Yield Hunting in Multichain: How Mitosis Helps Increase Your DeFi Income

1. Introduction

Multichain: A Yield Klondike or a Labyrinth of Complexity?

The modern world of decentralized finance (DeFi) is a dynamic and ever-expanding universe of multiple blockchains. Ethereum, Solana, Polygon, Arbitrum, Optimism, Cosmos networks... Each ecosystem offers its unique opportunities for generating income: from yield farming and staking to liquidity provision and participation in lending protocols. Potential Annual Percentage Yields (APYs) can vary significantly from network to network, creating a true Klondike for those seeking maximum returns.

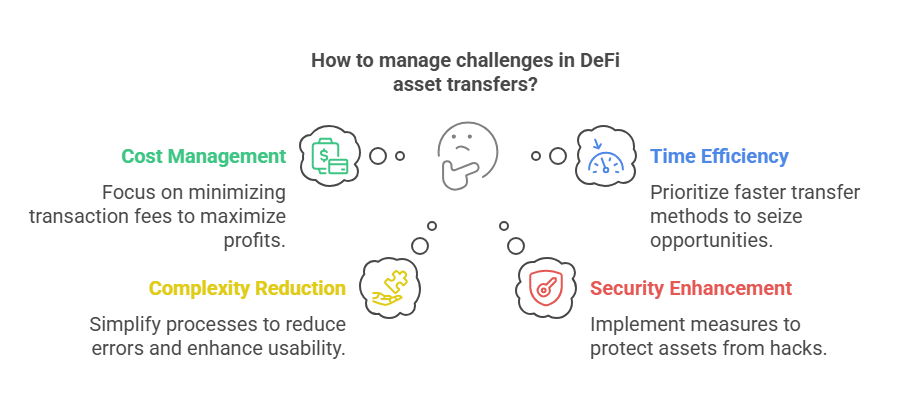

However, this Klondike often resembles a confusing labyrinth. Yield opportunities are scattered, and taking advantage of the best ones requires constantly moving assets between blockchains. This process comes with several difficulties:

- Costs: Fees for using bridges and transactions on different networks can eat up a significant portion of potential profits, especially with frequent transfers of small amounts.

- Time: Transferring assets via bridges can take anywhere from a few minutes to hours, during which a profitable opportunity might disappear.

- Complexity: Using different bridges, wrapped tokens, and wallets requires specific knowledge and increases the risk of errors.

- Security Risks: As we know, bridges remain a vulnerable point in DeFi, and there is always a risk of losing funds due to hacks.

As a result, many users either miss out on profitable opportunities on other networks or spend too much time and money managing their multichain assets.

Mitosis: Your Guide in the World of Multichain Yield?

What if there was a tool that could simplify navigation through this labyrinth and make the hunt for the best yields more efficient and secure? This is precisely where Mitosis enters the scene.

Mitosis is a next-generation liquidity protocol designed for the seamless and secure movement of assets between various blockchains. Thanks to its unique Ecosystem-Owned Liquidity (EOL) model and advanced security mechanisms, Mitosis aims to eliminate the main barriers hindering effective capital management in a multichain environment.

But how specifically can Mitosis help you increase the yield of your DeFi assets?

The Goal of This Article: Practical Strategies

In this article, we will move away from deep technical details and focus on practical strategies and scenarios where Mitosis can become your indispensable assistant in the pursuit of yield. We will examine how its capabilities can be used for:

- Optimizing stablecoin yields.

- Realizing arbitrage opportunities.

- Quickly accessing new farming pools and protocols.

- More efficient management of Liquid Staking Tokens (LSTs) in the context of restaking.

We will show how the speed, low costs (potentially), and security of Mitosis can turn complex multichain maneuvers into simple and profitable operations. Get ready to learn how to use Mitosis to make your capital work for you to the maximum, regardless of which blockchain holds the most attractive opportunity.

2. Practical Yield Strategies with Mitosis

Now let's move from theory to practice. How exactly can Mitosis help you in real DeFi operations aimed at increasing income? Let's consider several key scenarios.

Strategy 1: Optimizing Stablecoin Yields

Stablecoins (USDC, USDT, DAI, etc.) are the foundation of many DeFi strategies. The yield on them in lending protocols (Aave, Compound, Morpho) or liquidity pools can vary greatly between different blockchains and even different protocols on the same network.

- The Problem: Finding the highest rate is easy, but moving your stablecoins there quickly and cheaply is difficult. While you're transferring funds through a slow bridge, the rate might drop, or you'll lose part of the profit to fees.

- The Solution with Mitosis:

- Monitoring: You find an attractive APY rate for USDC on a protocol in the Arbitrum network, while your main funds are on Ethereum.

- Quick Transfer: Using Mitosis, you can quickly and (potentially) with low costs transfer your USDC from Ethereum to Arbitrum. Thanks to the EOL model and efficient architecture, Mitosis aims to minimize transfer time and cost.

- Deployment: You deposit your USDC into the high-yield protocol on Arbitrum.

- Reverse Transfer: When the rate on Arbitrum decreases or a more profitable opportunity appears on another network (e.g., Optimism), you can just as easily and quickly withdraw funds and transfer them using Mitosis to where the yield is higher.

Mitosis Advantage: The speed and efficiency of the transfer allow you to react promptly to rate changes and maximize stablecoin yield without losing profit to waiting times and high fees.

Strategy 2: Cross-Chain Arbitrage

Arbitrage involves profiting from the price difference of the same asset in different markets. In DeFi, this often means buying a token cheaper on a DEX in one network and selling it higher on a DEX in another network.

- The Problem: Arbitrage success critically depends on speed. The price difference might only exist for a few seconds or minutes. Slow and expensive bridges make most cross-chain arbitrage opportunities unprofitable.

- The Solution with Mitosis:

- Detection: You notice that token XYZ is trading at $1.00 on Uniswap (Ethereum) and $1.02 on Orca (Solana).

- Rapid Capital Movement: Using Mitosis, you instantly transfer capital (e.g., stablecoins) from Ethereum to Solana.

- The Trade: You buy XYZ on Solana for $1.00 (using the just-transferred funds) and simultaneously (or almost simultaneously) sell an equivalent amount of XYZ on Ethereum for $1.02 (using capital you had there, or by quickly transferring the XYZ bought on Solana back via Mitosis if speed allows).

- Profit Lock-in: You lock in a profit of $0.02 per token (minus fees).

Mitosis Advantage: The high speed and efficiency of Mitosis can make cross-chain arbitrage a reality, allowing traders to exploit short-term price inefficiencies between different blockchain ecosystems.

Strategy 3: Accessing "Hot" Farming Pools and Protocols

New blockchains or DeFi protocols often launch attractive incentive programs (yield farming) to attract liquidity, offering very high APYs initially.

- The Problem: Getting into such programs quickly is difficult. By the time you figure out the new bridge, find liquidity for gas in the new network, and transfer assets, the best opportunities might already be gone.

- The Solution with Mitosis:

- Information: You learn about the launch of a promising new protocol on the Base network with very high rewards for providing liquidity in an ETH/USDC pair.

- Instant Access: If Base is integrated with Mitosis, you can instantly transfer your ETH and USDC from any other supported network (e.g., Optimism) directly to Base.

- Participation: You promptly provide liquidity and start earning high rewards right from the program's start.

Mitosis Advantage: Removes barriers to entry into new ecosystems, allowing users to quickly participate in the most profitable and current yield farming programs across the multichain space.

Strategy 4: Optimizing LST Restaking

Restaking via protocols like EigenLayer opens up new income opportunities for your Liquid Staking Tokens (LSTs), such as stETH, rETH, cbETH. Different Actively Validated Services (AVS) or restaking protocols might offer varying reward levels and operate on different networks.

- The Problem: Your LSTs might be on one network (e.g., Ethereum Mainnet), while the most profitable AVS or restaking protocol is on another (e.g., a Layer 2 network or even a specialized L1 like Mitosis Chain in the future). Moving LSTs involves the same bridge problems.

- The Solution with Mitosis:

- Opportunity Search: You find an AVS operating on Arbitrum that offers the best yield for restaking your rETH, which is currently on Ethereum.

- Seamless Transfer: Using Mitosis, you securely and efficiently transfer your rETH from Ethereum to Arbitrum.

- Restaking: You deposit your rETH into the chosen AVS or restaking protocol on Arbitrum and start earning enhanced yield.

Mitosis Advantage: Simplifies the use of LSTs in the multichain restaking ecosystem, allowing users to easily move their assets to where they can generate the maximum utility and income.

These scenarios are just the tip of the iceberg. The flexibility and efficiency of Mitosis open doors to numerous other strategies, limited only by your ingenuity and knowledge of the DeFi market.

3. Important Considerations and Conclusion

Before You Start: What You Need to Consider

The strategies described above sound attractive, and Mitosis can indeed be a powerful tool for implementing them. However, as with anything related to DeFi and finance, it's important to approach them wisely and be aware of potential risks and nuances:

- Market and APY Volatility: Yields in DeFi are not constant. High APYs can quickly decrease as new liquidity flows in or market conditions change. Arbitrage opportunities may only exist for moments. The success of strategies depends on your reaction speed and constant monitoring.

- Smart Contract Risks: Any interaction with DeFi protocols, whether it's Mitosis, a lending protocol, a DEX, or a restaking platform, carries the risk of code errors or exploits. Use only audited and reputable protocols, but remember that there is no 100% guarantee of security.

- Impermanent Loss: When providing liquidity to pools on DEXs (for farming or arbitrage), you are exposed to the risk of impermanent loss if the price of assets in the pair changes significantly.

- Gas Fees: Although Mitosis aims to optimize its costs, you will still have to pay transaction fees on the source and destination networks. Factor these into your potential profit calculations, especially when working with smaller amounts.

- Mitosis Protocol Risks: Despite the focus on security using EigenLayer AVS and the EOL model, Mitosis, like any protocol, has its own inherent risks. It's important to follow security updates and audits.

- Do Your Own Research (DYOR): This article describes possible strategies but is not financial advice. Always conduct your own thorough research on protocols, networks, and assets before investing your funds. Evaluate the risk-reward ratio.

Mitosis as the Key to Multichain Efficiency

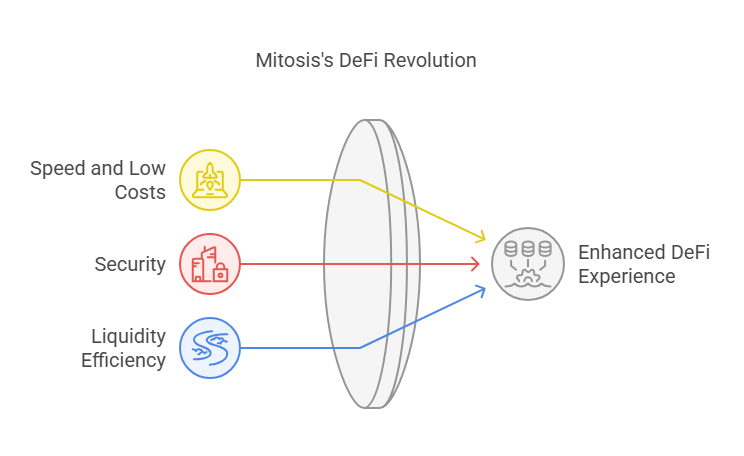

Despite the listed risks, it's undeniable that efficient and secure cross-chain solutions fundamentally change the game for active DeFi users. Mitosis, thanks to its key features, acts as precisely such a solution:

- Speed and Low Costs (Goal): Allows for prompt reaction to market opportunities and minimizes transaction losses.

- Security (AVS): Reduces the fundamental risk of losing funds when crossing blockchain borders.

- Liquidity Efficiency (EOL): Ensures stability and reduces slippage during transfers.

These factors make strategies that were previously too complex, risky, or expensive much more accessible and potentially profitable. Mitosis doesn't just move assets – it expands your capabilities for capital management across the entire DeFi universe.

Conclusion: Active Capital Management in a New Era

The multichain era opens up vast opportunities for income generation but requires new tools for effective navigation. Mitosis positions itself as one of these key tools, enabling users to overcome fragmentation barriers and actively manage their assets in search of the best yields.

By using Mitosis to optimize stablecoin yields, pursue cross-chain arbitrage, quickly access farming pools, or efficiently restake LSTs, you can significantly enhance your capital's efficiency. However, always remember the need for thorough analysis, risk management, and continuous learning in the dynamic world of DeFi.

Mitosis provides the fishing rod, but catching the fish is up to you. Use the protocol's capabilities wisely, and the multichain space can become a source of stable and high income for you.

Learn more about Mitosis:

- Explore details on the official website: https://www.mitosis.org/

- Follow announcements on Twitter: https://twitter.com/MitosisOrg

- Participate in discussions on Discord: https://discord.com/invite/mitosis

- Read articles and updates on Medium: https://medium.com/mitosisorg

- Blog: https://blog.mitosis.org/

Comments ()