ZK Projects and Short-Term Investments: What Investors Should Pay Attention To

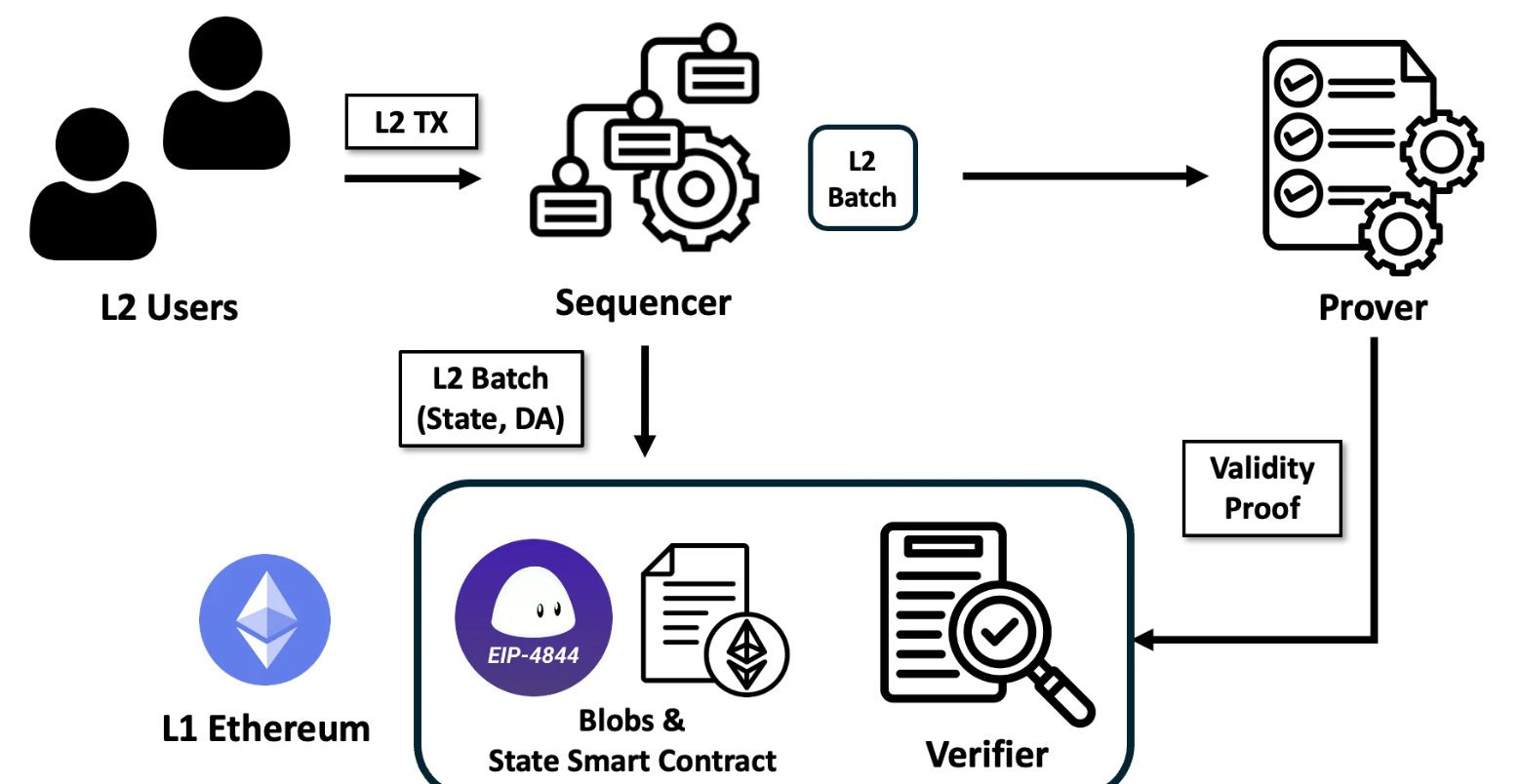

Zero-Knowledge (ZK) technologies are one of the fastest growing segments in the field of blockchain and cryptography. Their potential promises to radically change the methods of data verification, increase privacy and scalability of decentralized applications. However, the rapid growth of interest in ZK protocols is accompanied by a wave of hasty investment projects, which often turn out to be too risky.

In this article, we will analyze the main risks associated with short-term investments in ZK projects and offer approaches for a more sober assessment of such prospects.

Promises at the "pre-product" stage

Many ZK projects collect funding at early stages - before the appearance of a working product. Often, investors are offered to participate in private sales or IDOs, based only on the whitepaper and the team. The problem is that:

· The technological complexity of ZK schemes requires a long revision;

· The actual development time can be several times longer than stated;

· the team may overestimate its capabilities or simply fail to cope.

Investor Takeaway

Don't invest in a ZK project if its main thesis is "we will create zkRollup in 3 months". Assess whether there is GitHub activity, the team's experience, real progress and partnerships.

Tokenomics without sustainability

ZK projects often issue tokens with an unstable model. This is especially true for:

· an excessively high share of distribution to the team and investors;

· instant liquidity exit after TGE;

· lack of long-term token utility.

In the short term, this can lead to a "dump", when most of the early participants withdraw their profits, leaving retail investors with depreciated assets.

Evaluation Checklist for ZK Project Investments

|

Evaluation Area |

Key Questions |

What to Look For |

|

Team

& Background |

Does

the team have experience in cryptography and blockchain development? |

Verifiable

credentials, open-source contributions, prior successful projects. |

|

Technical

Progress |

Is

there a working demo, MVP, or testnet? |

GitHub

activity, regular updates, third-party audits. |

|

Token

Utility |

Does

the token have a real use case within the ecosystem? |

Staking,

governance, transaction fees, or access to services. |

|

Tokenomics

Structure |

Are

vesting schedules fair and long-term aligned? |

Gradual

unlocks, low initial insider allocations, strong community share. |

|

Real

Need for ZK Tech |

Is

Zero-Knowledge cryptography essential to the product’s value proposition? |

Clear

justification for ZK use; alternative technologies wouldn't deliver same

benefits. |

|

Regulatory

Compliance |

Can the

project operate legally in major jurisdictions? |

Legal

disclaimers, KYC/AML support, privacy implementation within compliant

frameworks. |

|

Hype vs

Fundamentals |

Is the

marketing driven by substance or social trends? |

Whitepapers,

roadmap clarity, and technical publications instead of just influencer buzz. |

Investor Takeaway

Tokenomics is more important than hype. Study vesting, look at the strategic goals of the token, whether there are real scenarios for its use in the ecosystem.

Hype illusion and influencers

ZK projects often become the object of massive influencer support, especially in the early stages. Mentions from large accounts can create the illusion of reliability and prospects. In reality, this is often an advertising campaign, not supported by the real value of the product.

Conclusion for the investor:

Focus on the facts, not on the Twitter bubble. If the project is actively promoted, but there is no documentation, no demo, no technical audit - this is an alarming sign.

Limited market for application

ZK technologies are really useful, but not everywhere. Some projects propose deliberately irrational applications of ZK proofs, just to “stick a fashionable label”. For example, using zk-SNARKs in an area where simpler solutions can do.

Conclusion for the investor

Ask yourself: why does the project really need ZK proofs? Sometimes you hear "because it's a trend", but that's not enough.

Regulatory risks

Some ZK projects are positioned as tools for complete anonymity and invisibility of transactions. This is of growing interest to regulators, especially in the US and EU. Restrictions, bans, or prosecutions are possible, especially if the project is used for money laundering.

Key Risks of Short-Term ZK Investments

|

Risk Category |

Description |

Impact on Investors |

|

Pre-product

Investments |

Many ZK

projects raise funds without a working prototype, based solely on promises

and a whitepaper. |

High

uncertainty, risk of delays or non-delivery. |

|

Unbalanced

Tokenomics |

Tokens

often have poor vesting schedules and high allocations to insiders. |

Price dumping

after launch, long-term value erosion. |

|

Hype-Driven

Marketing |

Projects

rely on influencers and social media buzz rather than technical substance. |

Illusion

of credibility, increased likelihood of FOMO-based investments. |

|

Weak

Product-Market Fit |

ZK is

sometimes used without clear necessity or value within the project’s use

case. |

Lack of

real-world adoption, weak demand for the token or service. |

|

Regulatory

Uncertainty |

Projects

with strong privacy features may face bans or legal actions, especially in

Western markets. |

Potential

delisting, investor losses due to shutdowns or restrictions. |

Conclusion for the investor

The regulatory background is extremely important. Anonymity is a plus from the technical side, but not always from the legal side. It is important to understand whether the project can exist in the legal field.

Conclusion

ZK projects are indeed an important stage in the evolution of Web3. But not every hasty project with the fashionable prefix "zk" guarantees growth or even a return on investment.

Before investing, investors should ask themselves critical questions:

1. Is there a real product or at least an MVP?

2. How transparent is the tokenomics?

3. Who is behind the project?

4. What is the real need for ZK in this particular case?

5. What risks might arise in 3-6 months?

A balanced, cold approach to ZK investments will help avoid mistakes and more likely find projects that will actually bring value - both technologically and financially.

Comments ()