Zootosis: Navigating Through the New Matrix of Mitosis

Introduction

For years, DeFi’s growth was fueled by a simple proposition: deposit liquidity, farm tokens, and chase the next airdrop. It was fast, chaotic, and in many ways and unsustainable. But the landscape is shifting. Users are getting smarter. Protocols are evolving. And incentives are becoming more aligned with long-term contribution than short-term extraction.

In the direction of Zootosis: a unique vault experience built on the foundation of Mitosis’s Matrix Vaults, designed not just to reward users but to engage them in the ecosystem’s growth. This isn’t just another yield farm with a fancy name. It’s a deeper experiment in composable DeFi design, where rewards are layered, incentives are amplified, and participation can ripple across protocols.

In this article, we’ll break down what makes Zootosis different, how it works, what it unlocks and most importantly, why it represents a smarter, more sustainable model for liquidity provision in the next phase of decentralized finance.

About The Zootosis Vault

At its core, Zootosis is a Matrix Vault, but with a twist. It represents a more evolved version of liquidity provision within the Mitosis ecosystem. Designed as an entry point for contributors who want more than passive yields, Zootosis fuses incentives from multiple protocols into a single, dynamic vault experience.

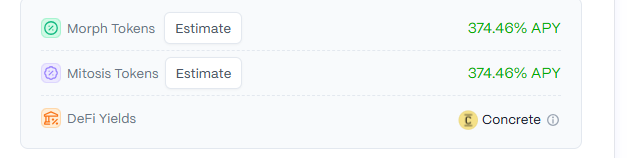

When you deposit into Zootosis, you’re not just farming for $MITO or idling your assets for APR. You're unlocking a layered reward structure that includes:

- Concrete Defi Yields: Your deposited assets goes into both concrete which gives DeFi yields on concrete

- Morph Tokens: By entering the zootosis, users are eligible for rewards in MORPH, a token tied to a partner project that recently raised over $20 million.

- Mito Tokens: The ecosystem-native token, key to future governance relevance.

But Zootosis is more than just a multi-perk vault, it’s a signal. A signal that Mitosis is doubling down on composability, rewarding active participation, and aligning its long-term growth with users who understand the value of staying early and staying active.

Zootosis for Contributors, Not just Farmers

Mitosis isn’t trying to be another high-APR attraction where capital flows in and out like clockwork. The Zootosis Vault reinforces this ethos, it’s built for contributors, not just farmers.

In DeFi’s short but intense history, we’ve seen mercenary capital dominate early-stage ecosystems. Yield chasers come and go, draining liquidity and often leaving protocols worse off than before. Zootosis flips this narrative by incentivizing participation, not just presence.

What makes it contributor-focused?

- Mito Token as a Loyalty Signal: Users aren’t just earning yield,they're accumulating Mito Tokens, which are increasingly becoming a proxy for dedication to the Mitosis ecosystem. These Token feed directly into future $MITO incentive, governance, and ecosystem influence.

- No Long-Term Lockups: By removing rigid lock-in periods, Zootosis empowers users to stay because they want to, not because they’re forced to. This subtle UX choice aligns with how real communities are built: on trust, not traps.

- Integrated Ecosystem Roles: Whether you’re an NFT holder, a liquidity provider, or even a protocol builder, Zootosis connects you into a network of opportunity where your actions,staking, contributing, voting have layered benefits.

This isn’t liquidity-as-a-service. It’s contribution-as-a-commitment. And that makes all the difference.

A Vault That Evolves With the Ecosystem

Zootosis isn’t static, it’s a living vault that grows and adapts as Mitosis scales. In a space where protocols often feel like one-time plays, Zootosis stands out as modular, progressive, and deeply aligned with long-term vision.

This vault is not just a product. It’s a reflection of what the Mitosis ecosystem is becoming decentralized, fluid, and reward-aware. Here’s how:

Dynamic Perks with Expanding Layers

As the ecosystem matures, users who engage early get access to perks that weren’t obvious at the start. This includes:

- Exposure to partner protocols like MORPH (raised $20M), enabling your capital to tap into multiple networks through one vault position.

- New Incentive qualifications — The new vault gives opportunity for users to earn MORPH tokens, MITO Tokens and Concrete Yields.

- Multi-yield opportunities, where one deposited asset can stack multiple layers of incentives yield, points, and future governance access.

- Stable-coin Support: User can deposit stables and won't need to worry about alts volatility.

Feedback-Driven Upgrades

Zootosis is designed with modularity in mind. Smart contracts are upgradable. Feedback loops from contributors are actively used to fine-tune parameters, reward weightings, and user experience. This means your voice isn’t just heard it helps steer the vault’s evolution.

In a crypto world that moves fast, Zootosis moves with the community not ahead of it, and never behind.

Adding Assets to the Zootosis Vault

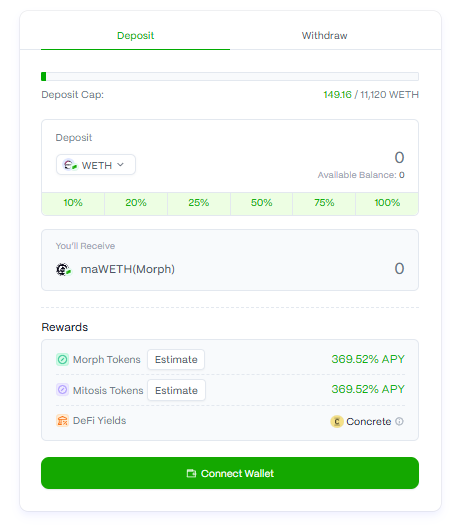

Depositing assets to the Vault is easy because the UI is user friendly and the UX gives users the best experience, To deposit assets head over to RELAY BRIDGE

Bridge some $ETH token from the relay bridge website to MORPH chain

>Use the CA of supported assets to swap to the asset you wish to deposit on MORPH Blockchain

Supported Assets

-WETH

-USDC

-USDT

-WBTC

Note: No lockups but time still matters, if you choose to exit early there is a penalty involved

-7 Days: lose 90%

-90 Days: lose 61%

270 Days: 0% penalty

when you are done acquiring your assets from Relay head to the zootosis vault page

Choose your desired asset and proceed to deposit, after successful deposit you will receive matrix asset equivalent to your deposited asset

Why This Matters Now

In crypto, timing is more than everything, it’s opportunity wrapped in urgency.

Zootosis isn’t just another vault drop. It’s part of a broader shift in how users are being rewarded for contribution, alignment, and belief in emerging infrastructure. With new primitives like modular chains, intent-based architecture, and re-staking models gaining traction, vaults like Zootosis serve as the connective tissue helping users capture upside from multiple directions at once.

The Final Phase is Ticking

Zootosis is already live and we’re in the final phase. That means:

- This is possibly the last window to gain exposure through maAssets before future perks are gated or diluted.

- Protocols aligned with Mitosis are likely watching Zootosis participants closely for governance roles, partnerships, and distribution opportunities.

- Those who act now are positioning themselves not just for rewards, but for a seat at the table in a rapidly expanding ecosystem.

Conclusion

Zootosis isn’t just a new feature it’s a statement.

It signals a shift toward smarter, more rewarding vault systems that align user behavior with long-term protocol growth. Through Mitosis, we’re seeing what it looks like when depositors become contributors, and yield isn’t just financial it’s reputational and directional.

For those watching from the sidelines, this may seem like just another phase. But for the builders, explorers, and aligned believers, Zootosis is a rare signal wrapped in opportunity.

Whether you're stacking maAssets for future perks, farming Mito tokens, or aligning with upcoming power players like morph, the Matrix Vault is your access pass.

Useful links

Programmable liquidity with mitosis

Cross chain liquidity grossary

The wild isn’t waiting. Neither should you.

Comments ()