ZK vs Optimistic: How Rollups Work and What Are Their Key Differences

Ethereum scalability remains one of the main challenges of the blockchain ecosystem. Among the proposed solutions, a special place is occupied by Layer 2 rollups — technologies that allow processing transactions outside the main blockchain with subsequent publication of the results in the Ethereum network.

The most common approaches are ZK rollups and Optimistic rollups. Both types work with the idea of data aggregation and reducing the load on L1, but the mechanisms for confirming the correctness of transactions, architectural principles and UX consequences are fundamentally different.

Architecture Basics: How Transactions Are Processed

Optimistic rollups (OR)

Optimistic rollups are based on the assumption of honesty - they consider all transactions valid until someone proves otherwise. This is achieved through the fraud proofs mechanism - fraud proofs that can be initiated within a certain window (usually 7 days).

The basic order of actions:

· transactions are processed by an operator outside L1;

· aggregated data is published in L1 as calldata;

· a verification window is launched;

· if there is no dispute, the data is considered valid.

ZK rollups (ZKR)

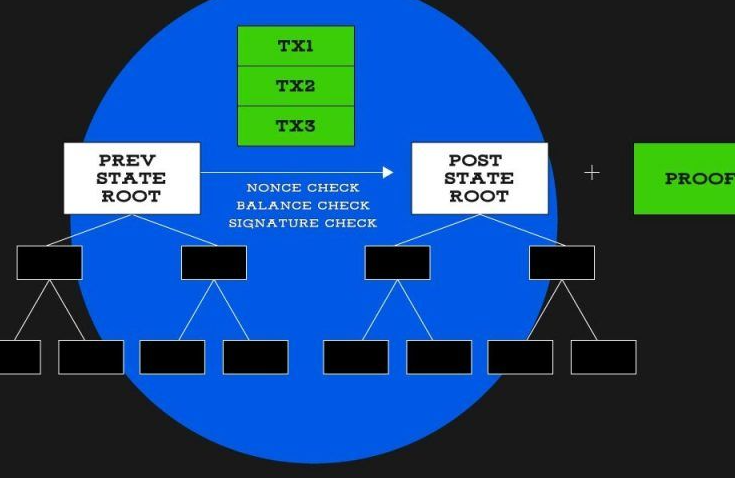

ZK rollups work on a different principle: they publish not just transaction data, but a cryptographic proof of their correctness - validity proof (usually based on SNARK or STARK).

Workflow:

1) the operator collects transactions and forms their Merkle commitment;

2) a mathematical proof of correctness is created;

3) both components are sent to L1;

4) the proof is verified by a smart contract, and the network state is updated.

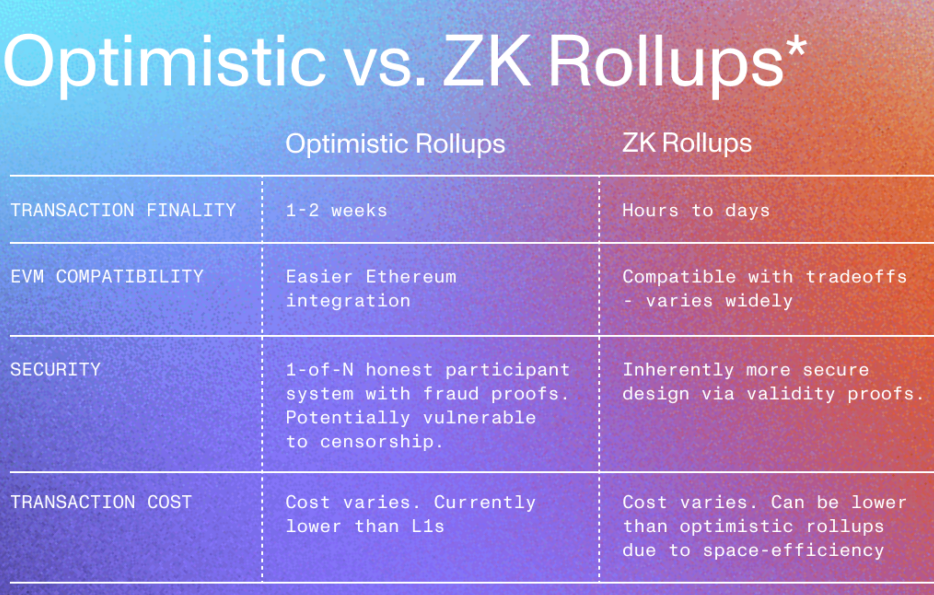

Key technical differences

Verification approach

Optimistic: trust until refutation. Requires active monitoring by validators.

ZK: mathematical proof of validity at the time of publication. Verification is built into the contract.

Finalization and withdrawals

Optimistic rollups have a withdrawal delay of up to 7 days while the dispute window is in effect.

ZK rollups allow for near-instant withdrawals, as correctness is proven immediately.

Load on Ethereum

Both types of rollups reduce the load on the main blockchain, but do so in different ways:

1) ORs transmit more raw data (calldata);

2) ZKRs send compact proofs, saving space but requiring more off-chain computation.

3) Complexity and computational costs

Performance, UX, and Use Cases

|

Criterion |

Optimistic Rollups |

ZK-Rollups |

|

Computation

Overhead |

Low |

High

(proof generation is costly) |

|

Gas

Efficiency |

Moderate

(depends on calldata volume) |

High

(compressed proofs reduce L1 data usage) |

|

Latency

for dApps |

Higher

(due to withdrawal delay) |

Lower

(instant finality benefits user experience) |

|

Ideal

Use Cases |

General-purpose

smart contracts, dApp migration |

Privacy-focused

apps, micropayments, high-frequency trading |

|

Scalability

Potential |

Medium

(depends on fraud-proof participation) |

High

(recursive proofs, fast finality enable massive scaling) |

|

Adoption

Stage |

Production-level,

battle-tested |

Emerging,

rapidly evolving with ZK-EVM progress |

|

Cross-chain

Readiness |

Limited |

Better

suited for multi-rollup and L3 architectures |

ZK rollups require significant resources to create a proof, especially for large transaction volumes. This creates the following technical features:

· high load on proof generators;

· requirement for specialized hardware or ZK accelerators;

· difficulty supporting general-purpose smart contracts (ZK-EVM is still in development).

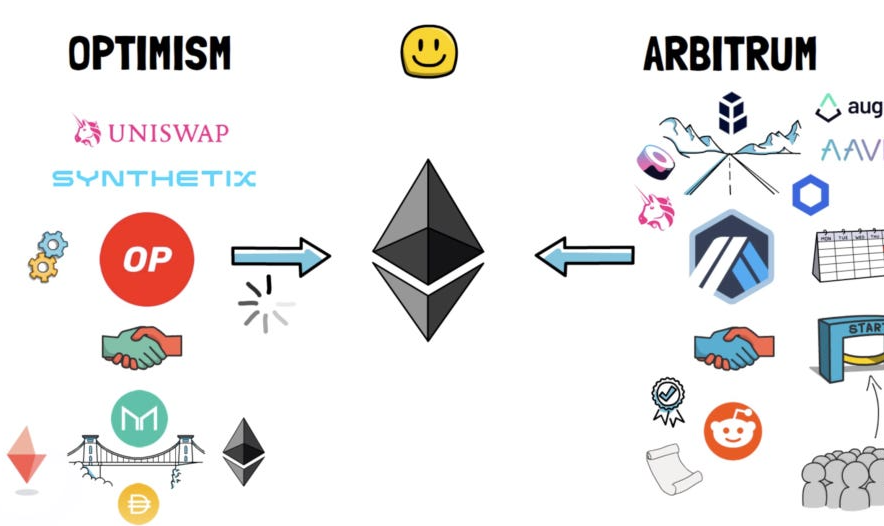

Optimistic rollups are simpler to implement and easier to run universal EVM contracts on. That's why solutions like Optimism and Arbitrum were the first to enter production and gain widespread adoption.

UX and User Experience

For the average user, the main difference is noticeable in the speed of withdrawals and compatibility with dApps:

· ZK rollups provide faster finalization and a better UX when moving funds;

· Optimistic rollups currently have more applications, are compatible with the existing Solidity stack, and have a more mature infrastructure.

· However, ZK rollups win in scenarios where privacy, micropayments, or mass data aggregation are important, including for enterprise solutions.

Core Technical Differences

|

Aspect |

Optimistic Rollups |

ZK-Rollups |

|

Verification

Method |

Fraud

proofs (assumes correctness until challenged) |

Validity

proofs (cryptographic verification at submission) |

|

Finality

Delay |

~7 days

(challenge window) |

Immediate

(upon proof verification) |

|

Proof

Type |

Interactive

fraud proof |

SNARK/STARK

validity proof |

|

Data

Availability |

Posts

full transaction data (calldata) |

Posts

minimal proof and state diff |

|

Execution

Compatibility |

Fully

EVM compatible |

Partial

EVM support (zkEVMs still evolving) |

|

Security

Dependency |

Requires

active challengers |

Relies

on math-based proof validity |

|

Withdrawal

Speed |

Slow

(delayed due to challenge period) |

Fast

(immediate with verified proof) |

|

Maturity

of Ecosystem |

More

developed (Arbitrum, Optimism) |

Rapidly

growing (zkSync, Polygon zkEVM, Scroll) |

Security

Optimistic rollups are vulnerable to attacks if there are not enough active participants in the network willing to submit fraud proofs. This type of security is called interactive: it requires the participation of observers.

ZK rollups are secure due to mathematics: even if the network does not monitor the state, the proofs themselves are sufficient to confirm the correctness. This makes the system resilient to most attack vectors associated with the negligence of validators.

Evolution and prospects

As of 2025, optimistic rollups dominate in TVL volume, but ZK solutions are rapidly catching up. The introduction of ZK-EVM (Polygon zkEVM, Scroll, zkSync Era) brings the moment closer when universal smart contracts will be able to work in the ZK environment without serious performance compromises.

At the same time, we are seeing a transition from simple ZK platforms to systems with recursive proof aggregation and multi-chain integration. This opens the way for horizontal scaling and cross-rollup interaction.

Conclusion

ZK and Optimistic rollups solve the same problem - scaling Ethereum - but they do it in fundamentally different ways. The Optimistic approach is easier to implement and maintain, but it is slower and requires trust in the validators. The ZK approach is more complex and requires more resources, but it provides instant finality, mathematical certainty, and resistance to abuse. The future is likely to be hybrid systems that combine compatibility, speed, security, and reduced cost.

Comments ()