Institutional DeFi Liquidity: How EOL Can Serve Real-World Funds

Introduction

Institutional capital is entering DeFi with renewed interest in 2025 — and with it, the growing need for sustainable, secure liquidity infrastructure. While real-world asset (RWA) tokenization is unlocking traditional finance (TradFi) opportunities on-chain, the success of institutional adoption hinges on effective liquidity strategies. This is where Ecosystem-Owned Liquidity (EOL), pioneered by Mitosis, becomes a powerful solution.

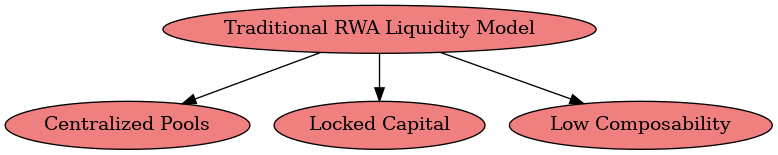

The Problem with RWA Liquidity Models

Traditional RWA-focused DeFi platforms often suffer from structural inefficiencies:

These models rely on siloed pools and restricted governance. Capital efficiency remains low, and liquidity fragmentation undermines scale. RWAs require not just tokenization — they need programmable, scalable, and composable liquidity.

Enter Mitosis: A New Approach to Institutional Liquidity

Mitosis introduces a modular solution tailored for institutional-grade liquidity provision. EOL (Ecosystem-Owned Liquidity) ensures that the protocol, not mercenary capital, governs and routes liquidity across chains.

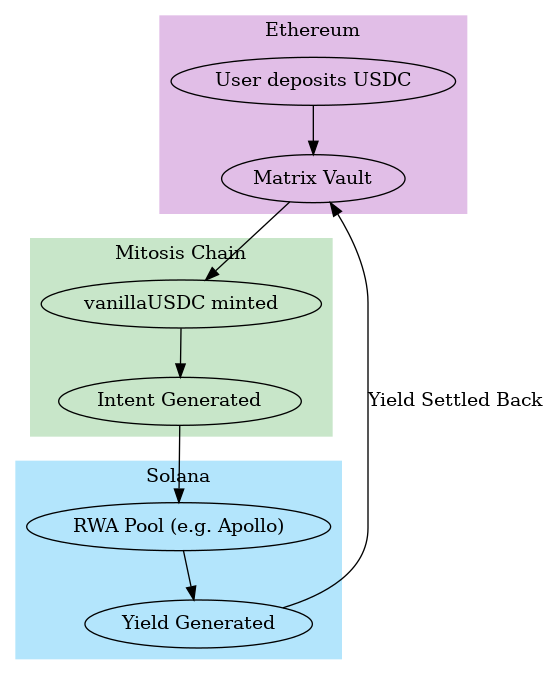

Key Components of the Mitosis Model

- Matrix Vaults: Entry point for capital; users deposit stablecoins like USDC.

- Vanilla Assets: 1:1 tokenized representations, enabling trustless cross-chain routing.

- Intent Layer: Generates and routes orders to protocols like Apollo on Solana.

- Yield Settlement: Yield returns are routed back automatically — improving transparency and automation.

Why EOL Aligns With Institutional Needs

Institutions seek regulatory clarity, long-term alignment, and infrastructure with risk-controlled mechanisms. Mitosis addresses these through:

- Transparency: LPs know exactly how capital is deployed across chains.

- Governance Participation: EOL vaults operate under decentralized governance.

- Composability: Vanilla Assets and Matrix Vaults work natively across Ethereum, Solana, and more.

- Security: With integration of Hyperlane and modular intent execution, asset routing minimizes bridge risk.

Institutional Integration Use Case

Imagine a yield-bearing USDC fund:

- Deposits into Mitosis.

- Liquidity routed to Apollo’s Solana-based RWA pool.

- Yield streamed back and visible in real-time.

- Governance can rebalance destinations.

This model is:

- Transparent ✅

- Cross-chain by design ✅

- Modular and upgradable ✅

Conclusion

As institutional capital increasingly enters DeFi, the limitations of traditional RWA liquidity models become clear. Ecosystem-Owned Liquidity (EOL) offers a new path — one that’s composable, governed, and built for the modular multi-chain world. Mitosis, with its Matrix Vaults, Vanilla Assets, and intent-based routing, is positioning itself as a foundation for the next wave of institutional DeFi. By bridging real-world capital with programmable liquidity, Mitosis ensures DeFi’s evolution isn’t just retail-friendly — it’s institutional-ready.

Resources and References

- Mitosis University (2025). Understanding Matrix Vaults

- Mitosis (2025). The 2025 Boom in RWA Tokenization

- Mitosis (2025). All You Need to Know as a Mitosis LP

- Limechain (2024). What are Real-World Assets in Web3

- CryptoNews (2024). The Growing Role of RWAs in Web3 Finance

Comments ()