

Liquidity providers (LPs) - LPs are individuals who deposit assets into Yarm’s liquidity pools, either backing a specific Yapper or, in the future, diversifying across multiple Yappers. They provide the capital that fuels Yarm’s DeFi strategies.

Yarm is not restricted to participation by content creators alone, individual LPs can participate in yarm as well.

Here is how LPs get a chance to provide liquidity -

Backing Specific Content Creators : LPs can deposit assets into a chosen content creator’s (Yarmer’s) pool, increasing liquidity and boosting the Yarmer’s carry rewards, based on the LP’s trust in their insights.

Auto-Diversification Across Top Yarmers : LPs can opt for an automated feature (planned for future release) that diversifies deposits across top Yarmers recommended by Yarm, based on the LP’s X interactions; only Single-Yarmer Mode is available at launch.

Both options provide access to better incentive tiers and socially curated DeFi opportunities, allowing LPs to follow "smart money" guided by respected Yarmers, you're not just following for contents but

Now let's understand with a short and sweet example how Individual LPs get to participate in yarm -

Let’s say Ash, an LP, has $5,000 to invest and follows a Yarmer named ABC on X, who’s known for spotting undervalued DeFi gems early.

As discussed Ash has two ways to participate - either by backing the yarmer or via auto-diversification by Yarm

Backing ABC (Single Yarmer Mode)-

Ash deposits his $5,000 into ABC's liquidity pool. This increases the pool’s liquidity, say from $50,000 to $55,000, and boosts ABC's carry rewards. Here if the Overlap score of such protocol is say 80 points then both the yarmers and LPs will enjoy some juicy APYs.

Auto-Diversification (not live on launch, it'll come in future) -

Once available, Yarm might notice Ash also interacts with Yarmers MNO and PQR. Ash deposits $5,000, and Yarm splits it: $1,667 into ABC's pool, $1,667 into MNO's, and $1,666 into PQR's. Ash gets diversified returns, cushioned by the collective wisdom of three trusted Yarmers.

In both cases, Ash leverages Yarm’s social curation to access better DeFi opportunities, guided by Yarmers he respects, making his LP position both strategic and rewarding.

Mitosis X

Docs - https://docs.mitosis.org/developers/vlf/overview

Yarm post - https://x.com/Yarm_AI/status/1942893921916624993?t=R4vxMvMZ1Ct9Lc6LHbaQKQ&s=19

Comments ()